Learn How To Apply For Tax Compliance Certificate using the enhanced and simplified process of TCC Application on KRA iTax Portal today.

In the past, getting a Tax Compliance Certificate from the Kenya Revenue Authority (KRA) was a daunting task, you could wait for days or even months for your KRA Tax Complication Certificate (TCC) to be Approved or Rejected.

Well now the long wait for getting Tax Compliance Certificate has come to an end. Starting this year 2020, this process has been simplified. Once you apply for KRA Tax Compliance Certificate, you will be issued with it immediately as long as you do not have any pending returns, liabilities or payments at Kenya Revenue Authority (KRA).

READ ALSO: How To Download KRA Income Tax Returns Form (Excel Sheet)

This is because Kenya Revenue Authority (KRA) has enhanced the Tax Compliance Certificate (TCC) application process on iTax Portal to a full self-serviced process managed by the taxpayer. This move is meant to create efficiency, transparency, and to expedite generation of TCC’s. At the same time, Kenya Revenue Authority (KRA) has urged all taxpayers to take full responsibility for their own tax compliance.

According to Kenya Revenue Authority (KRA), iTax system is now interactive to support the the self-service process, where the taxpayer applies and get a (TCC) without staff intervention. However, you need to take note that where there is any outstanding debt, the taxpayer will need to pay or apply for a payment plan, which upon approval, enables the taxpayer to continue with the self-service process of applying for Tax Compliance Certificate on iTax Portal.

So, in this article I am going to share with you the simplified process of KRA Tax Compliance Certificate application on iTax. This new simplied TCC application process is as from January 2020. Earlier (previous years), the process of applying for a Tax Compliance Certificate was long. You can check out our article on How To Apply For KRA Tax Compliance Certificate Using iTax Portal. Before we proceed any further, we need to understand what we mean by Tax Compliance Certificate.

What Is Tax Compliance Certificate?

Tax Compliance Certificate is a document issued by Kenya Revenue Authority (KRA) to taxpayers who have complied and filed their tax returns for a specific period and paid all taxes due as provided by Law. The KRA Tax Compliance Certificate is valid for a period of 12 months from the date it has been issued to a taxpayer.

Being compliant means that you have no pending liabilities with Kenya Revenue Authority (KRA). In simpler terms, compliant means you don’t owe KRA anything in terms of unpaid taxes. So, when you are compliant, something that Kenya Revenue Authority (KRA) wants all taxpayers to be, then applying for a Tax Compliance Certificate (TCC) will be a walk in the park. You will be able to get the TCC in less than 3 minutes of application.

If you are tax compliant, then KRA will issue you with a Tax Compliance Certificate (TCC) immediately you have finished applying for it on iTax. If you are not compliant, then KRA will give you the details of the pending returns and liabilities i.e. the years that you did not submit your KRA Returns and the years you have not paid for the liabilities accrued. Now, let’s looks at the simplified process of KRA Tax Compliance Certificate application in 2020 and going forward.

Tax Compliance Certificate Application Requirements

Before we start on the simplified process of TCC application, you need to have the following two requirements with you before you can proceed.

-

KRA PIN Number

The first thing that you need to have with you is your KRA PIN Number. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

-

iTax Password

The next item that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

How To Apply For Tax Compliance Certificate

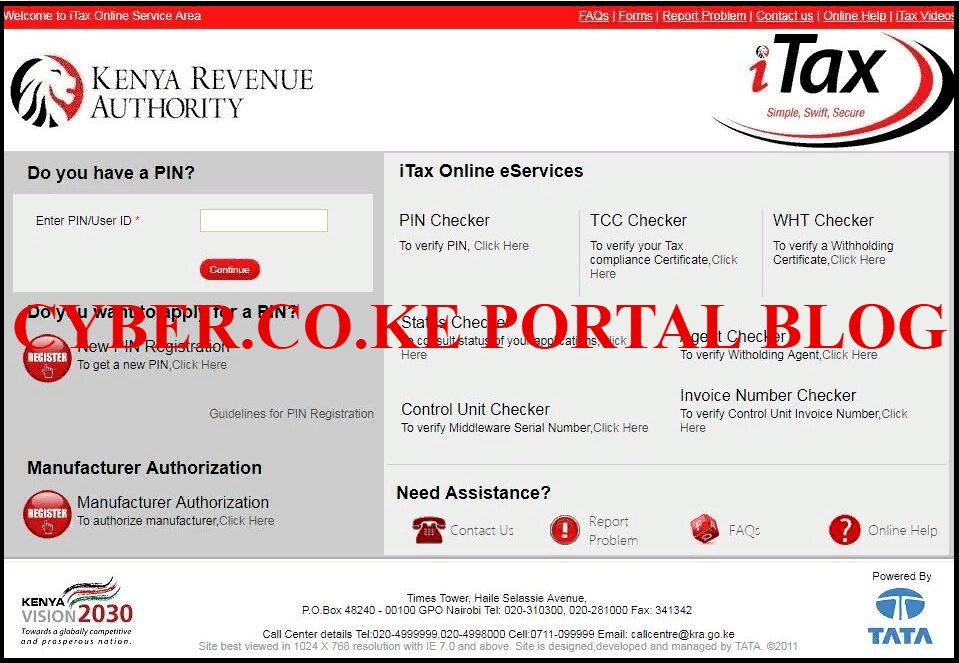

Step 1: Visit KRA Portal

The first step that you need to take is to ensure that you visit the KRA iTax portal using the link provided above in the title.

