Do you own a business and need to generate the Presumptive Tax Payment Slip on iTax? Learn How To Generate Presumptive Tax Payment Slip Using iTax Portal.

Since the beginning of this year, each business whose gross sales per year is not expected to exceed Kshs. 5,000,000.00 are supposed to be registered for Turnover Tax and start paying also the Presumptive Tax for the business each year (refer to Beginners Guide To Turnover Tax and Beginners Guide To Presumptive Tax).

Since Presumptive Tax is paid only once in a year, knowing How To Generate the Presumptive Tax Payment Slip is important for any business owner in Kenya.In this article, I am going to share with you the step by step guide on How To Generate Presumptive Tax Payment Slip Using iTax Portal.

READ ALSO: New Taxpayers: How To Login For The First Time To KRA Web Portal

By the end of this article, you will have known and learnt the steps that you need to for so as to generate the Presumptive Tax Payment Slip for your business in Kenya. After generating the Presumptive Tax Payment Slip, then you will be able to pay for the Presumptive Tax using either KRA Paybill Number or Banks.

This article will seek to address the key steps that a business owner needs to take so as to be able to generate the Presumptive Tax Payment Slip or what is referred to as the Payment Registration Number (PRN) using the KRA iTax Portal.

It will cover key areas including: What Is Presumptive Tax Payment Slip, Importance Of Presumptive Tax Payment Slip, Requirements Needed To Generate Presumptive Tax Payment Slip and How To Generate Presumptive Tax Payment Slip Using iTax Portal.

What Is Presumptive Tax Payment Slip?

The Presumptive Payment Slip is basically a Payment Registration Number document that is generated using the KRA iTax Portal so as to enable a taxpayer who owns and runs a business in Kenya pay for the Presumptive Tax for the business for a particular year. You need the Payment Registration Number (PRN) so as to be able yo Pay Presumptive Tax for your business.

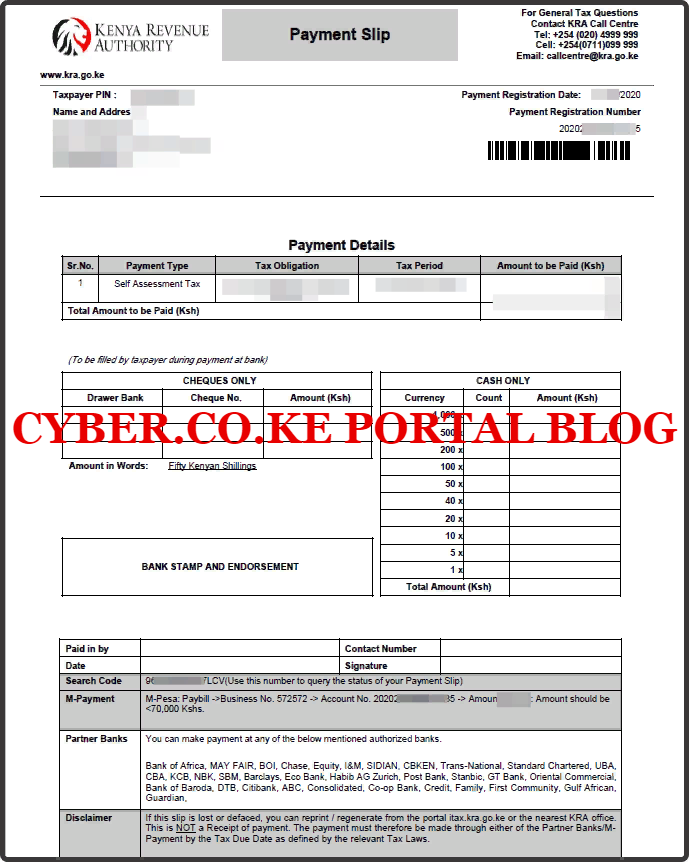

The first step in the process of paying for KRA Presumptive Tax is generating the KRA Presumptive Tax Payment Slip that has the Payment Registration Number (PRN) that serves as the account number when you will be paying the Presumptive Tax for your Business using either the KRA Paybill Number 572572 or by paying at the KRA Partner Banks in Kenya whereby you will have to present the Payment Slip for paying the KRA Presumptive Tax.

