The KRA Payment Registration Number abbreviated as PRN holds a very significant importance, as it facilitates convenient tax payments to the Kenya Revenue Authority (KRA). Comprising of numerical digits (e.g., 202425412****374), the PRN functions as the account number for remitting payments to KRA through either the Paybill Number 222222 or authorized banks in Kenya. Following the submission of various tax returns, such as VAT, PAYE, MRI, or TOT, it is mandatory to generate a KRA Payment Registration Number (PRN) for the subsequent payment and settlement of taxes owed to Kenya Revenue Authority (KRA).

Contained within a document known as the KRA Payment Slip or simply Payment Slip by KRA, the KRA Payment Registration Number (PRN) is accompanied by essential information such as the Payment Registration Date, Taxpayer Names and Address, Taxpayer KRA PIN Number, and Payment Details (indicating the tax amount payable to Kenya Revenue Authority – KRA). Additionally, the Payment Slip provides details such as the Paybill Number 222222 and a list of KRA-authorized banks where taxpayers can make payments associated with the generated Payment Registration Number (PRN) using iTax.

To generate a KRA Payment Registration Number (PRN), two crucial prerequisites must be fulfilled. These include possession of both your KRA PIN Number and iTax Password (KRA Password). The process of generating Payment Registration Number (PRN) involves logging into your iTax account, followed by executing the necessary steps to generate the Payment Registration Number (PRN) as reflected on the KRA Payment Slip. This blog post will cover the main process that all taxpayers in Kenya need to follow so as to generate PRN online quickly and easily today.

READ ALSO: How To Check Your KRA PIN Using KRA PIN Checker

Generating KRA Payment Registration Number (PRN) involves the following; Visit iTax (KRA Portal), Login Into iTax (KRA Portal), Click on Payments then Payment Registration, Fill the e-Payment and e-Payment Registration Form and finally Download KRA Payment Registration Number (PRN). Below is an in depth step-by-step process that you need to follow.

How To Generate KRA Payment Registration Number (PRN)

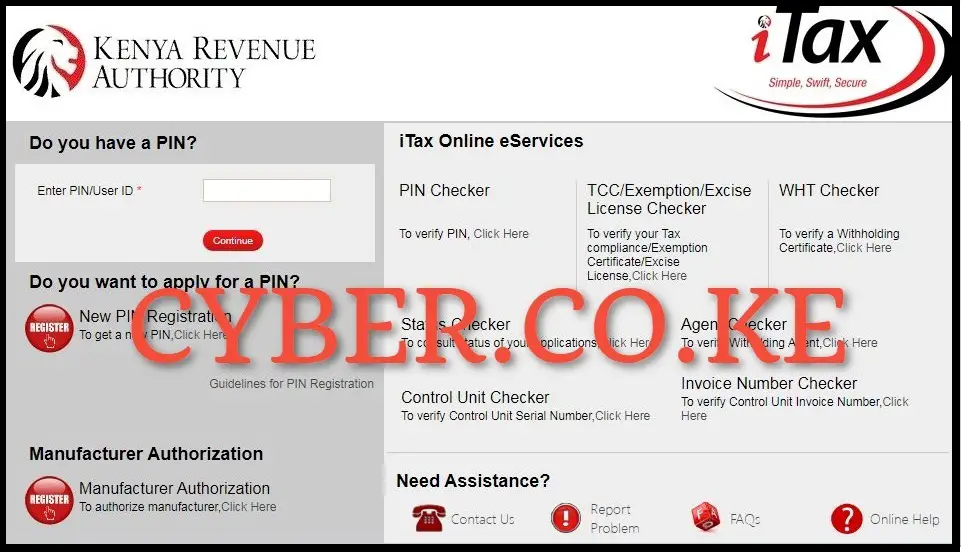

Step 1: Visit iTax (KRA Portal)

The process of generating KRA Payment Registration Number (PRN) starts by first visiting iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

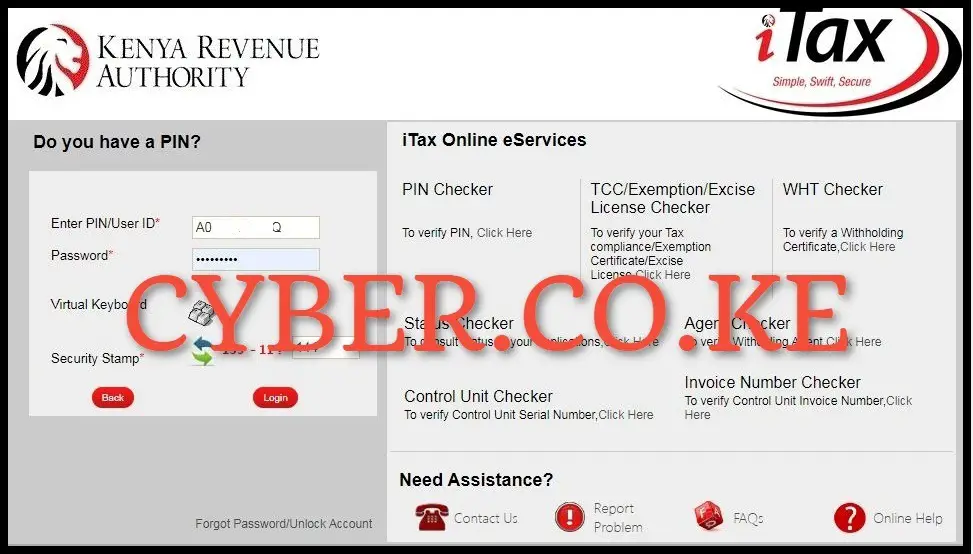

Step 2: Login Into iTax (KRA Portal)

