KRA Nil Returns is a type of Tax Return that is normally filed by individuals/taxpayers who don’t have any active source of income in Kenya. By source of income, we basically mean that they have no Business, Rental or Employment income. Thus the law requires that this type of taxpayers group file what is commonly known as KRA Nil Returns or simply Nil Returns using iTax (KRA Portal).

Failure to file KRA Nil Returns leads to an automatic penalty of Kshs. 2,000 per year not filed. This means that if you fail to file your KRA Nil Returns by 30th of June of each year, a penalty will be imposed which you then have to pay, something that you can easily avoid by just filing your KRA Nil Returns early.

If you are a student (still learning) in TVET institution, College or University or even unemployed individual in Kenya with an active KRA PIN Number, but no source active of income, you are required to file your KRA Nil Returns or Nil Returns on iTax (KRA Portal) on or before the elapse of the 30th of June deadline that is set by Kenya Revenue Authority (KRA).

READ ALSO: Step-by-Step Process of Resetting iTax Password

It is a good practice and something that KRA always reminds taxpayer to file their KRA Return including KRA Nil Returns (Nil Returns) as early as possible without having to wait for the last day in June so as to be able to file KRA Nil Returns. The earlier you file your KRA Nil Returns the better.

How To File KRA Nil Returns

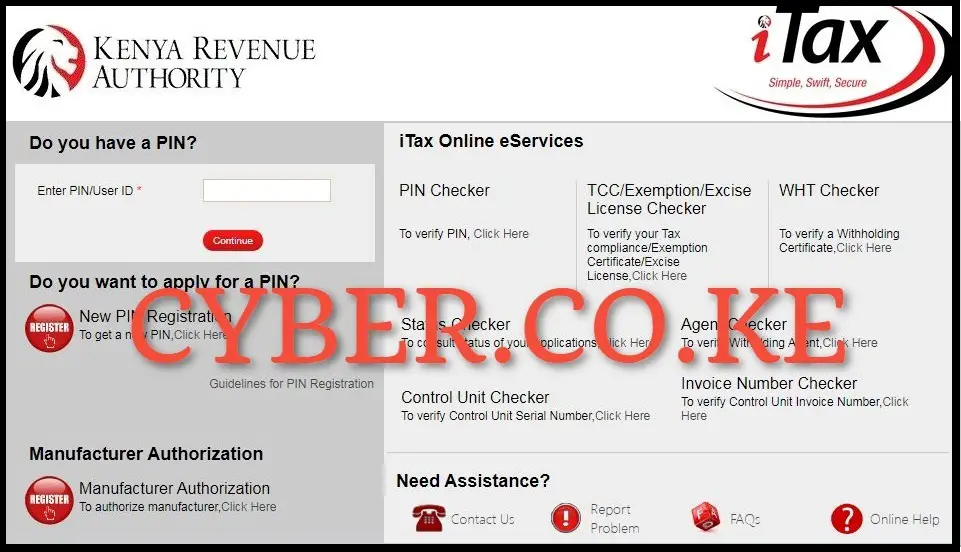

Step 1: Visit iTax (KRA Portal)

The first and foremost step in the process of How To File KRA Nil Returns is to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

