If you are a student in Kenya and have a KRA PIN Number, you are required to file your KRA Returns before the 30th of June deadline that is set out by Kenya Revenue Authority (KRA). So, whether you are in TVET Institution, College or University in Kenya, filing of KRA Returns is a must. In this case, all students file what is known as the KRA Returns for Students using iTax (KRA Portal).

Since majority of students are normally still in the learning process and most don’t have any source of income i.e. no rental income, no employment income and no business income, students are required to file KRA Returns i.e. KRA Nil Returns. This is the type of return that is filed by students who have an active KRA PIN Number but don’t have any source of income in Kenya.

To be able to file KRA Returns for Students, there are two key important requirements that you need to ensure that you have with you. This includes your KRA PIN Number and iTax Password (KRA Password). You are going to need these two so as to be able to login into your iTax account (KRA Portal account) so as to be able to successfully file KRA Returns for Students online with ease and convenience.

READ ALSO: How To Generate KRA Payment Registration Number (PRN) On iTax

Filing KRA Returns for Students involves the following; Visit iTax (KRA Portal), Login into iTax (KRA Portal), Click on Returns then File Nil Return, Select KRA Tax Obligation, Fill In The Income Tax – Resident Individual Nil e-Return Form and finally Download e-Return Acknowledgment Receipt. Below is an in depth step-by-step process that you need to follow.

How To File KRA Returns for Students

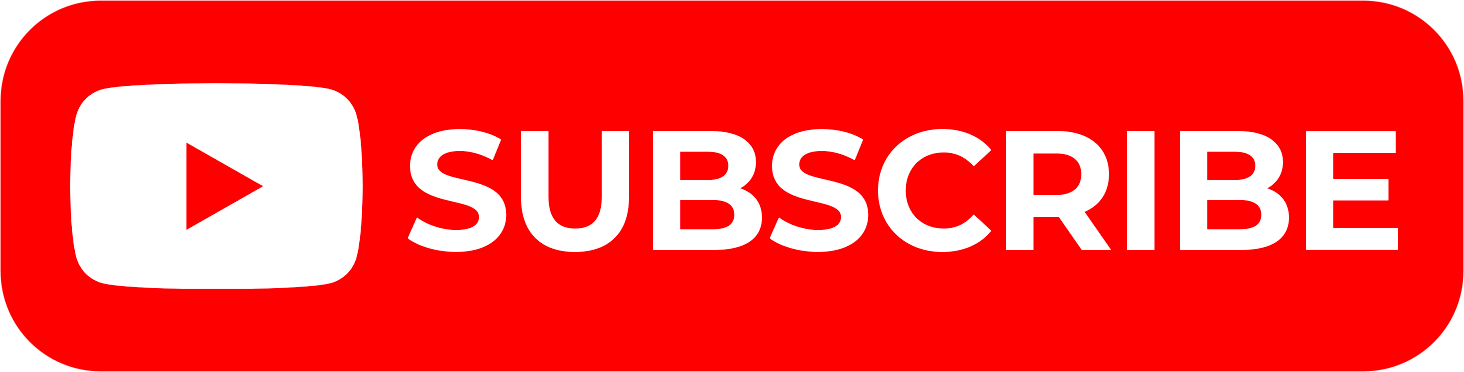

Step 1: Visit iTax (KRA Portal)

To be able to file KRA Returns for Students, you first need to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