Next, enter your KRA PIN Number and KRA Password (iTax Password), solve the arithmetic question (security stamp) and click on the “Login” button to access your iTax account (KRA Portal account).

Step 3: Click on Payments then Payment Registration

Upon successful login into iTax (KRA Portal) account, click on “Payments” and from the drop down menu, click on “Payment Registration” to start the process of generating KRA Payment Registration Number.

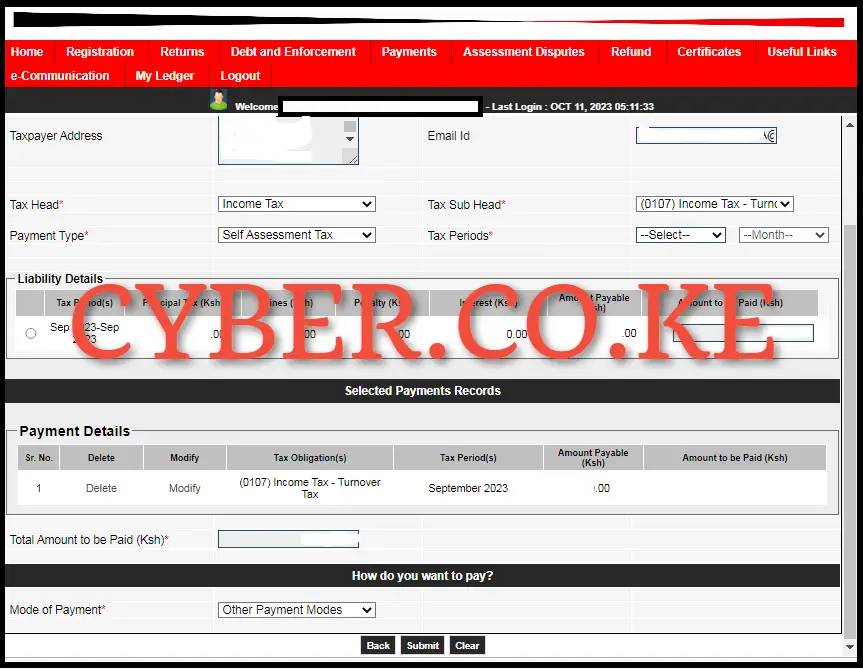

Step 4: Fill the e-Payment Form and e-Payment Registration Form

This step involves two main forms i.e. e-Payment Form and e-Payment Registration Form. The primary section within the Payment Registration module on the KRA Portal is the e-Payment Form.

It showcases crucial details such as Applicant Type, Taxpayer PIN Number, and Taxpayer Names. Simply click the “Next” button to access and load the subsequent e-Payment Registration Form.

The next form is the e-Payment Registration Form, that you need to fill in. This form captures essential payment details, including payment information and preferred payment method. Key fields to complete include Tax Head, Tax Sub Head, and Payment Type. Once you have added all the relevant details, click the “Add” button to incorporate this information into the payment records.

Concerning payment options, you can opt for either RTGS, Bank transfer, or alternative methods such as M-PESA Paybill Number 222222 (Government’s Single Payment Platform). Your choice is based on personal preference. Please ensure that you send the exact amount specified on the KRA Payment Slip to successfully finalize the transaction. After selecting your payment method, click the “Submit” button.

Step 5: Download KRA Payment Registration Number (PRN)

Finally, you need to download the generated Payment Registration Number (PRN) or simply the Payment Slip. To download the Payment Registration Number (PRN) found on the KRA Payment Slip, simply click the “Download KRA Payment Slip” text link. This action will initiate the automatic download of the KRA Payment Slip, saving the PDF version/format on your device. Subsequently, you can utilize the generated KRA Payment Slip to facilitate tax payments to the Kenya Revenue Authority (KRA).

READ ALSO: How To Download KRA Acknowledgement Receipt On iTax

The process of generating Payment Registration Number (PRN) requires that you first be able to access your iTax (KRA Portal) account using both your KRA PIN Number and iTax Password (KRA Password). Also ensure that you capture the correct amount of tax that is due or payable to Kenya Revenue Authority (KRA) for that tax obligation that you want to generate the PRN for. Once you have these two main requirements with you, you can follow the above outlined 5 main steps so as to be able to successfully generate KRA Payment Registration Number (PRN).