Do you need to know the type of KRA Tax Obligation that you are currently Registered for on iTax? Learn How To Check KRA Tax Obligations Using PIN Checker.

Registering for the right KRA Tax Obligation is very crucial as this will have a lasting impact on your KRA PIN Number. That’s why it is highly recommended that Kenyans use a trusted KRA Services provider like Cyber.co.ke Portal to apply for KRA PIN Registration services in Kenya.

In this article, I am going to share with you the steps that you need to check in the process of How To Check KRA Tax Obligations Using PIN Checker. By the end of this article, you will have learnt How To Check and Confirm the KRA Tax Obligation that you are currently registered for on KRA iTax Portal.

READ ALSO: How To Reprint KRA Acknowledgement Receipt Using KRA iTax Portal

Knowing what we mean by KRA Tax Obligations is quite important as it forms the basis of Tax Compliance by Taxpayers in Kenya. This article will seek to address key terms and concepts related to KRA Tax Obligation such as: What Is KRA Tax Obligations, What Is PIN Checker, Types Of KRA Tax Obligations, Compulsory KRA Tax Obligations, Requirements Needed To Check KRA Tax Obligations and How To Check KRA Tax Obligations Using PIN Checker.

Registering for the right KRA Obligation is really important. That is why you should use us when applying for your KRA PIN online. Not many people know which KRA Tax Obligations that they are supposed to register for on iTax Portal, but with our KRA PIN Registration services, we take care of all that.

So, when you are looking to be registered for the right Tax Obligation, then the best and better option is to use our KRA PIN Registration services. So, whether you are an individual or non-individual, the right KRA Obligation is very important for you and you should ensure that you don’t make any mistake by choosing the wrong Tax Obligation. Let us help you with your KRA Tax Obligation Registration.

What Is KRA Tax Obligations?

KRA Tax Obligations refers to the Statutory obligation that a taxpayers is registered for on iTax Portal. During the process of KRA PIN Registration, a KRA Tax Obligation for that taxpayer is chosen in the process of KRA PIN Registration at Cyber.co.ke Portal.

Selecting the right KRA Tax Obligation(s) is important. That is why here at Cyber.co.ke Portal, we have vast experience in KRA PIN Registration services and we ensure that you are registered for the correct KRA Tax Obligation as required by Kenya Revenue Authority (KRA). You can submit your order online at Cyber.co.ke Portal through our KRA PIN Registration services in Kenya.

The KRA Tax Obligations is the building block of any KRA PIN Certificate. Registering for the right KRA Tax Obligation determines the type of Taxes that you will be paying to Kenya Revenue Authority (KRA). The KRA Tax Obligation will have the Effective Date From i.e. the date which the taxpayer was registered for that Tax Obligation at Cyber.co.ke Portal.

Having looked at what we mean by KRA Tax Obligations above, we now need to understand what a PIN Checker. This is important because in order to check and confirm the type of KRA Tax Obligation that a taxpayer is registered for on iTax, we need to use the PIN Checker functionality on the KRA iTax Portal.

What Is PIN Checker?

The PIN Checker is a functionality on iTax Portal that allows you to confirm whether or not a particular KRA PIN Number is Genuine and Valid. A genuine KRA PIN Number is usually generated by the KRA Domestic Taxes Department (DTD), is in Active Status and can be applied and gotten online using KRA PIN Registration Services at Cyber.co.ke Portal.

The PIN Checker also allows one to check the type of KRA Tax Obligations that a taxpayer is Registered for on iTax Portal. That is why this article will solely rely on the PIN Checker to enable us check the types of KRA Tax Obligations that a particular taxpayer is registered for on the KRA Web Portal or simply iTax.

Having looked at what the PIN Checker is above, we now need to look at the different Types Of KRA Tax Obligations on iTax. To be able to understand this better, the KRA Tax Obligations are normally classified into two i.e. KRA Tax Obligations For Individuals and KRA Tax Obligations For Non Individuals. This is as illustrated below.

Types Of KRA Tax Obligations

Just as described above, the KRA Tax Obligations are normally categorized into two i.e. KRA Tax Obligations For Individuals and KRA Tax Obligations For Non Individuals. Let us look at each of these types of KRA Tax Obligations below.

-

KRA Tax Obligations For Individuals

The first category of KRA Tax Obligation is normally for the individuals or simply Kenyans. Under this category, we have: Income Tax Resident, Income Tax Non Resident, Income Tax PAYE (for Employers only), Turnover Tax (ToT) and Value Added Tax (VAT).

