The KRA Tax Compliance Certificate is a very important document that is issued to taxpayers by Kenya Revenue Authority (KRA) confirming that the taxpayer whose details appear on the Tax Compliance Certificate has filed all the relevant tax returns and paid any taxes due as provided by Law. Once a taxpayer has complied with the tax Laws in Kenya, he or she issued with the Tax Compliance Certificate. Checking and confirming the validity of the Tax Compliance Certificate (TCC) is very important for different individuals and entities in Kenya.

There is normally a caveat in regards to the Tax Compliance Certificate that states; This certificate is issued on the basis of information available with the authority as at the certificate date mentioned above. The Authority reserves the right to withdraw the certificate if new evidence materially alters the tax compliance status of the recipient. Some individuals normally present a TCC that is not valid or has expired, thus forcing the need to confirm, verify and check validity of the Tax Compliance Certificate using the KRA Tax Compliance Certificate Checker on KRA Portal (iTax Portal).

To be able to check and confirm the validity of the Tax Compliance Certificate using the KRA Tax Compliance Certificate Checker functionality/feature that is on KRA Portal, you need to have with you the Tax Compliance Certificate Number. This is the most important number that is used to confirm whether a Tax Compliance Certificate is genuine or not. This Tax Compliance Certificate Number can be found of your Tax Compliance Certificate document just underneath the certificate date.

READ ALSO: How To Download KRA Payment Slip Online (In 5 Steps)

Requirements Needed In Checking Validity of Tax Compliance Certificate

As mentioned above, for you to check and confirm the validity of a KRA Tax Compliance Certificate online, you need to have the Certificate Number. This is the only important requirement in the process of checking and verifying its validity using the KRA Tax Compliance Certificate Checker functionality on iTax Portal (KRA Portal).

-

Tax Compliance Certificate Number

This is the number of the Tax Compliance Certificate that the KRA system generates when a taxpayer applies for the TCC online using his or her iTax account. It is a set of alphanumeric characters which you can input in the TCC Checker on KRA Portal to check if that Compliance Certificate is genuine or not. The TCC checker is a very important feature especially for employers who do recruitment of new employees in Kenya as they need to check and confirm that the documents being presented for employment is genuine or not.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To Check The Validity of Tax Compliance Certificate

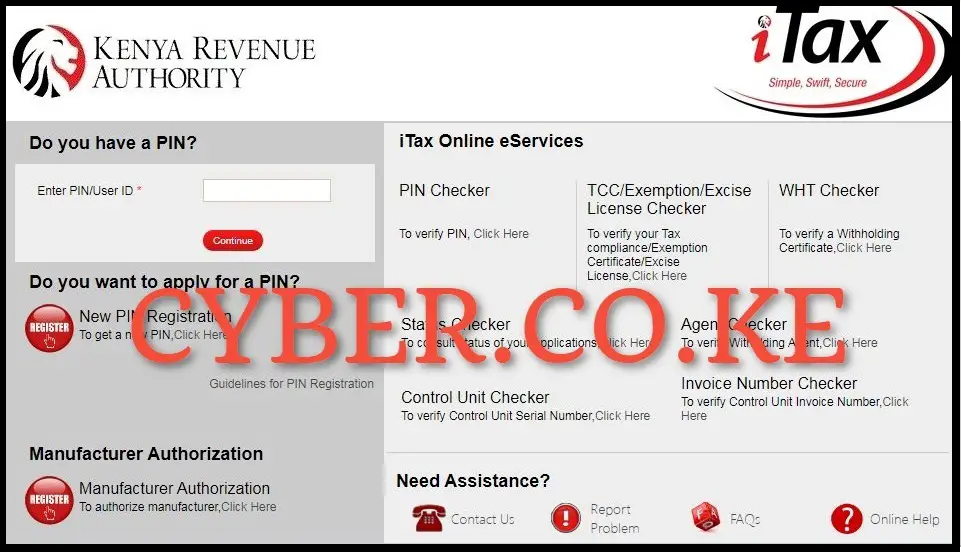

Step 1: Visit KRA Portal

The first step in process of checking and confirming if a Tax Compliance Certificate is valid or not involves visiting the KRA Portal using the link https://itax.kra.go.ke/KRA-Portal/

