Get to know How To File KRA Nil VAT Returns on iTax today. If you have VAT obligation on your KRA PIN, you should file the VAT Returns.

Value Added Tax is charged on supply of taxable goods or services made or provided in Kenya and on importation of taxable goods or services into Kenya.

It is important to note that KRA VAT Returns are file on or before 20th of each month. So, if you have VAT obligation, it means you always have to be on your toes tpo ensure that you meet the deadline and avoid the penalty of Kshs. 10,000 for late filing.

In this article I am going to share with you the step by step guide on How To File KRA Nil VAT Returns on iTax. Note that that NIL VAT Returns will only apply when you did not have any Vatable sales during the month.

How To File KRA Nil VAT Returns on iTax

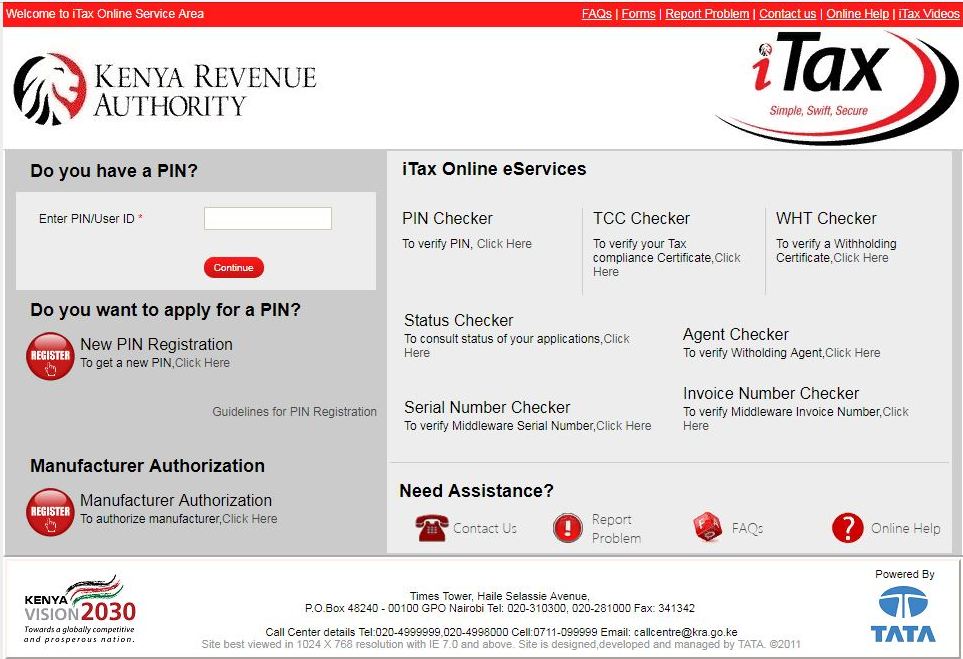

Step 1: Visit iTax Portal

The first step that you need to do is access your iTax Portal account using the link provided above.

