Have you filed Turnover Tax Returns, got the Payment Slip and now need to make Turnover Tax Payment? Learn How To Pay Turnover Tax Using KRA Paybill Number.

The last process in the the Turnover Tax blog series that I have been covering is the Turnover Tax Payment. As a business owner, once you have filed the Turnover Tax Returns, Generated the Turnover Tax Payment Slip and finally the last step will be Turnover Tax Payment or simply Payment of Turnover Tax. Knowing How To Pay Turnover Tax in Kenya is very important for each and every business owner.

In this article, I will be covering the step by step guide on How To Pay Turnover Tax in Kenya. We shall be looking at the Turnover Tax Payment processes using the payment methods that the Kenya Revenue Authority (KRA) has made available to taxpayers in Kenya.

READ ALSO: How To Generate Turnover Tax Payment Slip Using iTax Portal

In this article, we shall be making the Turnover Tax Payment using the KRA Paybill Number 572572. You can also choose to pay Turnover Tax using Banks but in this article, we shall be making Turnover Tax Payment using KRA Paybill Number.

Turnover Tax Payment is a must for each and every business that is eligible for the KRA Turnover Tax. If you can recall from the previous articles here at Cyber.co.ke Portal Blog, we have looked at the Turnover Tax Cycle that includes: Downloading Turnover Tax Returns Form, Filling Turnover Tax Returns Form, Uploading Turnover Tax Returns Form, Downloading Turnover Tax Acknowledgement Receipt, Generating Turnover Tax Returns Payment Slip and finally Paying Turnover Tax.

This article will be focusing on key aspects of the final process of Turnover Tax Payment using the KRA Paybill Number 572572. This includes: What Is Turnover Tax Payment, Methods Of Turnover Tax Payment, What Is KRA Paybill Number, Requirements Needed For Turnover Tax Payment and How To Pay Turnover Tax Using KRA Paybill Number 572572.

What Is Turnover Tax Payment?

Turnover Tax Payment is the process of paying the Turnover Tax due from the gross sales of a business in Kenya at the rate of 3% to Kenya Revenue Authority (KRA) using either the KRA Paybill Number or any of the KRA Partner Banks. Turnover Tax is paid after the taxpayer has filed the Turnover Tax Returns and generated the Payment Slip so as to be able to pay Turnover Tax for his or her business.

Turnover Tax Payment has a due date of 20th of the following month. So, if you operated and worked in your business and made sales for the month of February 2020, then you need to ensure that you file Turnover Tax Returns and make the payment for the Turnover Tax due from your business to Kenya Revenue Authority (KRA) on or before the 20th day of the following i.e. Turnover Tax Payment for February 2020 is due by 20th March 2020.

To be able to make Turnover Tax Payment, the taxpayer must have first registered for the Turnover Tax Obligation, then filed Turnover Tax Returns and generated the Turnover Tax Payment Slip that is going to be used in the process of Turnover Tax Payment using the modes of Tax Payments that are available in Kenya by KRA.

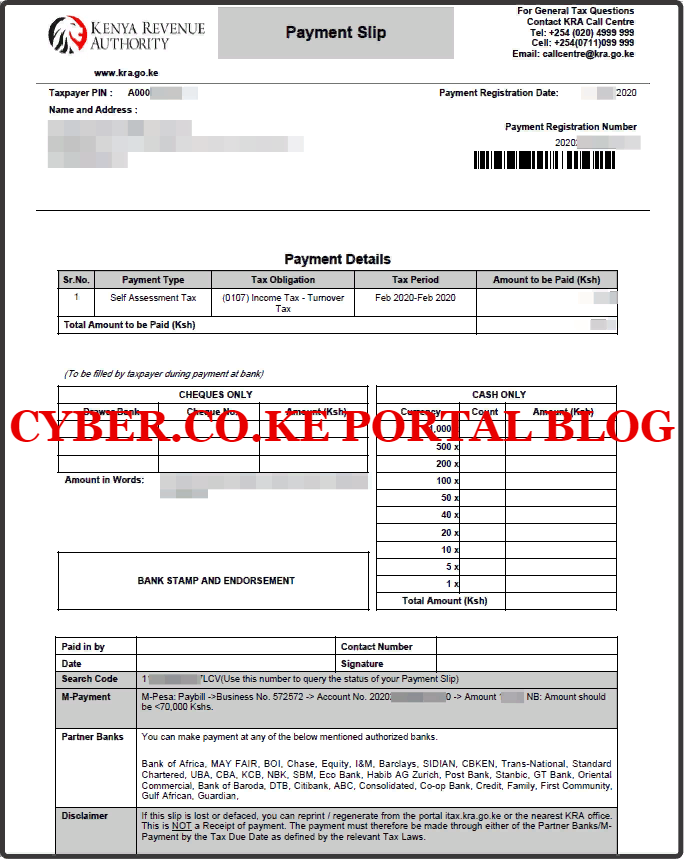

The payment details are on the Turnover Tax Payment Slip are going to be used in making payment for Turnover Tax by the taxpayer. It is important bto note that you will need that generated Turnover Tax Payment Slip and if you have no idea of how to go about that, you can check out our article on How To Generate Turnover Tax Payment Slip Using iTax Portal so as to be able to know how to get the Payment Slip that is needed for Turnover Tax Payment on KRA iTax Portal.

