The iTax Registered Mobile Number is quite important as it allows a taxpayer receive important notifications from Kenya Revenue Authority (KRA) via SMS. Having the correct iTax registered mobile number allows you to be able to receive One Time Password (OTP), password reset notifications and even some important notifications from KRA.

It is important that the mobile number on your iTax (KRA Portal) account be up to date and active. If it’s not, then you can easily change the iTax registered mobile number easily on iTax (KRA Portal). To be able to change iTax registered mobile number, you need to ensure that you have with you both the KRA PIN Number and iTax Password (KRA Password) which are part of the iTax login credentials.

In this blog post, I am going to share with you all the main steps that you need to follow in order to easily change the iTax registered mobile number quickly and easily. By changing the iTax registered mobile number to a new one, you will be able to get important notifications from Kenya Revenue Authority (KRA) such as the OTP verification codes, password resets among other set of important SMS notifications.

READ ALSO: Step-by-Step Process of Reprinting Company Tax Compliance Certificate

How To Change iTax Registered Mobile Number

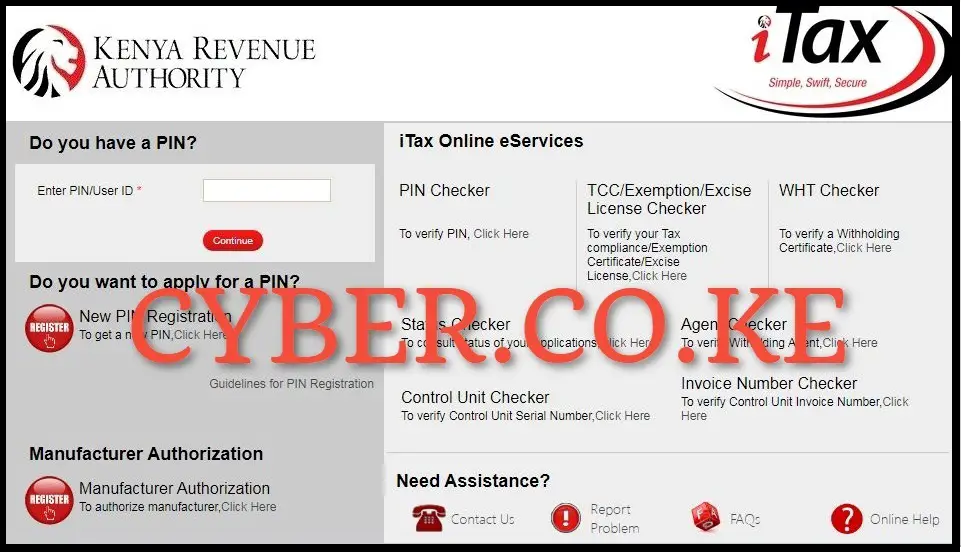

Step 1: Visit iTax (KRA Portal)

The first step in the process of changing iTax registered mobile number is to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

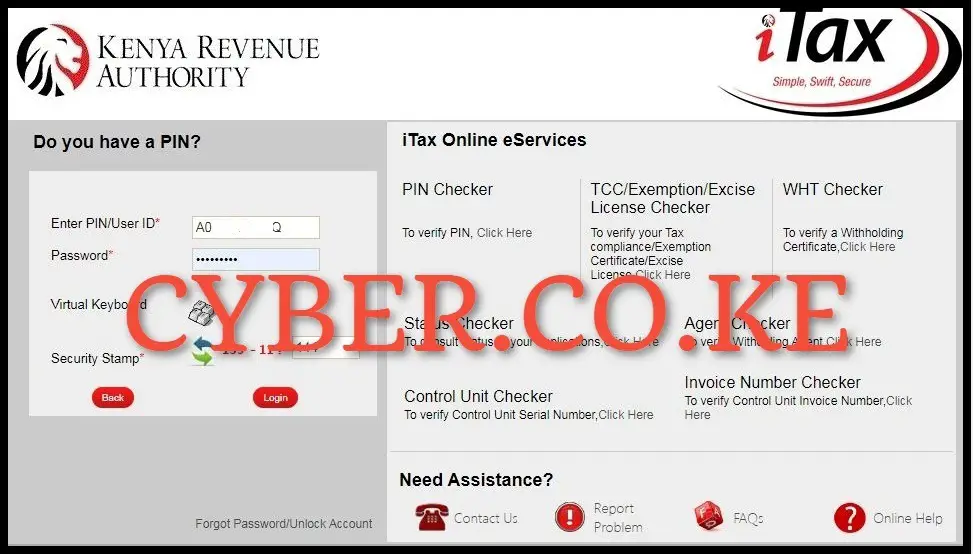

Step 2: Login Into iTax (KRA Portal)

Next, you need to enter your KRA PIN Number, iTax Password (KRA Password), solve the arithmetic question (security stamp) and then proceed to click on the “Login” button to access your iTax (KRA Portal) account to start the process of changing the mobile number on iTax (KRA Portal).

