Get to know How To Apply For Removal of KRA Tax Obligation using the KRA Tax Obligation Removal form for KRA PINs not on iTax.

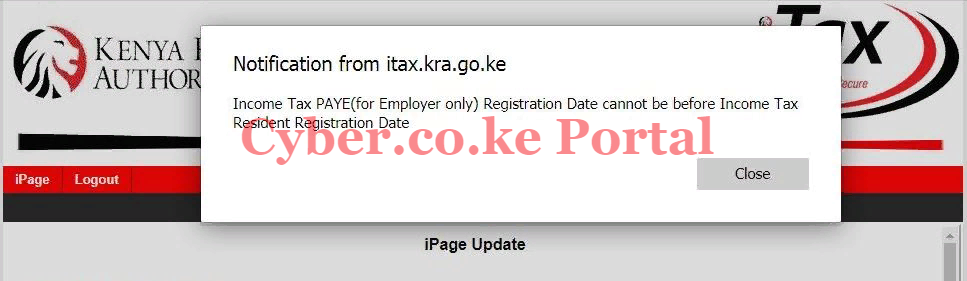

Are you registered for the wrong KRA Tax Obligation i.e. VAT obligation yet you don’t have a business or PAYE obligation yet you dont own a company with employees? This is the ultimate guide that will show you the step by step procedure that you should take and have those obligation(s) removed.

You need to take note that this in this process, I will be focussing on the KRA PINs that have note yet been Updated to iTax and have a VAT or PAYE obligation that is preventing the KRA PIN Update.

READ ALSO: How To Login Into iTax Portal

You will need to note that previously I had shared with you “Two Common PIN Not on iTax Issues and How to Solve Them.” You can refer to that blog post because it is the one that has laid the foundation to the process of Removal of KRA Tax Obligation that I will be sharing with you today.

Issues That Require Removal of KRA Tax Obligation

NOTE: You need to note that you need to request for the removal of VAT/PAYE obligation by writing a letter and filling the tax obligation removal form then submitting them to the station manager of your tax station requesting for waiver of penalties and interests accrued from those obligation(s).

Requirements Needed for Removal of KRA Tax Obligation

- The affected KRA PIN Number

- The KRA Tax Obligation Removal Form

- KRA Tax Obligation Removal Letter

Download: KRA Tax Obligation Removal Letter Sample

Now that we have those three items with us that is the KRA PIN Number, KRA Tax Obligation Removal Form and KRA Tax Obligation Removal Letter, we can begin the process of How To Apply For Removal of KRA Tax Obligation.

How To Apply For Removal of KRA Tax Obligation

Step 1: Download and Print the Tax Obligation Removal Form

The first step involves you downloading the KRA Tax Obligation Removal Form using this link. Remember this is a PDF document and you will need Adobe Reader to open and view it. You will definitely need a printer to print this form.

Step 2: Fill the Tax Obligation Removal Form

This will be the most tedious and long step. You will be required to fill the downloaded Tax Obligation Removal form. Note that this form has only 3 pages. You are required to fill only page 1 and 2. Page 3 is reserved for official use only.

I am going to share with you how to fill Part A of the form. Part B is for official use. That will be filled by KRA once you submit the form to KRA Station or KRA Offices.

PART A:

This part is for completion by the registered taxpayer applying for removal of Tax obligation (s). You need to take note that incomplete applications shall not be processed by KRA. Part A is made up of the following sections that you need to fill:

- Name of Taxpayer – Write your full names as appears on the national identity card.

- Personal Identification Number – Write your correct personal identification number (KRA PIN). If you have forgotten your PIN, you can retrieve it at KRA PIN Retrieval section here at Cyber.co.ke Portal.

- Postal Address – Write your postal address i.e 12345.

- Postal Code – Write your postal code i.e 00100.

- Telephone Contacts: (i) Cell phone number (mobile number), (ii) Landline number. Obviously you have a cell phone number so write it down and under landline you can just write N/A (Not Available).

- Physical Address: In this part you will be required tow write the following (if you have that is) – name of building, floor, office number, street/road, email address, nature of business (type of goods or services). In this example you are just a student and don’t have any or those. So, majority of those fields with be N/A.

- Tax obligations for which the taxpayer is currently registered: State the two obligations that you are currently registered for: (i) Income Tax Resident (default obligation) and either one of the following that was added erroneously (ii) Value Added Tax – VAT (ii) Pay As You Earn (PAYE).

- Tax obligation(s) to be removed: – either one of the following (i) Value Added Tax (VAT) (ii) Pay As You Eran (PAYE).

