Do you need to Register for KRA Turnover Tax on iTax Portal? Learn How To Register For Turnover Tax Using KRA iTax Portal.

By now you have already heard the buzz milling around Kenya that Businesses whose gross sales per year is less than Kshs. 5,000,000.00 need to Register for KRA Turnover Tax. So if you are a taxpayer who owns and runs a business that fits that description, you need to Register for Turnover Tax on KRA Portal.

In this article, I am going to share with you the steps and processes that are involved in How To Register For Turnover Tax Using KRA iTax Portal. By the end of this article, you should have known how to Register for Turnover Tax by using the KRA iTax Portal.

READ ALSO: How To Check And Confirm Your KRA PIN Using iTax PIN Checker

Just as a disclaimer, this article will be of great value for those individuals who already have a KRA PIN that is on iTax and need to Register for Turnover Tax in their KRA Web Portal Account. So if you have an existing KRA PIN and need to register that PIN Number for KRA Turnover Tax, this article will serve you better. If you don’t have a KRA PIN, you can request for KRA PIN Registration services here at Cyber.co.ke Portal.

To be able to Register for Turnover Tax on KRA Portal, you need to login using your KRA PIN Number and iTax Password. But in most cases, many Kenyans either have forgotten their KRA PIN Number or even the email that they used in KRA PIN Portal or KRA Portal (iTax Portal).

The good thing is that incase you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you. Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password.

What Is Turnover Tax?

Turnover Tax is a tax obligation by Kenya Revenue Authority (KRA) for businesses in Kenya whose gross sales per year is less than Kshs. 5,000,000.00 and is not expected to exceed that amount in a period of one year. Turnover Tax is charged at the rate of 3% of the gross sales of the business for a given month.

Turnover Tax is payable on or before the 20th day of the next month. For example, assuming your business qualifies for Turnover Tax and you registered for Turnover Tax in January 2020, you will pay the Turnover Tax on the gross sales that you made in January 2020 on or before the 20th day of February 2020.

So if in the month of January 2020 you made a total gross sales of Kshs. 90,000.00 then the amount of Turnover Tax than you will need to pay Kenya Revenue Authority (KRA) is 3% of that month’s gross sales. If you do the maths here that will be 3% of Kshs. 90,000, turnover tax calculations; (0.03*90,000 = Kshs. 2,700.00). From that example, the amount of Turnover Tax that you will pay KRA for the month of January 2020 is Kshs. 2,700.00 only. This Turnover Tax amount needs to be paid on or before the 20th of February 2020.

You need to take note that different businesses makes different gross sales in a month. Some can make profits and others can make losses, so the amount of KRA Turnover Tax that you will pay for your business will solely depend on how much you made in a given month, business qualifies and is eligible for Turnover Tax, then you need to register for the Turnover Tax on iTax Portal.

I won’t dwell much on Turnover Tax definitions and terminologies, if you need to learn more about the KRA Turnover Tax, you can check out the article The Complete Beginner’s Guide To KRA Turnover Tax (TOT) In Kenya. If you have any questions that you need answered about Turnover Tax, you can check out our article on Frequently Asked Questions: Presumptive Tax And Turnover Tax (TOT). If you feel you need support and assistance, just send us an email to: [email protected] or Chat with our Tax Team on WhatsApp at +254 723 737 740 and we shall glady advice and assist.

Now that we have fully addressed what you need to know about KRA Turnover Tax, we need to look at the key requirements that will be needed so as to Register for Turnover Tax on KRA iTax Portal. Just as I mentioned at the beginning of this article, our main focus is the group of taxpayers who already have a KRA PIN that is on iTax Portal. Why those who already have a KRA PIN on iTax Portal?

The reason why those who already have a KRA PIN that is already on iTax Portal can easily register for Turnover Tax is because of two key reasons. Before you Register a Business in Kenya on eCitizen you need to have a KRA PIN Number, which you can get here at Cyber.co.ke Portal through our KRA PIN Registration Services. Secondly, to Register for Turnover Tax, you are going to need the Business Registration Certificate so as to add the business as your source of income on iTax Portal. There is no way a taxpayer can register for Turnover Tax at the point which they are applying for KRA PIN Registration.

So this simply means that a new taxpayer cannot Register for Turnover Tax at the time they are registering for a new KRA PIN on iTax Portal. What new taxpayers can do is first submit their KRA PIN Registration orders at Cyber.co.ke Portal, then once they receive their KRA PIN and KRA PIN Certificate, apply for Business Name Registration on eCitizen and once they get the Business Name Registration Certificate, apply for Registration of Turnover Tax on iTax Portal or place order at Cyber.co.ke Portal for Business Income Amendment and Turnover Tax Amendment.

I think the guys at Kenya Revenue Authority (KRA) are aware of this scenario and situation for new taxpayers on iTax Portal who want to Register for Turnover Tax at the point of KRA PIN Registration, which is impossible tpo say the least. So, get a KRA PIN first at Cyber.co.ke Portal, Register your Business on eCitizen and get the Business Registration Certificate and then finally Register for Turnover Tax by following the steps in this article.

For you to Register for Turnover Tax on iTax Portal, you need to ensure that you have with you; KRA PIN Number, KRA iTax Password and Business Registration Certificate. We need to take a look at these two key requirements that you need to ensure that you have with you before registering for Turnover Tax on iTax Portal.

Requirements Needed To Register For Turnover Tax On iTax Portal

Just as highlighted above, the process of Registering for Turnover Tax on KRA iTax Portal requires that a taxpayer have with them; KRA PIN Number, KRA iTax Password and Business Registration Certificate. These three Turnover Tax Registration requirements are as explained in details below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable your Reset KRA iTax Password.