Having looked at the definition of Turnover Tax Payment above, we now need to shift gears and look at the Modes Of Turnover Tax Payment that a taxpayer can use to pay Turnover Tax for his or her business with.

Methods Of Turnover Tax Payment

There are two main methods that a taxpayer can use to pay Turnover Tax due for his or her business. The Turnover Tax Payment methods includes: Mobile Money Payment and Bank Payment. We shall look at each of the above Turnover Tax Payment methods in detailed view below.

-

Mobile Money Payment

A taxpayer can decide to use the Mobile Money Payment option inorder to pay for his or her business Turnover Tax to KRA. Mobile Money Payment simply refers to M-Pesa Payment through the KRA Paybill Number 572572. Once a taxpayer has generated the Turnover Tax Payment Slip on iTax Portal, then he or she can use the Mobile Money Payment option to pay for the Turnover Tax due.

-

Bank Payment

The other option that a taxpayer can use to pay Turnover Tax is the Bank Payment option. Once a taxpayer generates the Turnover Tax Payment Slip on iTax Portal, he or she can choose to pay the Turnover Tax due at any of the KRA Partner banks that are available in Kenya.

I do recommend the Mobile Money Payment option due to the flexibility and can be done on your phone quickly and easily. But if you are fond of and used to queuing, then paying the Turnover Tax at the Banks will be suitable for you.

Having looked at the methods of Turnover Tax Payment above, we now need to look briefly at What Is KRA Paybill Number. This is due to the fact that since in this article we are paying Turnover Tax for a business, we are going to use the KRA Paybill Number 572572 in this whole process of Turnover Tax Payment.

What Is KRA Paybill Number?

The KRA Paybill Number is a Mobile Money Payment options that taxpayers in Kenya can use to pay their KRA Taxes and even KRA Payments together with all other payments after generating the KRA Payment Slip on iTax Portal. The KRA Paybill Number is normally 572572, and taxpayers can use this KRA Paybill Number to make payments to the Kenya Revenue Authority (KRA).

Kenya Revenue Authority (KRA) choose to have a Paybill Number so as to make the process of paying for Taxes and other KRA Payments by taxpayers in Kenya easy and flexible at the palm of the taxpayers hands. Now that’s a plus for the KRA Paybill Number which makes paying of taxes efficient and seamless thanks to M-Pesa.

Using the KRA Paybill Number to pay Turnover Tax in Kenya is not only fast but also efficient. So, since most taxpayers have M-Pesa in Kenya, then the KRA Paybill Number is the best option to use inorder to make Turnover Tax Payment quickly and easily by just using your mobile phone.

Having looked at what we mean by KRA Paybill Number above, we now need to look at the key Requirements Needed For Turnover Tax Payment. This basically entails what you need to have with you in order to make Turnover Tax Payment. This is inline with our article on How To Pay Turnover Tax using KRA Paybill Number 572572.

Requirements Needed For Turnover Tax Payment

To be able to make Turnover Tax Payment, you need to ensure that you have with you the Turnover Tax Payment Slip and M-Pesa Number. These are the two key requirements that a taxpayer needs to have in order to make Turnover Tax Payment quickly and easily. The most important being the Turnover Tax Payment Slip as illustrated below.

-

Turnover Tax Payment Slip

On the Turnover Tax Payment Slip, you are going to need the Payment Registration Number (PRN). This number is very important as it is going as the account number when we shall be paying the Turnover Tax using KRA Paybill Number 572572.

-

M-Pesa Mobile Number

The fasted and quickest way to pay for Turnover Tax for your business on iTax is by using the KRA Paybill Number 572572. This requires that the taxpayer have a Safaricom M-Pesa Number so as to enable them use the KRA Paybill Number to make payments of their Turnover Tax quickly and easily to Kenya Revenue Authority (KRA).

Now that you have with you the two most important requirements that arte needed in the process of How To Pay Turnover Tax using KRA Paybill Number, we can now get our M-Pesa phone and highlight on the step by step guide that as a taxpayer in Kenya you need to follow on How To Pay Turnover Tax Using KRA Paybill Number 572572.

