Are you getting an error while uploading KRA Returns Template i.e. The template you uploaded is of incompatible type. Learn How To Download Latest KRA Returns Template From KRA Portal.

It is that time of the year whereby there is a crazy rush by taxpayers in filing their KRA Returns before the 30th June deadline. Be it filing KRA Nil Returns or KRA Employment Returns, every taxpayer is caught up in this rush either one way or the other.

The one who normally feel the pich are those taxpayers who are employed are are required to file KRA Returns using the KRA Returns Template and the KRA P9 Form. Knowing how to download the latest KRA Returns Excel Template is a must if you get incompatibility issues when trying to upload the KRA Template on KRA Portal.

READ ALSO: How To Print KRA PIN Certificate Using KRA iTax Portal

In this article, I am going to share with you the step by step guide on How To Download Latest KRA Returns Template From KRA Portal. This is is important especially when you get the error: “The template you uploaded is of incompatible type. Please download latest template from KRA Portal and use the same.”

By the end of this article, you will have learnt and known how you can get the latest KRA Template that is needed to file your KRA Employment Returns on the KRA iTax Portal. This is due to the fact that the KRA Template is an Excel Sheet and it is highly recommended by Kenya Revenue Authority (KRA) that all taxpayers download the latest KRA Returns Template from KRA Portal and use the same.

To be able to download the latest Returns Template from KRA Portal, we need tpo first understand some key terms and concepts that this article will seek to address. This is in relation to the KRA Template or simply what we refer to as KRA Returns Excel Template (KRA Excel Template). This article will lay great emphasis on: What Is KRA Returns Template (KRA Template), Features Of The KRA Returns Template, Errors Associated With KRA Returns Template (KRA Template), Requirements Needed To Download Latest KRA Returns Template (KRA Template) and How To Download Latest KRA Returns Template From KRA Portal.

What Is KRA Returns Template (KRA Template) – Version 18.0.6?

KRA Returns Template or KRA Template (KRA Returns Excel Template) is basically an Income Tax Returns Form that is in Excel version that a taxpayer downloads from his or her KRA iTax Web Portal Account so as to use it to file their KRA Income Tax Returns. It can also be defined as a document that a taxpayer uses to fill in the tax details for a period of 12 months and use the same to file KRA Returns. The KRA Returns Form is filled using the data that is captured of the Employee’s KRA P9 Form.

You need the KRA Template inorder for you to fill in the details of your income tax as shown in your KRA P9 Form or the KRA Tax Deduction Card. The KRA Excel Template is therefore a must for you to be able to file your KRA Returns on the KRA iTax and is also the most popular way of filing KRA Returns on iTax also. Each and every taxpayer is required to download the latest Returns Template from KRA Portal by ensuring that they have logged into their KRA iTax Accounts.

KRA Template plays an integral and important role in taxpayer’s Returns filing process on iTax Portal. If you are in employment, during the process of filing your KRA Returns it is important to ensure that you have with you both the P9 Form and the KRA Excel Template. Once you have these two items with you, then you will be able to file your KRA Returns without any hitches. But if you need help, you can fill and submit your KRA Employment Returns Filing here at Cyber.co.ke Portal.

This is because you will be filling in the data that is on your P9 Form on the KRA Returns Excel Template before validating it and uploading the same to KRA iTax Portal. These two documents form the most important requirements that are need to file KRA Employment Returns on KRA iTax Portal. Always remember than if employed, you will need to ask your employer to give you the P9 Form and then head over to iTax Portal Account and download the KRA Returns Template.

Having looked at the definition of KRA Template above, we now need to look at Features Of The KRA Returns Template (KRA Template). We need to understand the different sections that form the KRA Returns Excel Template that each and every taxpayer who is employed needs to download from the KRA Portal.