Each and every business that is eligible for Presumptive Tax is supposed to pay the Presumptive Tax annually at the rate of 15% of the cost of the business permit or the business licence permit that has been paid to the County Government. The good this is that the amount of Presumptive Tax paid by a business will be deducted from the Turnover Tax for that business.

Not that many business owners know the process that they need to follow so as to be able to generate the Presumptive Tax Payment Slips using iTax Portal. That’s what this article seeks to address in wide approach to Presumptive Tax Payment Registration. Knowing how to be able to generate the Payment Registration Number so as to pay the Presumptive Tax for the business.

Having looked at the definition of the Presumptive Tax Payment Slip above, we now need to look at the Importance of the Presumptive Tax Payment Slip to businesses in Kenya.

Importance Of Presumptive Tax Payment Slip

Basically the Presumptive Tax Payment Slip plays two important roles i.e. Payment of Presumptive Tax and Tracking Status of Payment of Presumptive Tax. These two are the most important functions of the Presumptive Tax Payment Slip that is generated using the KRA iTax Portal. Let us now look at each one briefly below.

-

Payment of Presumptive Tax

Basically the sole reason why a taxpayer needs to generate the payment slip on iTax Portal is so as to be able to pay the Presumptive Tax for business using the Payment Registration Number (PRN) that is displayed on the KRA Presumptive Tax Payment Slip. You need the generated Presumptive Tax Payment Slip so as to be able to pay the Presumptive Tax for your business for a given year.

-

Track Status for Payment of Presumptive Tax

The other importance of the Presumptive Tax Payment Slip is that it has a Search Code that you can use to track the status of your Presumptive Tax Payment at Kenya Revenue Authority (KRA). The Search Code together with the Payment Registration Number (PRN) will allow you easily track the Presumptive Tax Payment by using the Status Checker on the KRA iTax Portal.

Having looked at the importance of the KRA Presumptive Tax Payment Slip above, we now need to change gears and dive into the Requirements Needed To Generate Presumptive Tax Payment Slip. We need to look at what a taxpayers needs to have so as to be able to generate the KRA Presumptive Tax Payment Slip using iTax Portal.

Requirements Needed To Generate Presumptive Tax Payment Slip

To be able to generate the KRA Presumptive Tax Payment Slip on iTax Portal, a taxpayer or business owner needs to ensure that they have with them; KRA PIN Number, KRA iTax Password, Single Business Permit (SBP) Registration Number, Business Name and Amount Paid For The Single Business Permit (BSP).

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same as the one you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable you Reset KRA iTax Password.

-

Single Business Permit (SBP) Registration Number

You are going to need the Single Business Permit (SBP) Registration Number. When you apply for a SBP in your County, you will be issued with the County Permit and you are going to need the Business Permit Registration Number that is displayed on the SBP. You write the Business Permit Number as shown on the Permit.

-

Business Name

You will also need the Business Name as appearing on the Business Permit. This is because Presumptive Tax is paid by businesses on a yearly basis and since we are generating the KRA Presumptive Tax Payment Slip for the business, the business name is important in this case. For ease of record keeping, ensure that the business name is the same as the one you added through the Business Income Amendment process.

-

Amount Paid For The Single Business Permit (BSP)

Last but definitely not the least is the amount that you paid for the business permit at County Government. So, depending on the amount you paid, you will need to capture that amount so as to be able to calculate the KRA Presumptive Tax that your business needs to pay Kenya Revenue Authority (KRA) at the rate of 15% of the amount paid for the Single Business Permit at the County.

Having looked at the Requirements Needed To Generate Presumptive Tax Payment Slip above, we now need to look at the step by step process of How To Generate Presumptive Tax Payment Slip Using iTax Portal. Ensure that you have with you the above required items before commencing on the process.

