If you find yourself burdened by unpaid principal taxes or facing penalties and interest accrued from the same, there is some good news on the horizon – the KRA Tax Amnesty 2023 that runs from 1st September 2023 to 30th June 2024. This is the best opportunity to take advantage of the Tax Amnesty and have all the penalties and interest removed by Kenya Revenue Authority (KRA).

This initiative offers taxpayers in Kenya a valuable opportunity to settle their tax arrears and clear outstanding liabilities while enjoying significant benefits in the form of reduced penalties and interest charges. The Finance Act of 2023 also eliminated previous tax waiver and abandonment provisions, encouraging taxpayers to take advantage of this new tax amnesty opportunity to pay only the principal tax and have the penalties and interest cleared for them by Kenya Revenue Authority (KRA).

This means that going forward, there will no longer be waiver applications and all taxpayers are advised to utilize the Tax Amnesty 2023 program. According to Finance Act 2023, Tax Amnesty was introduced for persons with penalties and interest but have no principal taxes owed for periods up to 31st December 2022; and persons who have principal tax accrued up to 31st December 2022 but pays the outstanding principal tax debt by 30th June 2024. Those taxpayers who only have penalties qualify for automatic Tax Amnesty and are not required to apply for KRA Tax Amnesty.

READ ALSO: The Complete Beginner’s Guide To KRA Tax Amnesty 2023

Frequently Asked Questions About KRA Tax Amnesty

1. What is KRA Tax Amnesty? – The KRA Tax Amnesty is a limited time offer targeted for a class of Taxpayers with an aim of addressing a specific problem or achieving a specific objective. The Finance Act, 2023 introduced Section 37E to the Tax Procedures Act, 2015 which has granted a tax amnesty on penalties and interest on tax debt for periods up to 31st December 2022.

2. Do I qualify for the KRA Tax Amnesty? – A person qualifies for the KRA Tax Amnesty on penalties and interest where the person – (i) Has no principal taxes owed but there are penalties and interest for periods up to 31st December 2022 and (ii) Fully pays any outstanding principal taxes accrued up to 31st December 2022, by 30th June 2024.

3. How long will KRA Tax Amnesty run? – The KRA Tax Amnesty commenced on the 1st September 2023 and shall run up to 30th June 2024. You are required to take advantage of this fresh start being offered by Kenya Revenue Authority (KRA).

4. Can I apply for a payment plan? – Yes. The tax amnesty application form will also enable you to make the payment plan request. Amnesty will however be granted only for principal taxes paid in full before 30th June 2024. Amounts that remain unpaid by 30th June 2024 will be subject to enforcement measures.

5. What is the difference between Amnesty, Waivers and Write-offs? – The Finance Act, 2023 introduced Section 37E into the Tax Procedures Act (TPA) 2015 which grants the tax amnesty. At the same time, it also deleted Sections 37 Section 89 of the same Act which provided for Write-off of taxes and waivers respectively. Therefore, there will be no application, processing and granting of waivers of interest, penalties and fines for periods starting 1st July, 2023.

6. What happens to Interest Penalties and Fines accrued for periods from 1st January, 2023? – The provision on waiver of penalties and interest was deleted, effective 1st July 2023. Therefore; (i) For taxpayers who had lodged their applications for waiver of penalties and interests accrued for the aforementioned periods before 30th June 2023, the mitigating factors provided will be evaluated and the applications processed accordingly; (ii) For those who had lodged their applications for the waiver of penalties and interest after 30th June 2023, they will be required to pay all the interest and penalties.

7. Do all tax obligations qualify for amnesty? – The tax amnesty only covers tax laws covered under the Tax Procedures Act, 2015. Customs duties administered under the East Africa Community Customs Management Act (EACCMA) do not qualify for amnesty. The amnesty covers penalties and interest on tax debt for periods up to 31st December 2022 with the exception of interest and penalties imposed under Section 85 of the Tax Procedures Act, 2015 (Tax Avoidance penalty).