Features Of The KRA Returns Template (KRA Template)

Just as described above, the KRA Returns Excel Template is comprised of many sections but only 4 sections are the most important in the whole KRA Template workbook. These sections of the Returns Excel Template includes: Basic Information Section, Employment Income Section, Details of PAYE Deducted Section and Tax Computation Section. Now let us look briefly at what each section of the KRA Template entails.

-

Basic Information Section of the KRA Template

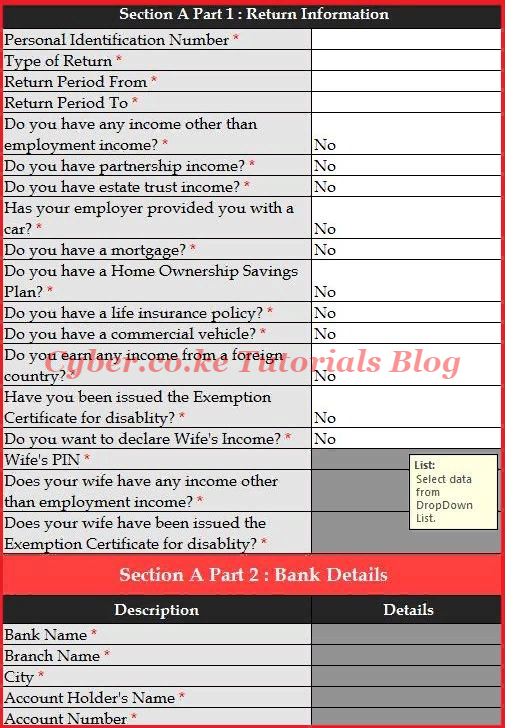

This is the first part of the KRA Template. In this section, you need to take note of Part 1 and Part 2 of Section A. The Section A Part 1 is basically the Return Information section while the Section A Part 2 is the Bank Details section. This is illustrated in the screenshot below.

-

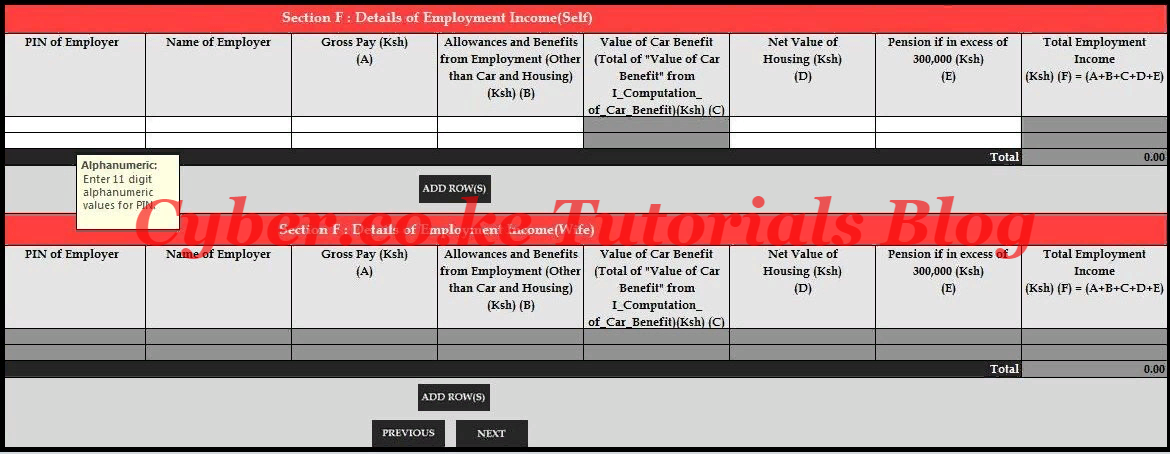

Employment Income Section of the KRA Template

The next section is the Employment Income Section. This is the section whereby you fill in the details of employment as per you P9 Form. This is illustrated below.