-

KRA Tax Obligations For Non Individuals

The second category of KRA Tax Obligation is for Companies, Groups, Societies or Organizations. This what we normally refer to as Non Individuals. Under this category, we have the following Tax Obligations: Income Tax Company, Income Tax Partnership, Income Tax PAYE (for Employer only) and Value Added Tax (VAT).

Now that we have looked at the different types of Tax Obligations above, we need to know the Compulsory Tax Obligations for both Individuals and Non Individuals in Kenya. This is what we refer to as the default Tax Obligations that are used in the process of KRA PIN Registration at Cyber.co.ke Portal.

Compulsory KRA Tax Obligations

Taxpayers are registered for different types of Tax Obligations on iTax depending on the source of income. This can be categorized into Individual Obligations and Non Individual Obligations. This is as illustrated below.

-

Individual Obligations

Under Individuals, the default KRA Tax Obligation is Income Tax Resident for Kenyans and Income Tax Non Residents for Foreigners. If the taxpayer has a business whose gross sales is less than Kshs. 5,000,000.00 per year, then they need to Register for Turnover Tax Obligation(ToT). If you own a business that charges VAT for services and goods and sales is over Kshs. 5,000,000.00 per year, then you need to register for Value Added Tax (VAT) Obligation and finally if you have employees, then you need to register for Pay As You Earn (PAYE) Obligation. You can be registered for any of the above Tax Obligations on iTax using Cyber.co.ke Portal‘s KRA PIN Registration Services for Individuals in Kenya.

-

Non Individual Obligations

Under Non Individuals, the default KRA Tax Obligation is Income Tax Company. This applies to both Companies and Groups in Kenya. If the Company is a Partnership, then you need nto register for Income Tax Partnership Obligation. If the company has employees, then the Pay As You Earn (PAYE) Tax Obligation should be registered and if the company offers services or goods that are vatable, then you need to register for the Value Added Tax (VAT) Obligation on iTax. You can apply and get all these Non Individual Tax Obligations at Cyber.co.ke Portal through our KRA PIN Registration Services for Non Individuals in Kenya.

Having looked at the compulsory KRA Tax Obligations above for both Individual Taxpayers and Non Individual Taxpayers, we now need to look at the Requirements Needed To Check KRA Tax Obligations.

Requirements Needed To Check KRA Tax Obligations

To be able to check the Tax Obligation(s) that a taxpayer is registered for on iTax, you need to ensure that you have a certain set of requirement that is needed in this process. This is basically the KRA PIN Number.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

Now that you have with you the key requirement that you need for the process of checking and confirming the type of Tax Obligation that you are registered for on iTax Portal, we can now look at the step by step guide on How To Check KRA Tax Obligations Using PIN Checker. In this article, we shall be checking the KRA Tax Obligation for an Individual taxpayer on iTax.

How To Check KRA Tax Obligations Using PIN Checker

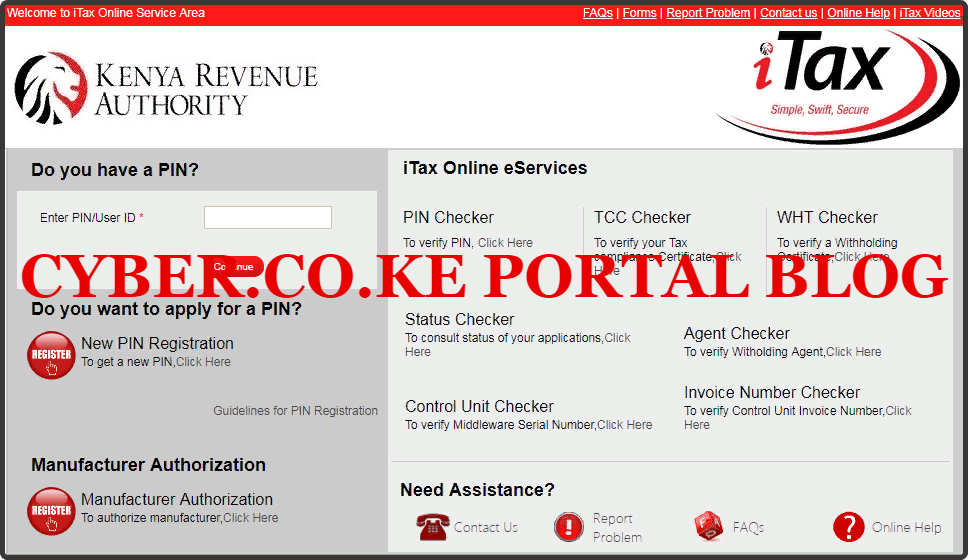

Step 1: Visit KRA Portal

The first step that you need to take is to ensure that you visit the KRA iTax Web Portal using the link provided above in the title.