- Reasons for request for removal of Tax obligation(s): You will need to provide sufficient reasons for removal of either one of those tax obligations to be removed. Be precise and upto the point.

- Documentary evidence attached in support of the reasons above (where applicable): You need to provide substantial evidence to show that any of those two obligations were added erroneously to your KRA PIN. Example of evidence could be College/University letters and transcripts to showcase that at the time of PIN Registration you were still learning and you were not in business (VAT) nor employing people (PAYE).

- Attach copies of PIN, Certificate of Incorporation, Business Registration and the documentary evidence where applicable: (for those who were in college your transcripts and letters will come in handy as supportive evidence for removal of those tax obligations)

- Name of Applicant: Write your official names.

- Position./Designation: This can either be a student or taxpayer.

- Signature: Append your signature on the Tax Obligation Removal Form.

- Date: Write the date of filling the Tax Obligation Removal Form.

By filling all those details as highlighted above in Part A of the form, you not not just stop there. Remember that you also need to write a Letter on the same to accompany this Obligation Removal form.

The reasons why you also write a letter and submit it together with the form by the attached evidence, is that it helps in giving your application more weight and reasons for approval of removal of those obligations easily. That now leads us into step 3.

Step 3: Write Removal of Tax Obligation Application Letter

As mentioned above, dont just fill the tax obligation removal form and submit it to your KRA Station plainly, you need to draft a letter addressed to KRA Station Manager to accompany that form together with the evidence required. The most difficult part is how do you write this letter. Luckily, I will give a quick tip on how to go about that.

NOTE: To know your KRA Tax Station, dial *572#, Inquiry >>> Domestic Tax Service >>> Tax Station Inquiry to know your Tax Station.

If you can recall, there is a blog post that I wrote a while back on How To Write KRA Waiver Letter. This will guide you on how official letters to KRA are written. Note that there is no said specific format of writing this letter.

So, the letter will be made up of five key sections that includes the following:

- Taxpayer/Applicant Details: names, postal address, mobile number and date.

- KRA Station / Office contacts: manager, tax station and domestic tax department (DTD).

- Request: Removal of either the VAT or PAYE obligation on the KRA PIN.

- Context of the letter: Explain in details why you are applying for removal of the said tax obligation (s). Since the Tax obligation form had limited space, the letter gives you the opportunity to expound on your issues and request in detail.

- Closing: This has your name, signature and KRA PIN number.

The KRA Tax Obligation Removal letter should look something like this as show below:

Your Names,

Postal Address,

Mobile Number,

Date.

The Station Manager,

Kenya Revenue Authority,

“Your Tax Station”

Domestic Tax Department (DTD)

RE: APPLICATION FOR REMOVAL OF TAX OBLIGATION ON KRA PIN NUMBER A001234567B.

I am hereby writing this letter to request for the removal of the VAT/PAYE tax obligation that was added to my KRA PIN. The above obligation(s) was added to my PIN when I first requested the PIN via the old Mapato System.

At the time I got the KRA PIN number I was neither in business nor an employer. At that time, I was still pursuing my tertiary education in College/University. I have also attached my academic transcripts and letters to confirm the same.

“” {Give more reasons why you require the removal of either VAT or PAYE obligation. Explain your reasons well so as to get the obligation removal request approved.} “”

I am hereby writing this letter requesting your humble office for removal of the said obligation(s) so as to enable the PIN be migrated to iTax Portal. I look forward to your response to this urgent matter . Thanking you in advance.

Yours faithfully,

“Your Name”

“Signature”

“Your KRA PIN Number”

Now that you have drafted that letter, you can attach it together with the Tax Obligation removal form. You can download the Word Version of the above Obligation Removal letter using the provided link below.

Download: KRA Tax Obligation Removal Letter Sample

Step 4: Submit the Tax Obligation Removal Form, Letter and Attached Documents to your KRA Station

The last step you will need to do is submit all those documents to KRA Stations or KRA Offices for processing of the Tax Obligation Removal request. You will wait for approval of the Application for Removal of Obligation(s). Once that application for removal of the wrongly registered tax obligation is approved, you can then submit your KRA PIN Update order at Cyber.co.ke Portal.

READ ALSO: Two Common PIN Not on iTax Issues and How to Solve Them

You need to follow up with an officer at your KRA Station to ensure the obligation(s) is removed. Once the request is approved, then the KRA PIN can be updated on iTax and enable you file KRA Returns easily. So now you know what to do so as to solve the challenge of VAT or PAYE obligation on KRA PIN. That is How To Apply For Removal of KRA Tax Obligation online today.