How To Generate Presumptive Tax Payment Slip Using iTax Portal

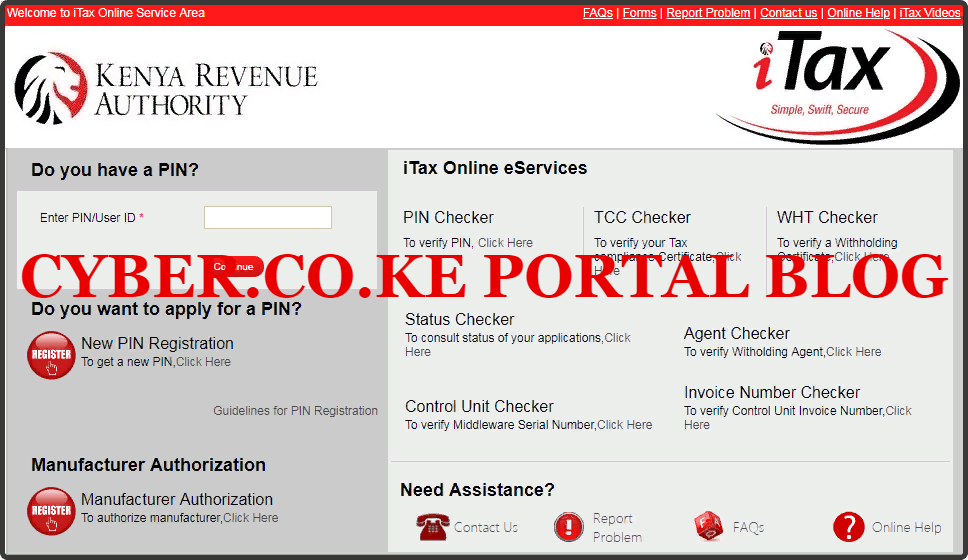

Step 1: Visit KRA Portal

The first step that you need to take in How To Generate Presumptive Tax Payment Slip Using iTax Portal is to ensure that you visit the KRA iTax Web Portal using the link provided above in the description. Take note that the above is an external link that will take you to the KRA iTax Portal i.e. link will open in a new tab.

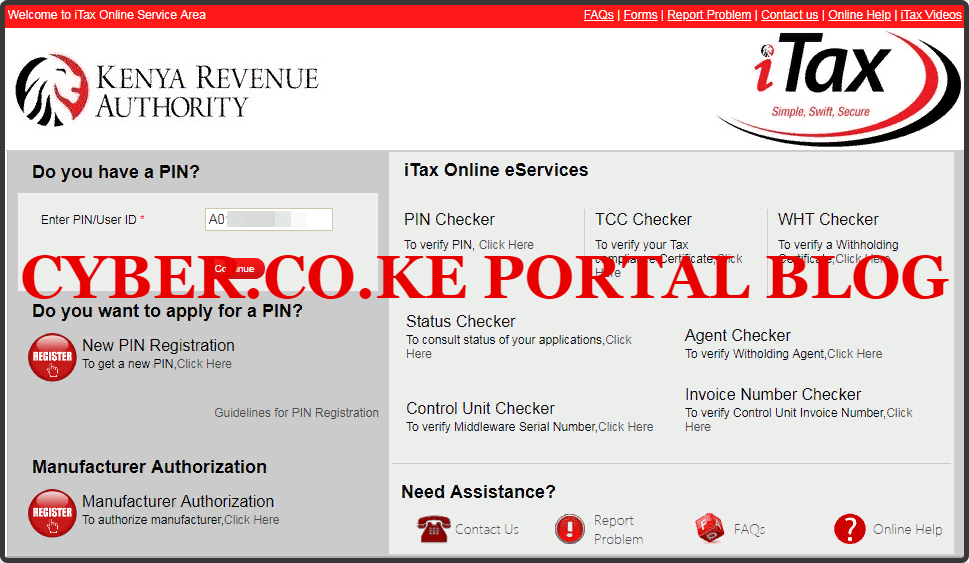

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA iTax Web Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Portal Account Dashboard. By entering the correct KRA PIN Number and iTax Password in the KRA Log In process, then you will be able to access you KRA Web Portal Account dashboard. Since we want to generate the KRA Presumptive Tax Payment Slip, we shall proceed to Step 5 below.