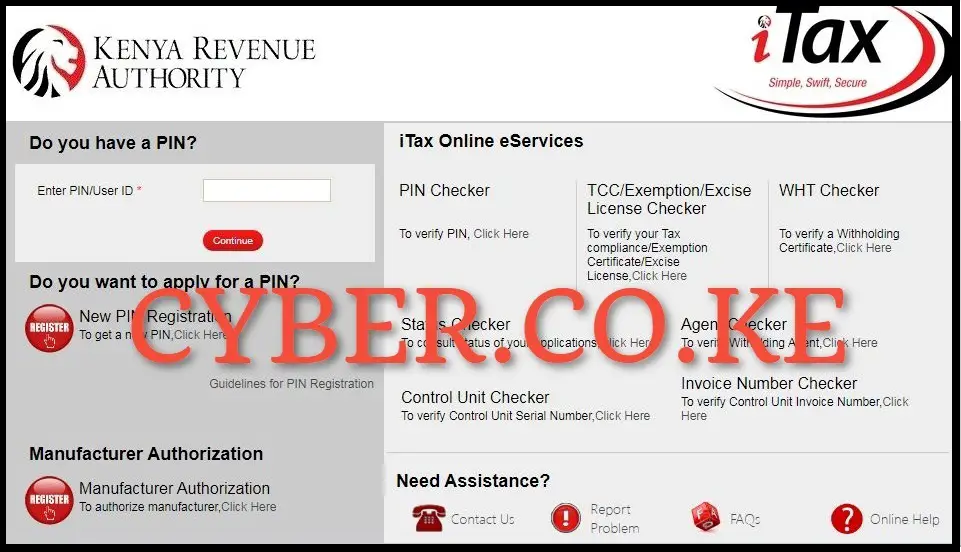

Step 2: Login Into iTax (KRA Portal)

In this step, you need to enter your KRA PIN Number, iTax Password (KRA Password), solve the arithmetic question (security stamp) and click on the “Login” button to access your iTax account (KRA Portal account).

Step 3: Click on Returns then File Nil Return

Upon successful login into iTax account (KRA Portal account), click on “Returns” followed by “File Nil Return” to initiate the process of filing KRA Returns for Students.

Step 4: Select KRA Tax Obligation

Next, select the KRA Tax Obligation that you are filing the KRA Returns for on iTax (KRA Portal). Since we are filing KRA Returns for Students, the KRA Tax Obligation that we need to select is the “Income Tax – Resident Individual.” Once you have selected the correct KRA Tax Obligation, proceed to the next step by clicking the “Next” button.