How To Pay Turnover Tax Using KRA Paybill Number 572572

Step 1: Go To M-PESA Sim Toolkit

The first step will involve you accessing your M-PESA Sim Toolkit on your Sim Card so as to be able to use the Safaricom M-PESA. This is as illustrated below.

Step 2: Go to Lipa na M-Pesa

Next, you will click on the M-PESA menu, then click on Lipa na M-PESA from the options that appear. This is as illustrated below.

Step 3: Select Paybill

Once you have clicked on Lipa na M-PESA, you will now need to click on Paybill. This is as shown in the screenshot below.

Step 4: Enter Business Number: 572572

Next, you will need to enter the KRA Paybill Number. The Paybill Number for Kenya Revenue Authority (KRA) is 572572. First you will see the Enter Business Number option and next you will click on it and enter the KRA Paybill Number which is the Business Number. This is as illustrated below.

- Click On Business Number

- Enter Business Number

Step 5: Enter Account Number: 202020***********2 (Payment Registration Number is the Account Number)

In this step, you will need to enter the Payment Registration Number (PRN) that appears on the Turnover Tax Payment Slip. The PRN will serve as the account number. This is as shown below.

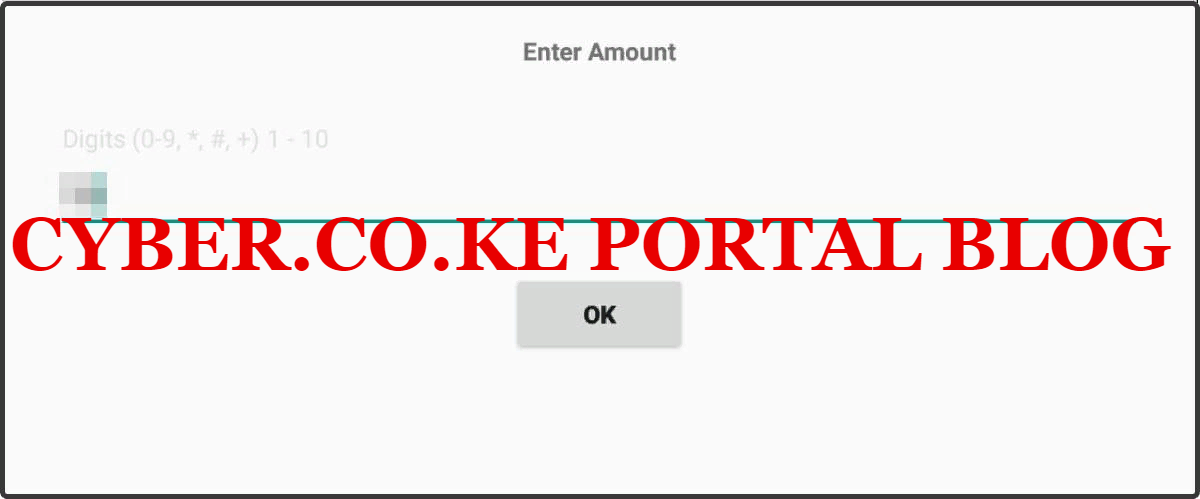

Step 6: Enter the amount: Kshs. ***** (As Displayed On The Turnover Tax payment Slip)

Next, you will enter the amount of Turnover Tax that your business needs to pay to Kenya Revenue Authority (KRA). This amount should be the same as the one displayed on the Turnover Tax Payment Slip. This is as illustrated below.

Step 7: Enter your M-PESA PIN and confirm the details

In this step, you will need to enter your M-PESA PIN so as to authorize the Turnover Tax Payment to Kenya Revenue Authority (KRA) as shown below.

Once you have entered your M-PESA PIN and confirmed the payment details. The Turnover Tax amount will be sent to Kenya Revenue Authority (KRA) for that specific account number (PRN). Once you paid the Kshs. ****** Turnover Tax Payment, you will get a notification from M-PESA and KRA confirming payment for the same. That will serve as the final confirmation that you have paid the KRA Turnover Tax using KRA Paybill Number. You should be able to receive two messages i.e. from M-Pesa and from KRA through ELMA.

- M-Pesa Message

OB******YZ Confirmed. Kshs. *****.** sent to Kenya Revenue Authority for account 20202*********35 on 11/3/20 at 9:00 PM.

- KRA Message (ELMA)

Dear customer, we confirm your payment Ref OB******YZ for E-Slip No. 20202*********35 of KES *****.** has been received on 11/03 21:00 by KRA.

READ ALSO: How To File Turnover Tax Returns In Kenya Using iTax Portal

The above two messages serve as a confirmation that your Payment for Turnover Tax has been successfully received by KRA. That will mark the successful end of Turnover Tax Payment using KRA Paybill Number. If you need any help or assistance on How To Pay Turnover Tax in Kenya, you can subit your order online here at Cyber.co.ke Portal and we shall gladly assist you on the same.