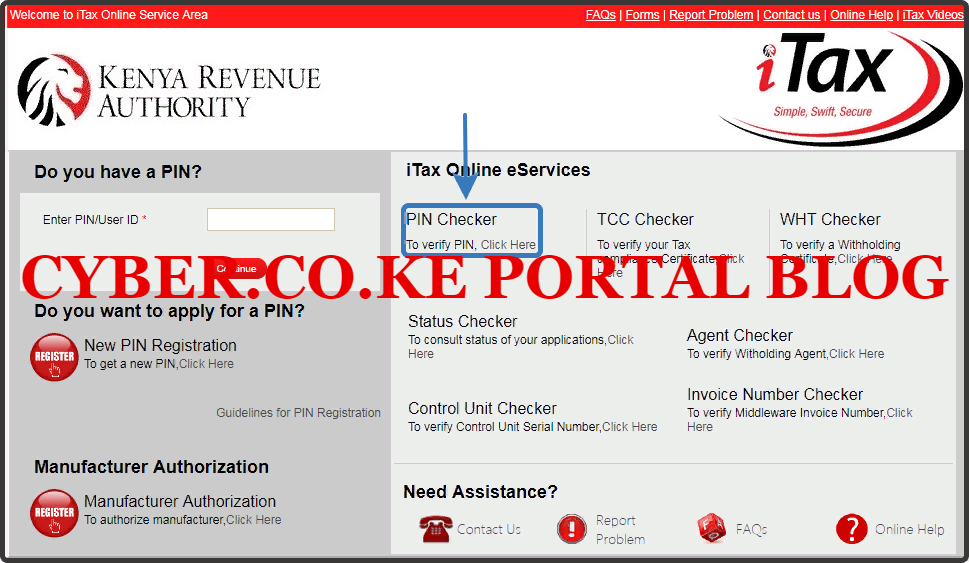

Step 2: Click On PIN Checker Functionality On iTax

Next, you will need to click on the PIN Checker functionality on the KRA iTax Portal. This is as illustrated in the screenshot below.

