The KRA Payment Registration Number (PRN) is very important in that it allows taxpayers to easily make tax payments to Kenya Revenue Authority (KRA) with ease. KRA Payment Registration Number (PRN) is comprised of numerical digits i.e. 202320000****367 and the Payment Registration Number serves as the account number when making payments to KRA either using the Paybill Number 222222 or even at any of the KRA authorized banks in Kenya. After filing your KRA Returns either VAT, PAYE, MRI or even TOT, you are required to generate a KRA Payment Registration Number (PRN) which is normally contained on the KRA Payment Slip, that will aid in payment of the respective taxes to KRA.

The Payment Registration Number (PRN) is normally contained in a document that is commonly referred to as the KRA Payment Slip (Payment Slip). It is this payment slip that contains the information such as; Payment Registration Date, Payment Registration Number (PRN), Taxpayer Names and Address, Taxpayer KRA PIN Number and Payment Details (the amount of tax that a taxpayer needs to pay Kenya Revenue Authority – KRA). Also it contains details such as the Paybill Number 222222 and the list of authorized banks by KRA that you can make tax payments for that KRA Payment Registration Number (PRN) that is normally using iTax.

To be able to generate KRA Payment Registration Number (PRN) on iTax, there are two key requirements that you need to ensure that you have with you. This includes both your KRA PIN Number and KRA Password (iTax Password). You need to have both of these as generating KRA Payment Registration Number (PRN) requires one to first login into their respective iTax accounts, and following the necessary steps so as to be able to generate the Payment Registration Number (PRN) that is found on the KRA Payment Slip.

READ ALSO: How To Check Your KRA PIN Using KRA PIN Checker

Requirements Needed In Generating KRA Payment Registration Number (PRN) On iTax

As mentioned above, the process of generating KRA Payment Registration Number (PRN) requires one to have with them both their KRA PIN Number and KRA Password (iTax Password). Below is a brief summary of what both of these two requirements entails in relation to the process of How To Generate KRA Payment Registration Number (PRN) On iTax.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you when you want to login to iTax so as to be able to generate the KRA Payment Registration Number (PRN). If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

-

KRA Password (iTax Password)

The next requirement that you need to have with you in the process of generating KRA Payment Registration Number (PRN) on iTax is your KRA Password, which you will need to access your iTax Portal account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for KRA Password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at CYBER.CO.KE and have your Email Address changed so as to enable your Reset KRA Password.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To Generate KRA Payment Registration Number (PRN) On iTax

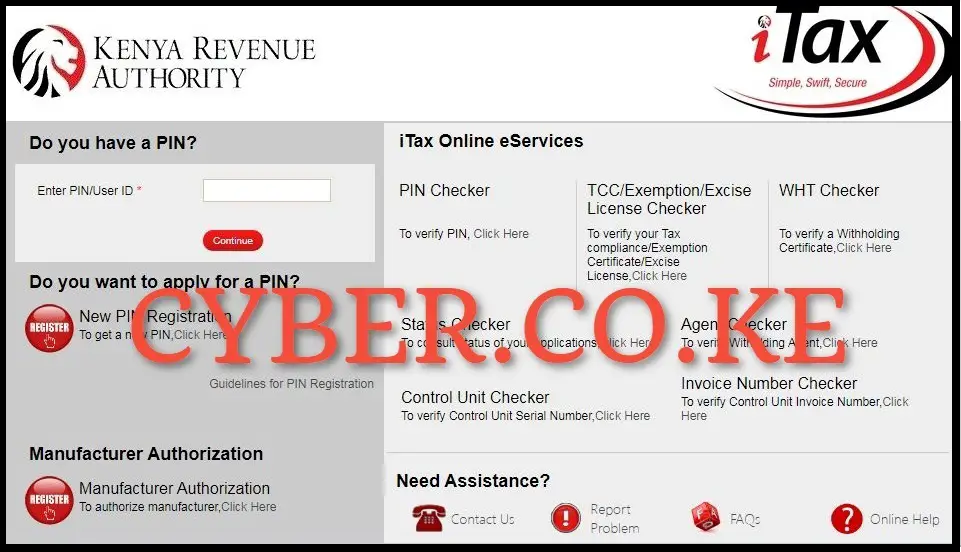

Step 1: Visit iTax

To be able to generate KRA Payment Registration Number (PRN), you first need to visit iTax by using https://itax.kra.go.ke/KRA-Portal/

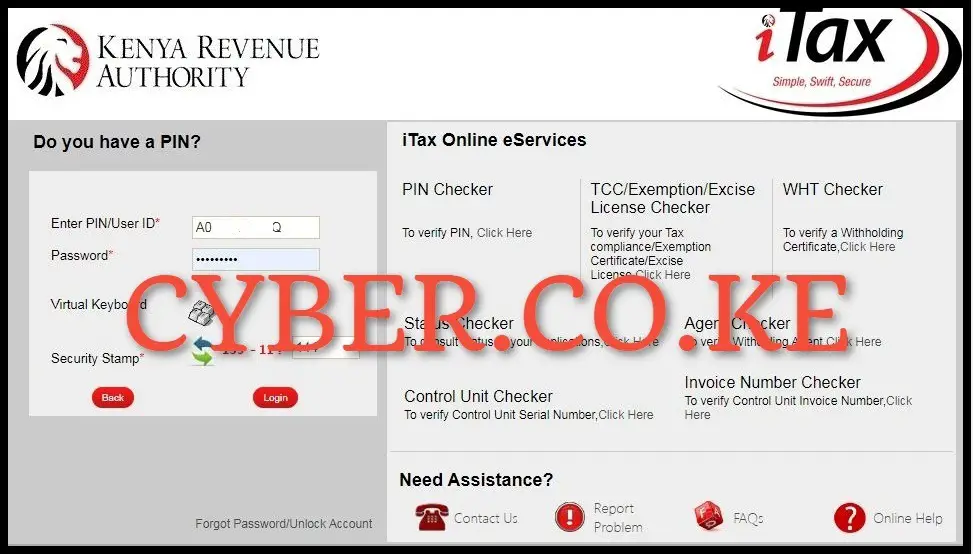

Step 2: Login Into iTax

In this step, enter both your KRA PIN Number and KRA Password (iTax Password), solve the arithmetic question (security stamp) and click on the “Login” button to access your iTax account and start the process of generating Payment Registration Number (PRN) on iTax.