-

Business Registration Certificate

For you to be able to Register for Turnover Tax, you need to ensure that you own and rune a business that is eligible for KRA Turnover Tax. The business registration certificate is important because you will need to amend the source of income details on iTax Portal and add business as a source of Income on iTax Portal.

If you need to know how to amend your source of Income and add business as the main source of income to your KRA PIN, check out our article about How To Add Sole Proprietorship Business On KRA iTax Portal. This will guide you on how to add your Sole Proprietorship details and have that business linked to your KRA PIN Number on iTax Portal.

Now that you have with you the above three key requirements that are needed in the process of registering for Turnover Tax on KRA iTax Portal, we can now officially look at the steps involved in How To Register For Turnover Tax Using KRA iTax Portal.

How To Register For Turnover Tax Using KRA iTax Portal

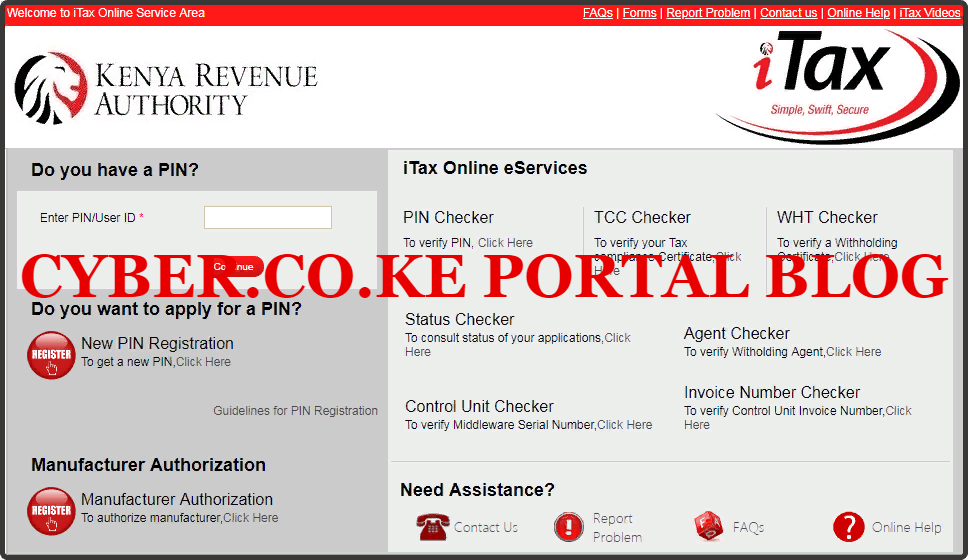

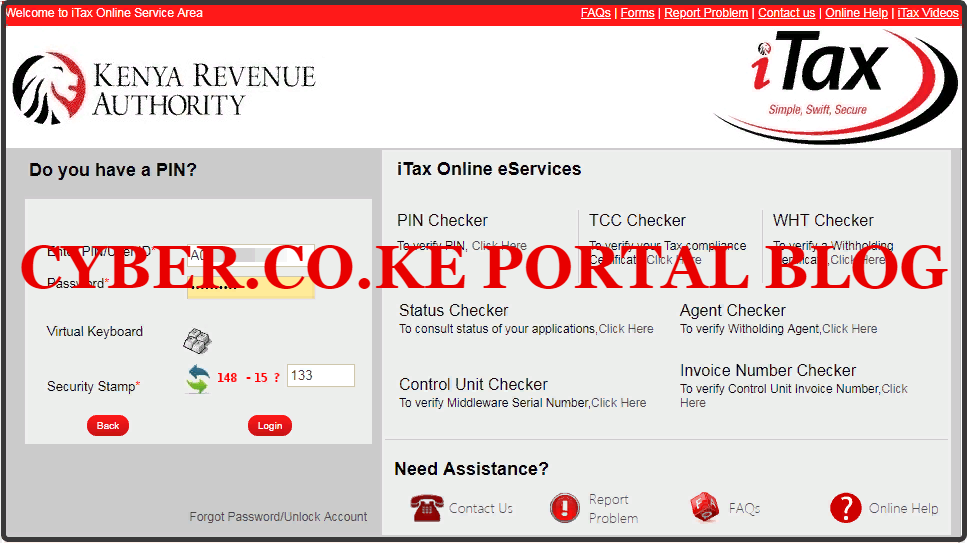

Step 1: Visit KRA Portal

The first step that you need to take is to ensure that you visit the KRA iTax Web Portal using the link provided above in the title. Note that above link open in an external tab.

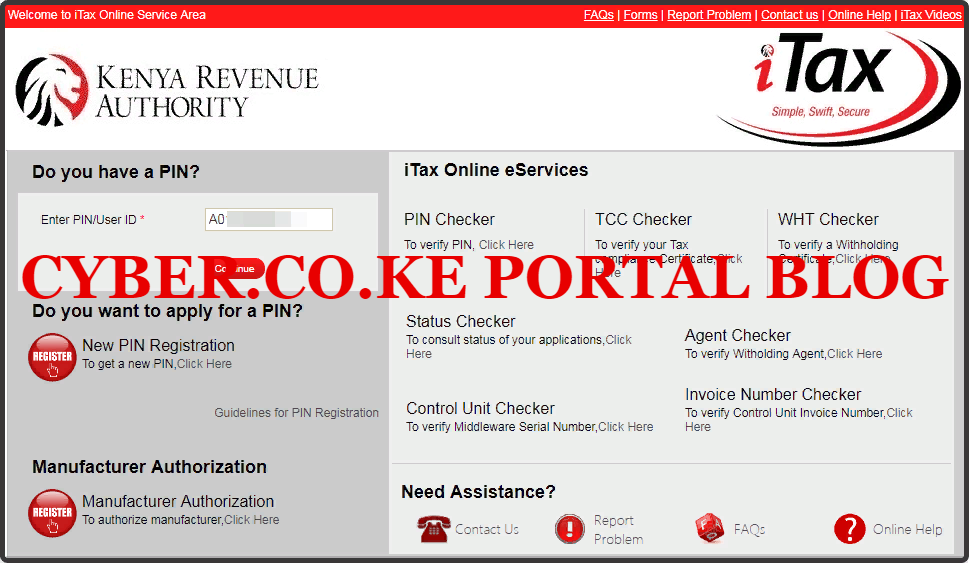

Step 2: Enter Your KRA PIN Number In The PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your KRA iTax Web Portal Account.