-

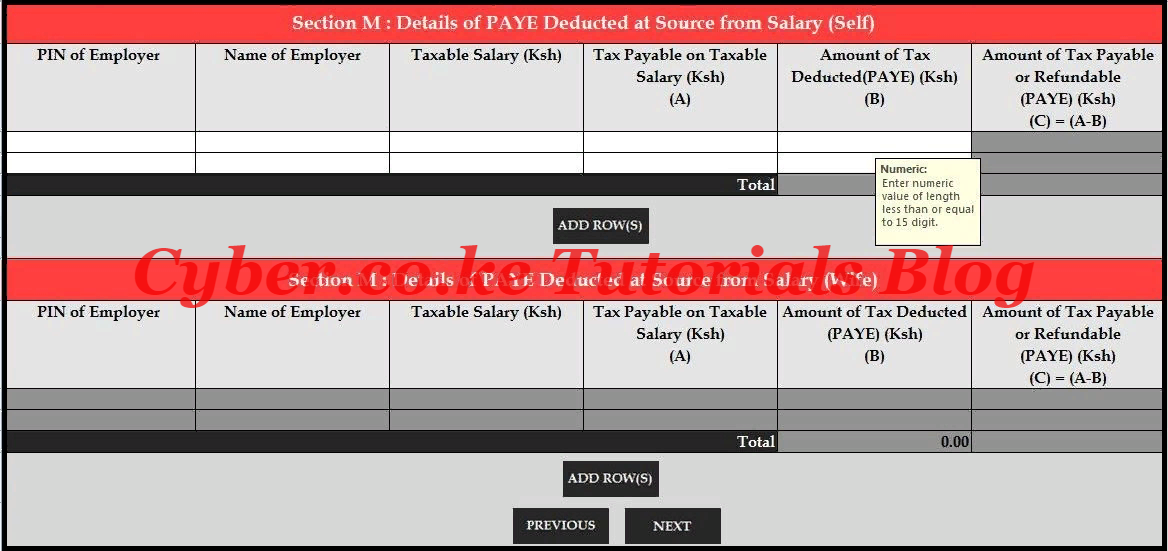

Details of PAYE Deducted Section of the KRA Template

The next section of the KRA Returns Template is the Details of PAYE deducted section. This is where you fill in the PAYE deducted for they year as shown in your P9 Form. This is as illustrated below.

