If you are a student in Kenya and have an active KRA PIN Number but no source of income, you are required to file KRA Nil Returns online using iTax (KRA Portal) on or before the elapse of the 30th June deadline as set out by Kenya Revenue Authority (KRA).

Failure to file KRA Nil Returns for Students leads to an automatic penalty of Kshs. 2,000 being imposed for late filing of KRA Nil Returns for Students. For you to be able to file KRA Nil Returns for Students using iTax (KRA Portal), you need to ensure that you have with you both the KRA PIN Number and KRA Password (iTax Password) which are part of the login credentials needed to access iTax (KRA Portal) so as to be able to file KRA Nil Returns for Students.

In this blog post, I will be sharing with you the main steps that are involved in the whole process of How To File KRA Nil Returns for Students.

READ ALSO: How To File KRA Nil Returns In 2024 Easily

How To File KRA Nil Returns for Students

The following are the 6 main steps involved in the process of How To File KRA Nil Returns for Students that you need to follow.

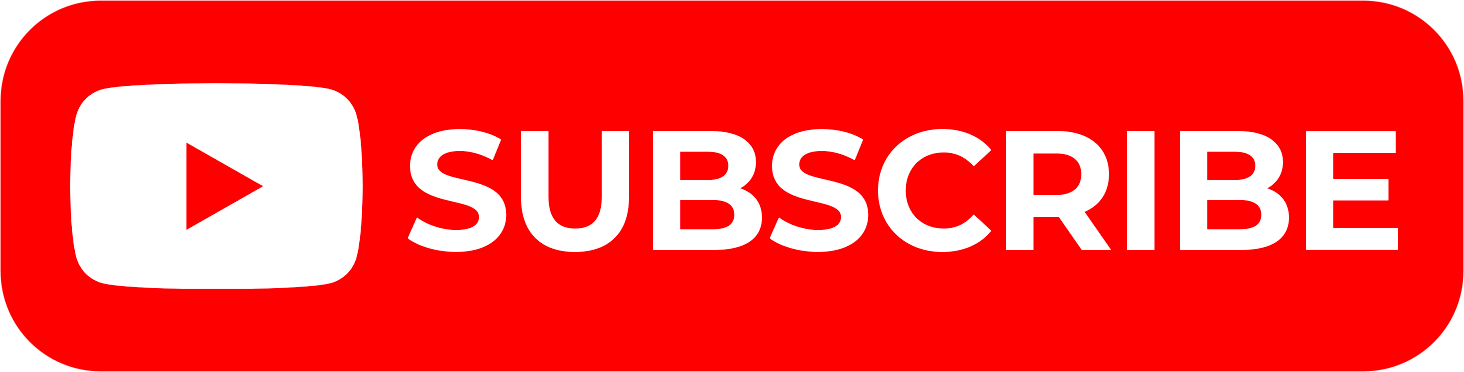

Step 1: Visit iTax (KRA Portal)

To be able to file KRA Nil Returns for Students online, you first need to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

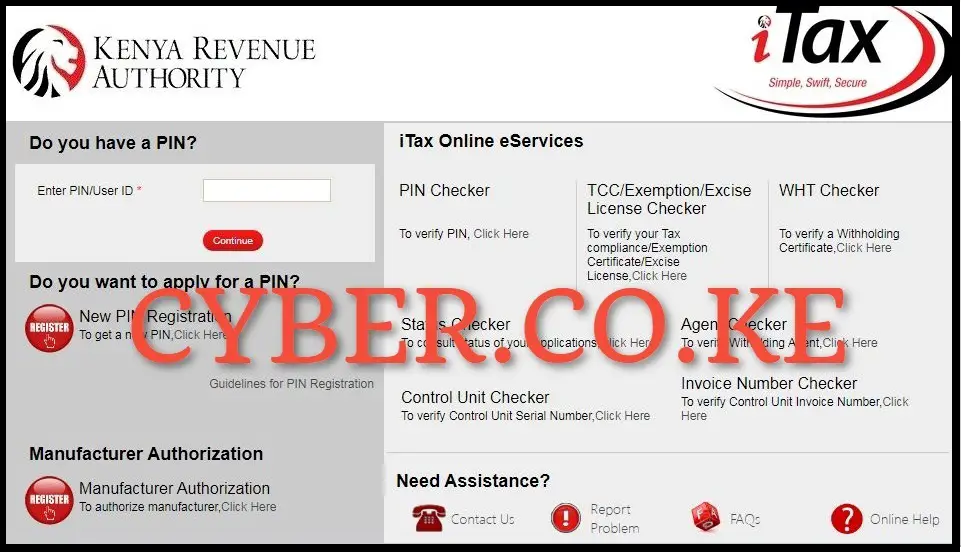

Step 2: Login Into iTax (KRA Portal)

In this step, you need to enter your KRA PIN Number, KRA Password (iTax Password), solve the arithmetic question (security stamp) and proceed to click on the “Login” button to access your iTax (KRA Portal) account.

Step 3: Click on Returns then File KRA Nil Returns

Next, from the iTax (KRA Portal) account dashboard, click on “Returns” then click on “File Nil Return” from the drop down list.

Step 4: Select KRA Tax Obligation

In this step, you need to select the KRA Tax Obligation that you are filing the KRA Returns for. Since we are filing KRA Nil Returns for Students, we select the KRA Tax Obligation as “Income Tax – Resident Individual” after selecting, click on the “Next” button.