Step 4: KRA iTax Web Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Web Portal Account Dashboard.

Since the process of Registering for Turnover Tax on iTax is an Amendment process, i.e. we are amending the KRA PIN details on iTax, you will need to proceed to step 5 below.

Step 5: Click On Amend PIN Details Under Registration Menu

In this step, we need to start the process of KRA PIN Amendment by clicking on the “Amend PIN Details” under the Registration menu tab and from the drop down list, select the “Amend PIN Details” menu. This is as illustrated in the screenshot below.

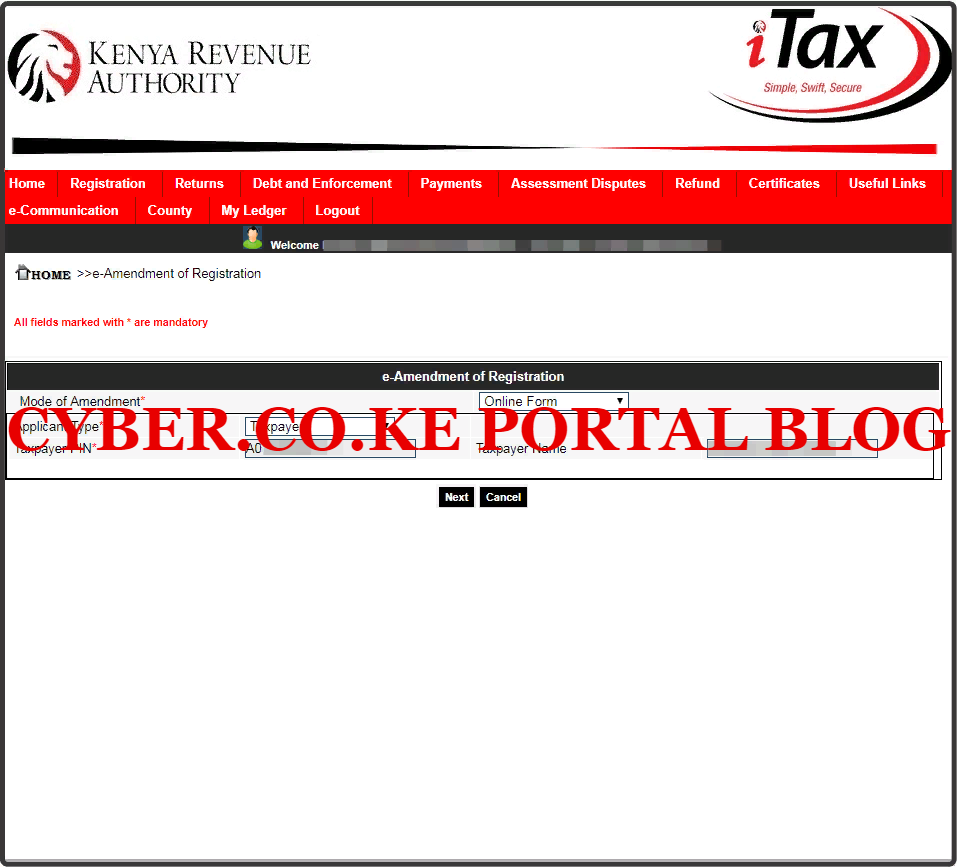

Step 6: Select Mode of KRA PIN Amendment

In this step, you will need to select the Mode of KRA PIN Amendment that you are going to use. The fastest and easiest Mode of Amendment is the Online Form option. You can also choose to use the Upload Form mode of amendment, but I wouldn’t recommend that option. Once you have selected the “Online Form” option, click on the “Next” button.

