Filing of Turnover Tax (TOT) Returns by taxpayers in Kenya is normally done monthly on or before the 20th of each month. One is required to download the Turnover Tax Form and fill in the business turnover details for the previous month before uploading the Turnover Tax Form on KRA Portal. It is important that taxpayers who are registered under the Turnover Tax (TOT) obligation know the correct steps that are involved in filling the Turnover Tax Returns Form.

In this article, I will be sharing with you the most important steps that you are supposed to follow in filling in the KRA Turnover Tax Form with ease and correctly before uploading the Turnover Tax Form on iTax Portal. You need to know that Turnover Tax (TOT) is a tax obligation that is filed each and every month by the taxpayers who are registered under this tax obligation in the KRA Portal.

As a rule of thumb, Kenya Revenue Authority (KRA) always puts an emphasis on taxpayers to file their Tax Returns before the elapse of the set deadlines to avoid unnecessary tax penalties. To be able to fill in the Turnover Tax Returns Form (Turnover Tax Form), you need to have with you your KRA PIN Number and the KRA Turnover Tax Form, which you can easily download from your KRA Portal account under the “Returns” menu in your account dashboard.

READ ALSO: How To Download Turnover Tax Form Online (In 5 Steps)

Requirements Needed In Filling Turnover Tax Returns Form

The process of filling the Turnover Tax (TOT) Returns Forms requires two important requirements i.e. KRA PIN Number and KRA Turnover Tax Returns Form. These two go hand in hand as to be able to fill in the Turnover Tax Form, your PIN is needed since there is a section that the KRA PINN Number needs to be captured in the KRA Returns Forms.

-

KRA PIN Number

The KRA PIN Number is the most important requirement that you need to have with you when you want to File Trnover Tax Returns using the Returns Form (Excel Sheet). You can’t fill in the Turnover Tax Form without inputting the KRA PIN Number in the required section of the Returns Form. If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team. This saves you time and is very convenient and fast.

-

Turnover Tax Returns Form

The next item that you need to have with you is the downloaded KRA Turnover Tax (TOT) Returns Form which you are required to download from your KRA Portal account. You need to take note that the Turnover Tax Form is an Excel Sheet and you need to use Microsoft Excel in order to fill in the Returns Form without any issues.

Once you have download the KRA TOT Returns Form from iTax Portal, then you can follow the steps that are outlined in this article on how to fill the Turnover Tax Returns Form easily. Kindly ensure that you have both the KRA PIN Number and the Turnover Tax Form i.e. the excel sheet version of the returns form for filing the Turnover Tax returns on KRA Portal.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To Fill Turnover Tax Returns Form (In 3 Steps)

Step 1: Open the Turnover Tax Returns Form

The first step in filling the Turnover Tax Form is to open the form which you downloaded from your KRA Portal account. Since it’s an Excel sheet, ensure that you have Microsoft Excel in the device that you are using.

