Are you looking to file your KRA Returns using the IT1 Individual Resident Return Form? Learn How To Download IT1 Individual Resident Return Form.

Filing of KRA Returns in Kenya is a very important exercise where taxpayers who have KRA PIN Numbers are supposed to file the Tax Returns on or before the stipulated Kenya Revenue Authority (KRA) Returns Deadline of 30th June of each year. So, whether you are employed or unemployed, you have to file to file your KRA Returns. Everyone with a valid KRA PIN Number is required by law to file their returns (Section 52B – Income Tax Act Cap. 470). Failure to which a penalty applies.

Normally KRA Returns for Individual Residents is Kenya is grouped in two i.e KRA Nil Returns (for those who are unemployed) and KRA Employment Returns (for those who are employed). The focus of this article will be on those who are employed as we shall learn and get to know the steps involved in downloading the IT1 Individual Resident Return Form on KRA Portal. So, if you are employed and looking for the IT1 Individual Resident Return form, then this article will come in handy for you.

READ ALSO: KRA Portal Login Steps Using KRA PIN and KRA Password

The IT1 Individual Resident Return Form is basically an Excel Sheet that is downloaded on KRA Portal so as to enable those taxpayers who are employed file their KRA Returns using their P9 Forms with ease and convenience. Sometimes it can be referred to as the KRA Returns Form, KRA Excel Sheet or simply KRA Tax Computation Sheet, and as from that description you can note that it basically allows the computation of Tax by the taxpayers in Kenya.

To be able to file file your KRA Returns if you are employed, there are normally two options i.e. File using IT1 Individual Resident Return Form and ITR For Employment Income Only. But in this article, we shall be focusing on the steps that are involved in downloading the IT1 Individual Resident Return Form on KRA Portal. This Return Form plays an important role in filing KRA Returns for Employees in Kenya who have their KRA P9 Form issued to them by their employers.

To be able to download the IT1 Individual Resident Return Form on KRA Portal, you need to be logged in first. That is only possible if you have with you the two most important requirements that are needed in the whole process of downloading IT1 Individual Return Form on KRA Portal. You need to ensure that you have with you the KRA Portal login credentials that comprises of the KRA PIN Number and KRA Password. Once you have the two credentials with you, then you can easily follow the step by step procedure that is outlined in this article on How To Download IT1 Individual Resident Return Form.

Requirements Needed To Download IT1 Individual Resident Return Form

To be able to Login to KRA Portal so as to Download IT1 Individual Resident Return Form, there are a set of requirements that you need to ensure that you have with you. This includes; KRA PIN Number and KRA Password. These two play an important role as you will need them in order to login to KRA Portal so as to be able to download the KRA Return form that is needed for the process of Filing KRA Returns on KRA Portal for those taxpayers who are in employed or simply those who are employed in Kenya.

Just as I have mentioned above, to be able to login to KRA Portal, you are going to need your KRA PIN Number and KRA Password as these two form the most important KRA Portal login credentials. Let’s look at each of these key requirements briefly below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA Password

The next requirement that you need to have with you is your KRA Password. You will need the KRA Password to access your KRA Portal Account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your KRA Portal Account.

You can only change or reset your KRA Password if the email used in KRA iTax Portal is the same as the one you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable you Reset KRA Password.