8. Is there any evidence to be attached when Applying for amnesty? – No attachments are needed when you apply for KRA Tax Amnesty . Once the taxpayer accepts our terms and conditions in the online application form, they will be committing to pay the outstanding debt by 30th June 2024 in order to enjoy the amnesty.

9. How do we deal with debts that we don’t agree with for periods before 31st December 2022? – When making the tax amnesty application, only select the periods with debt you agree with and leave out the debts in dispute. Upon submitting the online application, follow up with your respective Tax Service Office (TSO) to have the debts in dispute fully resolved. After reconciliation, you may proceed and apply for amnesty for the reconciled and agreed amounts within the amnesty period. To hasten the reconciliation process, submit to the debt officer all necessary documents required to validate the debt as soon as possible to avoid missing out on the amnesty.

10. How will I know that amnesty has been given? – For periods which have no outstanding principal taxes, your ledger will be credited with an amount equal to the penalties and interest owed, by 30th June 2024. With regard to periods that have outstanding principal taxes, your ledger will be credited with an amount equal to the penalties and interest owed, upon payment of outstanding principal taxes in full.

11. What will happen if I don’t sign up for the amnesty or if I fail to honour the terms adhere to the terms and conditions of the tax amnesty? – Penalties and interest relating to principal taxes that are not paid in full by 30th June 2024 will be subject to enforcement measures as provided in law.

12. Am I required to apply for the tax amnesty? – If you have paid all the principal taxes that were due by 31st December 2022, you will be entitled to automatic waiver of the penalties and interest related to that period and will not be required to make an amnesty application. If you have not paid all the principal taxes accrued up to 31st December 2022, you will be required to apply for the amnesty and propose a payment plan for any outstanding principal taxes which should be paid not later than 30th June 2024.

13. I have not been filing returns if I file now, can I benefit from Amnesty? – Yes, you will qualify for the amnesty for penalties and interest relating to tax debts for periods up to 31st December 2022. Any penalties and interest accruing from 1st January 2023 shall however be payable.

14. Will I qualify for amnesty if I have objected to an assessment or I am undergoing other dispute resolution process? – Yes, as long as the matter is resolved and principal tax is paid in full within the amnesty period i.e. before 30th June 2024.

15. I have not filed KRA Returns i.e KRA Nil Returns for a long time or for a certain year. Will I be eligible to have the penalties removed in the KRA Tax Amnesty? Yes. If you have never filed your returns on iTax for periods upto 31st December 2022 or you failed to file returns for a certain year and penalized, you qualify for automatic tax amnesty, whereby all the penalties for the years you have not filed returns will be removed. You don’t need to apply for tax amnesty if you only have penalties and interests.

Requirements Needed In Applying For KRA Tax Amnesty

In this article, we will look at the steps involved in the process of How To Apply For KRA Tax Amnesty. We shall be using the KRA Tax Amnesty Form that in the KRA Portal to submit the Tax Amnesty application before the elapse of the KRA Tax Deadline that is on 30th June 2024. To be able to apply for KRA Tax Amnesty, you need to have with you both your KRA PIN Number and KRA Password, as these two form the basis of the credentials needed to login to KRA Portal (iTax Portal).

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you when you want to login to KRA Portal. If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

-

KRA Password (iTax Password)

The next requirement that you need to have with you in the process of applying for KRA Tax Amnesty is your KRA Password which you will need to access your KRA Portal account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for KRA Password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at CYBER.CO.KE and have your Email Address changed so as to enable your Reset KRA Password.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To Apply For KRA Tax Amnesty (In 5 Steps)