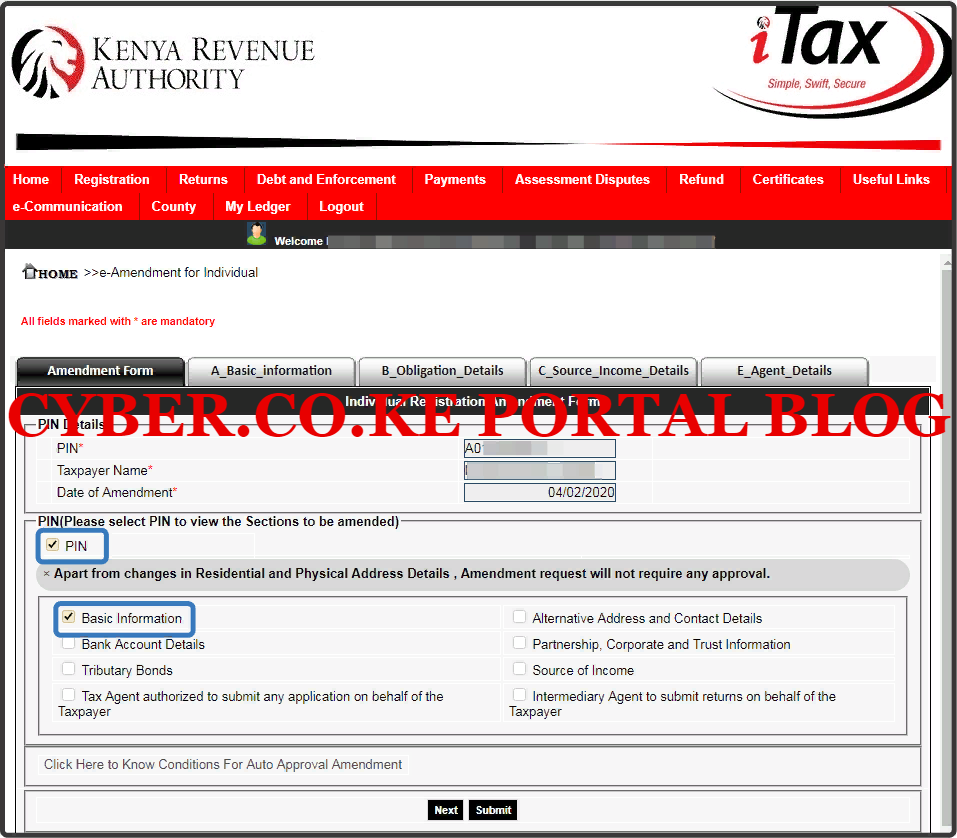

Step 7: Select By Ticking The Checkbox For PIN and Basic Information in the KRA PIN Amendment Form

In the Amendment Form, you will need to select by ticking the checkboxes next to the PIN option and the Basic Information option. This is because we are registering Turnover Tax to the KRA PIN. This is as illustrated below. Once you have checked the two boxes, click on “Next” button.

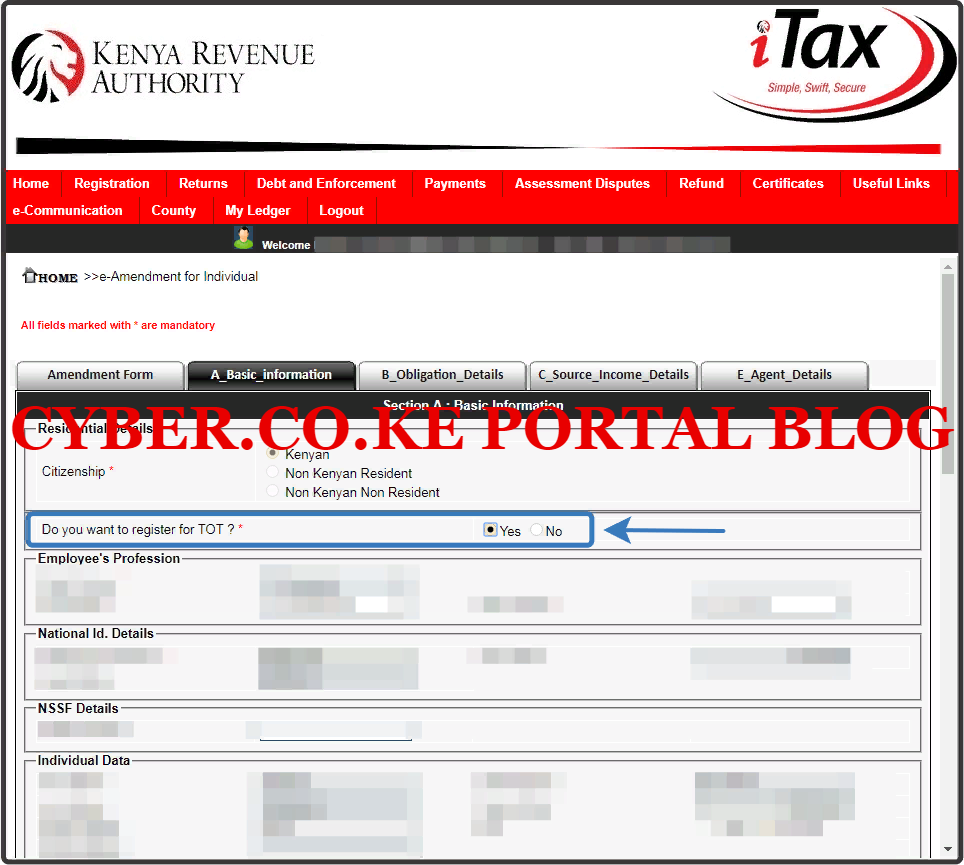

Step 8: Do You Want To Register For Turnover Tax?

Now this is the most important step as it is here where you will have to choose that you want to Register for Turnover Tax. In the Basic Information tab (A_Basic_Information), on the question, Do you want to Register for Turnover Tax (TOT)? Click on the “Yes” check box. This is because we want to register our KRA PIN for Turnover Tax. So you will need to click on the Yes option.

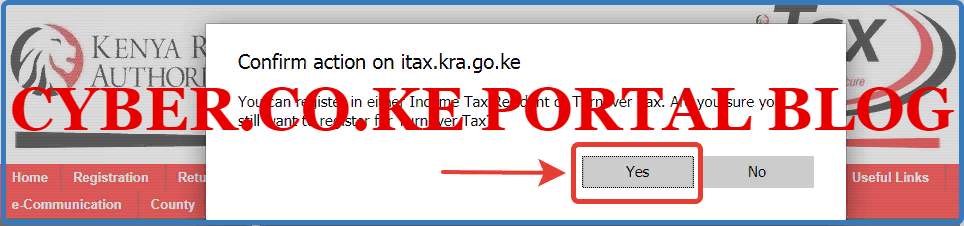

At this point, you should get a pop up window from itax.kra.go.ke asking you to confirm action i.e. “You can register in either Income Tax Resident or Turnover Tax. Are you sure you still want to Register for Turnover Tax? You need to select the Yes option as we are registering for the KRA Turnover Tax. This is as illustrated in the screenshot below:

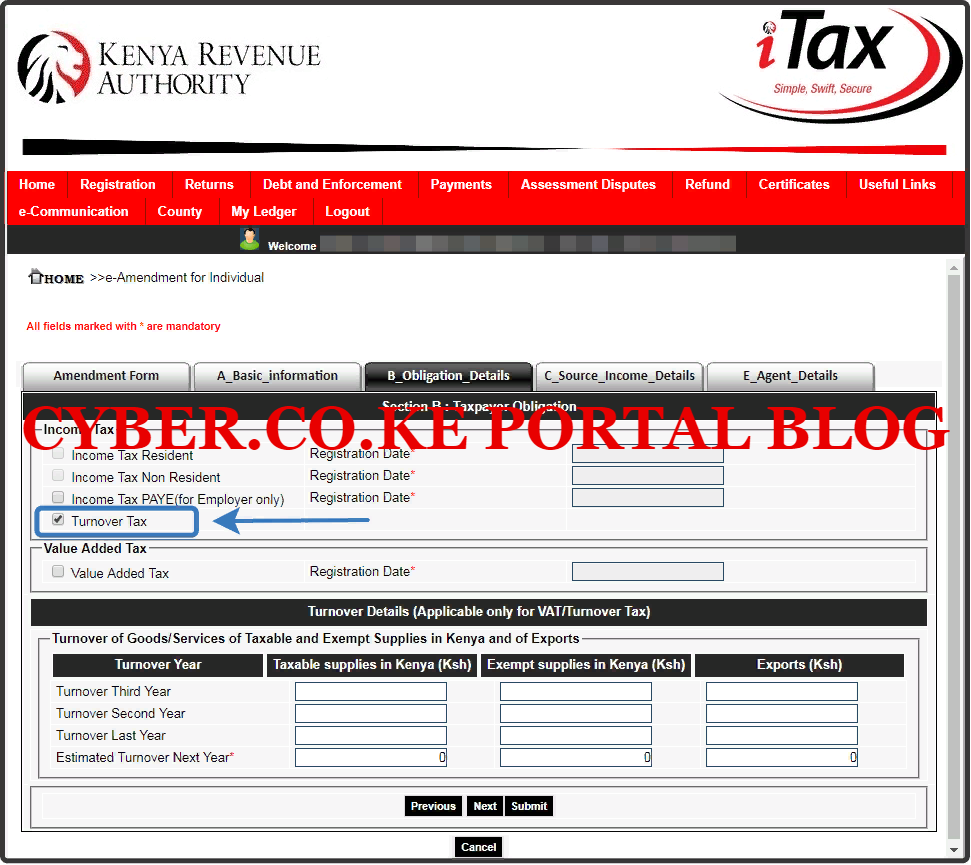

Step 9: Select Turnover Tax In The Obligation Details Section

Once you have selected Yes option in step 8 above that you need to Register for Turnover Tax, you will need to hoover to the Obligation Details tab (B_Obligation_Details). In this section, you will need to tick the check box next to Turnover Tax. This is as illustrated below.

At this tame, you will note that the Income Tax Resident Obligation is removed and the check box next to Turnover Tax is active, which in this case you will need to select it by ticking in the check box. Also note that there is no Registration Date for the Turnover Tax.

Why is this the case? Since this process is an Amendment, a task will be generated for approval at your KRA Tax Station, so the date that the Turnover Tax registration is approved will be the date appearing on your KRA PIN Certificate.

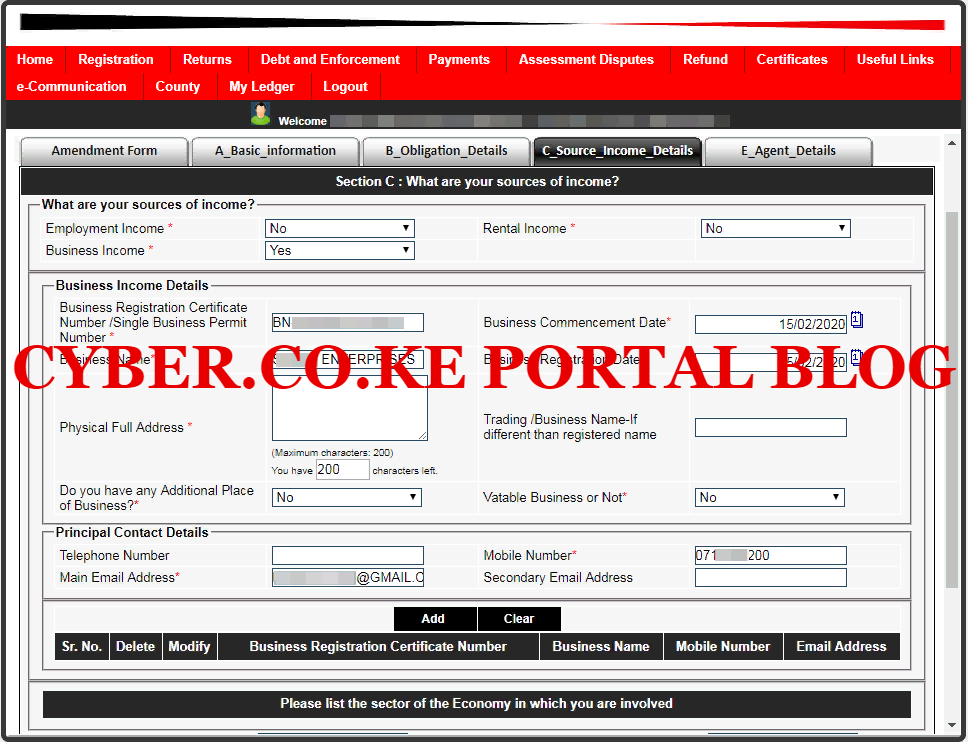

Step 10: Fill In Business As Source Of Income In The Business Income Details Section

You need to take note that when you choose to Register for Turnover Tax in step 8 above, this will activate the Business details section and Business income will be selected to Yes. You will now need to have your Business Registration Certificate and capture the business information in this section. This is as illustrated below.