How To Download IT1 Individual Resident Return Form

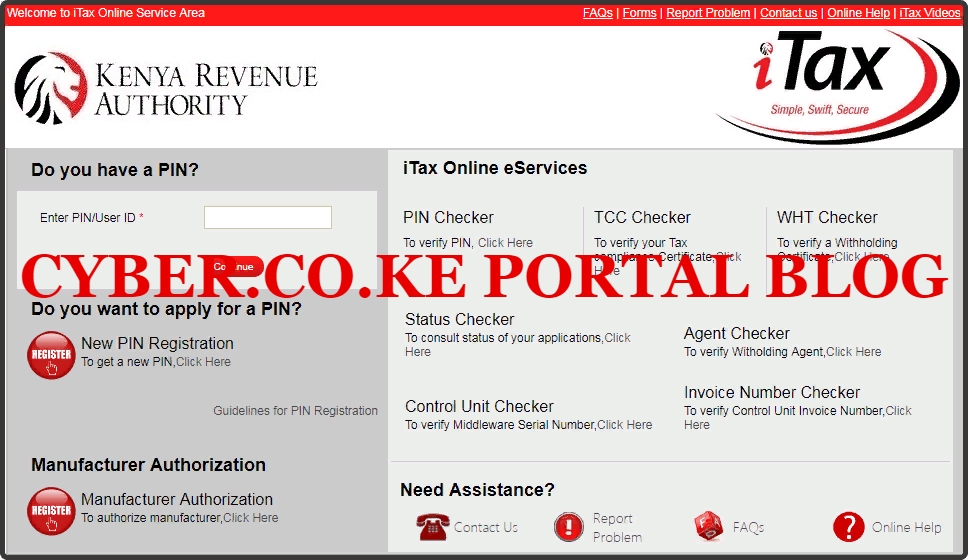

Step 1: Visit KRA Portal

The first step in the process of downloading the KRA IT1 Individual Resident Return Form that you need to take is to ensure visit the KRA Portal. You can click on https://itax.kra.go.ke that will take you to the KRA Portal. Note that the link will open in a new browser tab.

