Get to know the step by step process of How to Generate KRA Payment Slip via iTax. Learn where the Payment Slip will be needed by KRA.

Today, I am going to show you How to Generate KRA Payment Slip via iTax for Income Tax Individual. Our main focus will be on generating the Payment slip so as to pay for KRA Penalty that has been imposed on the KRA PIN.

In simple terms, we are going to generate a payment slip to pay for KRA Penalty that was imposed due to late filing. In this post, we are going to use an example of a Taxpayer who was fined Kshs. 2,000 by KRA for late filing of the 2017 Income tax returns.

NOTE: This individual had no source of income at that time / period (2017), and the Taxpayer did file theKRA Nil Return on time. The penalty of Kshs. 2,000 was automatically applied by the iTax system and now we have to apply for KRA Payment Registration so as to enable us pay the penalty for late filing of returns for that period.

How to Generate KRA Payment Slip via iTax

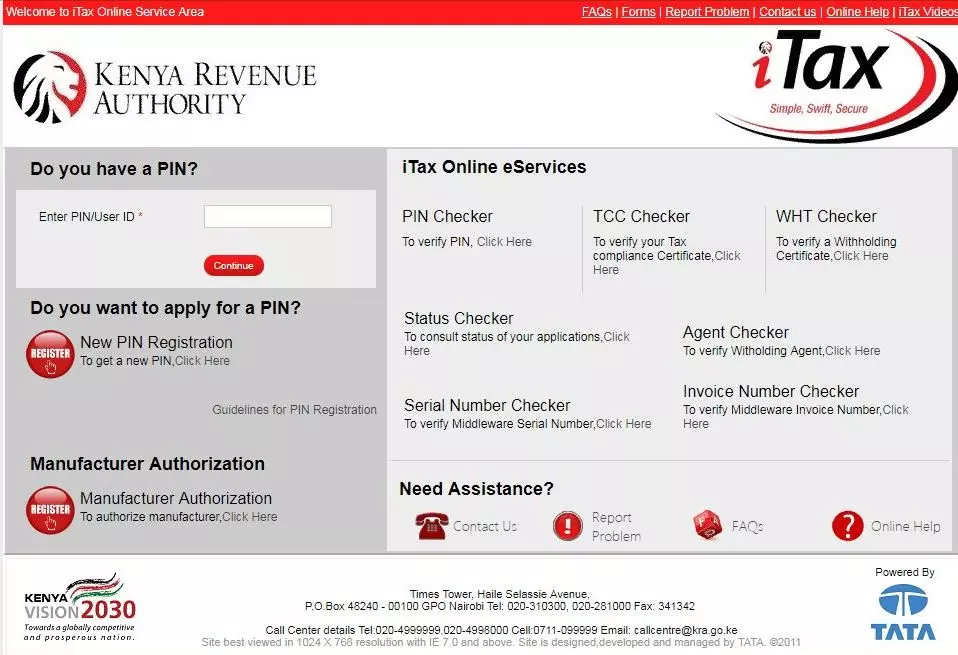

Step 1: Visit iTax Portal

The first step in generating payment slip by KRA is by visiting the iTax Portal using the above link provided and as shown below.