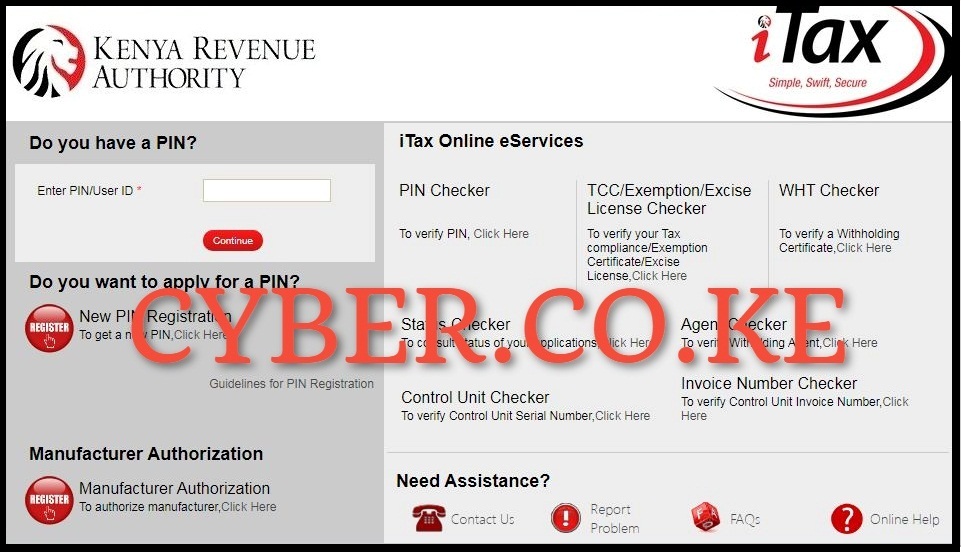

Step 1: Visit KRA Portal

The first step in the process of applying for KRA Tax Amnesty in Kenya is by visiting https://itax.kra.go.ke/KRA-Portal/ where the application for KRA Tax Amnesty needs to be made by a taxpayer using the Tax Amnesty application form.

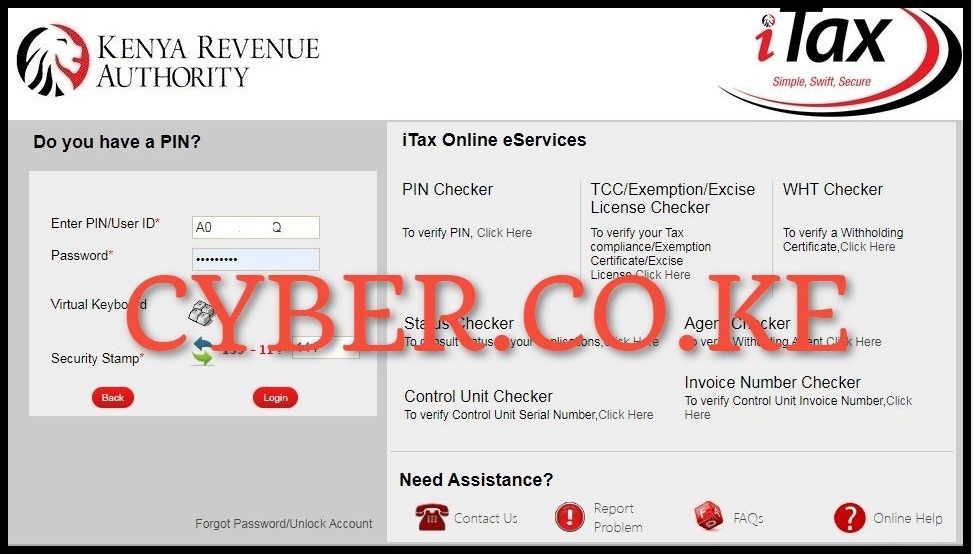

Step 2: Login to KRA Portal

In this step, you need to login to KRA Portal by using your KRA PIN Number as the username and your KRA Password. Afterwards, solve the arithmetic question (security stamp) and click on the “Login” button.