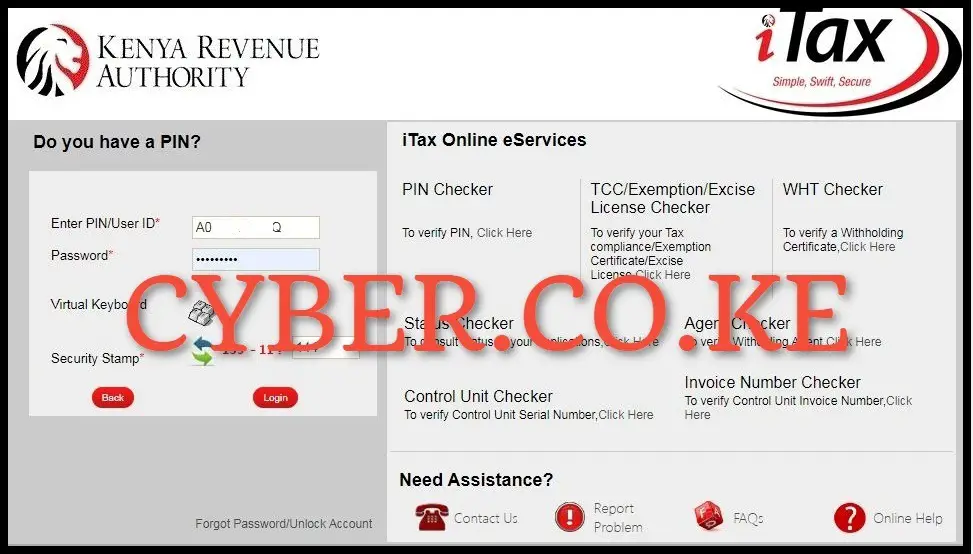

Step 2: Login Into iTax (KRA Portal)

Next, you need to use both your KRA PIN Number and iTax Password (KRA Password), solve the arithmetic question (security stamp) then click on the “Login” button to login into your iTax account (KRA Portal account).

Step 3: Click on Returns then File Nil Return

Once you have successfully logged into your iTax account (KRA Portal account), on the top menu, click on the “Returns” module and then click on “File KRA Nil Return” from the drop down list to start the process of filing your KRA Nil Returns on iTax (KRA Portal).

Step 4: Select KRA Tax Obligation

Next, you need to select the type of KRA Tax Obligation that you want to file the KRA Nil Returns for on iTax (KRA Portal). You need to select the “Income Tax – Resident Individual.” Once you have selected the KRA Tax Obligation, proceed to the next step by clicking on the “Next” button.

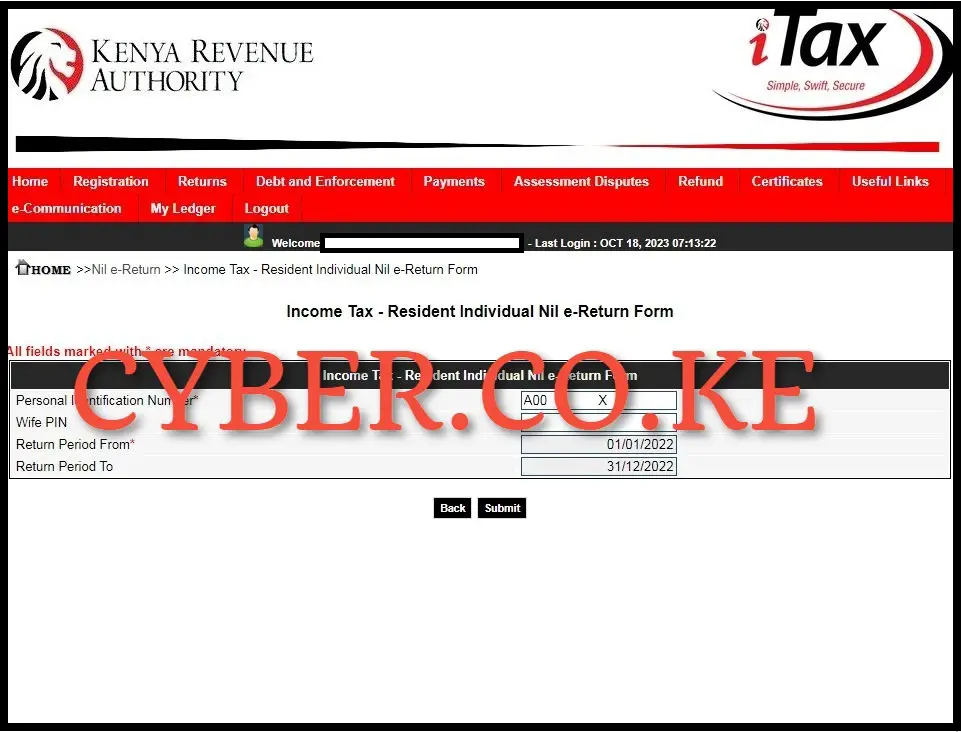

Step 5: Fill In The Income Tax – Resident Individual Nil e-Return Form

In this step, you need to fill the Income Tax Resident Individual Nil e-Return Form i.e. this is the form that those filing KRA Nil Returns or Nil Returns need to fill in. To do that, enter the Return Period From which in our case is 01/01/2023 and this will auto-fill the Return Period To as 31/12/2023, then proceed to click on the “Submit” button.