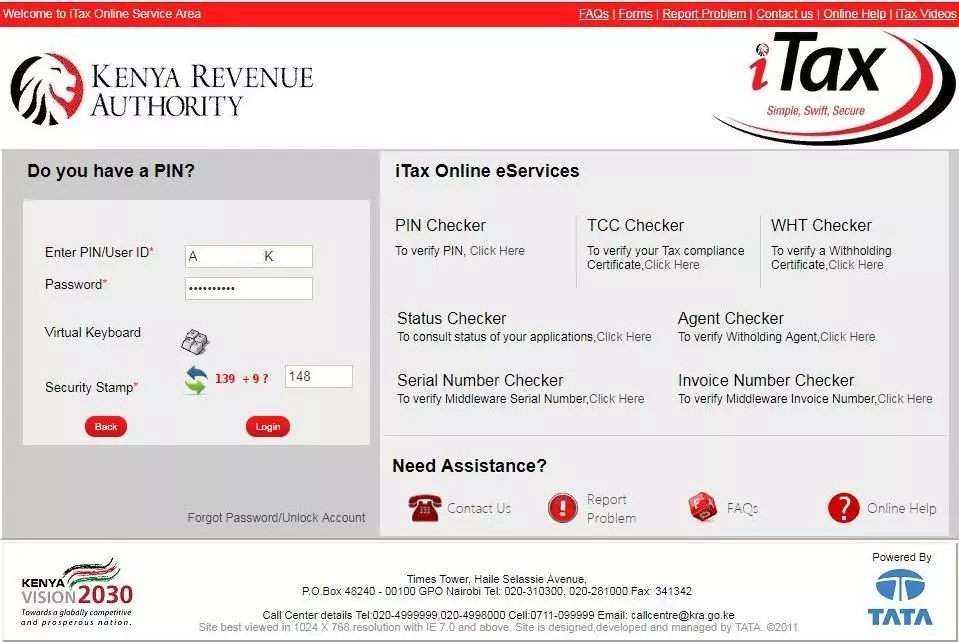

Step 2: Enter your KRA PIN Number and KRA Password

The next will be for you to enter your KRA PIN Number and KRA Password so as to enable you to log into your iTax account. This is as shown below.

Once you have entered your KRA PIN Number and KRA Password, click on the login button.

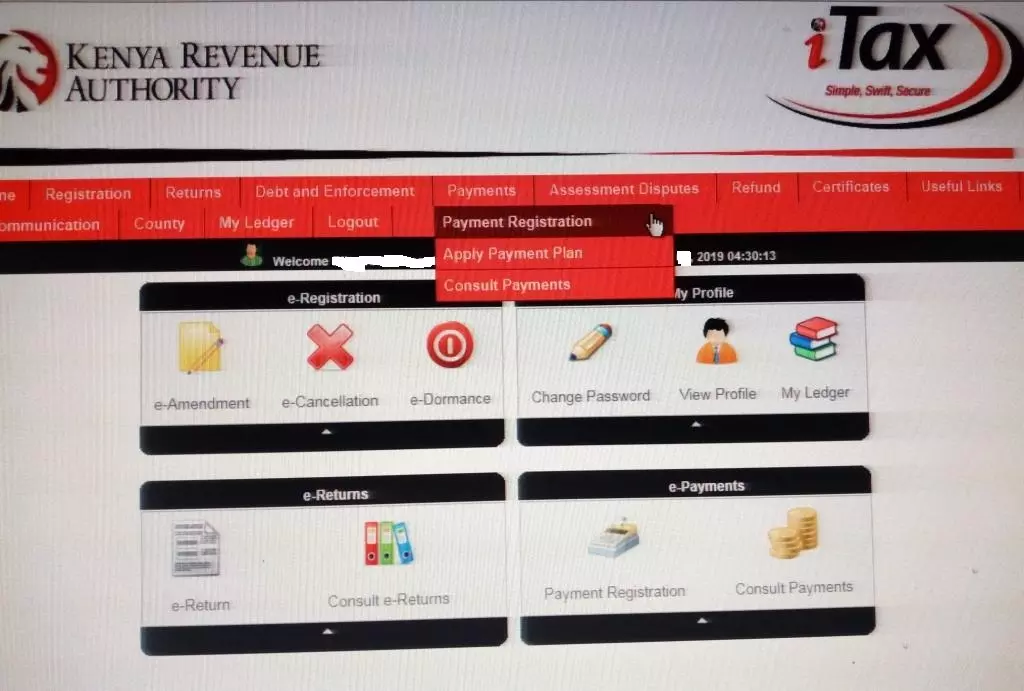

Step 3: iTax Web Portal Account

Upon successful login, you will be taken to your iTax Web Portal account / iTax dashboard / iTax iPage. This is as shown below.

Step 4: Click on Payments Tab then Payment Registration

In this step, you will be required to click on the Payments Tab then Payments Registration. This is as shown below.

