Get to know How To Login Into iTax Portal online today at Cyber.co.ke Portal. Learn the steps involved in logging into KRA iTax Portal.

Have you just gotten your new KRA PIN from Cyber.co.ke Portal Kenya? Now, it’s time to log into your KRA iTax Account which were sent to your email address by Kenya Revenue Authority (KRA). Learning the steps involved in accessing your KRA iTax Account is very important.

In this article, I am going to share with you the steps that are involved in logging into your iTax Portal account. The KRA iTax Portal allows you to do a variety of tax related matters in Kenya on a day to day basis.

READ ALSO: How To Verify KRA Tax Compliance Certificate Using iTax TCC Checker

Logging into KRA Portal or iTax is a process that requires you to have both your KRA PIN Number Number and iTax Password. To be able to access and view all the resources on iTax, you need to be logged into your iTax Account.

The problem is that not that many Kenyans know the process that they need to follow. The good thing is that incase you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that.

Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you. Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password.

Key Uses Of KRA iTax Portal

Before we proceed, we need to take a look at the various uses of the iTax Portal. Some of the major uses of the iTax Portal includes:

- Filing of Nil Returns

- Filing of Employment Returns

- Filing of VAT Returns

- Submission of Monthly PAYE Deductions

- Application of KRA Tax Compliance Certificate

- KRA Advance Tax Payment

- KRA Payment Slip Generation

We need to take a look at each of the major uses of the KRA iTax portal in brief so as to understand the uses of the iTax Portal. You need to take note the above are just the most commons uses of iTax.

-

Filing of Nil Returns

Majority of Kenyans use the iTax Portal to file nil returns. Nil returns means that the taxpayer has no source of income so he/she has to file KRA Nil returns each year on or before 30th June. You can check our article of How To File KRA Nil Returns using iTax Portal.

-

Filing of Employment Returns

The KRA iTax Portal also allows those in employment to file their yearly employment returns on or before 30th June of each year. Those in employment use their KRA P9 Forms during the process of returns filing. You can check our article on How To File KRA Returns using P9 Form.

-

Filing of VAT Returns

KRA iTax Portal allows business owners to file their VAT Returns each month on or before 20th day of that month. Failure to not file the returns attracts a penalty of Kshs. 10,000 per month.

-

Submission of monthly PAYE deductions

Employers in Kenya use KRA iTax Portal to remit the Pay As You Earn (PAYE) of their employees each month to Kenya Revenue Authority (KRA) on or before the 9th day of the month.

-

Application of KRA Tax Compliance Certificate

If you are in need of a KRA Tax Compliance Certificate, you can apply for one using the iTax Portal. You can check our article on How To Apply for KRA Tax Compliance Certificate. The Tax Compliance Certificate is issued to taxpayers who have duly declared and submitted their returns to KRA.

-

KRA Advance Tax Payment

Before you take your vehicle either a passenger carrying vehicle of luggage carrying vehicle for the yearly inspection at NTSA Inspection Centre, you need to apply for KRA Advance Tax Payment. You can check our article on How To Apply for KRA Advance Tax Payment.

-

KRA Payment Slip Generation

iTax Portal allows you to generate various payment slips online that you need to use to pay KRA with. You can check our article on How To Generate KRA Payment Slip using iTax.

Now that we have covered some of the uses of the KRA iTax Portal, we can proceed and take a look at the steps that are involved in logging into your iTax Account.

How To Login Into iTax Portal

Before we proceed, there are two items that you need to have so as to enable you log into iTax Portal. These two includes:

- Your KRA PIN Number

- Your iTax Password

If you don’t have your KRA PIN Number, you can place order online for KRA PIN Registration here at Cyber.co.ke Portal. For those who have forgotten their KRA PIN, you can place KRA PIN Retrieval order and we shall send your KRA PIN via email.

If your KRA PIN is not on iTax, you can request for KRA PIN Update and we shall migrate the KRA PIN to iTax Portal. If you have forgotten your KRA PIN Email, you can request for KRA PIN Change of Email here.