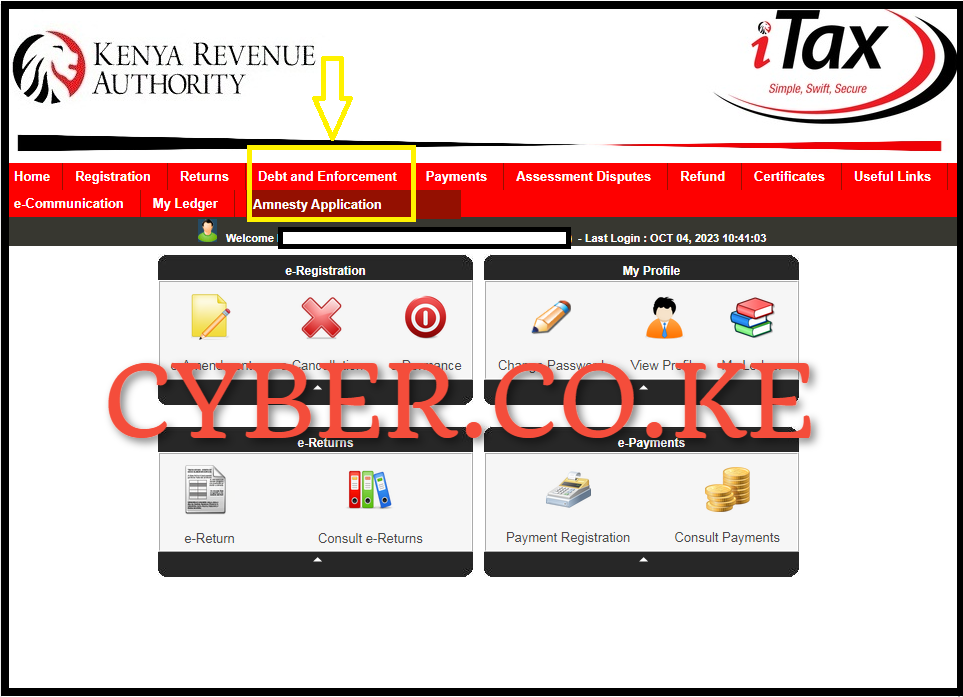

Step 3: Click on Debt and Enforcement then Amnesty Application

Once you have logged into KRA Portal, on the top menu items, click on “Debt and Enforcement” then click on “Amnesty Application” from the drop-down menu list.