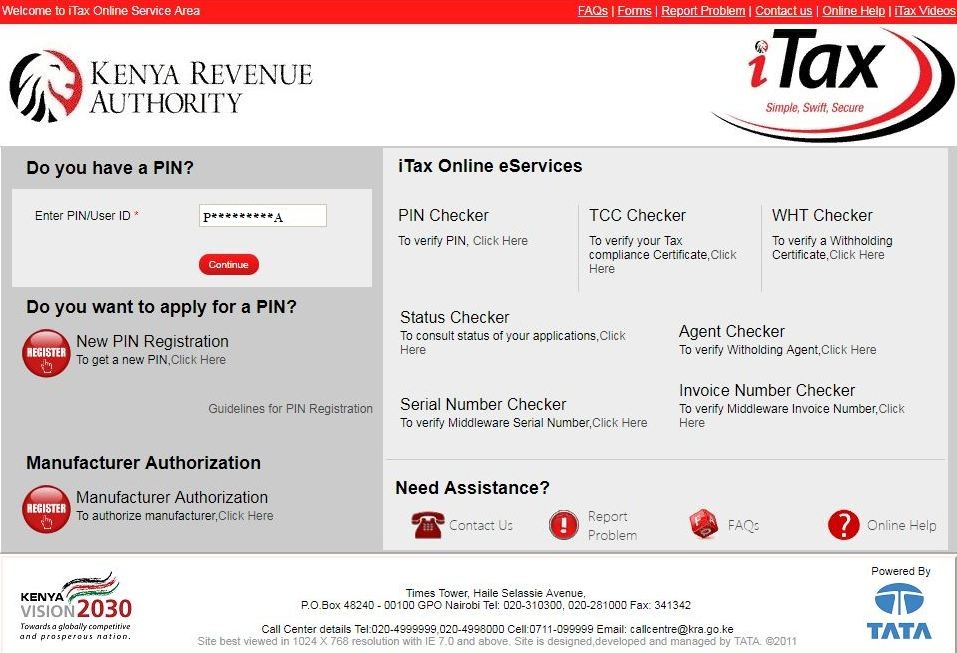

Step 2: Enter your KRA PIN

Next, you will be required to enter your KRA PIN number. This is as shown below.

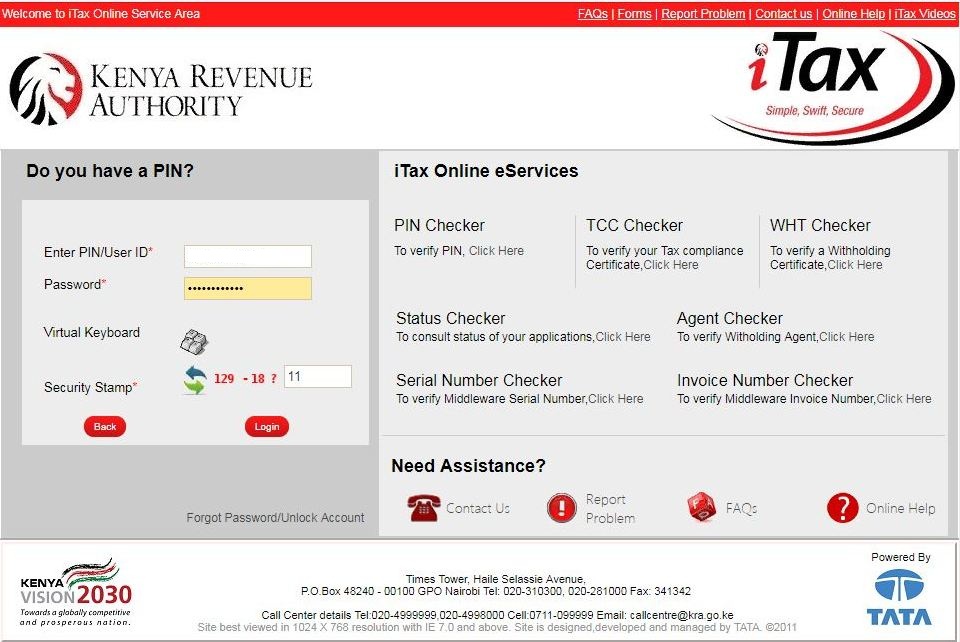

Step 3: Enter your KRA Password

The next step, you will be required to enter your KRA Password. Once you have entered your KRA Password and solved the arithmetic question, click on the login button.

Step 4: iTax iPage Account Dashboard

Once you have successfully logged into your iTax account (iPage) you should see the following as shown below. In you iTax account you can do a variety of tasks online. Our main focus for this blog post will be on KRA Nil VAT Returns.