You can check our article on How To Reset KRA iTax Password if you need to get a new iTax password for logging into the KRA iTax Portal. Now that you have all the requirements with you, we can begin the process of How To Login Into iTax Portal.

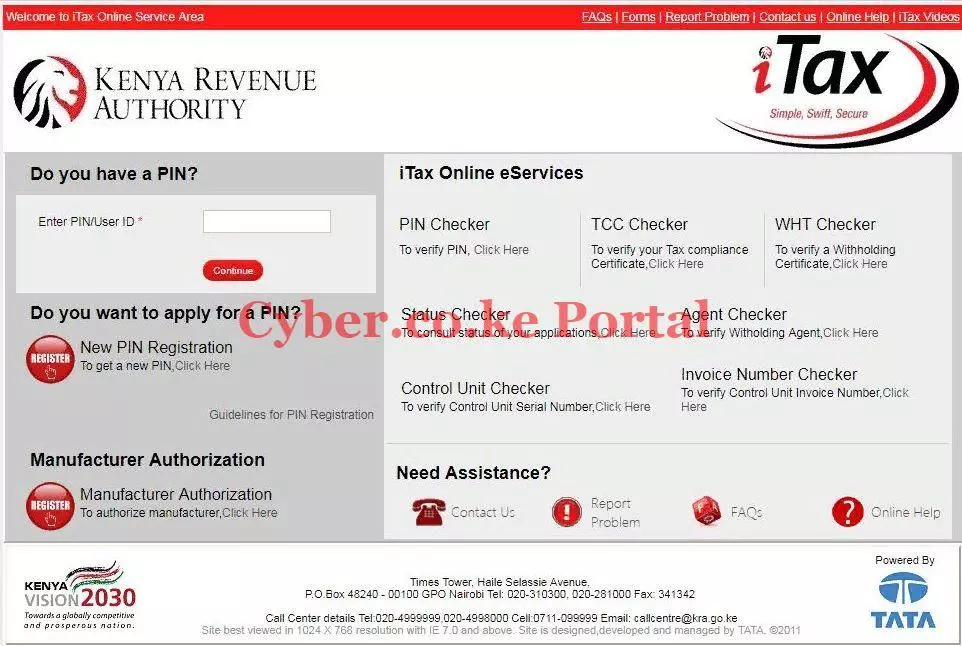

Step 1: Visit KRA Portal

The first thing that you need to do is to access the KRA iTax Portal using the ling provided in the description above.