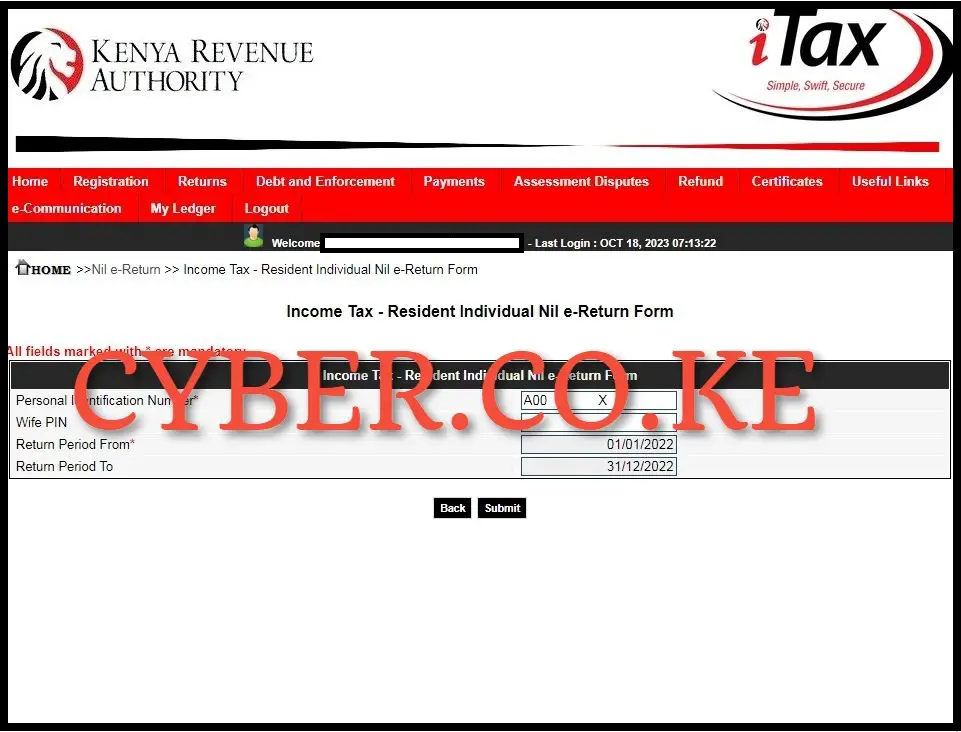

Step 5: Fill In The Income Tax – Resident Individual Nil e-Return Form

In this step, you need to fill in the Income Tax Resident Individual Nil e-Return form. You have to enter the Return Period From which in our case is 01/01/2023 and this will auto-fill the Return Period To as 31/12/2023, then proceed to click on the “Submit” button.

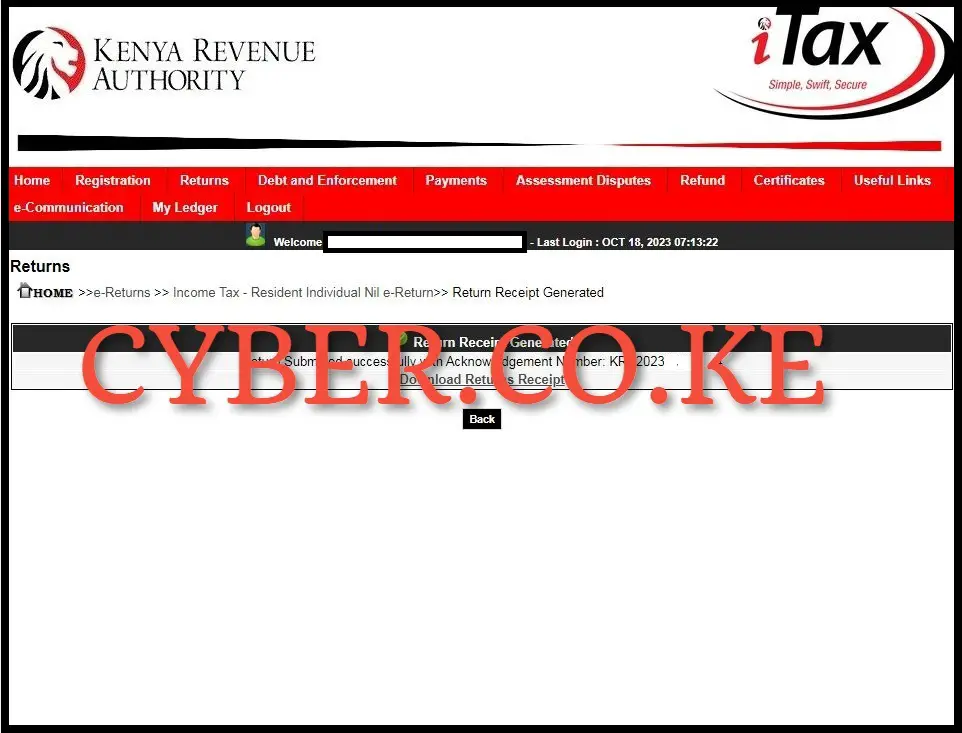

Step 6: Download e-Return Acknowledgment Receipt

The last step after successfully filing KRA Returns for Students is to download the e-Return Acknowledgement Receipt. To download the KRA e-Return Acknowledgment Receipt for Students, just click on the text link that reads “Download KRA Returns Receipt” to download and save the e-Return Acknowledgement Receipt on your device.

READ ALSO: How To Check Your KRA PIN Using KRA PIN Checker

For you to successfully file KRA Returns for Students using iTax (KRA Portal), you need to ensure that you are first able to login into your account using both your KRA PIN Number and iTax Password (KRA Password). Also, ensure that you don’t have any source of income (i.e. you are a student and want to file Returns for Students on iTax). Once you are logged in, you can follow the above outlined 6 main steps so as to be able to file KRA Returns for Students.