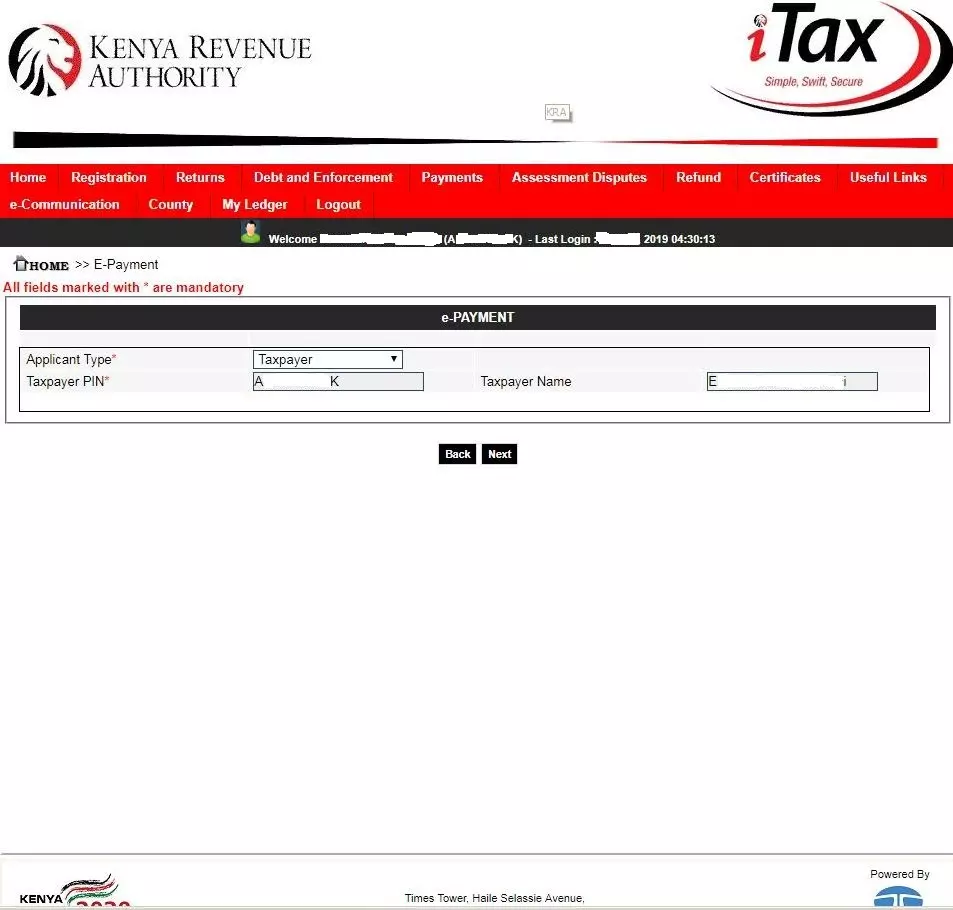

Step 5: ePayment Dashboard

After clicking on the Payments then payments registration tab, you will be taken to the epayment dashboard which has preselected fields such as applicant type (tax payer), taxpayer pin (KRA PIN Number) and Taxpayer Name. This is as shown below.

Click on the next button to proceed to the next step.