You can also refer to our article on How To Add Sole Proprietorship Business On KRA iTax Portal so as to get a full understanding of how to amend business income details on iTax Portal. We normally prefer that you amend your Business Income details first then Register for Turnover Tax after approval of Amendment of Business Income.

In the case of this article, we amended the Business Income first then now we are registering for Turnover Tax. If you have with you your Business Registration Certificate, you apply for Turnover Tax Registration and at the same time amend the source of income to Business Income on iTax Portal.

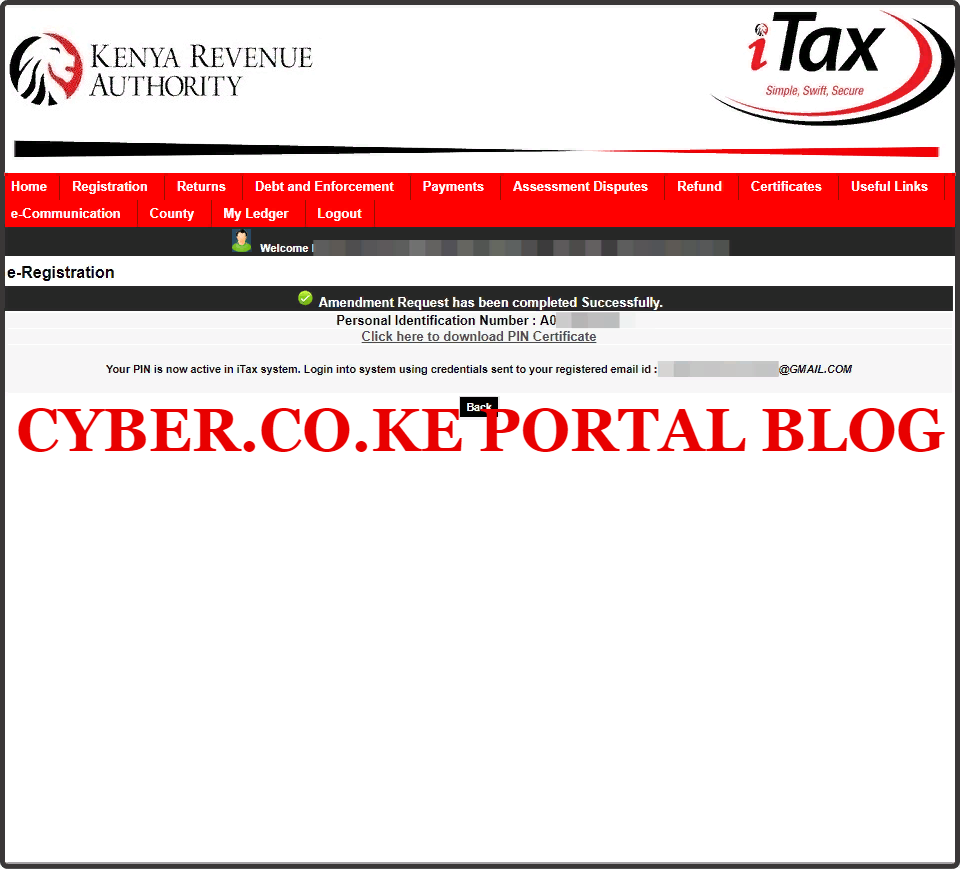

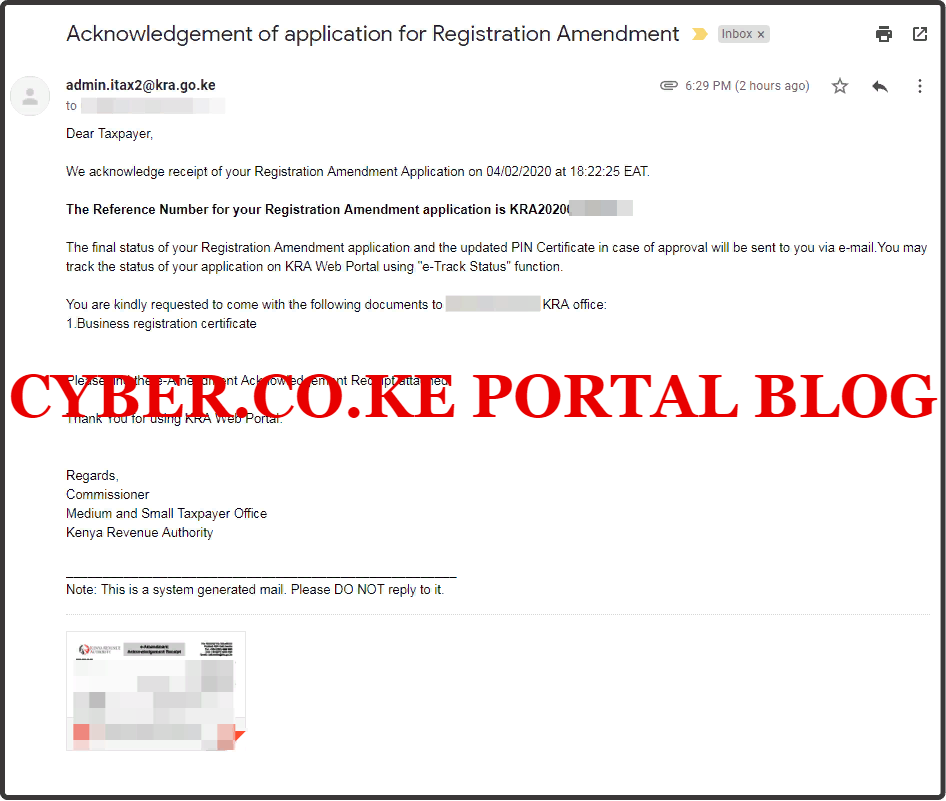

Step 10: Download The Turnover Tax Registration Acknowledgement Receipt

In this step, once you have successfully submitted your request to KRA for Registration of Turnover Tax on KRA iTax Portal, you will need to download the Turnover Tax Acknowledgement Receipt that you can use to track the status of the Turnover Tax Registration Amendment.

