Get to know Withholding Tax in Kenya online today. Learn and understand what Withholding Tax in Kenya entails and the quick steps in filing the tax.

Learn more about Withholding Tax in Kenya today. Get to know all information pertaining to KRA Withholding Tax in Kenya and whom the tax applies to. The Withholding Tax is tax that is withheld from the payments that are made to an individual in Kenya.

Today, I am going to share with you more information about Withholding Tax. Before we begin, we need to look at the basics of this tax from its definition upto how to declare it in your annual return.

READ ALSO: How To Download Income Tax Resident Individual Form On iTax

The penalty for late submission of Withholding Tax is the lesser of 10% of the tax due or Kshs. 1 Million. Qualifying interests and qualifying dividends are examples of final Withholding Tax.

Withholding Tax is not charged on employment income therefore if you have a withholding certificate you need to declare that you have another source of income on the IT1 excel return form.

The process of filing Withholding Tax Return is the same as filing the employment returns using the P9 Form. So, I am just going to brush through the steps for declaring the Withheld Tax on the Excel sheet. You can check our article on How To File KRA Returns Using P9 Form. In this article, we shall highlight the key concepts and terms pertaining to KRA Withholding Tax.

What Is Withholding Tax?

Withholding Tax in Kenya is tax that is deductible from certain classes of income at the point of making a payment to a non-employee. It can be pre-payment or a final tax. The person making the payment is responsible for deducting and remitting the tax to Kenya Revenue Authority (KRA).

Withholding Tax is deducted at source from several income like: interest from banks at 15%, dividends at 5%, and royalties at 5%, insurance commission at 5% and consultancy fee 5% for residents.

Withholding Tax Transactions in Kenya

Withholding Tax transactions in Kenya includes the following;

-

Management or Professional Fee

This is payment made to a person other than an employee by his/her employer; as a consideration for managerial, technical, agency, contractual, professional or consultancy services.

-

Training Fee

This is a payment made in respect of business or user training service designed to improve efficiency and includes payment for incidental costs associated with provision of such services.

-

Consultancy Fee

The rate of the fee is 5% for residents and 15% for non-residents. This is a payment to any person acting in an advisory capacity or providing services on a consultancy basis.

-

Agency Fee

This is payment made to a person for acting on behalf of any other person/group, or on behalf of the government and excludes any payments made by an agent on behalf of a principal when such payments are recoverable.

Withholding Tax is not deductible where the withholdee is exempt under any law in Kenya e.g. official aid funded projects, exempt bodies etc.

Double Taxation Agreements

Double Taxation (DTA) agreements are agreements negotiated between countries or jurisdictions to provide for reciprocal rights of a territory with respect to taxation. When you pay income tax twice on the same source of earned income, asset or financial transaction, then this taxation principle is known as Double Taxation. Unless a DTA expressly states otherwise, tax will be paid in Kenya in the first place and claimed by the other party (where applicable) in the home country.

How to Declare Withholding Tax Certificate

Step 1: Download the IT1 Form (Income Tax Individual Return)

To declare your Withholding Tax certificate; Download the IT1 (Income Tax Individual return), follow the steps provided in the “Read Me” sheet to enable macros.

Download Income Tax Resident Individual Form (Excel)

Step 2: Return Information (Section A)

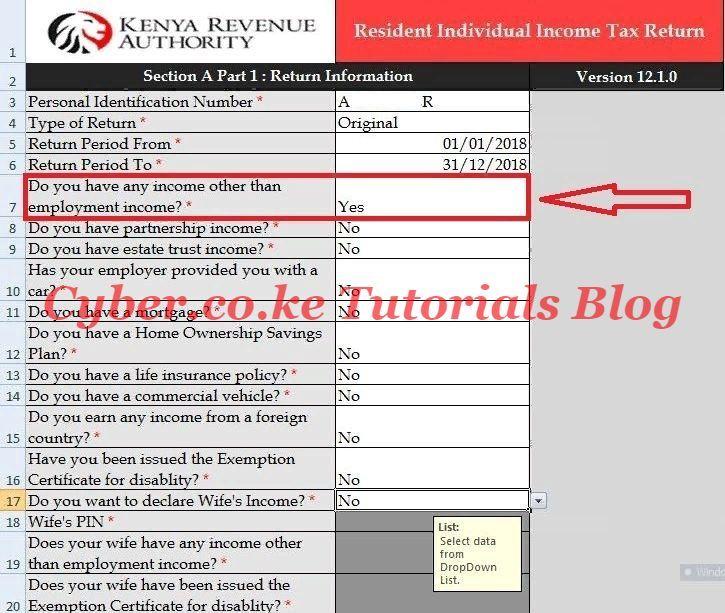

Click on sheet A; Basic info, Enter your KRA PIN Number, choose ‘original’ as the type of return if you are not making an amendment to an already filed return. If you’re filing last year’s return, enter 01/01/2018 as the ‘Return Period From’ and 31/12/2018 as the ‘Return Period To’.

On Row 7, Select ‘Yes’ where you are asked if you have any other source of income other than employment. Since you have income apart from employment, the law requires you to maintain proper books of accounts.