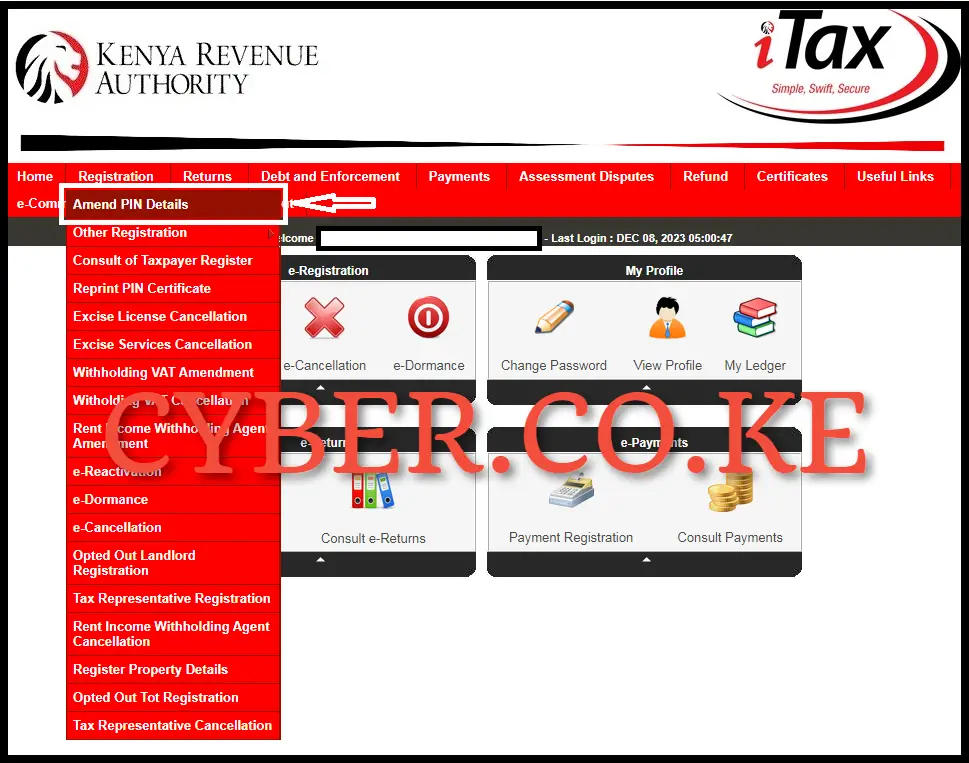

Step 3: Click On The Registration Menu Followed By Amend PIN Details

Once you have successfully logged into iTax (KRA Portal) account, on the top let side of the account dashboard, click on “Registration” followed by “Amend PIN Details” from the drop down menu items list.

Step 4: Select The Mode of Amendment in the e-Amendment of Registration Form

In this step, you need to select the mode of Amendment as “Online Form” in the e-Amendment of Registration Form, which is the fastest and easiest way of doing KRA PIN Amendments on iTax (KRA Portal). The system will automatically populate other fields on the e-Amendment of Registration Form, including Applicant Type, Taxpayer Name, and Taxpayer Name. After selecting the amendment mode, proceed to the next step by clicking the “Next” button.

Step 5: Fill In The Individual Registration Amendment Form

Next, you need to fill in the Individual Registration Amendment Form by selecting the PIN and Basic Information sections since to change the mobile number on iTax (KRA Portal), you need to amend the basic information section within the Principal Contact Details of the Individual Registration form. Once you’ve chosen these two fields, proceed by clicking the “Submit” button.

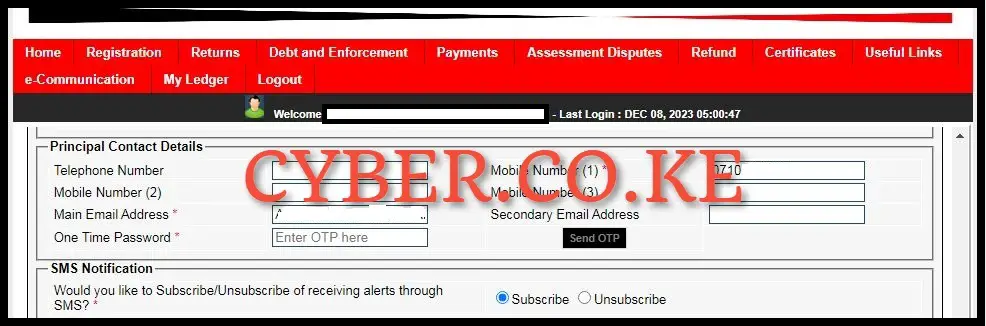

Step 6: Under Basic Information Section, Scroll to Principal Contact Details

In this step, under the Basic Information section, scroll down until you reach the Principal Contact Details where mobile number field is located. On the form field titled “Mobile Number (1)” – this is the primary and main mobile number, you need to enter the new mobile number that you want to use on iTax (KRA Portal). Also, tick the “Subscribe” check box under SMS Notification as this will enable you receive SMS alerts from Kenya Revenue Authority (KRA).