Step 11: Approval Of Turnover Tax Registration

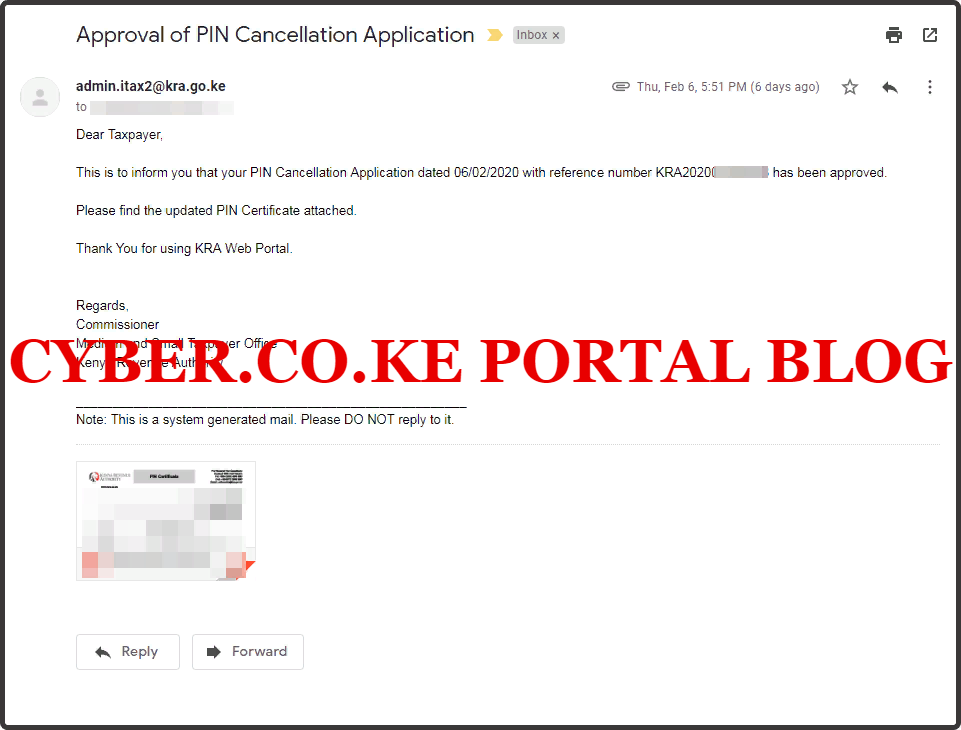

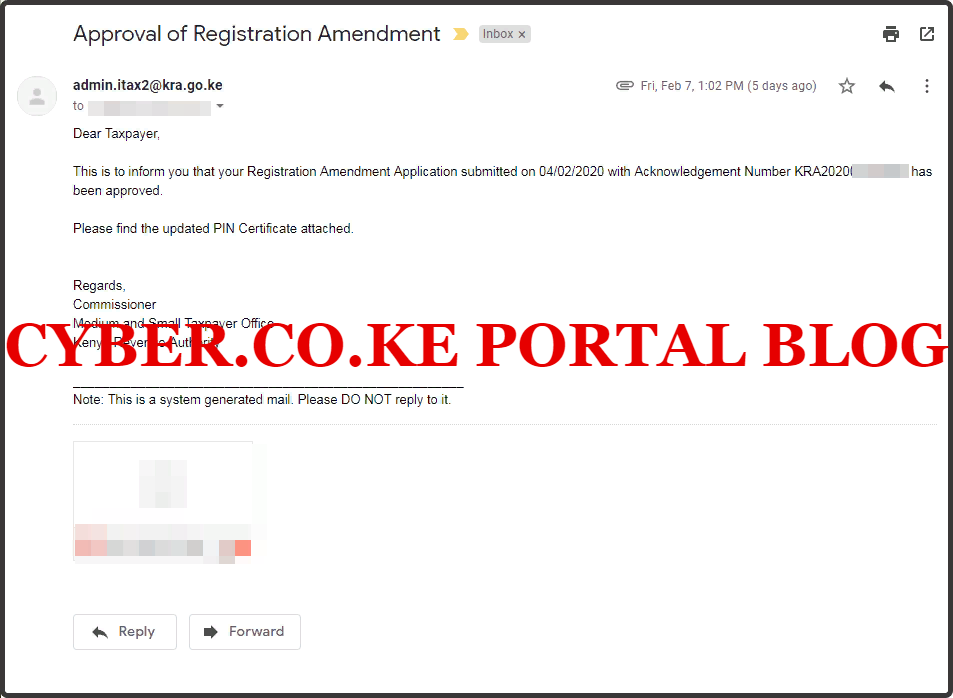

Once you have done all the above, you need to take note that the approval of Registration of Turnover Tax by KRA can take upto 3 working days. Once approved, you will receive emails confirming the same. Normally you are supposed to receive 3 Approval Emails. These includes: Business Income Amendment Approval, Approval of PIN Cancellation and Approval of Registration Amendment.

-

Business Income Amendment Approval

Since registering for Turnover Tax triggers amendment of business income details, once that is approved by KRA, an approval email will be sent out. This is what we call approval of business income amendment. Since we added business income, this generated a task that went for approval and once approved we got the email as illustrated below.