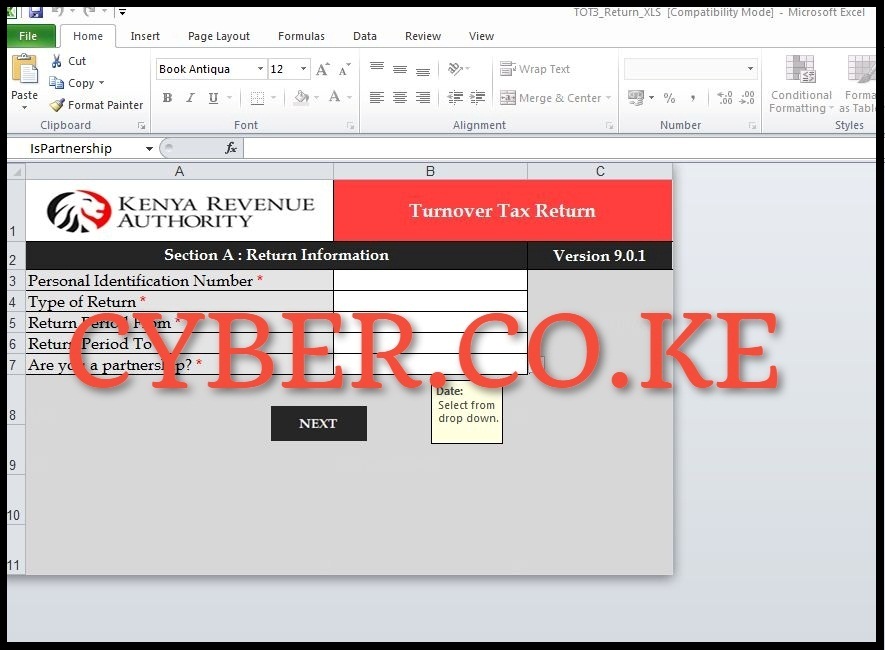

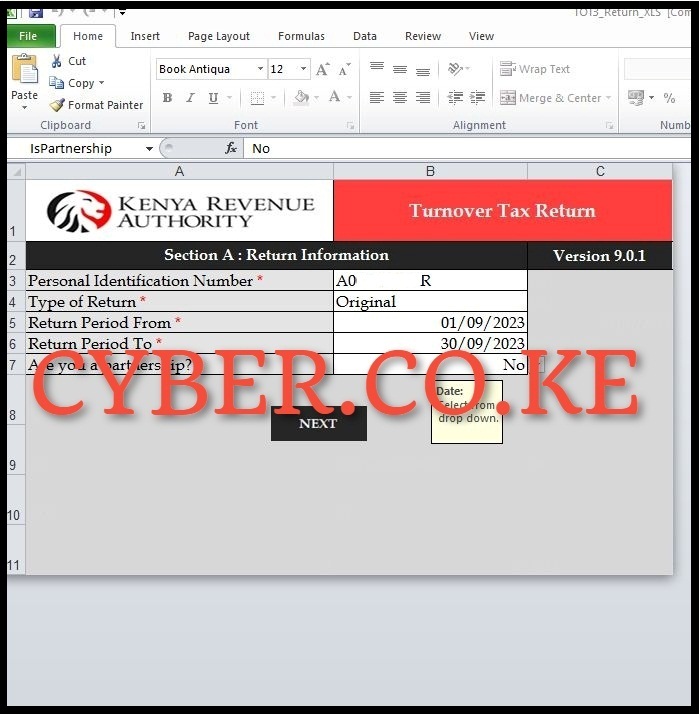

Step 2: Fill in Return Information (Section A)

In the section A part of the Turnover Tax (TOT) Returns form, you are supposed to fill in the following fields; Personal Identification Number (PIN), Type of Return, Return Period From, Return Period To and Are you a Partnership. After filling in the tax return information you can skip to the last section which is section D – Tax Due.

You might be asking why you have to skip section B, C and E? If you have details of any local purchases, you will fill in section B; if you have any Turnover Tax (TOT) credits carried forward from previous month(s), you will fill in section C and lastly, if your business is a partnership, you will fill in section E (details of partners).

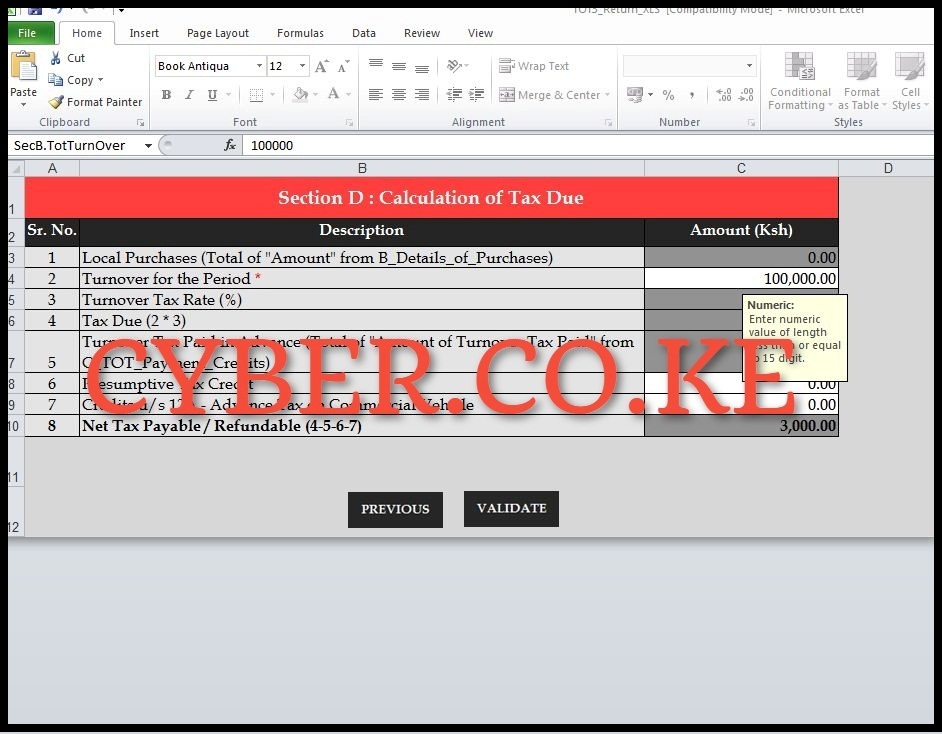

Step 3: Calculation of Tax Due

The most important step in the process of filling in the Turnover Tax (TOT)Returns Form is the calculation of the Tax Due in section D of the Turnover Tax Form. In this section, the most important field is the Turnover for the Period section (Sr. No. 2). Here you are supposed to fill in the total business turnover for the previous month.

Assuming in the month of September 2023 your business did a total sales of Kshs. 100,000.00, you will capture that figure in that section and the calculation of the Turnover Tax due will be displayed in Sr. No. 8 (Net Tax Payable/Refundable). The turnover tax rate in Kenya is 3% of the total sales the business made for the month.

READ ALSO: How To Check If You Have Filed KRA Returns (In 4 Steps)

Once you put in the turnover tax and the tax due is displayed, click on “Validate” button to validate the Turnover Tax Returns Excel Sheet before uploading it in your iTax account. Once you click on the validate button, you will see a pop up dialog box, ” Sheets are ready to be uploaded. Do you want to generate upload file?” Click the “Yes” button and the zipped filled Turnover Tax Returns Form will be saved in the Documents section of your devices. From there, you will be able to upload the generated zipped Turnover Tax Returns form in your iTax account.