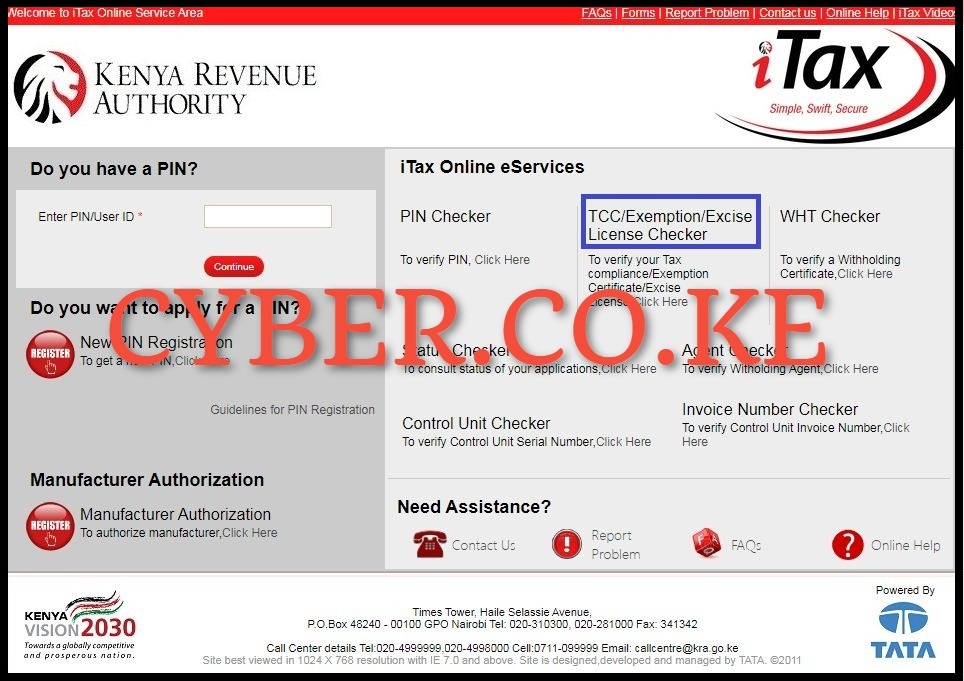

Step 2: Click on TCC/Exemption/Excise License Checker

Next, on the KRA Portal homepage, click on “TCC/Exemption/Excise License Checker” link so as to verify the Tax Compliance Certificate online.