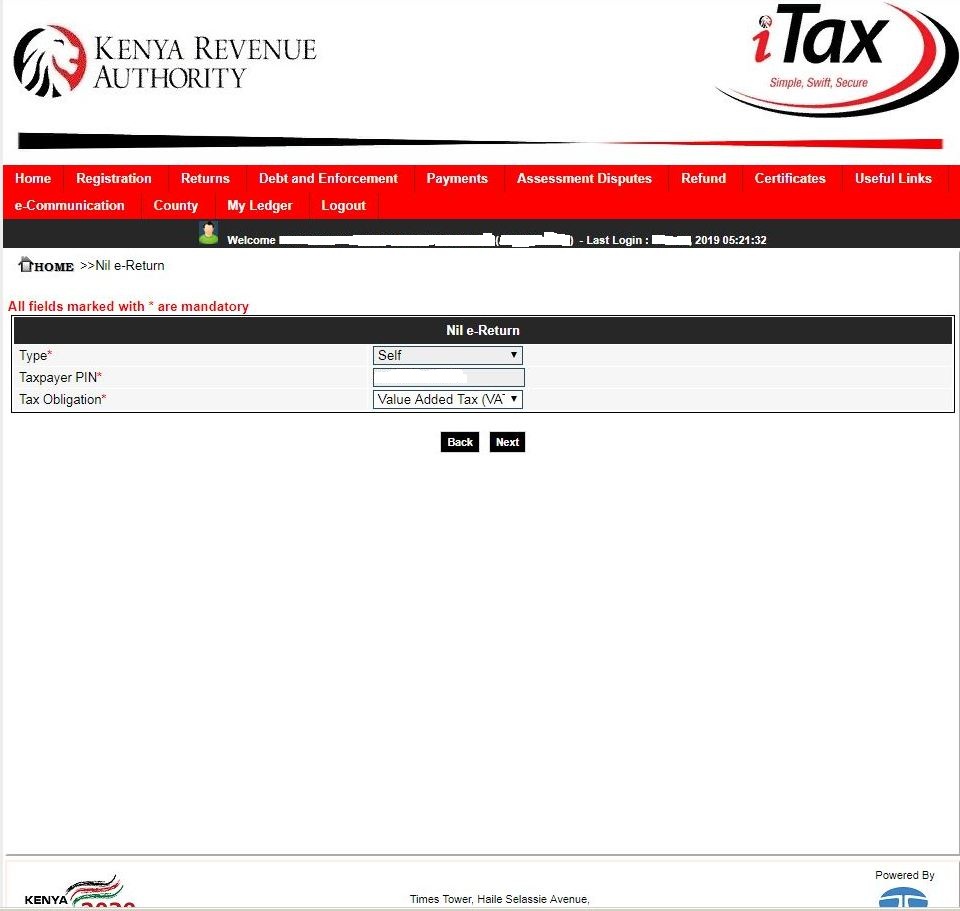

Step 5: Click on File Nil Return tab

In this step, you will be required to click on the File Nil Returns tab sub menu under Returns. This is as shown below.

Step 5: Select Tax Obligation i.e Value Added Tax (VAT)

In this step, you will be required to select the tax obligation. In our case, since we are filing KRA Nil VAT return, then then VAT option under the dropdown menu is what we select. This is as shown below.

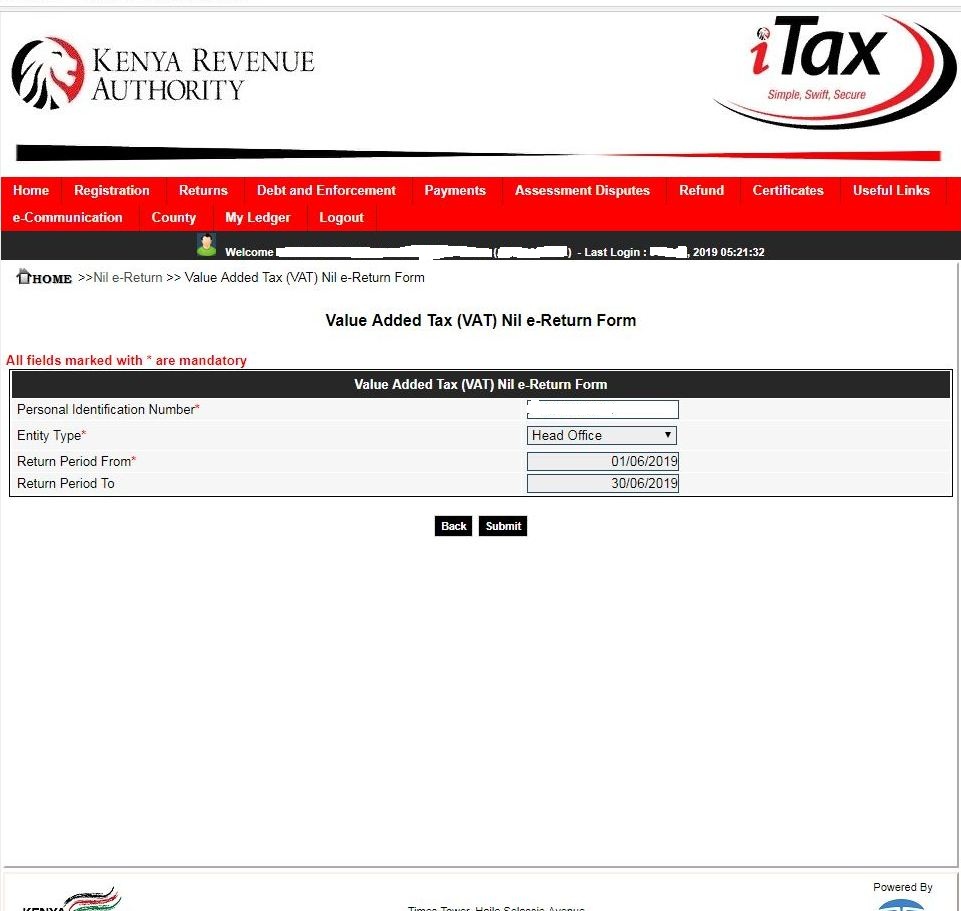

Step 6: Value Added Tax (VAT) Nil e-Return Form

In this step, you will note that the return date is automatically pre-selected by the system. Click the submit button to proceed as shown below.

