The P9 Form (also known as KRA P9 Form/Tax Deduction Card) is a very important document that is issued by your employer and that shows the details of your income and the deductions from the income for the period that you have worked for them. The P9 Form normally captures a period of 12 months (depends also on the duration of months that you have worked). The most common details displayed on the P9 Form includes; Tax Date, Taxable Pay, Pension, PAYE Auto and the MPR Value. The details display on the P9 Form might vary based on different employers. If your company, parastatal, organization etc have an online payroll system, then you can easily download the P9 Form online. If not, you can ask your HR to give you the P9 Form so as to be able to file your KRA Returns on iTax (KRA Portal).

READ ALSO: Step-by-Step Process of Resetting eCitizen Account Password

But all in all all P9 Forms contained the most important details i.e. the tax deductions and these details need to be used when you are filing KRA Returns for Employees online using KRA Portal (iTax Portal). It is highly recommended that employers give their employees the P9 Form as early as possible so as to facilitate the filing of KRA Returns. In this post, we shall be looking at the steps that are involved in downloading P9 Form online for Government Employees (Civil Servants/National Police Service/County Employees) in Kenya by using the Public Service Payroll (PSP Data-Warehouse v0.3). So if you want to get and download your GHRIS P9 Form or UHR P9 Form online, then you need to follow the steps outlined in this blog post.

How To Download P9 Form

The following are the 4 main steps involved in the process of How To Download P9 Form that you need to follow.

Step 1: Visit Public Service Payroll (GHRIS/PSP Data-Warehouse v0.3)

The first step in the process of downloading P9 Form online is to visit the Public Service Payroll (GHRIS/PSP Data-Warehouse v0.3) by using https://uhr.kenya.go.ke/ippd/auth/login.php

Step 2: Enter Your User ID and Password

Once you are on the Public Service Payroll, enter your User ID and Password then click on the “Login” button to access your Public Service Payroll account.

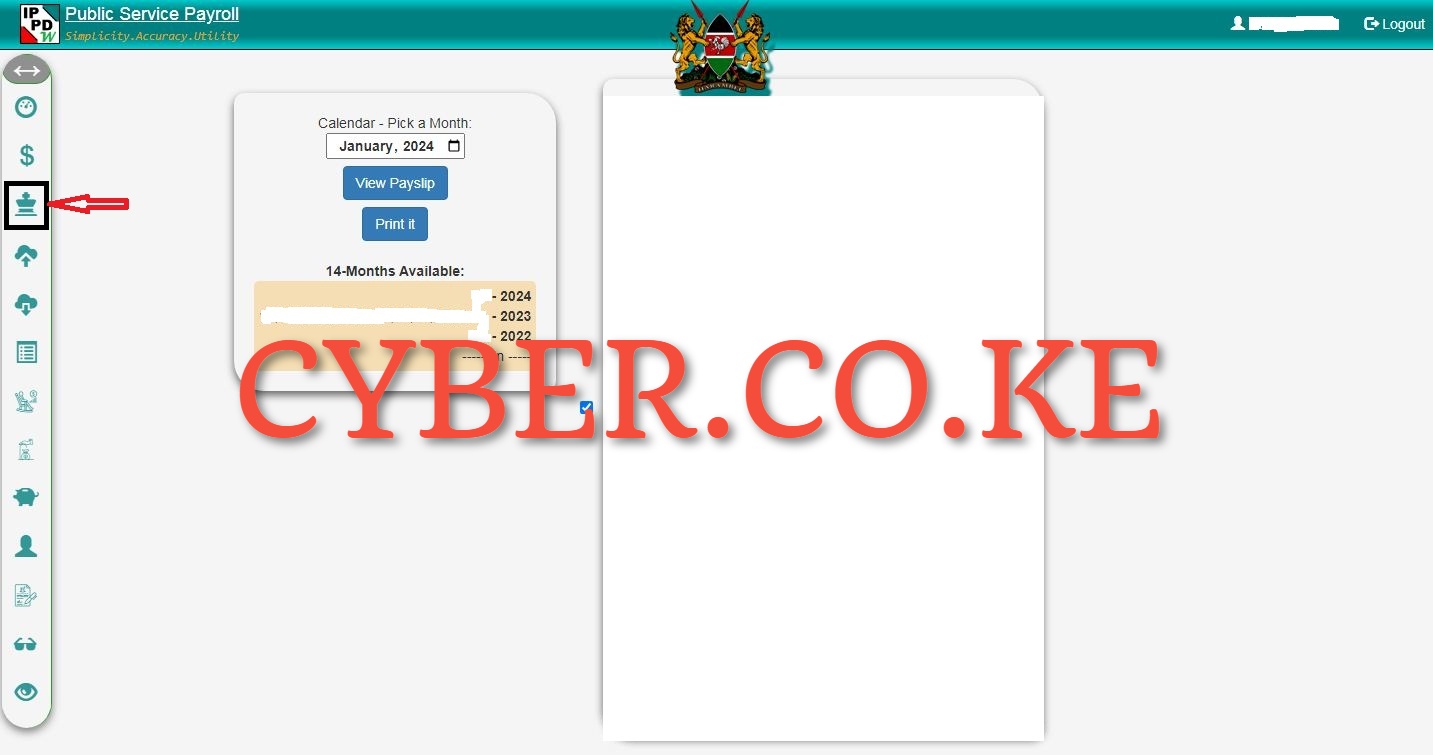

Step 3: Click on P9 Form

Once you are successfully logged into your Public Service Payroll account, on the left menu panel, click on the P9 Form icon to begin the process of downloading and getting your P9 Form online.

