Tax Compliance Certificate (TCC) is a document that is issued by Kenya Revenue Authority (KRA) to a taxpayer confirming that he or she has filed all the relevant tax returns and paid taxes due as provided by Law. The KRA Tax Compliance Certificate serves as a confirmation that a taxpayer is compliant and does not have any pending tax returns or pending tax liabilities.

In this article, I am going to share with you the steps the are involved in the whole process of How To Apply For Tax Compliance Certificate Using KRA Portal (iTax Portal). Before looking at the steps that you need to follow, we have to highlight the main requirements that are needed in the whole process of How To Apply For Tax Compliance Certificate Using KRA Portal.

For one to be able to apply for and get a Tax Compliance Certificate using KRA Portal (iTax Portal), you need to ensure that you have with you both the KRA PIN Number and KRA Password (iTax Password), which are the basic requirements needed to login to KRA Portal with ease. By having these two main requirements, the application for Tax Compliance Certificate will be much easier process to follow.

READ ALSO: How To Check KRA PIN Number Status Online (In 4 Steps)

Requirements Needed In Applying For Tax Compliance Certificate

Application for Tax Compliance Certificates requires a taxpayer to login to his or her KRA Portal account using both his/her KRA PIN Number and KRA Password as highlighted below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you when you want to login to KRA Portal. If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

-

KRA Password (iTax Password)

The next requirement that you need to have with you in the process of applying for Tax Compliance Certificate. You will need the KRA Password to access your KRA Portal account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for KRA Password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at CYBER.CO.KE and have your Email Address changed so as to enable your Reset KRA Password.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To Apply For Tax Compliance Certificate (In 5 Steps)

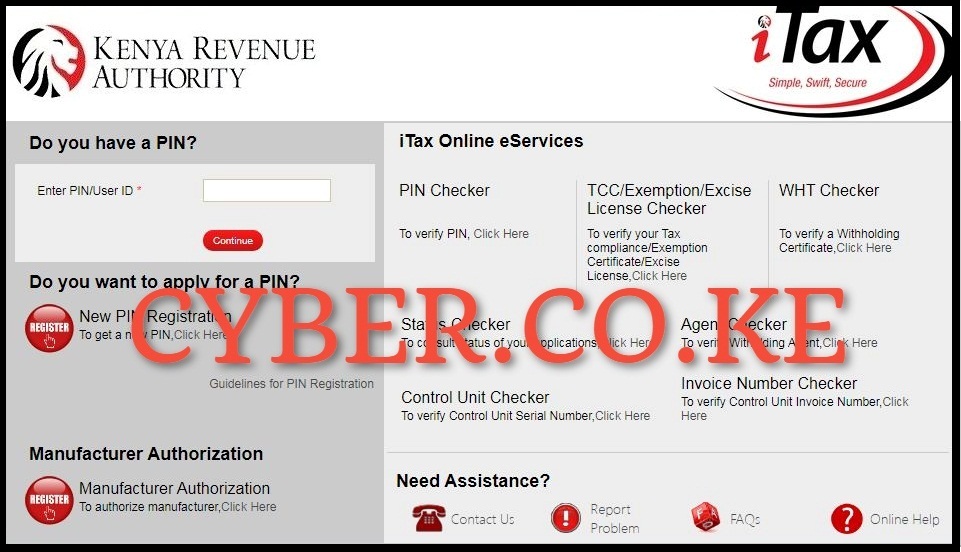

Step 1: Visit KRA Portal

The first process of applying for Tax Compliance Certificate (TCC), you need to visit the KRA Portal (iTax Portal) by using the link https://itax.kra.go.ke/KRA-Portal/ for easy access.