Step 6: Fill in the Payment Information Details

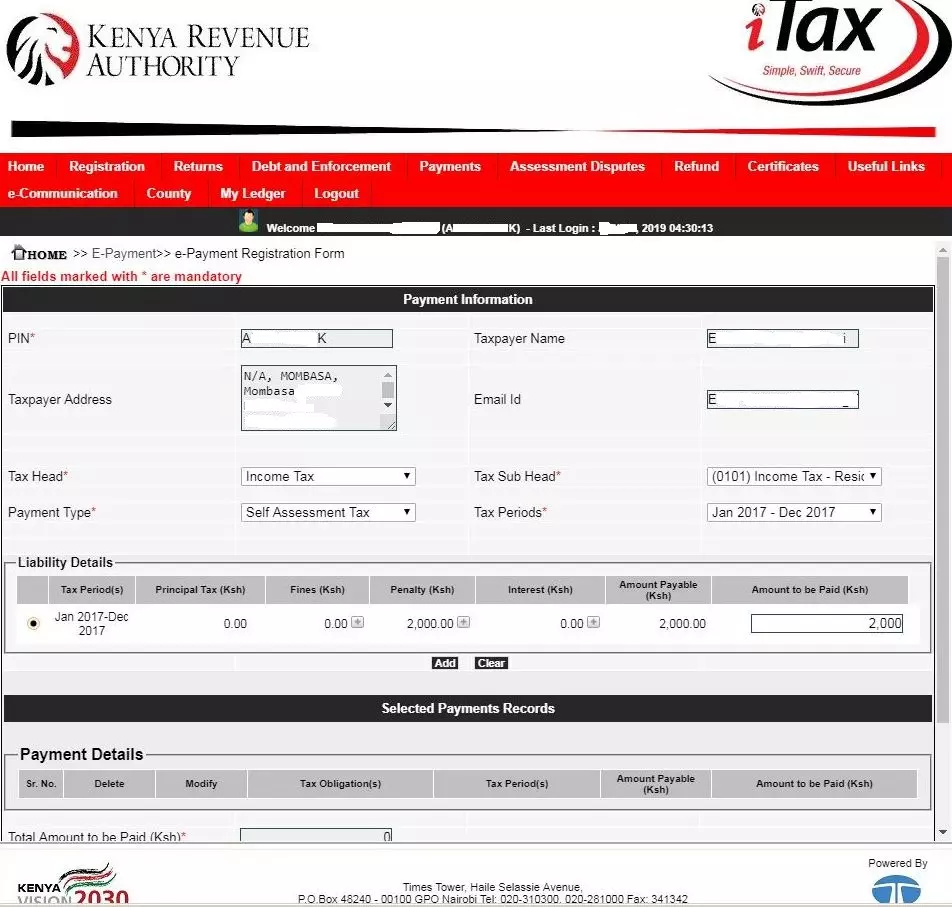

In this step, you are supposed to fill in the payment information details. The PIN, Taxpayer Name, Taxpayer Address and Email ID are automatically pre-filled by the system. Your work will be to select the other fields i.e. tax head, tax sub head, payment type and tax period. This is as shown below.

As explained at the beginning of this post, the taxpayer failed to file the 2017 Nil returns on time, and in this case a penalty of Kshs. 2,000 was imposed. So, we are going to generate the KRA Payment Slip for the amount of Kshs. 2,000 to pay and clear the 2017 penalty.

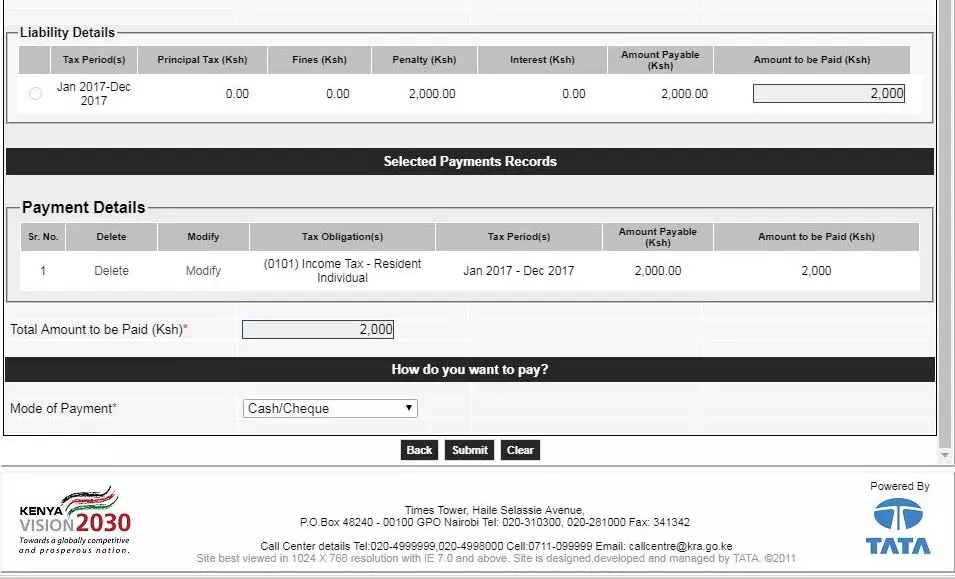

Step 7: Payment Details and Mode of Payment

In this step, we are going to add the payment details and mode of payment that we are going to use. In our case, the mode of payment is Cash/Cheque. This is as shown below.

Once you have filled in the amount to be paid, click on the submit button.