-

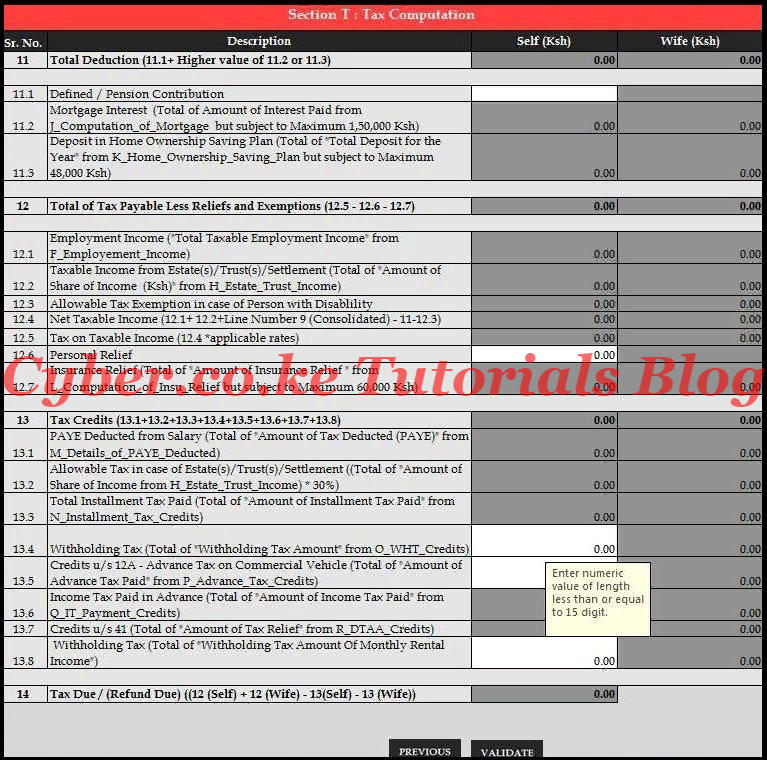

Tax Computation Section of the KRA Template

The last and most important section of the KRA Returns Template is the Tax Computation Section. This is the section where you compute the amount of Tax Due or Refund Due and validate the KRA Template so that you can upload it in your KRA Web Portal Account. Below is a screenshot of the same.

Now that we have looked at the different sections that are most important in the KRA Template above, we now need to shift gears a little bit and look at Errors Associated With KRA Returns Template (KRA Template).

Errors Associated With KRA Returns Template (KRA Template)

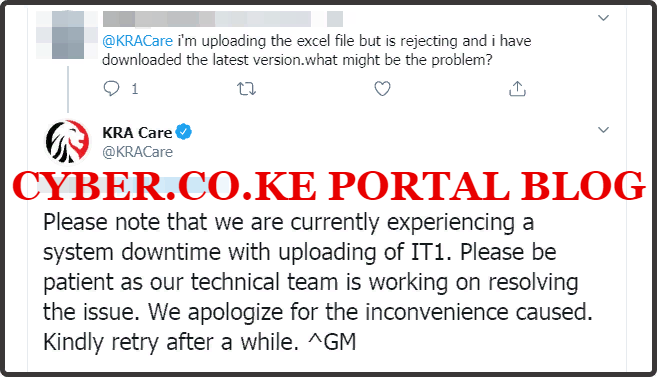

There is one common that is associated with the KRA Template. This error arises due to iTax Server Downtime and makes it hard for the taxpayer to upload the validated KRA Template in his or her iTax Account while filing the KRA Employment Returns. Below is a screenshot of that error.

Basically the error will state: “The template you uploaded is of incompatible type. Please download latest template from KRA Portal and use the same.” First thing you need to do is not panic when you get the above error message while trying to upload the KRA Template in your iTax Account. This error is normally as a result of iTax System Challenges (Server Downtime Issues at KRA) that are expected to be experienced during the KRA Returns Filing Period.

The above error normally arises because of a system downtime with uploading of IT1. The IT1 is basically the KRA Returns Template or simply the KRA Returns Excel Template. Due to system challenges on the KRA iTax Portal, it will be a common thing that almost all taxpayers who are trying to file their KRA Employment Returns on iTax will face. All you need to do is be patient and await Kenya Revenue Authority (KRA) fix the challenges related to uploading the Returns Template on iTax Portal.

This will be a great time to ensure that you have filled in the Returns Template correctly and if not, you can go ahead and download the latest template in your KRA Portal account, fill the template and re-upload it on iTax Portal. Hopefully this will solve the incompatible template issues that you might face while trying to upload the KRA Template on iTax Portal.

Having looked at the template you uploaded is of incompatible type issue above, we now need to look at the key Requirements Needed To Download Latest KRA Returns Template (KRA Template). Basically to be able to download the latest template from KRA Portal and use the same, you need to have two key requirements i.e. KRA PIN Number and KRA iTax Password. This is as discussed below.

Requirements Needed To Download Latest KRA Returns Template (KRA Template) – Version 18.0.6

To be able to download latest template from KRA Portal and use the same, you need to have the two key requirements that are normally needed to access KRA Portal Account. This includes the KRA PIN Number and KRA iTax Password. This is as explained and described below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same as the one you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable you Reset KRA iTax Password.

Having looked at the requirements that are needed to download the latest template from KRA Portal, we now need to look at the step by step guide on How To Download Latest KRA Returns Template using iTax Portal. We need to understand the procedure that all taxpayers in Kenya should follow in order to get the latest template on KRA Portal i.e. How To Download Latest KRA Returns Template From KRA Portal.