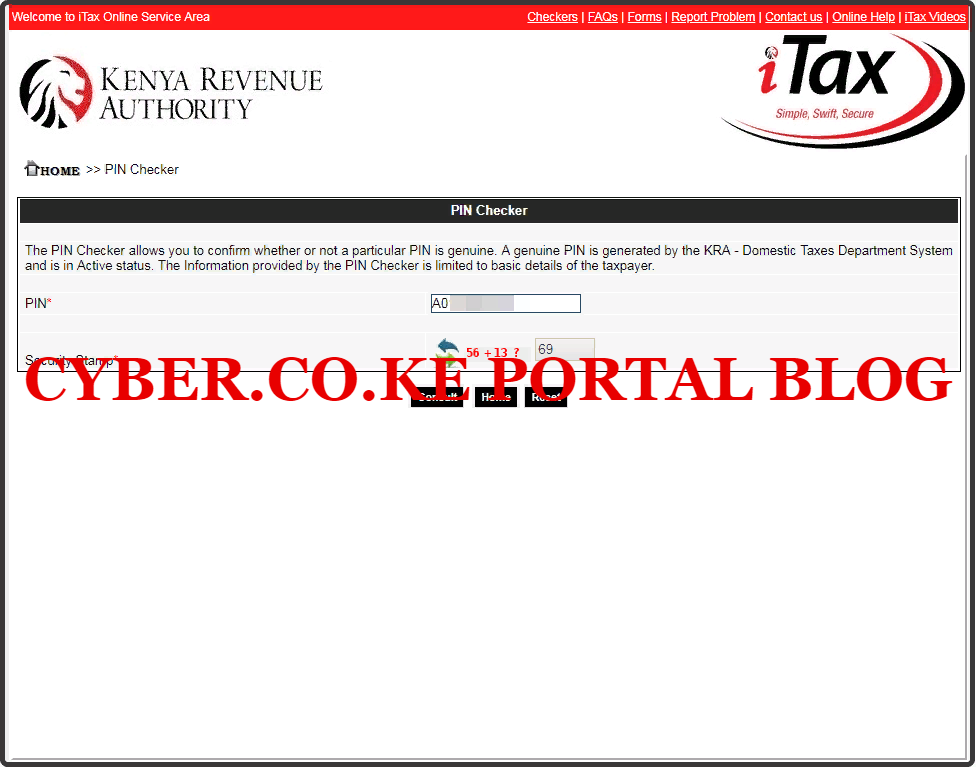

Step 3: Enter KRA PIN Number and Solve Arithmetic Question (Security Stamp)

In this step, you need to enter the KRA PIN Number that you need to confirm and check whether or not it is genuine on and is iTax Portal. Once you have the KRA PIN and solved the arithmetic question, click on the “Consult” button.

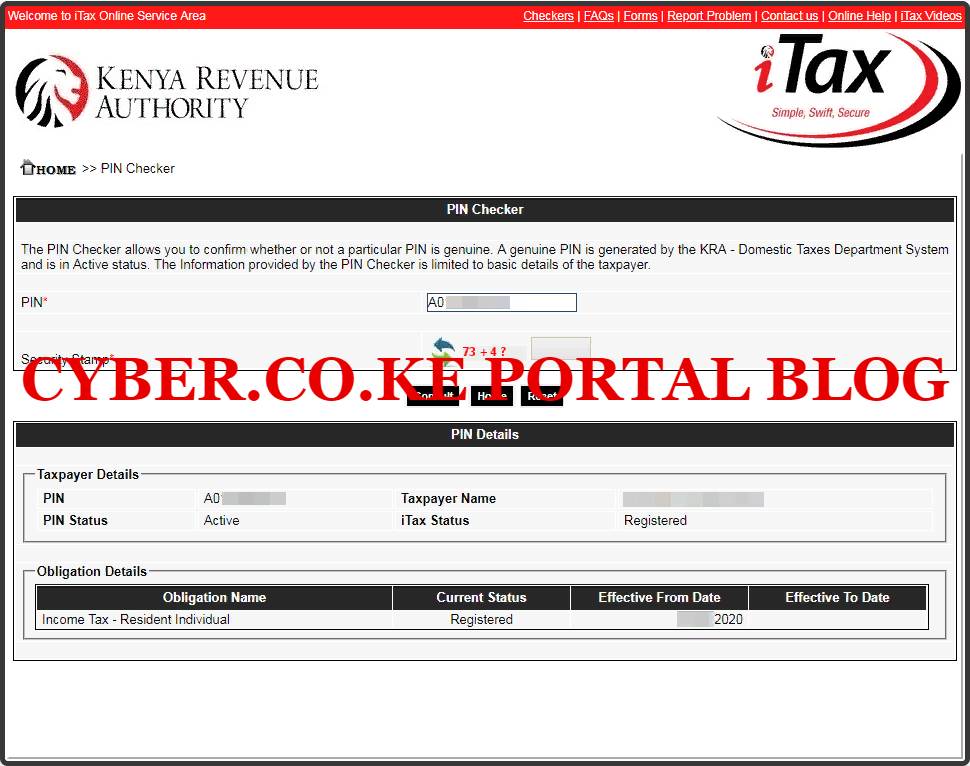

Step 4: PIN Checker Results – KRA Tax Obligation Results

This is the last step whereby the PIN Checker will display the PIN Details for you to check and confirm on iTax Portal. Just as we had discussed under the functions of the PIN Checker above, a genuine KRA PIN will display both the Taxpayer Details and Obligations details. You will see the KRA Tax Obligation that the taxpayer is registered for on iTax under the Obligation Details section. This is as shown below.

READ ALSO: KRA Announces New PAYE Rates And VAT Rates In Response To COVID-19

In the above example, we were checking the KRA Tax Obligation for Individual taxpayer on iTax. If you want to check the KRA Tax Obligations for Non Individuals on iTax, then you will simply follow the same process. The same applies to the other types of KRA Tax Obligations on iTax. Should you need proper registration of KRA Tax Obligations on iTax, then you need to submit your order online here at Cyber.co.ke Portal and we shall gladly assist you in registering for the correct KRA Tax Obligation on iTax in Kenya.