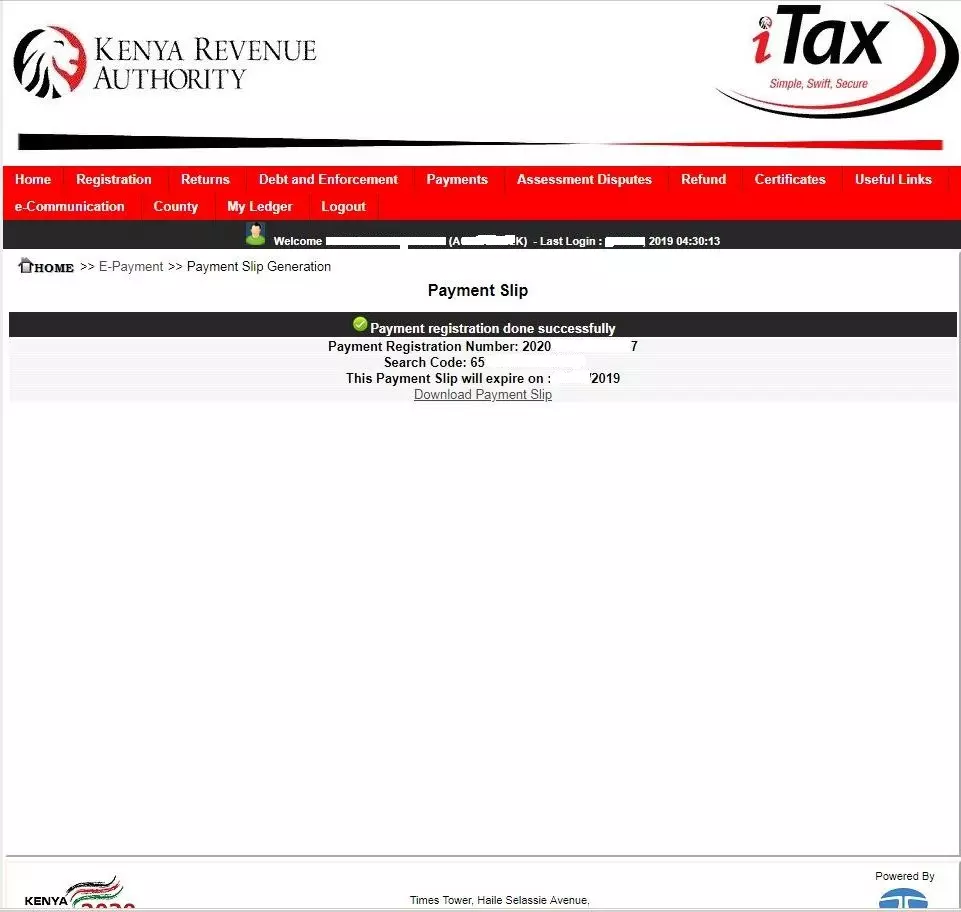

Step 8: Download KRA Payment Slip

The last step in this process of generating KRA Payment slip is downloading and printing the Payment slip generated via iTax. This is as shown below.

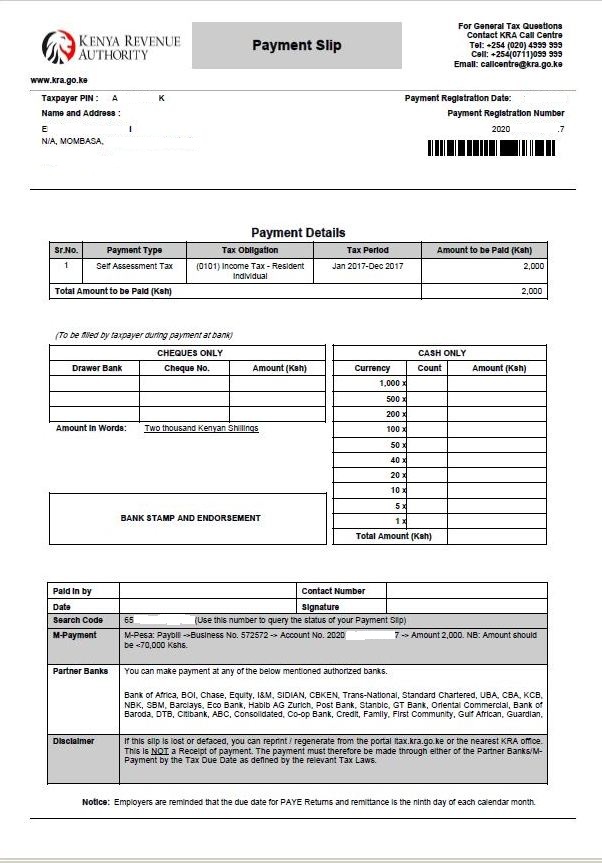

You need to note the following about the generated KRA Payment Slip:

- The payment slip contains payment registration number / account number.

- The payment slip contains a search code.

- The payment slip expires after 30 days from the date it is generated.

You can make payment using either Bank or M-Pesa. Sometimes M-Pesa might experience delays, so paying via Bank is very much advisable. You can make payment using the following banks in Kenya: Bank of Africa, BOI, Chase, Equity, I&M, SIDIAN, CBKEN, Trans-National, Standard Chartered, UBA, CBA, KCB, NBK, SBM, Barclays, Eco Bank, Habib AG Zurich, Post Bank, Stanbic, GT Bank, Oriental Commercial, Bank of Baroda, DTB, Citibank, ABC, Consolidated, Co-op Bank, Credit, Family, First Community, Gulf African, Guardian Bank.

If you decide to make payment via M-Pesa, then you can use the KRA Paybill Number of 572572 and Account Number is the one shown on the generated KRA Payment Slip.