The KRA Nil Returns Receipt is a document that is issued to individuals who have filed their KRA Nil Returns on iTax (KRA Portal) for a given tax period. Just as the name suggests, the KRA Nil Returns Receipt is tax receipt that is issued to those individuals who don’t have an active source of income in Kenya and are filing KRA Nil Returns online on iTax (KRA Portal).

The KRA Nil Returns Receipt comprises of two main parts i.e. Personal Information and Return Filing details; and Return Summary. This document is issued by Kenya Revenue Authority (KRA) after successful filing of KRA Nil Returns on iTax (KRA Portal). It is part of what is commonly referred to as the e-Return Acknowledgement Receipt, which is issued immediately after filing your KRA Returns on iTax (KRA Portal).

If by any chance you filed your KRA Nil Returns on iTax (KRA Portal) and forgot to download or even save the KRA Nil Returns Receipt, the good news is that there is a functionality/module on iTax (KRA Portal) that lets you download a copy of the KRA Nil Returns with much ease and convenience.

READ ALSO: Step-by-Step Process of Reprinting KRA Clearance Certificate

To be able to do that, you first need to ensure that you have with you both your KRA PIN Number and KRA Password (iTax Password) which are needed in the process of accessing and logging into your iTax account (KRA Portal account). The necessary steps that you are supposed to follow in the whole process of How To Download KRA Nil Returns on iTax (KRA Portal) are fully covered and outlined in this blog post.

How To Download KRA Nil Returns Receipt

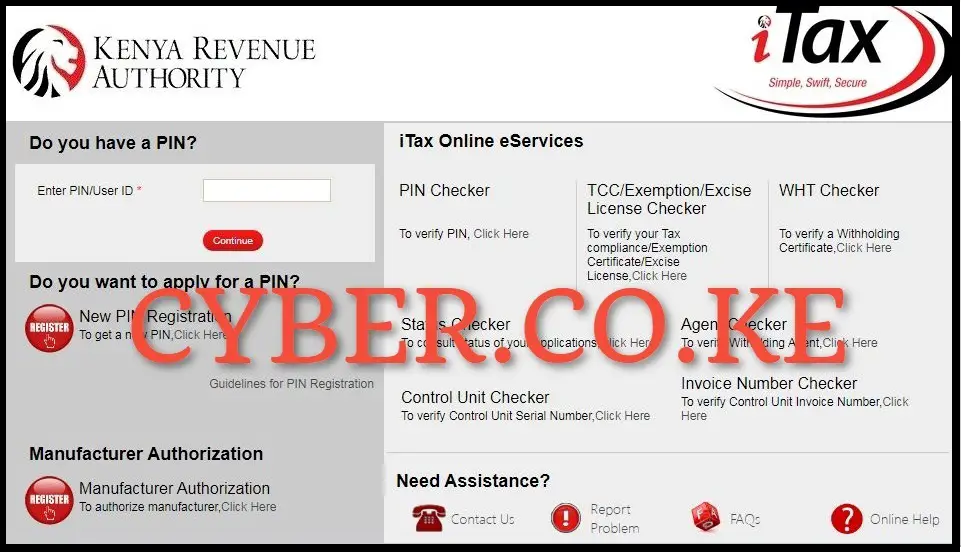

Step 1: Visit iTax (KRA Portal)

To be able to download KRA Nil Returns Receipt online, you first have to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

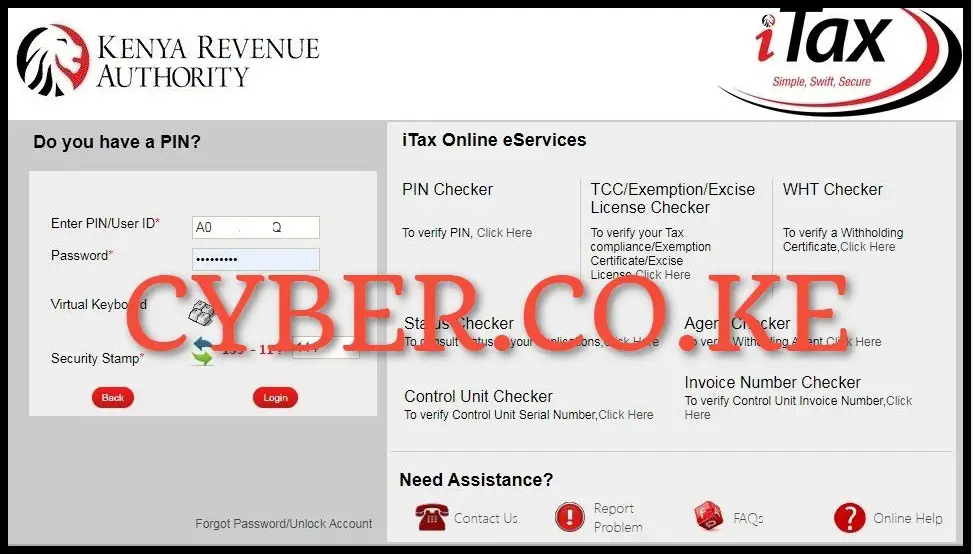

Step 2: Login Into iTax (KRA Portal)

Next, you need to enter your KRA PIN Number, KRA Password (iTax Password), solve the arithmetic question (security stamp) and then click on the “Login” button to access your iTax account (KRA Portal account).

Step 3: Click on Useful Links then Consult and Reprint Acknowledgement Receipt and Certificates

Once you are logged into your iTax account (KRA Portal account), on the top right hand side of the account dashboard, click on “Useful Links” module followed by “Consult and Reprint Acknowledgement Receipt and Certificates” from the drop-down menu items list.

Step 4: Fill the Consult and Reprint Acknowledgement Receipt Form

Once you have clicked on the Consult and Reprint Acknowledgement Receipt and Certificates link, you will be directed to the Consult and Reprint Acknowledgement Receipt Form which you are supposed to fill in certain fields. You need to fill in the following important fields on the form; Business Process – Taxpayer Return Processing; Business Sub Process – Original Return Filing; Obligation Name – Income Tax Resident Individual; Tax Period From; 01/01/2023 and Tax Period To: 31/12/2023 (choose the tax return period that you want the KRA Nil Returns Receipt for). Once you have filled in those details, click on the “Consult” button to load the KRA Returns Acknowledgement Receipt. Note, on the pop up window “Do you want to consult with given details?” click on “OK” button.

Step 5: Download KRA Nil Returns Receipt

The last and most important step is the downloading of the KRA Nil Returns Receipt on iTax (KRA Portal). To download the KRA Nil Returns Receipt on iTax (KRA Portal), on the output section of the consult criteria form just under the “Acknowledgement Number” column, click on the acknowledgement serial number i.e KRA2023***********7, which will in turn initiate the download of KRA Nil Returns Receipt on the iTax (KRA Portal). At this point you can choose to either print out a hard copy of the KRA Nil Returns Receipt or just save a soft copy of the KRA Nil Returns Receipt in PDF format (version).

READ ALSO: Step-by-Step Process of Downloading KRA Excel Sheet (v. 18.0.9)

The above 5 steps sums up the KRA Nil Returns Receipt download process that one needs to follow in order to get a copy of their Nil Returns Receipt online quickly and easily. Just as a reminder, you can only download KRA Nil Returns Receipt after you have already filed your KRA Nil Returns on iTax (KRA Portal). Also, you need to have with you both your KRA PIN Number and KRA Password (iTax Password) which are needed in helping you access your account. Once you have all these with you, you can follow the above 5 main steps that are involved in the whole process of How To Download KRA Nil Returns Receipt online using iTax (KRA Portal) quickly and easily.