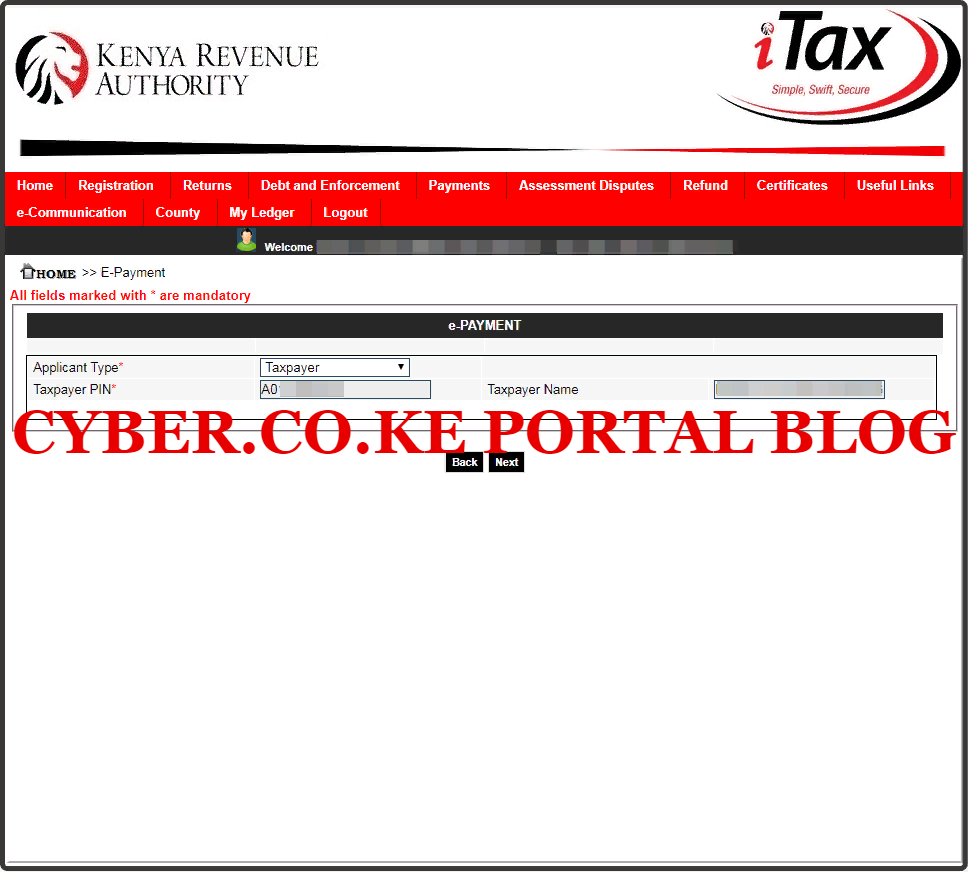

Step 5: Click On Payments Then Payment Registration Menu Tab

In this step, you will need to click on the Payments menu tab and click on Payment Registration from the drop down menu list as shown below.

Step 6: e-Payment Online Form

There is nothing much to do in this step as the fields of Applicant Type, Taxpayer PIN and Taxpayer Name are automatically pre-filled by the system. You only need to click on the “Next” button.

