CYBER.CO.KE is an independent Cyber Services website and is not affiliated with any government agency, including Kenya Revenue Authority (KRA). A service fee is charged for the assistance provided to customers in Kenya.

Get to know How To View Filed Returns on iTax today. Learn how you can view your filed KRA Returns online quickly and easily.

In this article, I am going to share to share with you the steps that are involved in viewing of your filed KRA Returns on iTax.

Viewing of filed KRA Returns is important as this will ensure that you have been tax compliant and have filed all your returns on the iTax portal. Sometimes you might need to confirm and be sure that you already filed your returns on iTax.

How To View Filed Returns on iTax

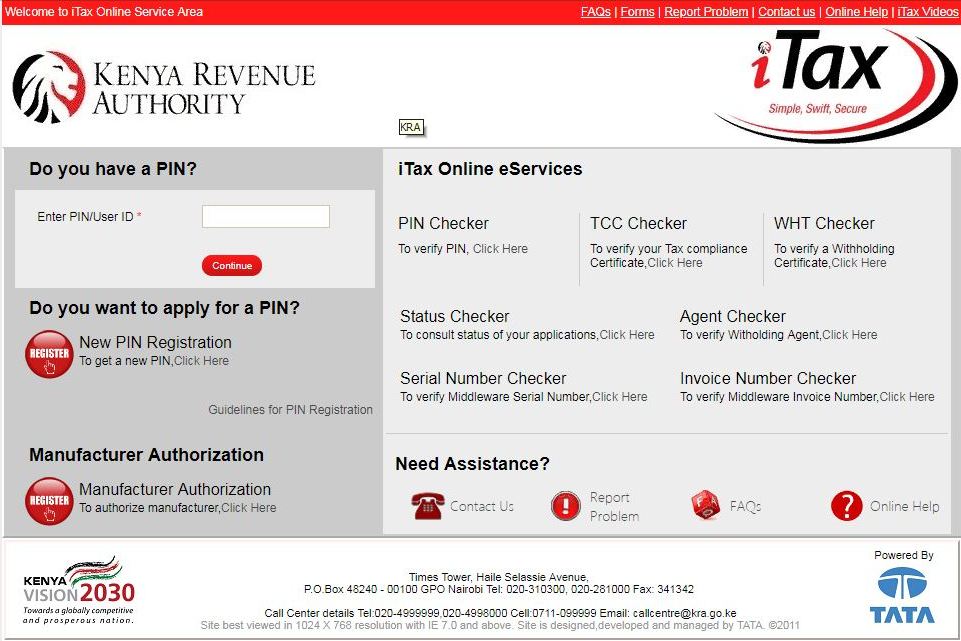

Step 1: Visit iTax Portal

The first step will be accessing the iTax portal using the provided link above.

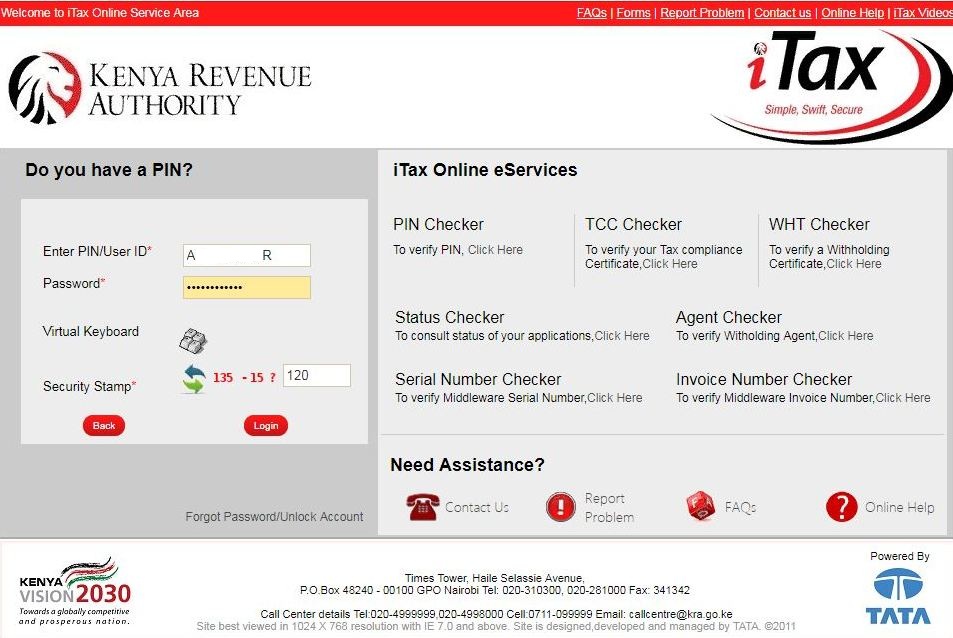

Step 2: Enter your KRA PIN and iTax Password

In this step, you will be required to enter your KRA PIN and iTax password. This is as shown below.