Step 4: Fill Application Form for Tax Amnesty and Amnesty Payment Plan

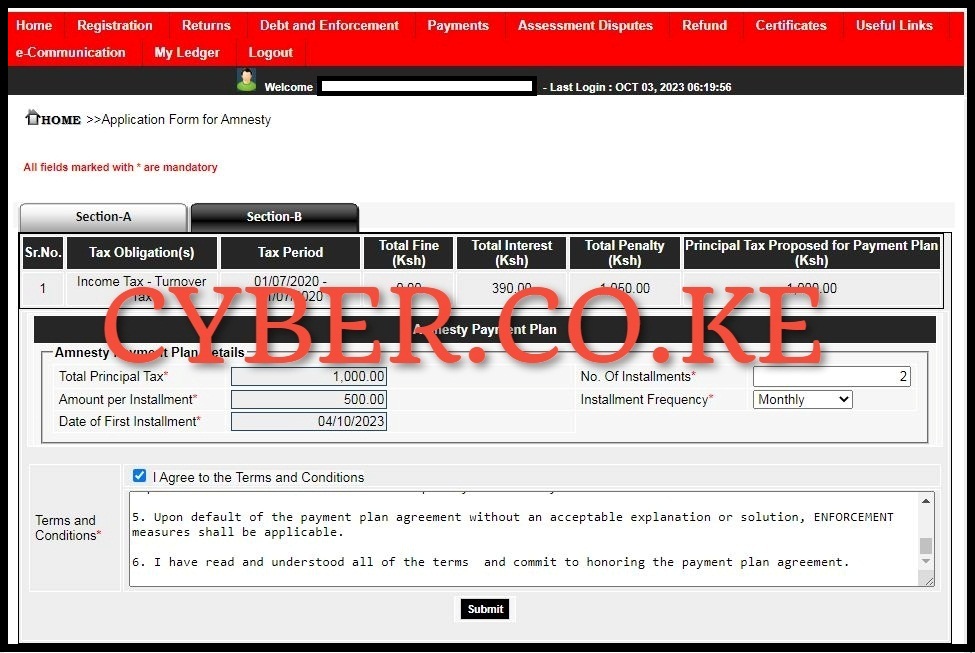

This is the most important step of the Tax Amnesty application process on KRA Portal (iTax Portal). The KRA Tax Amnesty Form is divided into two section i.e. SECTION A (called the Application Form for Amnesty) and SECTION B (Amnesty Payment Plan). This is as highlighted below;

- SECTION A: Comprises of; Applicant Information (Applicant Type, Taxpayer PIN, Mobile Number, Secondary Email Address, Taxpayer Name, Tax Service Office and Email Address) and Amnesty Details (Tax Obligation and Liability Details).

- SECTION B: Comprises of; Amnesty Payment Plan Details (Total Principal Tax, Amount per Installment, Date of First Installment, Number of Installments and Installment Frequency).

Below is a screenshot of the filled Application Form for Amnesty and Amnesty Payment Plan. In this example, we are applying for Tax Amnesty for a taxpayer who is registered under the Turnover Tax (TOT) obligation on KRA Portal (iTax Portal) and has an unpaid principal tax which has accrued penalties and interest.

Take note that the KRA Tax Amnesty focuses on the Principal Tax so as to clear all the penalties and interest accrued on the principal tax that was due. Depending on the type of tax obligation you want a Tax Amnesty on as long as there is a principal amount, then this process will help you apply for Tax Amnesty for tax obligation with much ease.

You will get the following error message: “Amnesty cannot be initiated. Since no liability exists for principal tax, in the amnesty period, for the selected Tax Obligation” when you choose an obligation that has no liability on the principal tax that was due. This means that you only apply for Tax Amnesty for the tax obligation that has a principal tax that is overdue and has attracted penalties and interest.

SECTION A: Application Form for Amnesty

In the Amnesty Details section, select the tax obligation which will in-turn auto-populate the liability details. In this example we are using Turnover Tax as the tax obligation. The liability details shown will be: Tax Period(s), Principal Tax (Kshs.), Fines Tax (Kshs.), Interest (Kshs.), Penalty (Kshs.) and Total Fines Interest and Penalty (Kshs.). Click on the “Add All” button to proceed to SECTION B – Amnesty Payment Plan.

SECTION B: Amnesty Payment Plan

This is the most important section of the KRA Tax Amnesty Form. The most important thing about this section is that it allows you to select the number of installments you need to make payment of the principal tax due. The number of installments ranges from 1 to 8; meaning the principal tax can be paid upto 8 installments.

This is quite good as it gives you ample of time to spread the principal tax into manageable payment plan that is convenient to a taxpayer. Also, you can select the installment frequency, either Monthly, Quarterly or Yearly. This will depend on your current financial capability of paying the principal tax in installments. Take note that the principal tax has to be cleared by 30th June 2024.

If you select frequency as yearly, the number of installments is 1; If you select quarterly, the number of installments is 2 and if you select monthly, the number of installments is 8. In this example, the total principal tax is Kshs. 1,000.00, the number of installments selected is 2 and the installment frequency is Monthly. Tick on the “I Agree to the Terms and Conditions” checkbox, the click on the “Submit” button. For your reference purposes; the following are the Terms and Conditions of the KRA Tax Amnesty 2023.