Once you have entered your new mobile number on iTax (KRA Portal), scroll down on the amendment form and then click click on the “Submit” button. A pop up notification will appear whereby you need to click on “OK” to submit the amendment (changing) of Mobile Number on iTax (KRA Portal) request. The system will auto-approve the change of mobile number on iTax (KRA Portal).

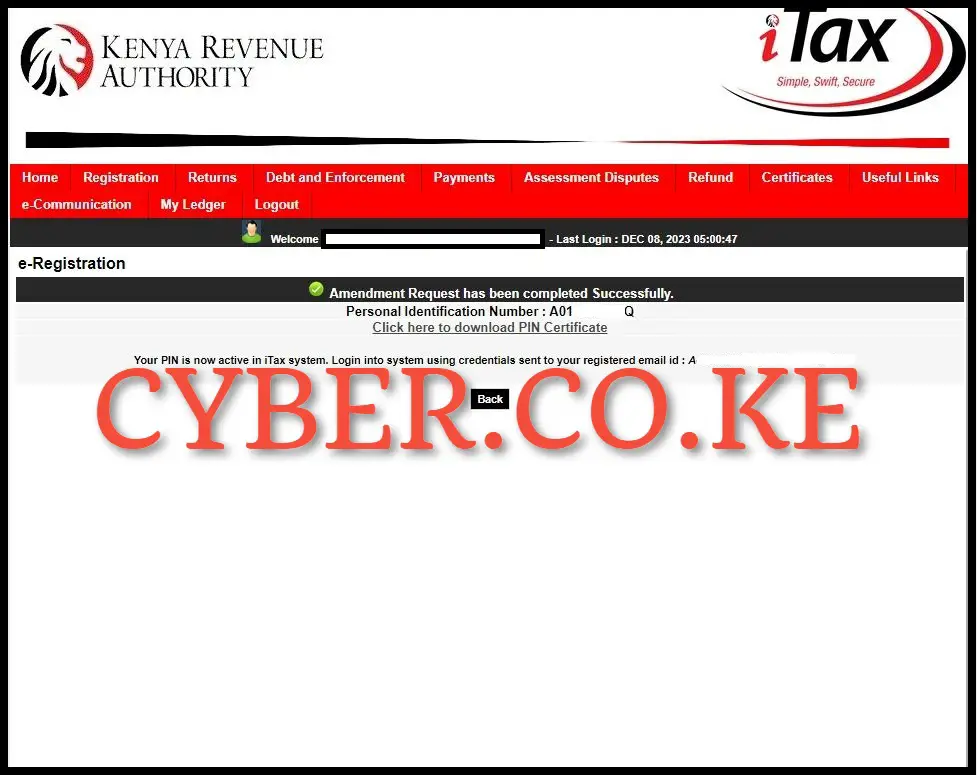

Step 7: Amendment Request has been completed Successfully

Once you have submitted the amendment form, you will see an message “Amendment Request has been completed Successfully” meaning the amendment and changing of the iTax registered mobile number has been successful and a new mobile number has been linked to the KRA PIN Number on iTax (KRA Portal). You need to take note that changing of mobile number on iTax (KRA Portal) is quick as the number will be changed in the system immediately and will will also reflect in all other KRA systems. With the new mobile number on iTax (KRA Portal), you will be able to now receive KRA OTP Verification Codes, Password Resets and all other important SMS notifications from Kenya Revenue Authority (KRA).

READ ALSO: Step-by-Step Process of Reprinting Company KRA PIN Certificate

The above 7 steps sums up the main steps that all taxpayers in Kenya need to follow during the process of changing the iTax registered mobile number. As mentioned at the beginning of this blog post, the iTax registered mobile number is that number that is on iTax (KRA Portal) which is linked to the KRA PIN Number. Changing of mobile number on iTax (KRA Portal) is simple and fast provided you have both the KRA PIN Number and KRA Password (iTax Password), once you have all these with you, you can follow the outlined steps so as to change the iTax registered mobile number easily.