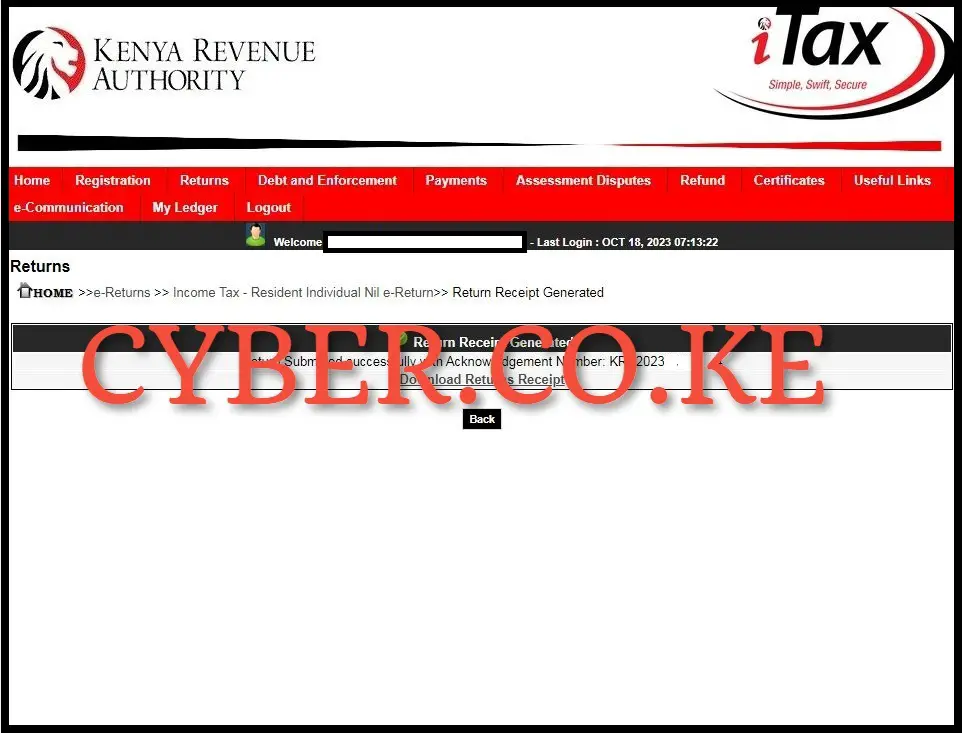

Step 6: Download KRA e-Return Acknowledgement Receipt

The last step in the process of How To File KRA Nil Returns online is to download the KRA e-Return Acknowledgement Receipt also known as the KRA Returns Receipt. This KRA Nil Returns Receipt serves as a final confirmation that your KRA Nil Returns have been successfully filed and received by Kenya Revenue Authority (KRA). To download the KRA Returns Acknowledgment Receipt, just click on the text link that reads “Download KRA Returns Receipt” to download and save the e-Return Acknowledgement Receipt on your device.

READ ALSO: Step-by-Step Process of Resetting KRA Password

The above 6 steps sums up the whole process of filing KRA Nil Returns online using iTax (KRA Portal). As a reminder, filing of KRA Nil Returns is for those who don’t have any source of income in Kenya i.e. students and unemployed. You also need to ensure that you have with you both your KRA PIN Number and KRA Password (iTax Password) which are the main requirements needed in the process of How To File Nil Returns. Once you these two with you, follow the above steps to successfully file KRA Nil Returns before the set deadline of 30th June this year.