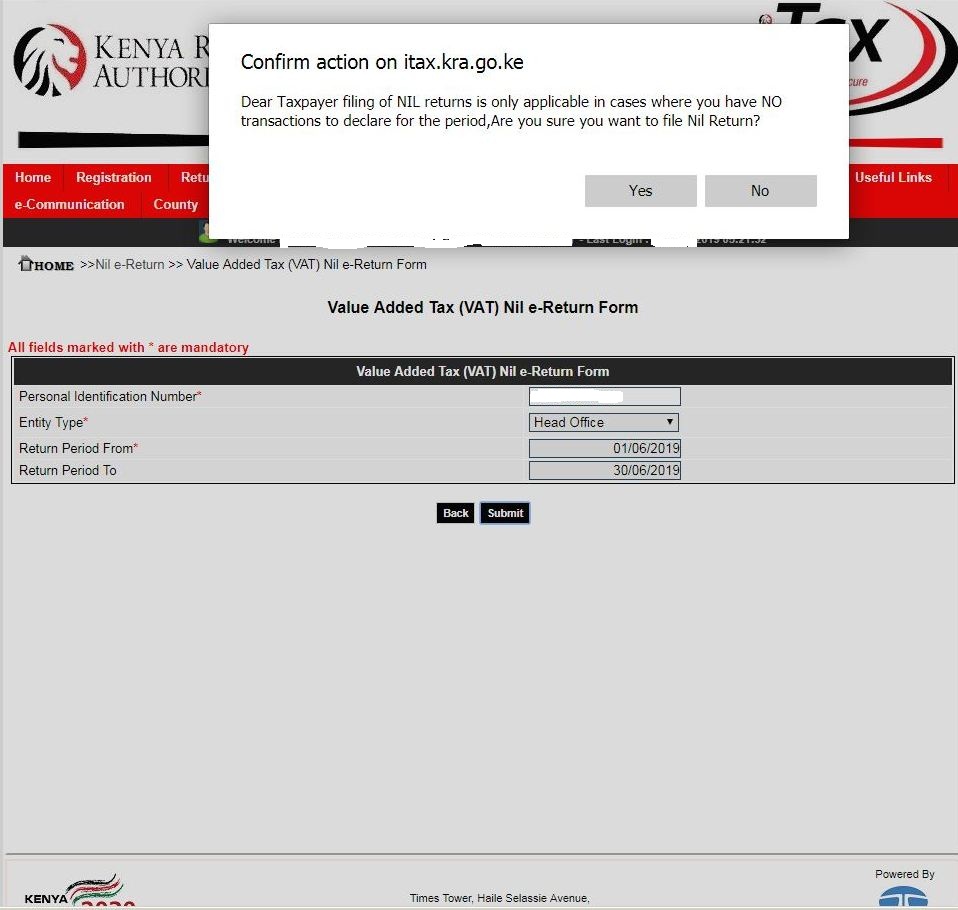

Step 7: Confirm VAT Return Submission

A pop up will appear for you to confirm if you wish to submit the KRA Nil VAT Return. Click on the Yes button to submit the VAT Nil Return.