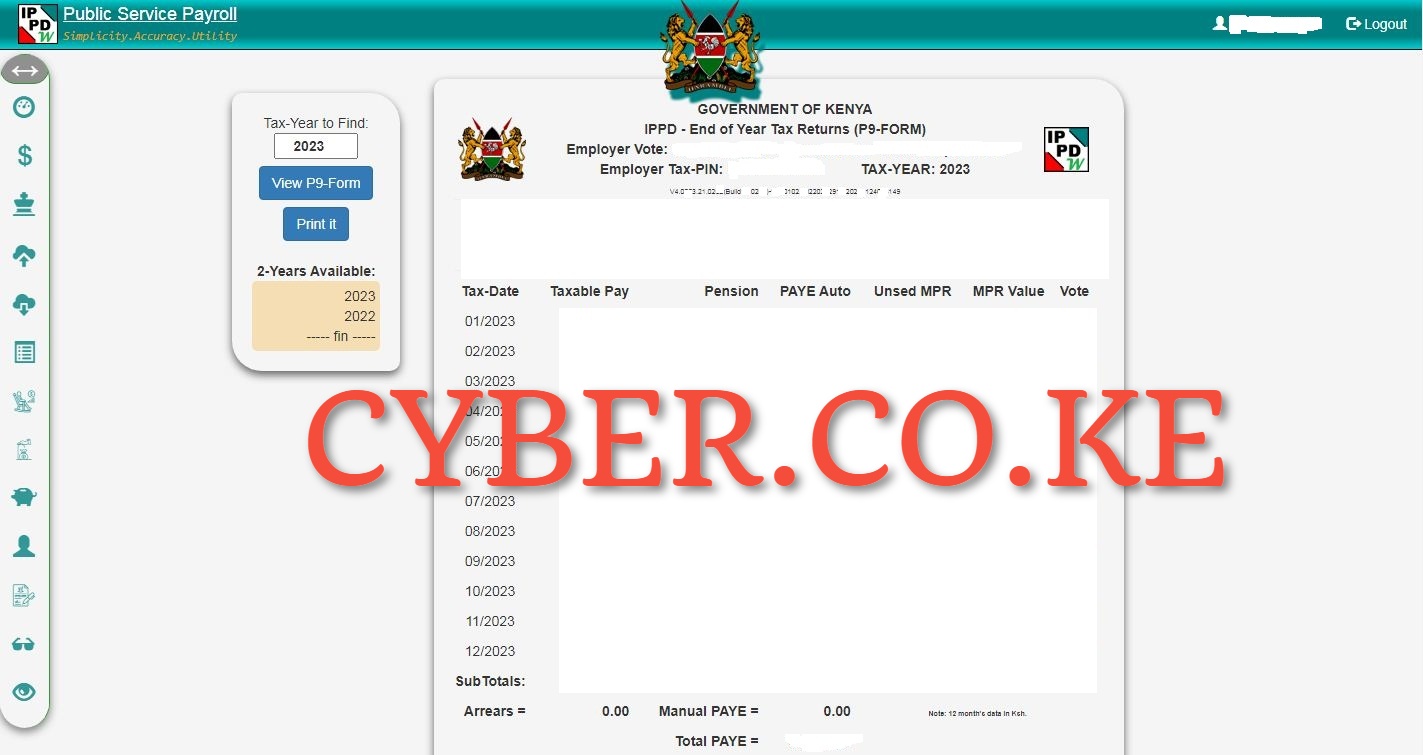

Step 4: Download P9 Form

The last step in the process of getting your P9 Form is to download it from your Public Service Payroll account. You need to ensure that you are downloading the latest P9 Form i.e. download KRA P9 Form for the year 2023 online. To download and print your P9 Form, just click on the “Print P9 Form” button which will initiate the downloading of the KRA P9 Form online. From this point you can either print a copy of the P9 Form or save the P9 Form PDF version.

READ ALSO: Step-by-Step Process of Changing eCitizen Account Password

The above 4 steps sums up the whole process that you need to follow so as to be able to download your P9 Form online quickly and easily. As mentioned, if your employer has an online payroll system, then you can get the KRA P9 Form online using the respective online payroll system in Kenya. You need to follow the above steps if you are employed in the Public Service either Civil Servant, County Employee or even the National Police as all P9 Forms are contained in the Government Public Service Payroll System. Remember to get your P9 Form early so as to file your KRA Returns before the elapse of the 30th June deadline.