Once you have entered your KRA PIN and iTax password plus answered the arithmetic question, click on the log in button.

Step 3: Click on the Returns tab then View Filed Returns

In this step, you will be required to click on the returns tab then click on View Filed Returns. This is as shown below.

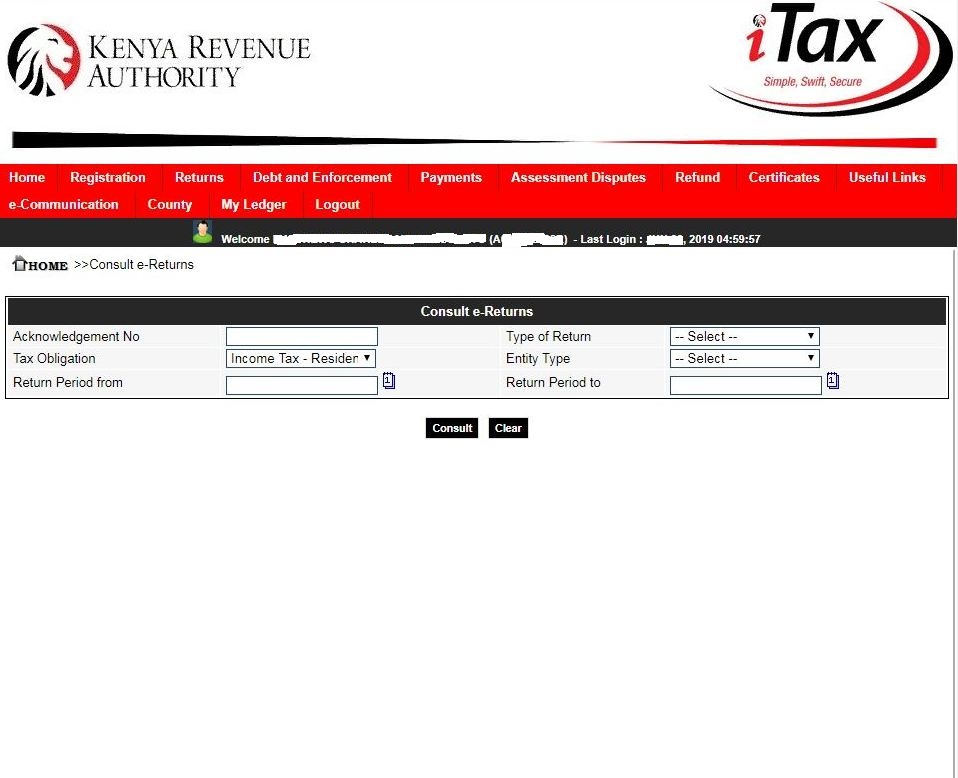

Step 4: Consult e-Returns

This is the stage whereby you consult the e-Returns i.e to view the filed returns on your iTax account. The most important field to select here is the Tax Obligation field since we are viewing filed KRA Returns for an individual (Income Tax Resident Individual). This is as shown below.

Once you have selected the tax obligation, click on the Consult button.