-

Approval of KRA PIN Cancellation

You will get from KRA once you choose to Register for the Turnover Tax on your KRA PIN, this is the Approval of KRA PIN Cancellation email notification. Why KRA PIN Cancellation? Since you are registering for Turnover Tax as your new KRA Tax Obligation on your KRA PIN, the previous Income Tax Resident has to be cancelled and removed from your KRA PIN and this process involves the temporary cancellation of your KRA PIN Number.

-

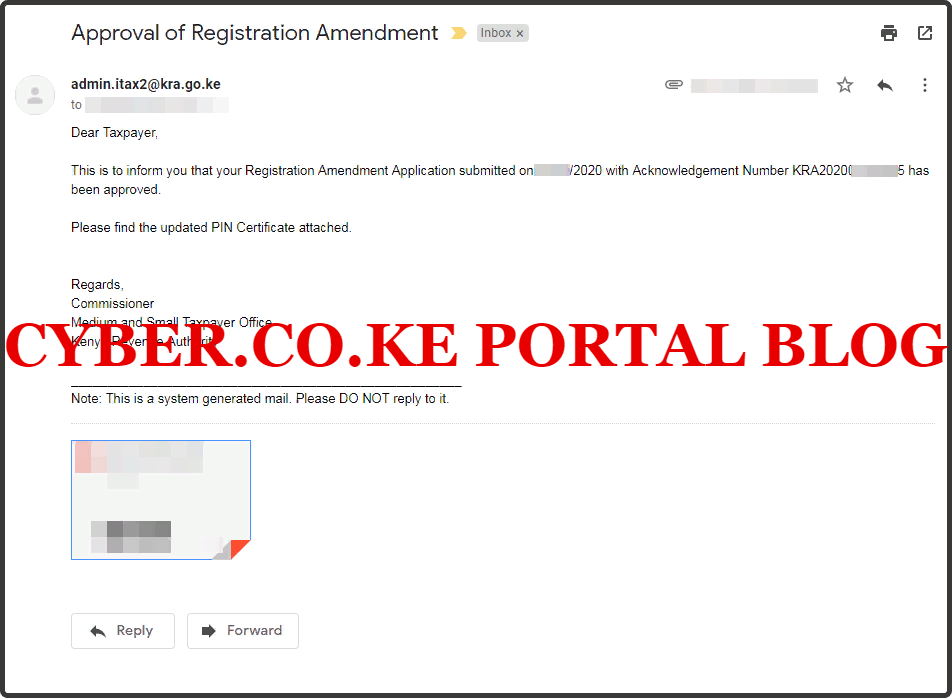

Approval of Turnover Tax Registration Amendment

The last and final email that you will get from KRA after Approval of the addition of Turnover Tax Obligation on your KRA PIN Number is the Approval of Registration Amendment. Since the process of Registering for Turnover Tax is an Amendment process, once approved you will get an email notification of the same. This will serve as the final and last notification that the process of adding Turnover Tax Obligation on KRA PIN using iTax Portal is complete.

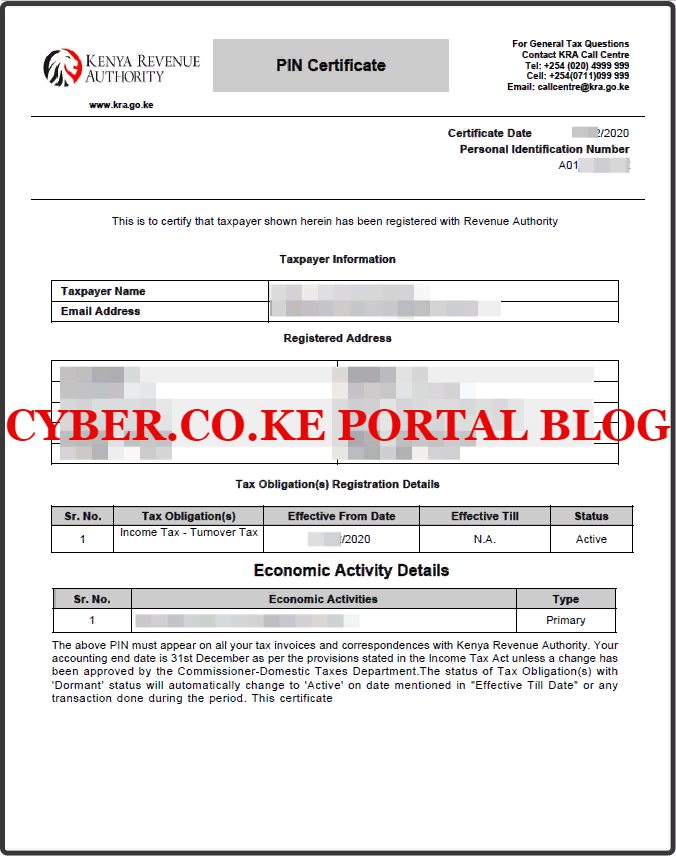

Once you have your Turnover Tax Registration request approved by Kenya Revenue Authority (KRA) after you have followed the Turnover Tax Registration steps above, you can now begin to file your Turnover Tax Returns and generate the Turnover Tax Payment Slip. You will note that your new KRA PIN Certificate will have the Turnover Tax displayed under the Tax Obligation(s) Registration Details section. This is as illustrated below:

READ ALSO: How To Use KRA Portal Print PIN Certificate Functionality

Just as a quick reminder, the approval of Registration of Turnover Tax can sometimes take upto 5 working days. But at the end, it will normally get approved as long as you have followed the above Turnover Tax Registration steps and procedures. If all these sees like a technical jargon to you, let our teams of tax experts assist you. Submit your order for Business Income Amendment and Turnover Tax Amendment today.