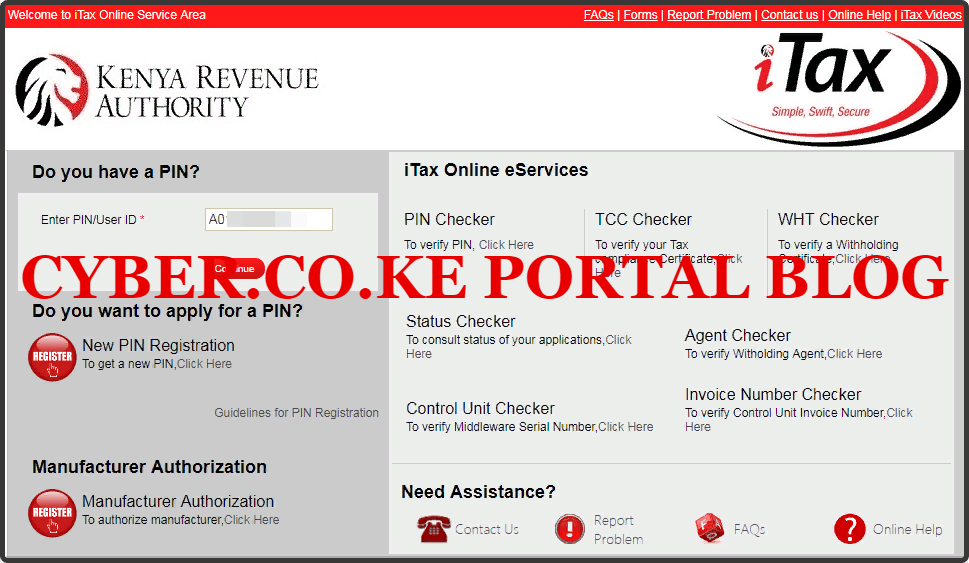

Step 2: Enter KRA PIN Number

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

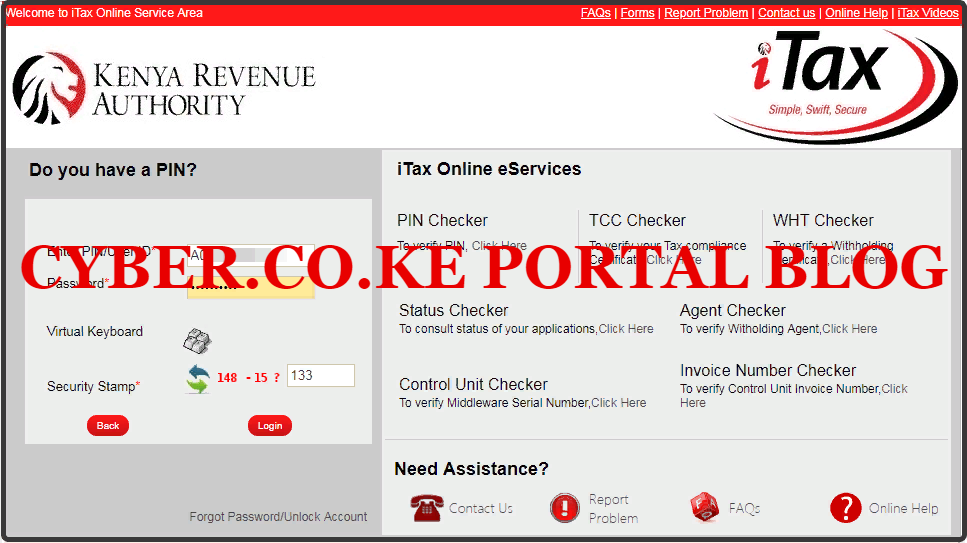

Step 3: Enter KRA Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA Password and also solve the arithmetic question (security stamp). If you have forgotten your KRA Password, you can check our article on How To Reset KRA Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your KRA Portal Account.

Step 4: KRA Portal Account Dashboard

Once you have entered the correct KRA Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA Portal Account Dashboard.

Step 5: Click On The Returns Menu

In this step, on the iTax Account menu list, navigate to “Returns” menu tab and click on “File Return” from the drop down menu list. This is as illustrated in the screenshot below.

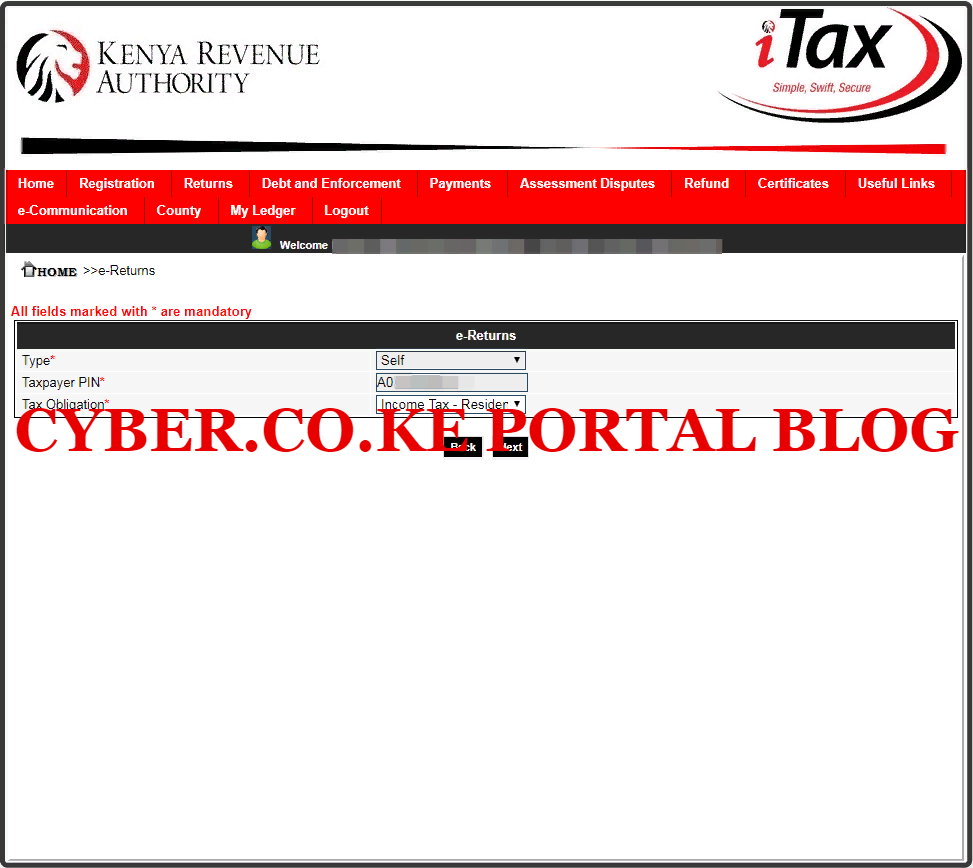

Step 6: Select Tax Obligation As Income Tax Resident Individual

In this step, you will need to select the tax obligation as Income Tax Resident Individual this is because we are downloading the IT1 Individual Resident Form from the KRA Portal. The Type and Taxpayer PIN entry fields are automatically pre-filled. Once you have selected the Tax Obligation, click on the “Next” button.