KRA Tax Amnesty Terms and Conditions

The KRA Tax Amnesty 2023 on the penalties and interest is subject to the following terms and conditions;

- Amnesty shall only be applicable for periods up to 31st December 2022 where all the pending principal taxes have been cleared.

- This form shall serve as an amnesty application and the payment plan agreement.

- Where the taxpayer cannot honor the payment plan agreement, they should seek prior approval from the TSO head before the due date stating the reason and the proposed payment date for the next installment.

- Any penalties and interest relating to the principal tax under the tax amnesty period that remains unpaid after 30th June 2024 shall not qualify for amnesty.

- Upon default of the payment plan agreement without an acceptable explanation or solution, ENFORCEMENT measures shall be applicable.

- I have read and understood all of the terms and commit to honoring the payment plan agreement.

Once agreed to the terms, submit your Tax Amnesty Application form.

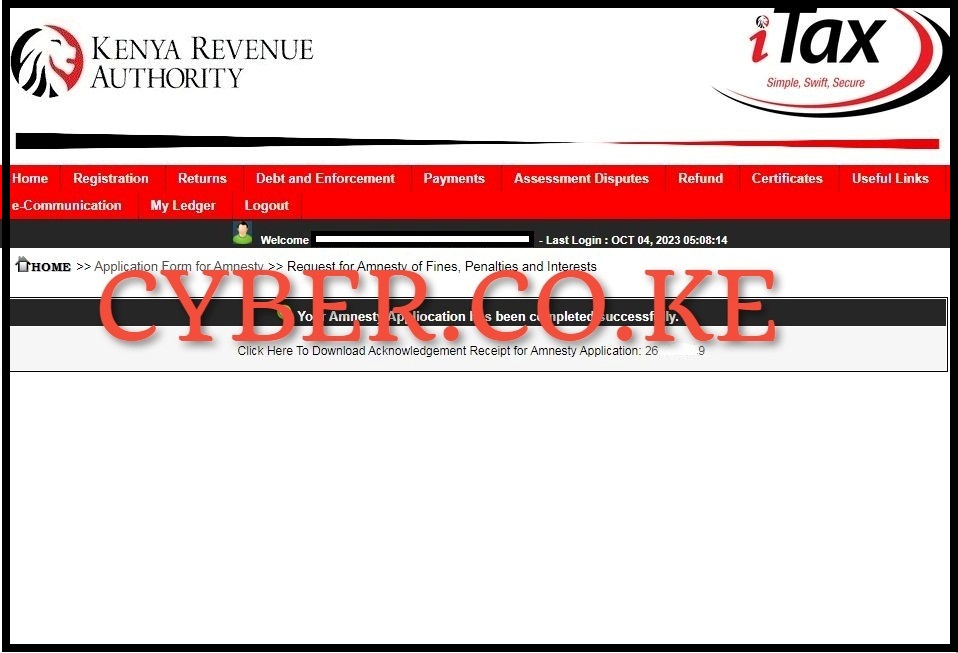

Step 5: Download Acknowledgement Receipt for Amnesty Application

Once you have filled in your Tax Amnesty application using KRA Portal by following the outlined steps above, you will need to download the Acknowledgement Receipt for Amnesty Application by clicking on the Notice Notice. This will mark the end of your application for the KRA Tax Amnesty 2023, which will be submitted to Kenya Revenue Authority (KRA).

READ ALSO: How To Check KRA PIN Number Status Online (In 4 Steps)

Your KRA Tax Amnesty Payment Plan will be submitted for approval by Kenya Revenue Authority (KRA) and you will received an email notification once it has been approved for you to make the first installment payment as per the submitted Tax Amnesty application form. Ensure the you make timely payments for your installment payment plan before the set deadline of 30th June 2024 by Kenya Revenue Authority (KRA). If you have no principal taxes the KRA Tax Amnesty is automatic. If you have any principal taxes kindly clear the arrears by generating a payment slip on your iTax portal to enjoy the 100% waiver on penalties and interests.