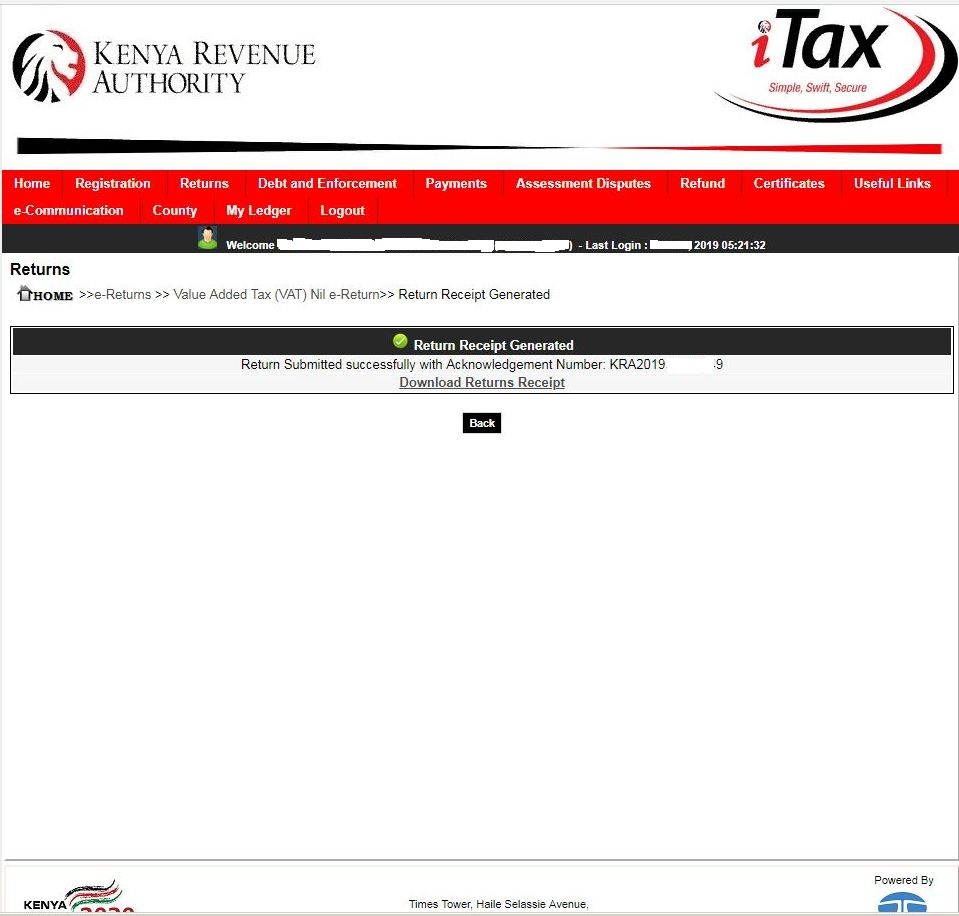

Step 8: Download Nil VAT Returns Receipt

In this step, you will be required to download the Nil VAT Return receipt. This is as shown below.

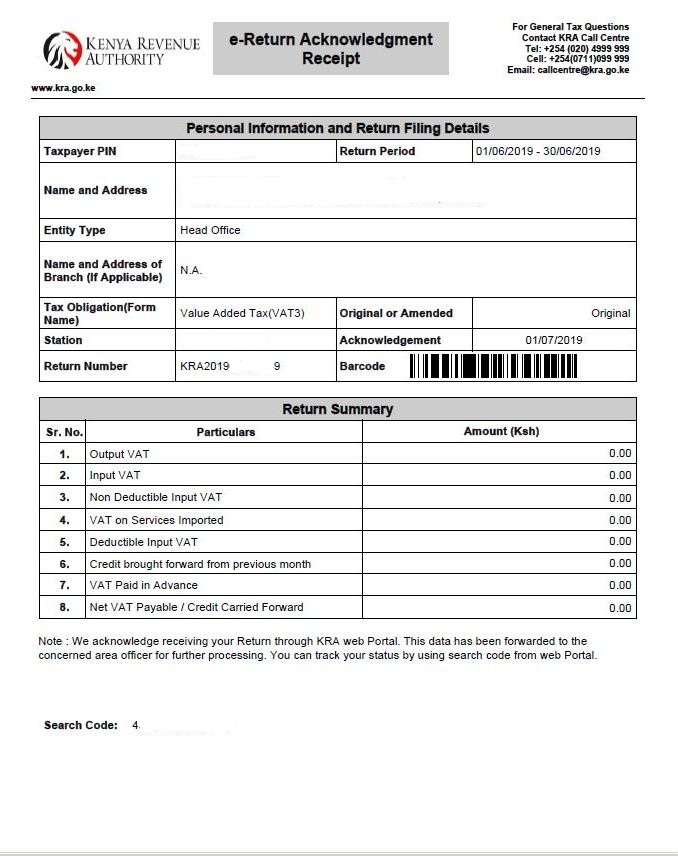

Step 9: VAT Nil Return e-Return Acknowledgement Receipt

In this last step, you will download the Acknowledgement Receipt as a final confirmation that you have filed your NIL VAT Returns for that month.

And those are the simple steps that you need to follow when filing Nil VAT Returns on iTax Portal. Feel to share this blog post online.