In response to the ongoing COVID-19 Pandemic, Kenya Revenue Authority (KRA) has announced new PAYE and VAT Rates which takes effect in the month of April 2020.

We all know the world at large is currently dealing with the COVID-19 Pandemic and most Governments have put in place measures that seek to cushion its citizens from the long term pandemic of the COVID-19.

Here in Kenya, in response to the President’s directive, the Kenya Revenue Authority (KRA) put in place some measures to cushion taxpayers in Kenya. Before I begin, we all are aware that COVID-19 has impacted nearly every facet of life not only in Kenya but also globally and to make it through the pandemic, we need to have hope that COVID-19 will soon end.

READ ALSO: How To Reprint KRA Acknowledgement Receipt Using KRA iTax Portal

We all need to take personal responsibility to protect ourselves, our families and our friends. Always remember to stay safe and follow the directives given out by the Government. Stay Home.

In this article, I will be highlighting the key new measures that the Government has announced in Kenya and which Kenya Revenue Authority (KRA) will start implementing starting this month of April 2020. Basically, I will be highlighting the: New PAYE Rates For 2020, Tax Reliefs 2020, Resident Corporate Income Tax Rate, New Turnover Tax Rate 2020 and New VAT Rate 2020.

As the Country faces this global health challenge, all citizens are called upon to play their part. Therefore, KRA is encouraging all taxpayers to continue paying all taxes due to support the Government in provision of critical services. Taxpayers are required to determine correctly their tax liability and remit the same in a timely manner.

Measures Proposed By The Government To Be Implemented By KRA

According to Kenya Revenue Authority (KRA), Taxes play a fundamental role in Kenya’s sovereignty. Kenya significantly funds its national budget though Taxes that both Individuals and Non Individuals pay to KRA. To mitigate the effects of COVID-19 to the Kenyan economy, the Government of Kenya has proposed various measures including the following:

- Reduction of Personal Income Tax top rate (PAYE) from 30% to 25%.

- 100 % Tax Relief for persons earning up to Ksh. 24,000.

- Reduction of Resident Corporate Income Tax rate from 30% to 25%.

- Reduction of Turnover Tax rate for SMEs from 3% to 1%.

- Immediate reduction of VAT rate from 16% to 14%.

Additional Measures Put In Place And Implemented By The Government

Further to the above measures, the Government has also implemented the following measures:

- Suspension of all listing for all persons including companies at Credit Reference Bureau (CRB)

- Lowering of Central Bank Rate (CBR) to 7.2%

- Lowering of Cash Reserve Ration (CRR) to 4.2%

- Central Bank of Kenya to offer flexibility to banks on loans that were active as of March 2020 to maintain liquidity levels

- Facilitating expedited payment of VAT Refunds by allocating an additional Ksh. 10B

- Setting up a fund to which players in the Public and Private Sector are contributing in support of Government efforts

New PAYE Rates For 2020 (Starting 25th April 2020)

Following the enactment into law of reduced rates of tax, the following are the new individual monthly and annual tax rates in deducting and remitting Pay As You Earn (PAYE) taxes on emoluments/pensions of employees.

