The Group Tax Compliance Certificate (TCC) is a document that is issued to Groups that have filed all their KRA Returns and paid any taxes due to Kenya Revenue Authority (KRA). Group Tax Compliance Certificate certifies that a group is compliant when it comes to matters KRA Returns and tax payments in Kenya.

The Group Tax Compliance Certificate is important in scenarios where the group wants to apply for a tender as an example and the requirement is normally to include the Group KRA PIN Certificate and the Group Tax Compliance Certificate (TCC). This has necessitated to the importance of all groups to apply for Group Tax Compliance Certificate online using iTax (KRA Portal). For a group to be able to apply for Tax Compliance Certificate on iTax (KRA Portal), there are two main requirements that are needed in the whole process.

These two includes both the Group KRA PIN Number and iTax Password (KRA Password). Also, you need to ensure that the Group Tax Returns are up to date in line to the accounting period of the group. In this blog post, I will share the main steps that one needs to follow in the process of How To Apply for Group Tax Compliance Certificate (TCC) online using iTax (KRA Portal).

READ ALSO: Step-by-Step Process of Downloading Group KRA PIN Certificate

How To Apply for Group Tax Compliance Certificate (TCC)

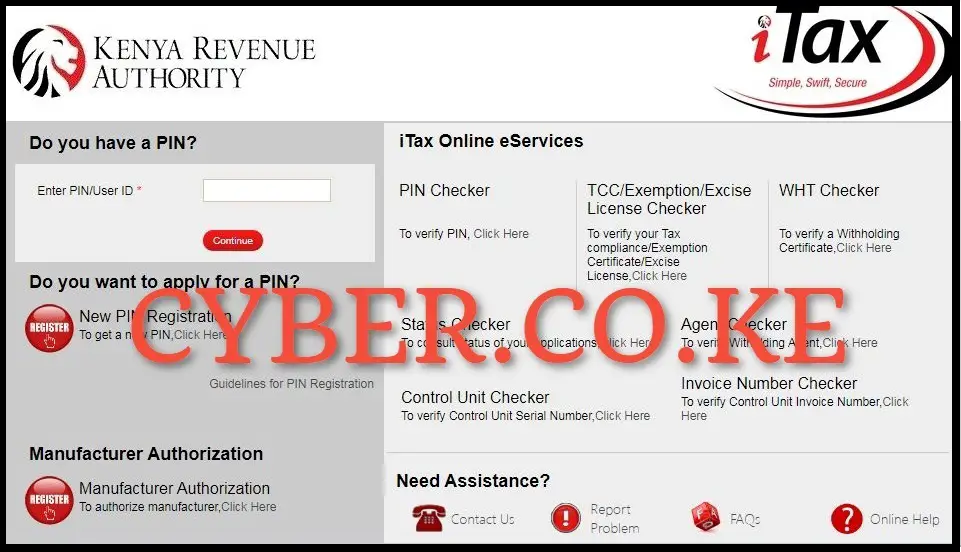

Step 1: Visit iTax (KRA Portal)

The first step in the process of How To Apply for Group Tax Compliance Certificate (TCC) is to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

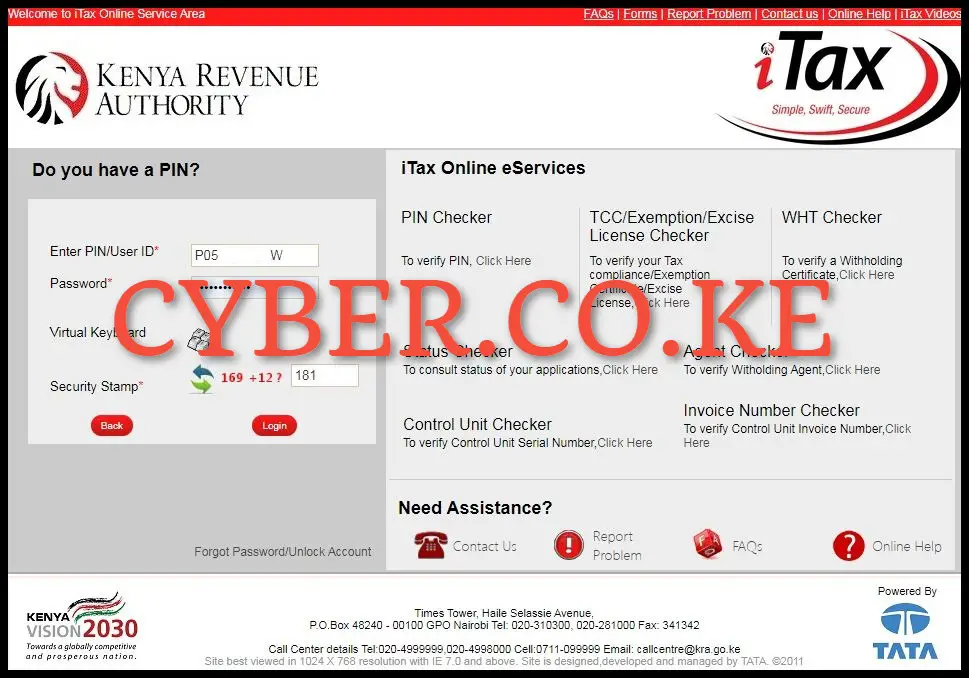

Step 2: Login Into iTax (KRA Portal)

Next, you need to enter the Group KRA PIN Number, iTax Password (KRA Password), solve the arithmetic question (security stamp) and then click on the “Login” button to access iTax (KRA Portal) so as to start the process of Group Tax Compliance Certificate (TCC) application online using iTax (KRA Portal).