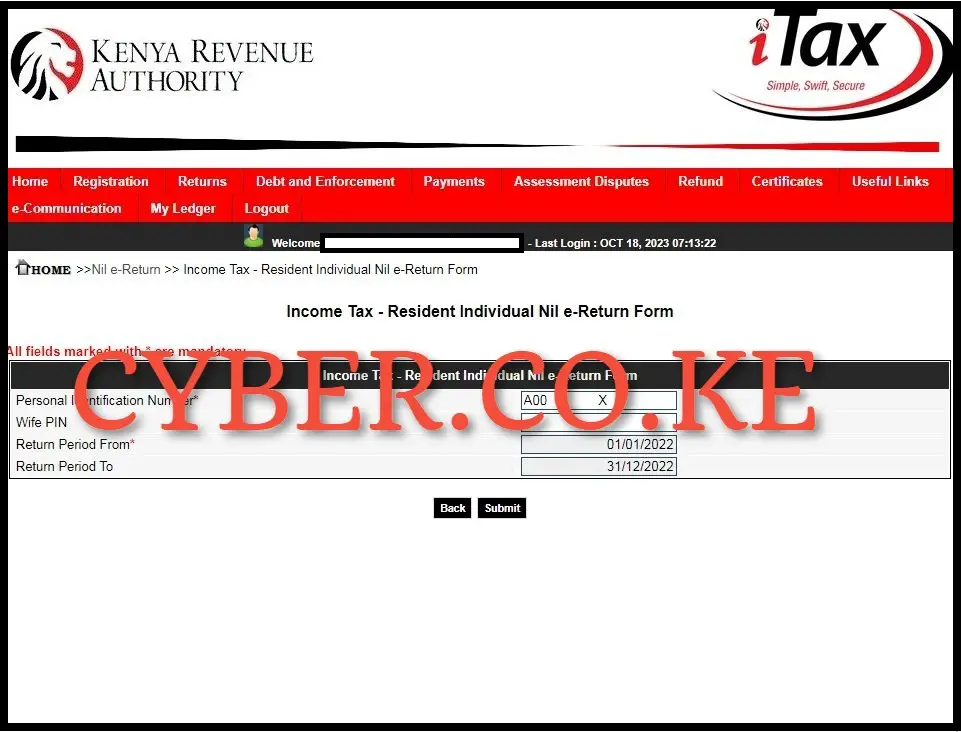

Step 5: Fill In The Income Tax – Resident Individual Nil e-Return Form

Next, in this step you need to fill in the Income Tax Resident Individual Nil e-Return form. If your KRA Returns are up to date, you will just need to enter the Return Period From which will then auto-populate the Return Period To. Take note that this happens only if your KRA Returns filing are up to date. So, in our case we put the Return Period From as 01/01/2023 which will set the Return Period To as 31/12/2023 afterwards, click on the “Submit” button.

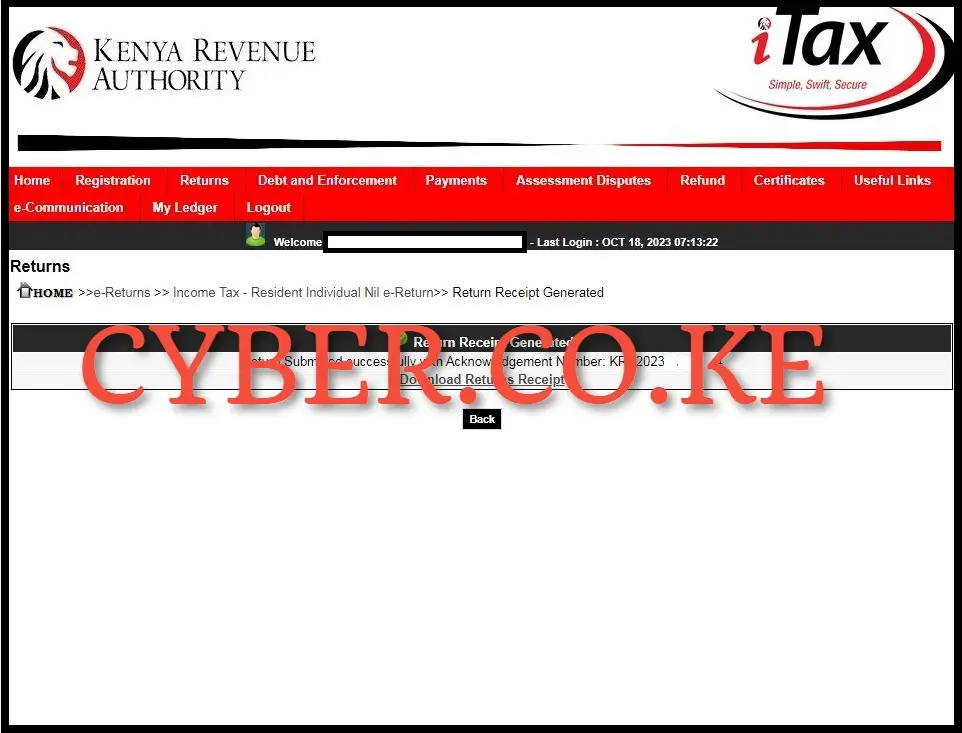

Step 6: Download e-Return Acknowledgement Receipt

In this final step, after successfully filing KRA Nil Returns for Students, you need to download the generated e-Return Acknowledgement Receipt. To download the e-Return Acknowledgement Receipt, just click on the “Download KRA Returns Receipt” link to save the KRA Returns Acknowledgement Receipt on your device and even print a copy the same receipt.

READ ALSO: How To Download IT1 Excel Sheet on iTax (KRA Portal)

The above 6 steps sums up the process of How To File KRA Nil Returns for Students online using iTax (KRA Portal). So, if you are a student in TVET Institution, College or University and don’t have any source of income, you are required to file your KRA Nil Returns online by following the above 6 main steps. Remember, failure to file KRA Nil Returns leads to a penalty of Kshs. 2,000 for late filing. You can avoid the penalties by requesting for KRA Nil Returns Filing service here at CYBER.CO.KE today.