Step 7: Fill The e-Payment Registration Form

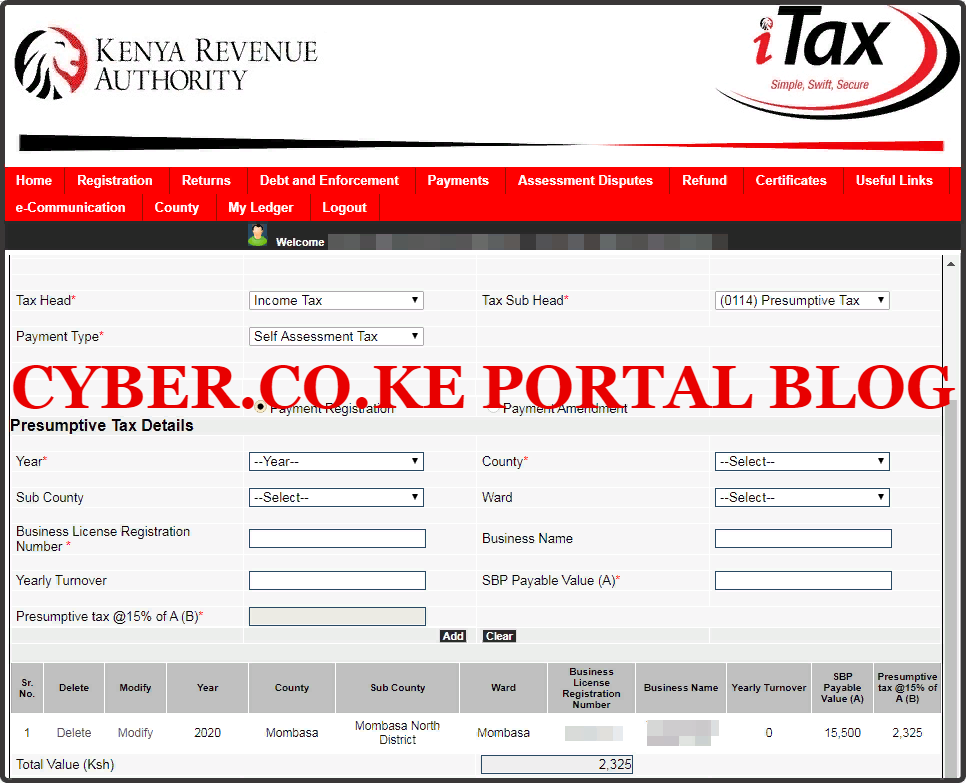

This is the most important step in the process of generating the KRA Presumptive Tax Payment Slip using KRA iTax Portal. In this step, you will be required to fill the following fields; Tax Head (Income Tax), Tax Sub Head (Presumptive Tax – 0114) and Payment Type (Self Assessment Tax). Once you have filled the above fields as shown, tick the check box for Payment Registration and this will load the Presumptive Tax Details.

Next, you will have to fill in the Presumptive Tax Details i.e. Year (2020), County, Sub County, Ward, Business Licence Registration Number, Business Name and SBP Payable Value. Once you have filled in those details, iTax will automatically calculate the amount of Presumptive Tax due at the rate of 15% of the SBP Payable Value, then click on the “Add” button. This is as illustrated below.

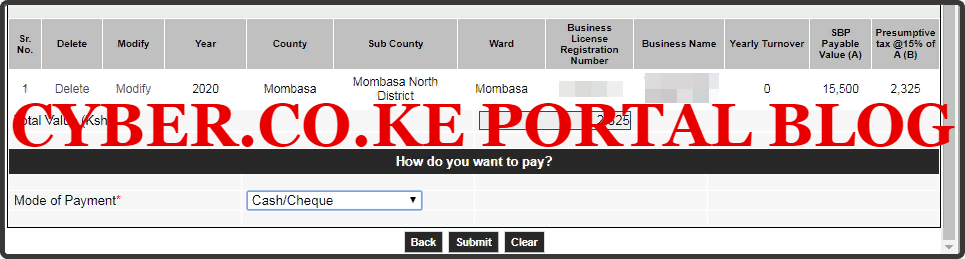

Step 8: Select The Mode Of Payment For KRA Presumptive Tax

Since we are going to pay the KRA Presumptive Tax using KRA Paybill Number, the Mode of Payment we need to select will be “Cash/Cheque” Once you have done that, click on the “Submit” button. This is as illustrated below.