How To Download Latest KRA Returns Template (Version 18.0.6) From KRA Portal

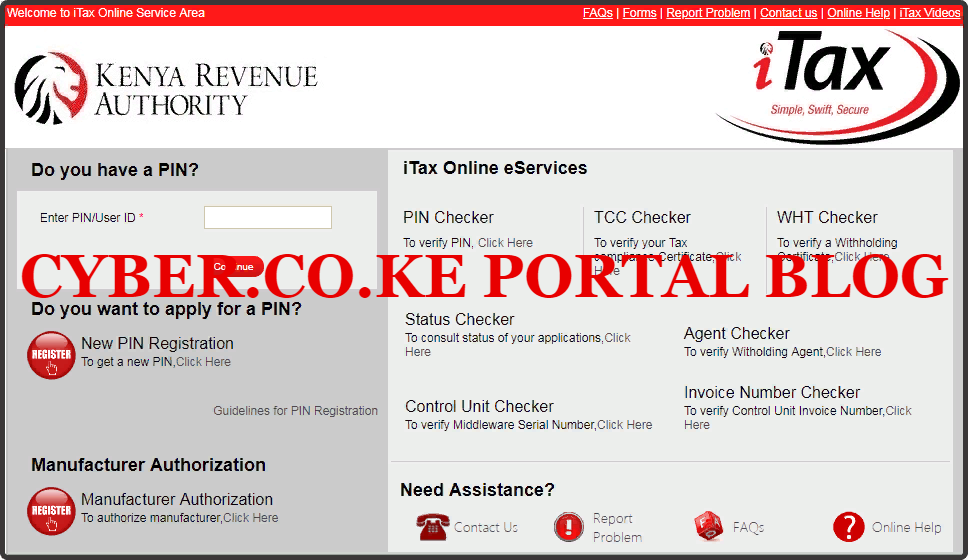

Step 1: Visit KRA Portal

The first step that you need to take in the process of How To Download Latest KRA Returns Template From KRA Portal is to ensure that you visit the KRA iTax Web Portal using the link provided above in the above description. Take note that the above is an external link that will take you to the KRA iTax Portal i.e. link will open in a new tab.

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” button to proceed to the next step.

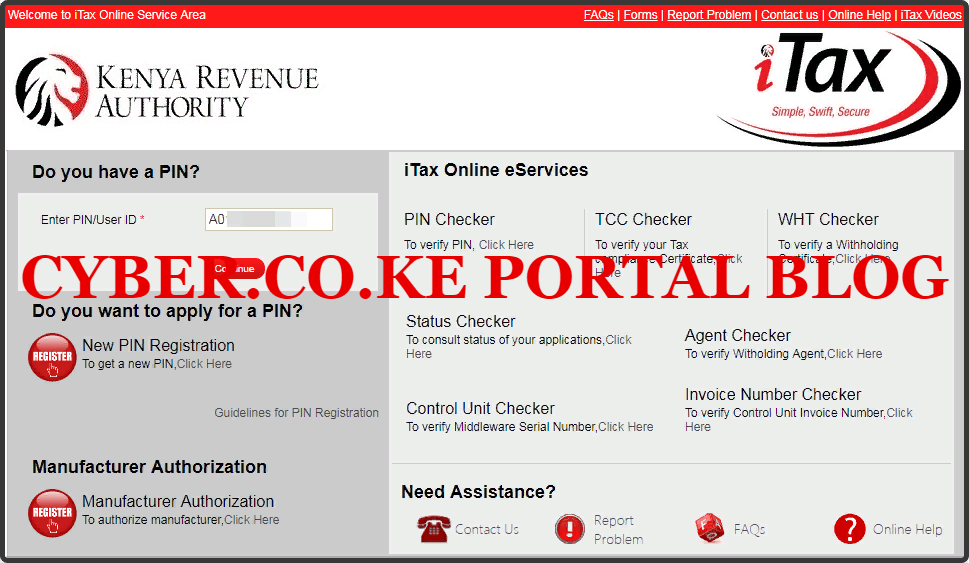

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Web Portal Account Dashboard. Here upon successful login process, you are able to view a wide range of iTax Portal functionalities. Since we need to Download the latest KRA Returns Template Using KRA Portal, that we need so as to solve the error message template you uploaded is of incompatible type, we proceed to Step 5 below.