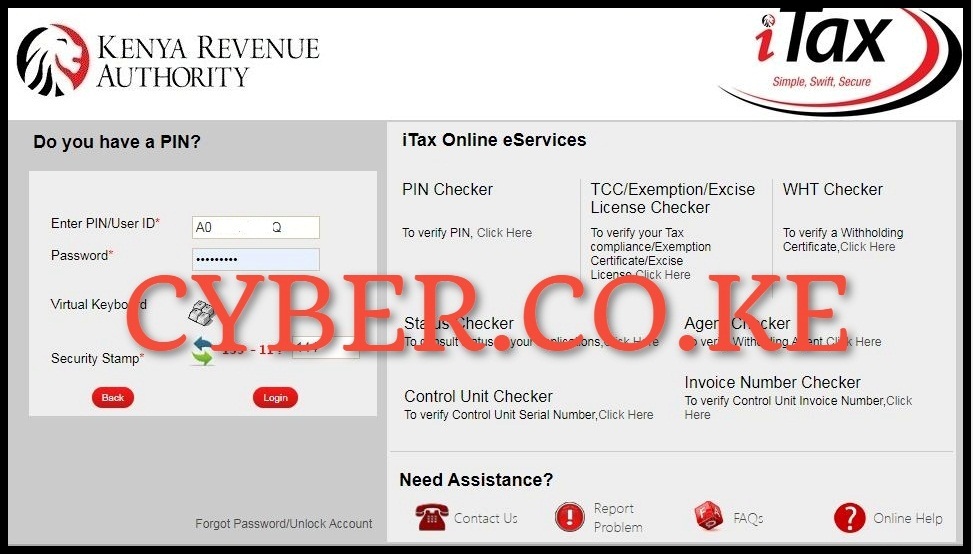

Step 2: Login to KRA Portal

Next, you need to login to KRA Portal by using both your KRA PIN Number and KRA Password as the login credentials. Ensure that you enter the correct KRA Portal login credentials. Afterwards, solve the arithmetic question and click on the login button to access your iTax account dashboard.

Step 3: Click on the Certificates Menu Tab

Once logged into KRA Portal, click on the certificates menu tab and from the menu drop down list, click on “Apply for Tax Compliance Certificate (TCC)”. A pop up message “Please be informed that you are entitled for the Tax Compliance Certificate (TCC) without any workflow. Please click ‘OK’ to continue” will appear, you are to click on “OK” to proceed to the next step. This means that you will be issued with the Tax Compliance Certificate by Kenya Revenue Authority (KRA) immediately since you don’t have any pending tax returns or tax liabilities.

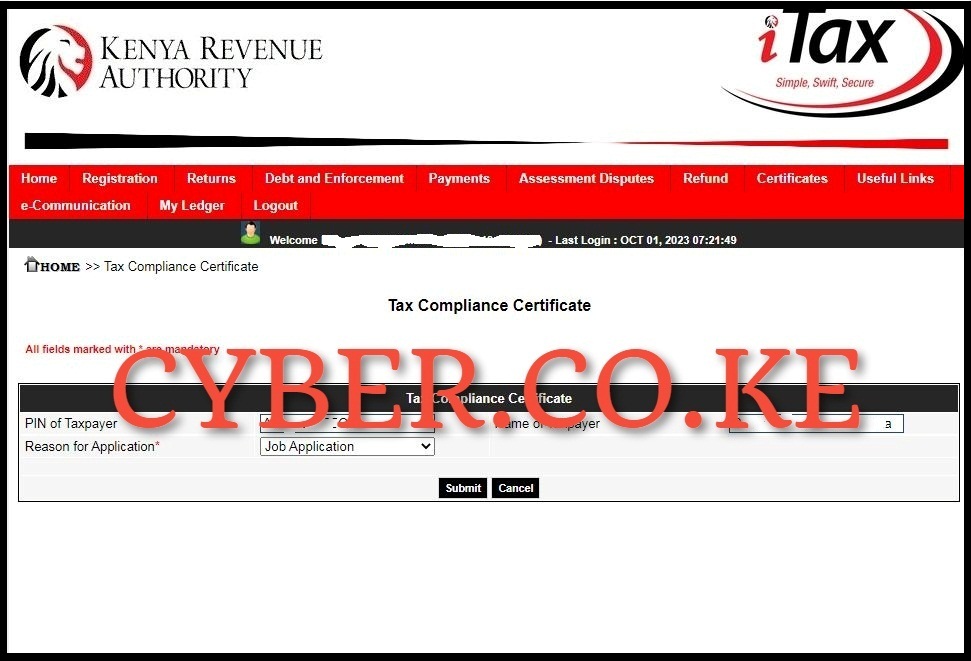

Step 4: Provide Reason for Application of Tax Compliance Certificate (TCC)

In this step, you are to provide the reason why you are applying for Tax Compliance Certificate, the reasons can be either: Job Application, Government Tender, Renewal of Work Permit, Clearing and Forwarding Agents, Seeking Liquor Licences, Confirmation of Compliance Status or other Regulatory Requirements. Select the one that suits you best depending on where you wanted to use the Tax Compliance Certificate. Once you have entered the reason for applying for KRA Tax Compliance Certificate, click on “Submit” button.

Step 5: Download Tax Compliance Certificate

In this last step, you will required to download your generated Tax Compliance Certificate from the KRA Portal. The message “Approval receipt for Tax Compliance Certificate generated successfully” means that the process of application for Tax Compliance Certificate on KRA Portal is complete and it has been auto approved, so you just need to download the Tax Compliance Certificate.

READ ALSO: The Complete Beginner’s Guide To KRA Tax Amnesty 2023

This 5th step marks the end of the whole process of How To Apply For Tax Compliance Certificate Using KRA Portal. To download the Tax Compliance Certificate, you are supposed to click on the acknowledgement number which will automatically download your newly applied Tax Compliance Certificate. You can decide to save the softcopy or even print out the hardcopy of the Tax Compliance Certificate.