Step 3: Click on Certificates

Once you are logged into iTax (KRA Portal) account successfully, click on the “Certificates” menu on the top right hand side of the iTax account dashboard followed by “Apply for Tax Compliance Certificate” from the drop down menu list. A pop up message “Please be informed that you are entitled for the Tax Compliance Certificate (TCC) without any workflow. Please click ‘OK’ to continue” will appear, you are to click on “OK” to proceed to the next step.

Step 4: Provide Reason for Application of Group Tax Compliance Certificate (TCC)

In this step, you need to provide a reason of applying for Group Tax Compliance Certificate (TCC). The good thing is that iTax (KRA Portal) is configured with the various reasons for application of Tax Compliance Certificate (TCC) including; Job Application, Government Tender, Renewal of Work Permit, Clearing and Forwarding Agents, Seeking Liquor Licences, Confirmation of Compliance Status or other Regulatory Requirements. Choose one that suits your needs and then click on the “Submit” button.

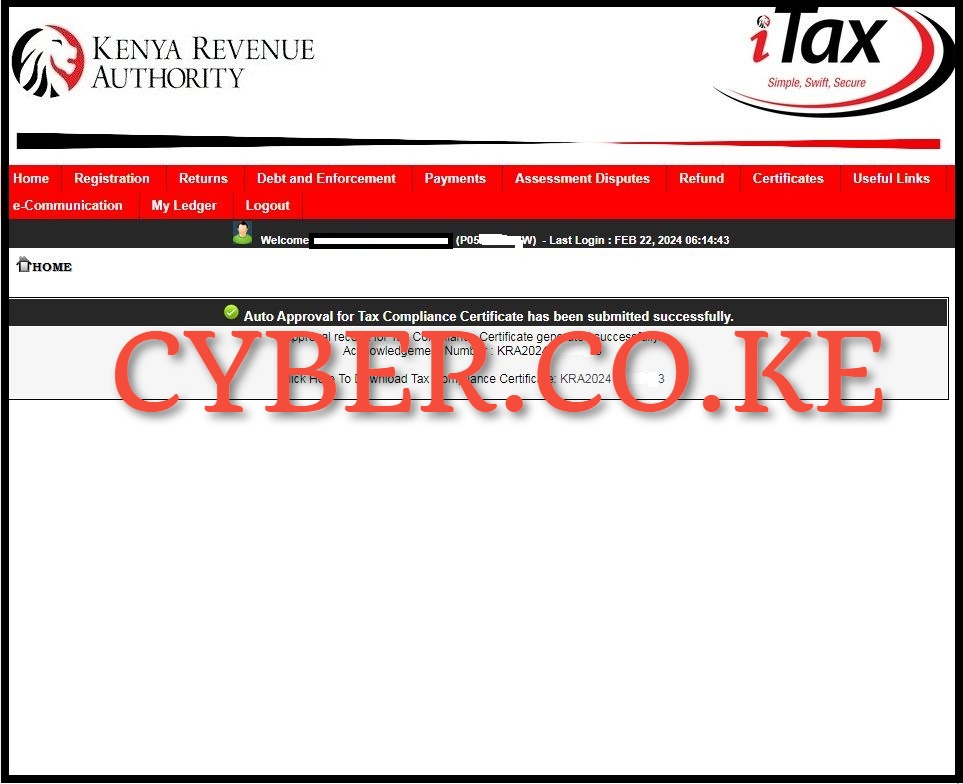

Step 5: Download Group Tax Compliance Certificate (TCC)

The last step in the process of How To Apply for Group Tax Compliance Certificate (TCC) is the downloading of the auto approved Tax Compliance Certificate (TCC) for the Group. The message “Approval Receipt for Tax Compliance Certificate Generated Successfully” means that the process of application for the Group Tax Compliance Certificate (TCC) on iTax (KRA Portal) is complete and it has been auto approved by the system, so you just need to download the Group Tax Compliance Certificate (TCC). To download the Tax Compliance Certificate (TCC) for Group, click on the text link labeled “Click Here To Download Tax Compliance Certificate: KRA2024*******3” which will inturn save the Tax Compliance Certificate (TCC) to the device that you are using.

READ ALSO: Step-by-Step Process of Downloading e-Return Acknowledgement Receipt

The above 5 steps sums up the process of Group Tax Compliance Certificate (TCC) application online using iTax (KRA Portal). As a reminder, for the Group to be issued with a Tax Compliance Certificate (TCC) by Kenya Revenue Authority (KRA), the Group has to be tax compliant i.e. filed all KRA Returns as per the accounting period of the Group and paid any taxes due. Also, you need to ensure that you have with you the Group KRA PIN Number and KRA Password (iTax Password) that are needed to access iTax (KRA Portal) account. Once you have all these with you, you can follow the above 5 main steps so as to apply for Group Tax Compliance Certificate (TCC) successfully using iTax (KRA Portal).