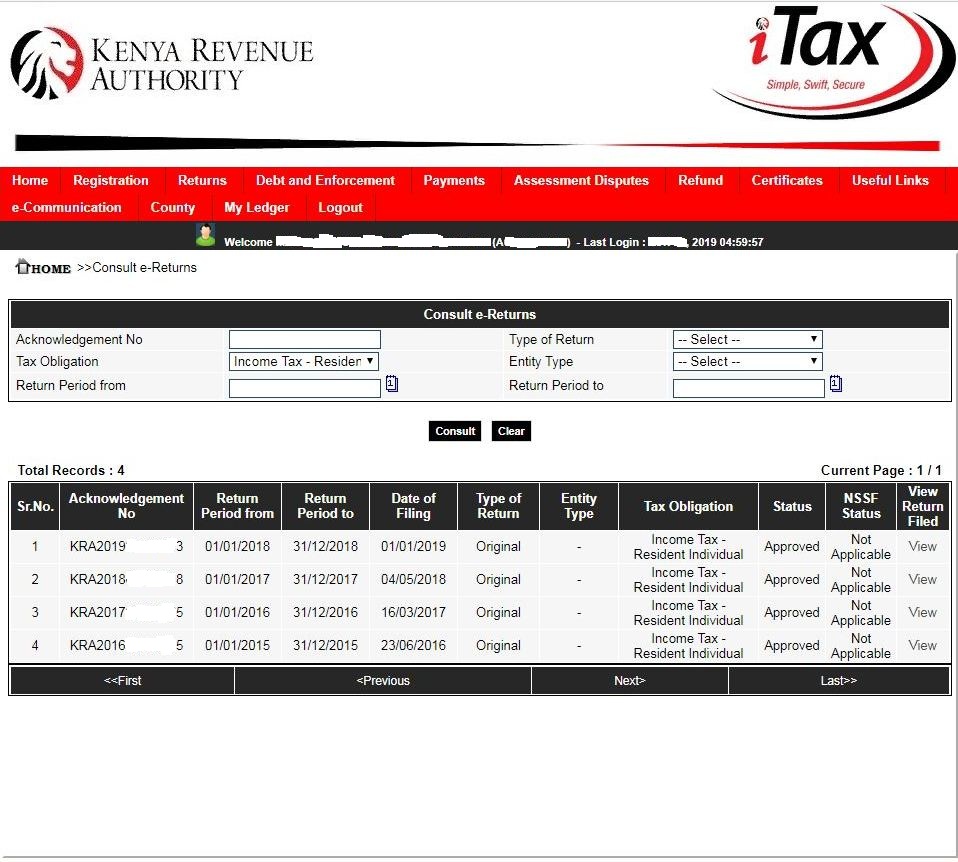

Step 5: View Filed KRA Returns

This is the last step whereby you will be able to see all your filed returns on iTax. In our case, we can see all the filed returns for the years 2015, 2016, 2017 and 2018. This is as shown below.

And that is how you can view your filed KRA returns on iTax in 5 simple and easy steps. Feel free to share this guide online today.

Matthews Ohotto is a Writer at CYBER.CO.KE where he specializes in writing helpful and informative Step-by-Step Tutorials that empower Kenyans with practical skills and knowledge. He holds a Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT). Get KRA Individual Services and KRA Returns Services in Kenya.

ADVERTISEMENT

Check Out Our Popular Blog Posts

Check Out Our KRA Individual Services

Register KRA PIN Number

Submit Service Request →Retrieve KRA PIN Certificate

Submit Service Request →Update KRA PIN Number

Submit Service Request →Change KRA PIN Email Address

Submit Service Request →Check Out Our KRA Returns Services

File KRA Nil Returns

Submit Service Request →File KRA Employment Returns

Submit Service Request →File KRA Amended Returns

Submit Service Request →File KRA Withholding Tax Returns

Submit Service Request →Check Out Our KRA Tax Calculators

Calculate Turnover Tax (TOT)

TOT Calculator →Calculate Monthly Rental Income (MRI)

MRI Calculator →Calculate Value Added Tax (VAT)

VAT Calculator →Calculate Pay As You Earn (PAYE)

PAYE Calculator →CYBER.CO.KE

Get KRA Services Online Today

CYBER.CO.KE is a trusted online cyber services website dedicated to providing KRA Individual Services and KRA Returns Services to customers in Kenya on a day to day basis.

The KRA Individual Services that we offer to customers includes: Registration of KRA PIN Number, Retrieval of KRA PIN Certificate, Updating of KRA PIN Number and Changing of KRA PIN Email Address.

The KRA Returns Services that we offer to customers includes: Filing of KRA Nil Returns, Filing of KRA Employment Returns, Filing of KRA Amended Returns and Filing of KRA Withholding Tax Returns.

If you are looking for dependable, fast and reliable KRA Services in Kenya, we are ready and available to support you at every step of the way.

We prioritize customer convenience, clear communication and prompt service delivery, making sure that your submitted service request is completed in the shortest time possible.

ADVERTISEMENT