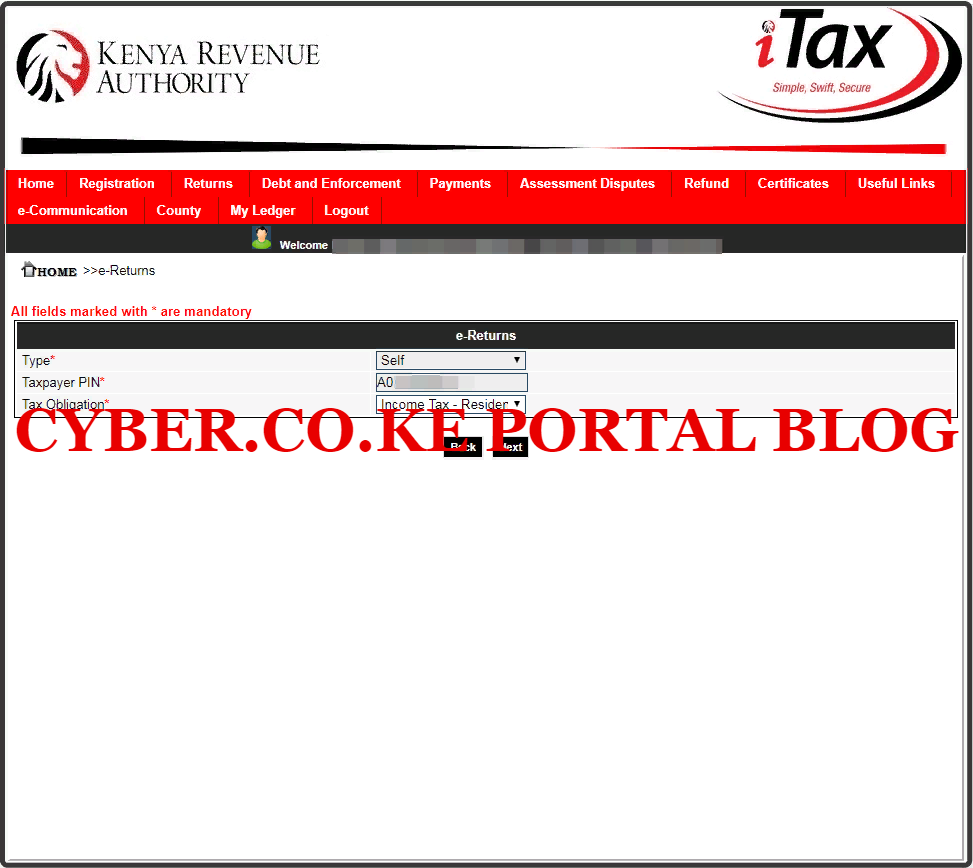

Step 5: Click On Returns Then File Return From The Drop Down Menu List

In this step, you will need to click on the Returns menu item and from the drop down list, click on File Returns. This is because we need to download the latest version of the KRA Returns Template on KRA Portal. This is as illustrated in the screenshot below.

Step 6: Select Tax Obligation As Income Tax Resident Individual

In this step, you will need to select the tax obligation as Income Tax Resident Individual. The Type and Taxpayer PIN are automatically pre-filled. Once you have selected the Tax Obligation, click on the “Next”button.