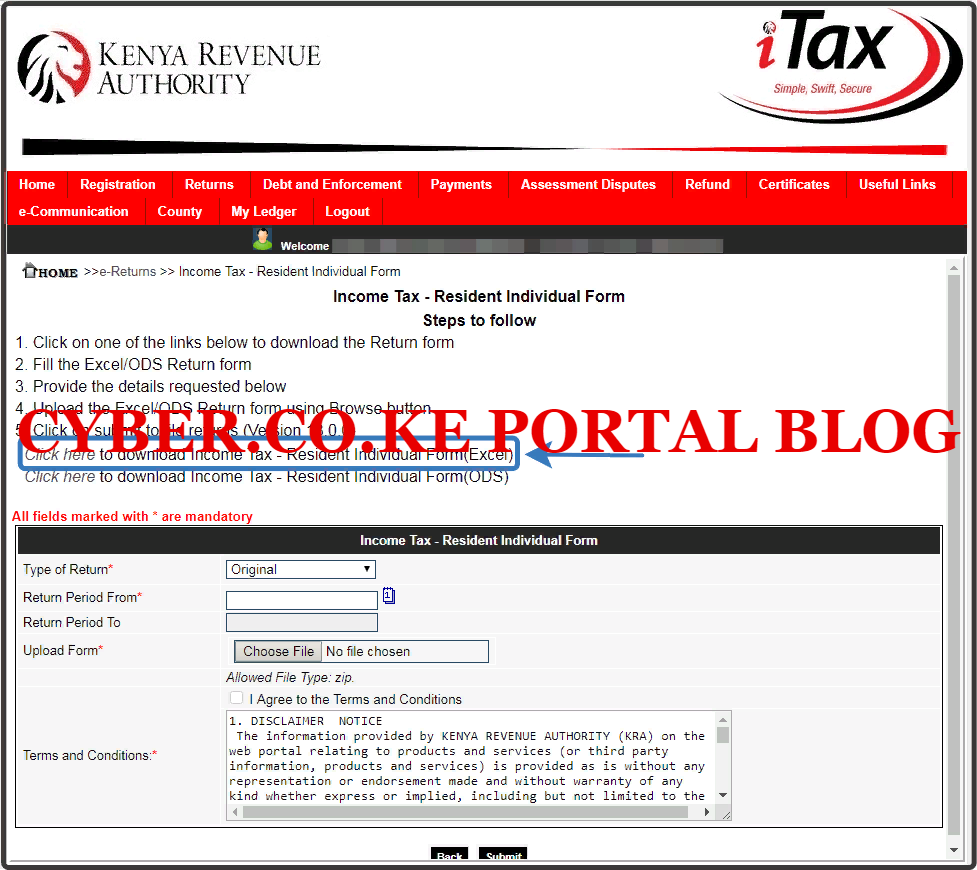

Step 7: Download IT1 Individual Resident Return Form (Version 18.0.3)

In this step, you will need to download the KRA IT1 Individual Resident Return Form version 18.0.3 that is referred to as the KRA Returns Form or KRA Excel Sheet for Filing KRA Returns on KRA Portal. You need to take note that the IT1 Individual Resident Return Form is a zipped file and you need to ensure that your laptop or computer has MS Office suite i.e. Microsoft Excel (MS Excel) installed.

Once you click on the Download KRA Returns Form on KRA Portal, a zipped file will be downloaded to your Computer or Laptop. You will need to unzip the file so as to open the IT1 Individual Resident Return Form that is an Excel Workbook or Excel Worksheet (Excel Sheet). Download The Latest KRA IT1 Individual Resident Return Form (as at 07/05/2021) IT1_Individual_Resident_Return_XLS (version 18.0.3).

READ ALSO: How To File KRA Nil Returns Using KRA Portal

The next steps will involve filling in the IT1 Individual Resident Return Form using the details contained on the KRA P9 Form for Employees. You need to ensure that you have your KRA PIN Number, Employer’s KRA PIN Number, KRA P9 Form and KRA Returns Form that you have just downloaded from iTax. So, next time you need to download the Individual Resident Return Form on KRA Portal, just follow the outlined above steps.