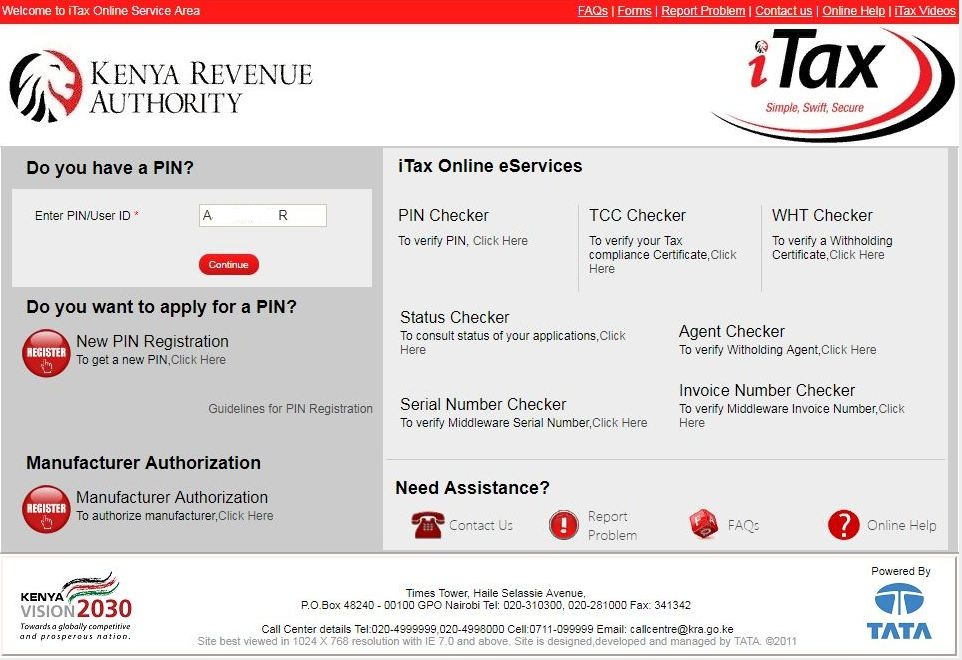

Step 2: Enter your KRA PIN Number

Next, you will need to enter your KRA PIN Number. If you dont remember your KRA PIN, you can request for KRA PIN Retrieval at Cyber.co.ke Portal. Once you have entered your KRA PIN Number, click on the “Continue” button.

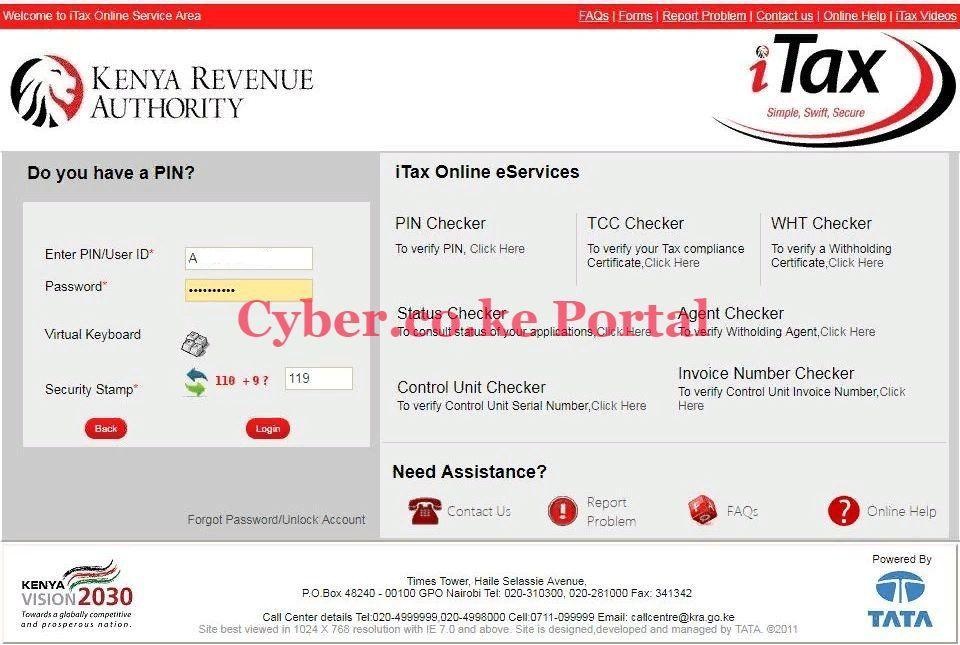

Step 3: Enter your iTax Password and Security Stamp

In this step, you will be required to enter your KRA iTax Password and solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can follow the procedures outlined in How To Reset KRA iTax Password. Your password reset will be sent to your email address and your can use it to change to a new iTax Password.

Once you have entered your iTax Password and solved the arithmetic question (security stamp), click on the “Login” button to log into iTax Portal Account.

Step 4: iTax Portal Dashboard

Once you have successfully logged into iTax, you will be able to see your iTax Dashboard. This is as shown below.

READ ALSO: How To Apply For Removal of KRA Tax Obligation

That being the last step in logging into KRA iTax. So, next time you want to log into iTax, you can follow the above steps. The above 4 steps form the process that you need to follow when you need to log into your KRA iTax Web Portal Account.