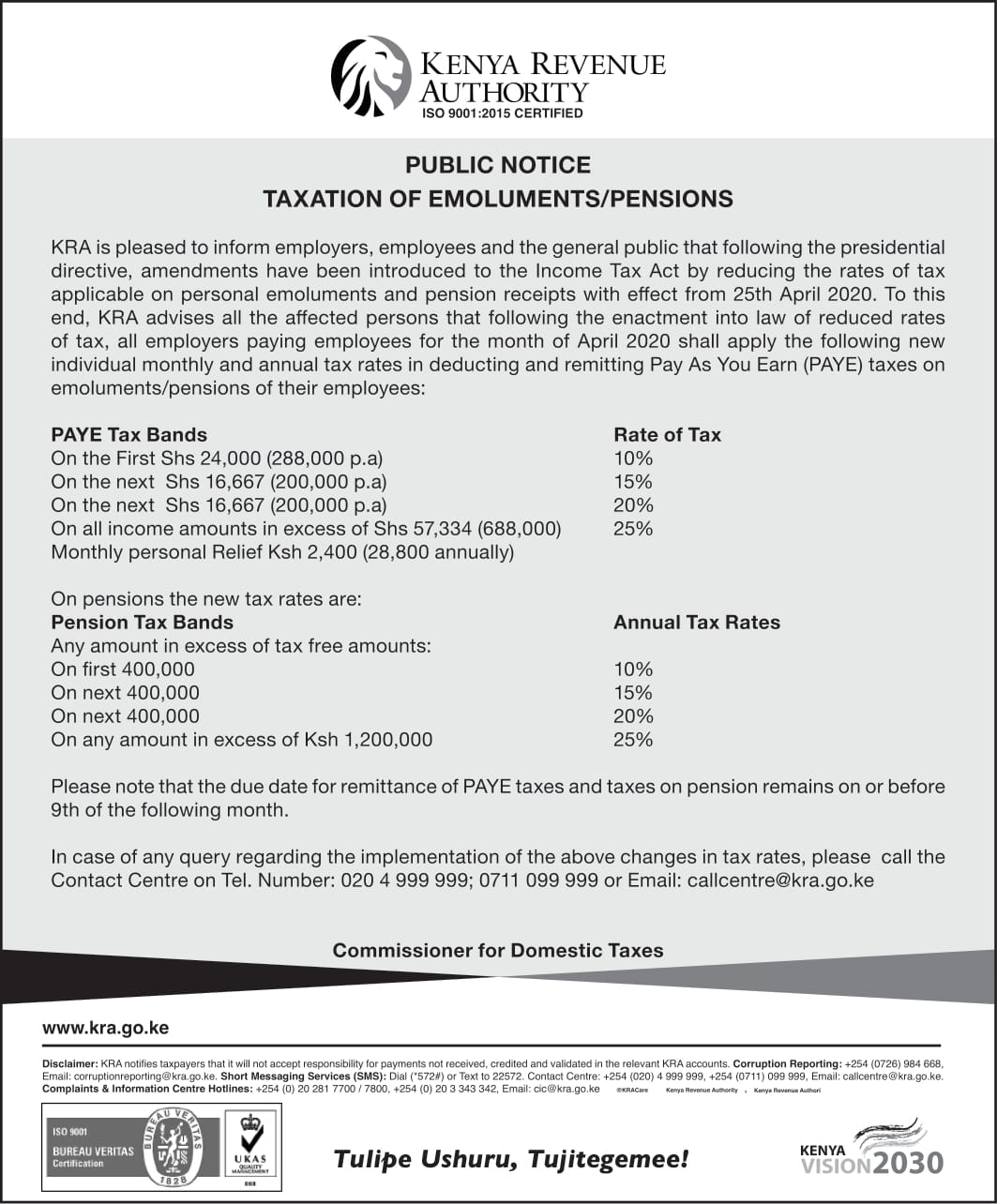

Through a Public Notice dated 27th April 2020, it states: “KRA is pleased to inform employers, employees and the general public that following the presidential directive, amendments have been introduced to the Income Tax Act by reducing the rates of tax applicable on personal emoluments and pension receipts with effect from 25th April 2020.

To this end, KRA advises all the affected persons that following the enactment into law of reduced rates of tax, all employers paying employees for the month of April 2020 shall apply the following new individual monthly and annual tax rates in deducting and remitting Pay As You Earn (PAYE) taxes on emoluments/pensions of their employees:

| PAYE Tax Bands | Rate of Tax |

| On the First Shs 24,000 (288,000 p.a) | 10% |

| On the next Shs 16,667 (200,000 p.a) | 15% |

| On the next Shs 16,666 (200,000 p.a) | 20% |

| On all income amounts in excess of Shs 57,334 (688,000) | 25% |

| Monthly personal Relief Ksh 2,400 (28,800 annually) |

On pensions the new tax rates are:

| Pension Tax Bands | Annual Tax Rates |

| Any amount in excess of tax free amounts: | |

| On first 400,000 | 10% |

| On next 400,000 | 15% |

| On next 400,000 | 20% |

| On any amount in excess of Ksh 1,200,000 | 25% |

Please note that the due date for remittance of PAYE taxes and taxes on pension remains on or before 9th of the following month.

Analysis Of The New KRA PAYE Rates 2020

The First Kshs. 24,000 will attract a tax of Kshs. 2,400. You will then get a personal relief of Kshs. 2,400 which will cancel the tax paid out. As a result of you earn Kshs. 24,000 and below you will get 100% Tax relief as per the President’s directive and approval by Parliament on the same. In simple mathematics:

If for example you are earning Kshs. 24,000 per month, the New PAYE Rate is 10% (Rate of Tax X Salary : 10% of Kshs. 24,000.00) = Kshs. 2,400. The tax relief is Kshs. 2,400 so total tax payable will be: (Tax Payable – Tax Relief) = Kshs. 2,400 – Kshs. 2,400= Ksh. 0 meaning you will take home the full amount of Kshs. 24,000.00

MOST ASKED QUESTION BY EMPLOYEES : What happens if your April salary didn’t take this new tax rate into the equation? Your employer should reimburse you the difference depending on how they choose to do this, they will most likely pay the difference together with your salary for the month of May. You can check more about the Public Notice by KRA by reading New KRA PAYE Rates Apply To All Benefits And Emoluments Earned In April 2020.

On its part, KRA will continue supporting individuals and businesses in accessing their services to ensure all taxes are paid in a timely manner at this critical time. KRA will decisively handle any matter that pertains to deliberate non-payment of taxes. In the event that a taxpayer is not able to honour the agreed payment plan, it’s mandatory that the same is reviewed and agreed with our debt team.

KRA stated that it appreciates that taxpayers are required to provide proof of transaction in response to VAT inconsistency reports. Taxpayers are supposed to submit documents and in some instances appear in person at our premises. This is not tenable in the current environment.

READ ALSO: How To Download Latest KRA Returns Template From KRA Portal

To mitigate this, KRA has deferred the physical submission of documents and appearance before our teams. Taxpayers will be duly notified of when they can appear in person. In the interim, taxpayers are advised to submit evidence of transactions through [email protected].