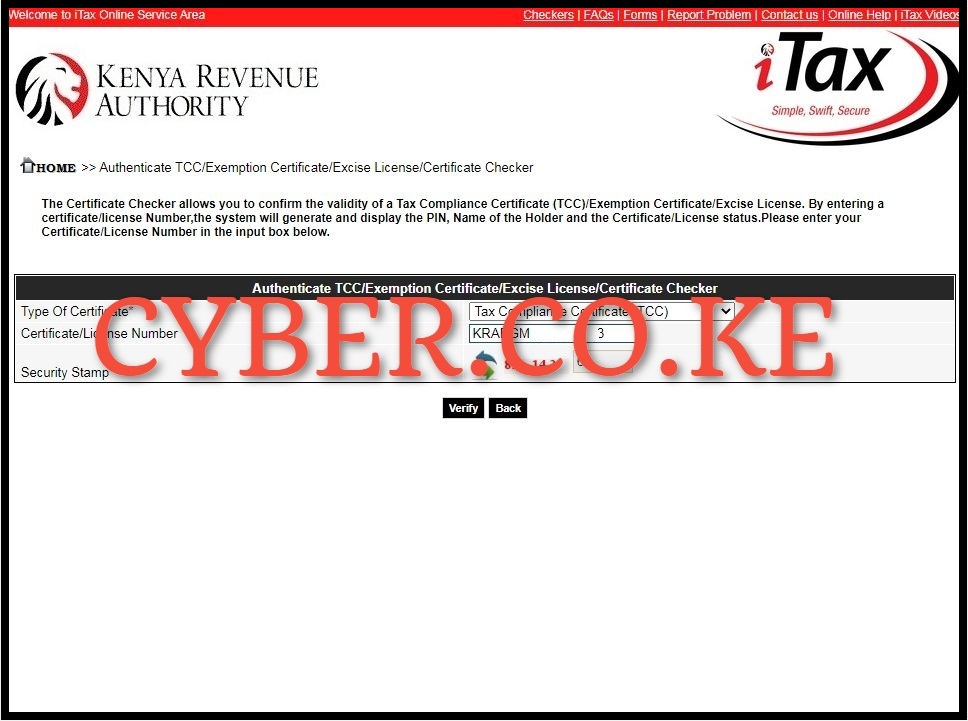

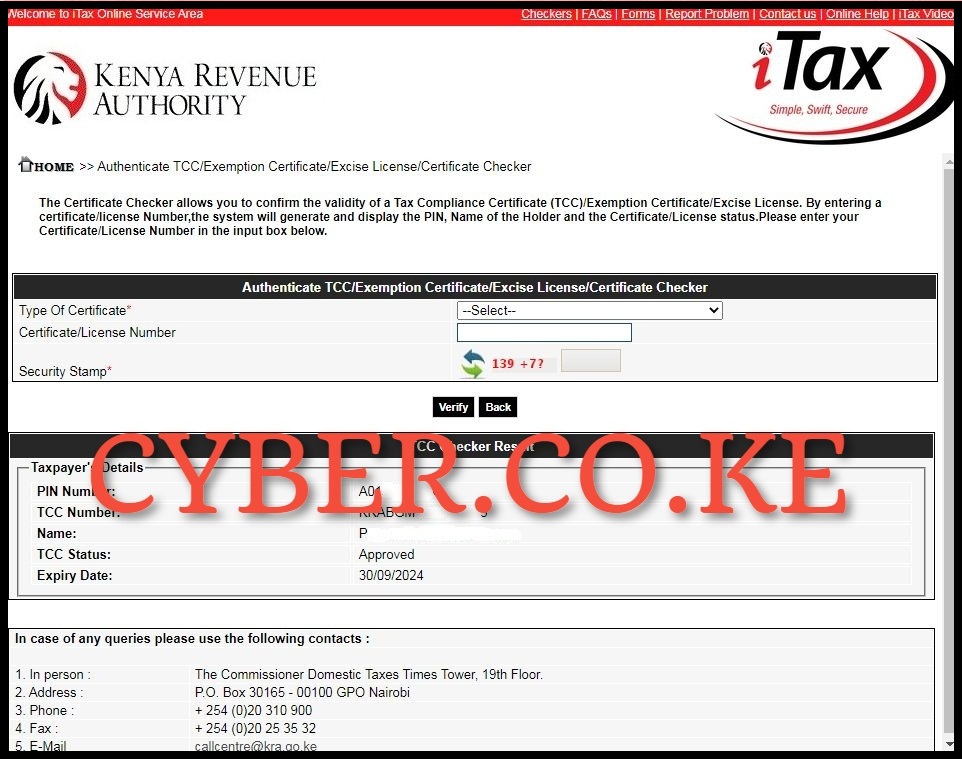

Step 3: Authenticate Tax Compliance Certificate using TCC Checker

This is the most important step in the process of checking the Tax Compliance Certificate using the TCC Checker. In this step, you will be required to select the type of certificate and fill in the certificate number. So, in our case the Type of Certificate is Tax Compliance Certificate (TCC) and Certificate Number is the number of the Compliance Certificate that we are verifying on KRA Portal using the TCC Checker feature/functionality. Once you have filled in these two key fields, click on the “Verify” button. A pop up will appear asking you “Are you sure you want to validate TCC Number?” Click on OK to load the TCC Checker Results.

Step 4: Tax Compliance Certificate Checker Results

In this last step, the results of the KRA Tax Compliance Certificate Checker will be displayed. The outcome is normally either “Valid/Approved” on “Invalid”. If the Tax Compliance Certificate (TCC) is valid/genuine, then the following fields will have some details i.e. PIN Number (the KRA PIN Number of the taxpayer), TCC Number (the Tax Compliance Number), Names (the names of the taxpayer), TCC Status (approved) and Expiry Date (the date that the Tax Compliance Certificate expires). If the above fields are displayed, the the Tax Compliance Certificate is Valid and Genuine. If you get a result such as “Sorry, your TCC Number: “KRABGM*********5″ is invalid”, that simply means is not valid (not genuine).

READ ALSO: How To Reset KRA Password Online (In 7 Steps)

As a taxpayer it is important to ensure that you file all your tax returns and pay any tax due so that you can easily be issued with the Tax Compliance Certificate by Kenya Revenue Authority (KRA). This is a very important document that all taxpayers need to have. Just ensure you follow the right process of obtaining your Compliance Certificate on KRA Portal (iTax Porta). Next time you want to check and confirm the validity of Tax Compliance Certificate, just follow the above outlined 4 main steps in using the KRA Tax Compliance Certificate Checker (KRA TCC Checker).