Step 3: Click on Payments then Payment Registration

Once you are logged into iTax account, on the top menu, click on “Payments” module and from the drop down list, click on “Payment Registration” to start the process of generating Payment Registration Number (PRN) on iTax.

Step 4: Fill the e-Payment and e-Payment Registration Form

In this step, two pivotal sections come into play: the e-Payment Form and the e-Payment Registration Form. The initial form arrives pre-populated with essential information, streamlining the process. Conversely, the latter form serves as the platform for inputting intricate payment details, necessitating careful and accurate data capture.

- e-Payment Form

The primary section within the Payment Registration module on the KRA Portal is the e-Payment Form. It showcases crucial details such as Applicant Type, Taxpayer PIN Number, and Taxpayer Names. Simply click the “Next” button to access and load the subsequent e-Payment Registration Form.

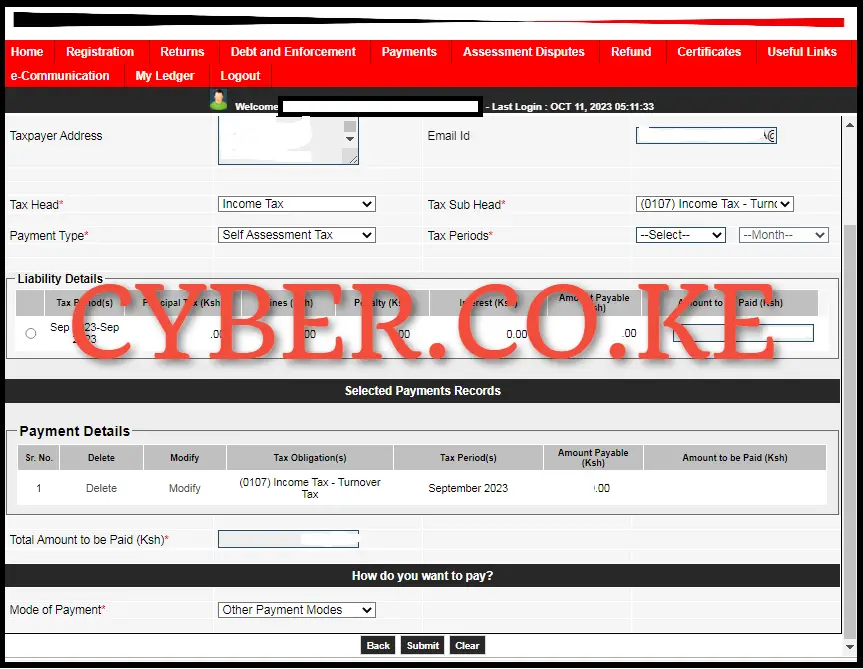

- e-Payment Registration Form

The significance of the e-Payment Registration Form lies in its role in facilitating the generation of the KRA Payment Registration Number (PRN) on iTax. This form captures essential payment details, including payment information and preferred payment method. Key fields to complete include Tax Head, Tax Sub Head, and Payment Type.

For instance, when generating a KRA Payment Slip (that contains the Payment Registration Number – PRN) for Turnover Tax on iTax, fill in the following details:

– Tax Head: Income Tax

– Tax Sub Head: (0107) Income Tax Turnover Tax

– Payment Type: Self Assessment Tax

– Tax Periods: 2023 – September

Click the “Add” button to incorporate this information into the payment records.

Regarding payment modes, you have the flexibility to choose between RTGS, Bank, or alternative methods like M-PESA Paybill Number 222222 (Government’s Single Payment Platform). The selection depends on your personal preference. Ensure that you remit the precise amount indicated on the KRA Payment Slip to complete the transaction successfully. Once you have selected the mode of payment, click on the “Submit” button.

Step 5: Download KRA Payment Registration Number (PRN)

The last step involves downloading the payment slip that contains the KRA Payment Registration Number (PRN). To download the Payment Registration Number (PRN) that is contained on the KRA Payment Slip, click on the “Download KRA Payment Slip” text link, this will automatically download the KRA Payment Slip and save the PDF version/format of the KRA Payment Slip in your device and from there you can use the generated KRA Payment Slip in making the tax payment to Kenya Revenue Authority (KRA).

READ ALSO: How To Download KRA Acknowledgement Receipt On iTax

You will notice that the Payment Registration Number (PRN) is contained on the downloaded payment slip. When you are paying using the Paybill Number 222222, the Payment Registration Number (PRN) serves as the account number. When you are paying via the authorized banks, the whole payment slip showing the Payment Registration Number (PRN) is normally prsented at the bank tellers when making tax payments to KRA. So, next time you want to generate Payment Registration Number (PRN) on iTax, just follow the above outlined 5 key steps and you will be able to successfully generate the KRA Payment Registration Number (PRN).