Step 3: Tax Computation (Section T)

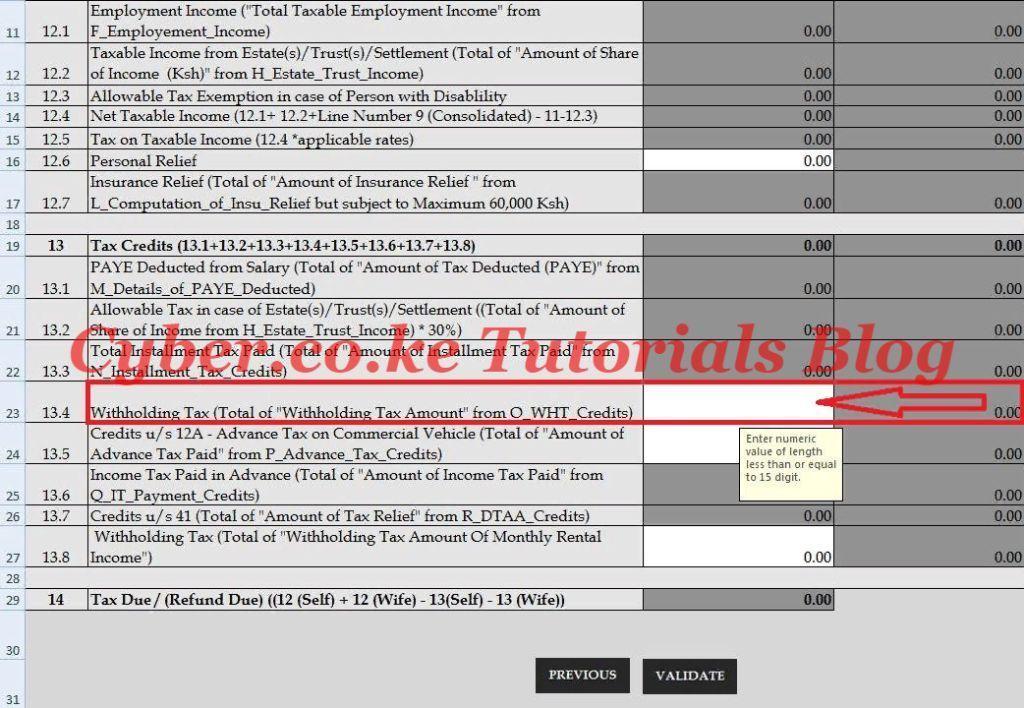

Declare the withheld amount in lump-sum in the Tax computation sheet (Sheet T, Row 23) and the gross amount in Sheet B, along with any expenses.

Fill the balance sheet and declare the amount withheld in the tax computation sheet,click on ‘validate’.

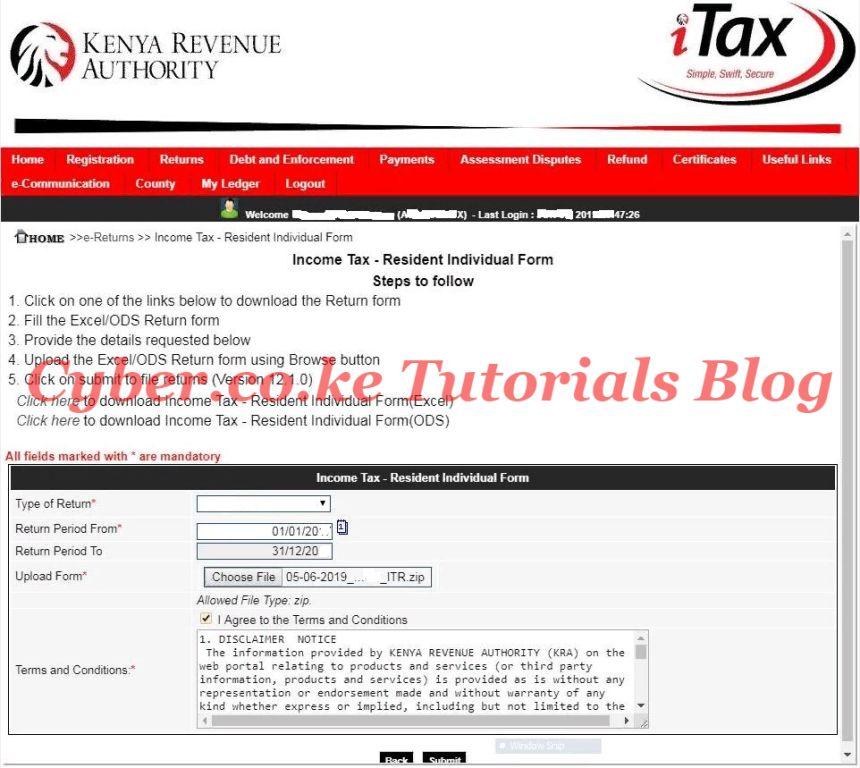

Step 4: Upload Zipped File on iTax Portal

READ ALSO: How To Confirm KRA PIN Using KRA PIN Checker on iTax

The last step involves uploading the zipped file on your iTax account once you have successfully validated it. Log in to iTax, click on Returns > File Return. Upload the zipped file on the upload page of your iTax profile. Lastly, you will need to download the KRA Returns eReturn Acknowledgement receipt. Feel free to read our next article on How To Change iTax Password During iTax First Time Login.