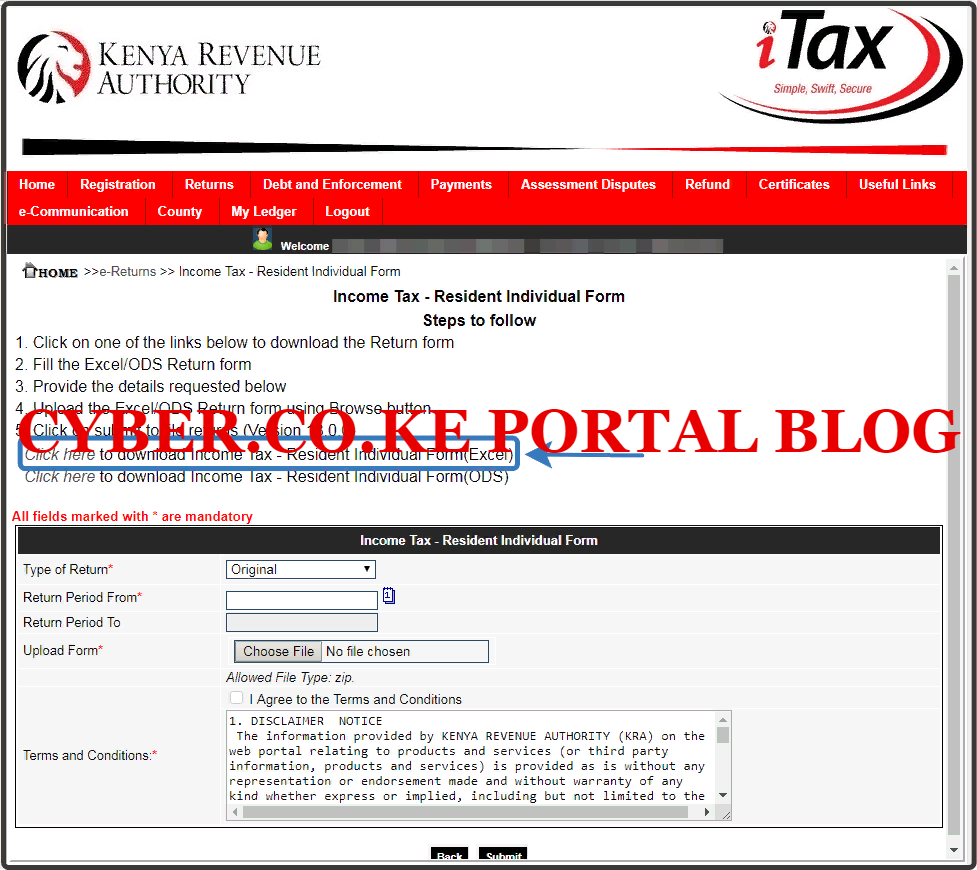

Step 7: Download Latest KRA Returns Template (KRA Template)

In this last step, you will need to download the latest KRA Returns Template that is referred to as the Income Tax Resident Individual Form the KRA Portal Account. As I mentioned in the beginning of this article, this is a zipped file and you need to ensure that your laptop or computer has MS Office suite that has the MS Excel installed.

Once you click on the Download Latest KRA Template, a zipped file will be downloaded to your Computer or Laptop. You will need to unzip the file so as to open the KRA Returns Template that is an Excel Workbook. Just as I mentioned above, you need to ensure that you have the latest version of Office installed on your device.

Just as the error that you were getting stated, “The template you uploaded is of incompatible type. Please download latest template from KRA Portal and use the same.” By following the above steps in downloading latest template from KRA Portal, you will have sorted the incompatibility issues that arises when you try to upload the Returns Template on the KRA iTax Portal.

READ ALSO: How To Pay Turnover Tax Using KRA Paybill Number 572572

If you continue to face the above incompatibility challenges when trying to upload the Returns Template, you can submit your KRA Employment Returns Filing order here at Cyber.co.ke Portal and have have our support team file your KRA Returns within 5 minutes.