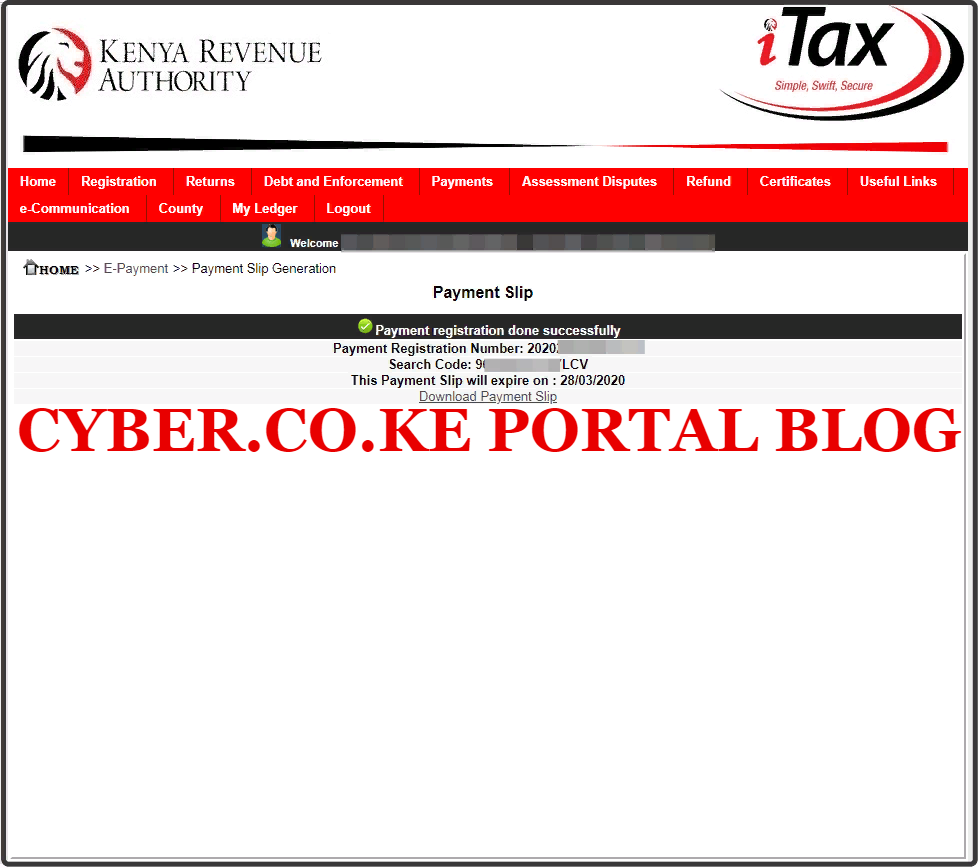

Step 9: Download Presumptive Tax Payment Slip

In this last step, you will need to download the KRA Presumptive Tax Payment Slip that has been generated successfully by the iTax Portal for your business. You do this by clicking on the “Download Payment Slip” link. This is as shown below.

On the downloaded KRA Presumptive Tax Payment Slip, you need to take note of the Payment Registration Number (PRN) that will as serve as the Account number when you will be paying for the KRA Presumptive Tax using either KRA Paybill Number or any of the KRA Partner Banks in Kenya. Below is a sample of the Presumptive Tax Payment Slip that we have generated in this process.

The above steps sum up the process of How To Generate Presumptive Tax Payment Slip Using iTax Portal. You need to that that your business needs to be registered first for Turnover Tax before you generate the Presumptive Tax Payment Slip using KRA iTax Portal.

READ ALSO: KRA PIN Recovery Process And Steps Using KRA iTax Portal

If you need any help, here at Cyber.co.ke Portal we offer both Turnover Tax Registration services and Presumptive Tax Payment Registration services so as to enable you relax and let our team of experts generate the Presumptive Tax Payment Slip and forward the same to your email address so as to enable you pay for the Presumptive Tax of your business in Kenya.