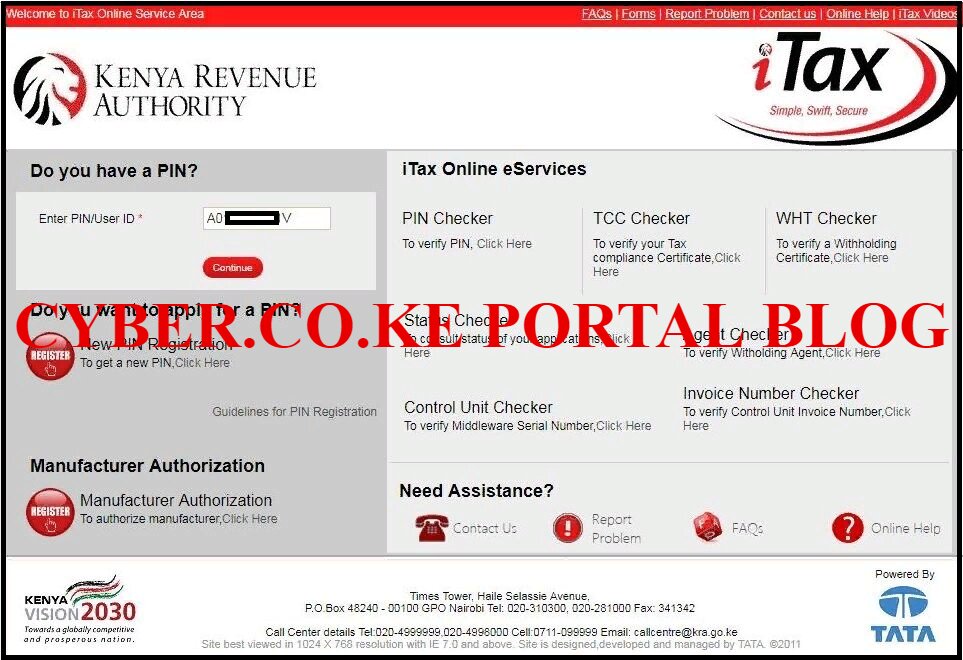

Step 2: Enter Your KRA PIN Number

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

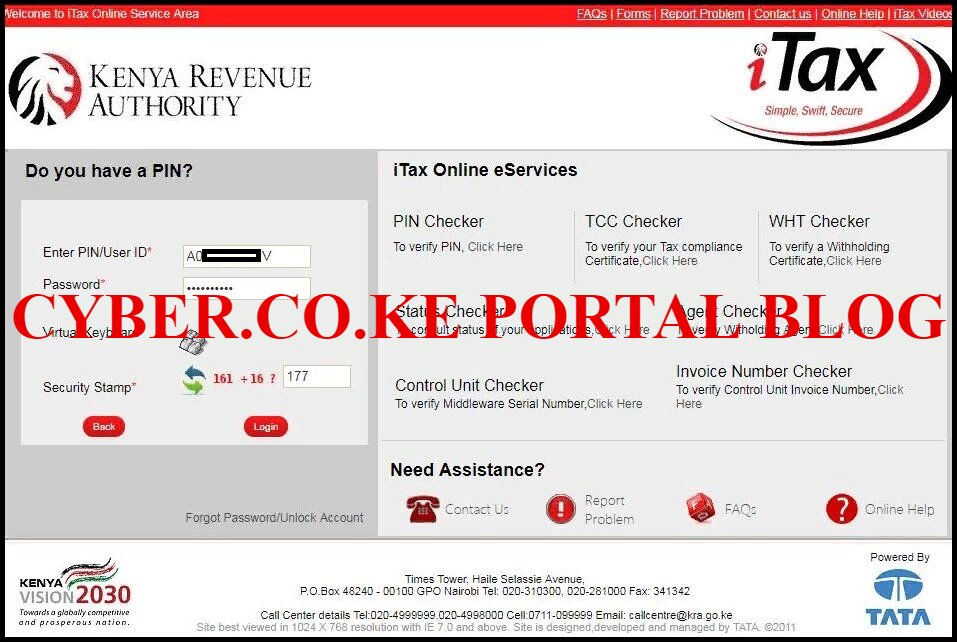

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: iTax Account Dashboard

Once you have entered the correct iTax Password as illustrated in Step 3 above, you will be able to see and access your iTax Account Dashboard. This is as illustrated in the screenshot below.

Step 5: Apply for Tax Compliance Certificate (TCC)

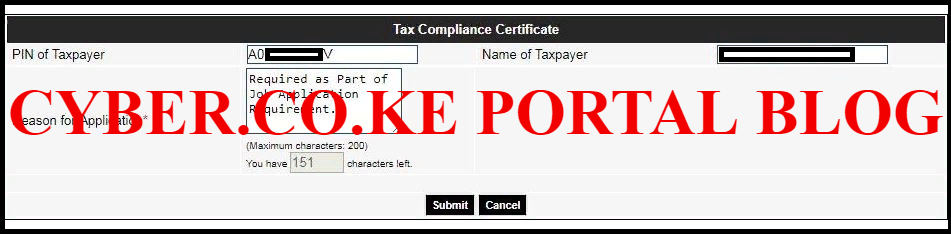

In this step, you will need to click on the certificates tab, then you click on the “Apply for Tax Compliance Certificate (TCC)” from the dropdown menu. This is as illustrated in the screenshot below. Now, you begin the process of TCC application.

You will take note that with this new enhancement, a popup window will be display as shown in the image above saying: “Please be informed that you are entitled for the Tax Compliance Certificate (TCC) without any workflow. Please click OK to continue.”

In simple terms, this simply means that if you choose to apply for the Tax Compliance Certificate, it will be issued to you immediately i.e the TCC Application will be Auto Approved by the iTax System. Click OK and proceed to filling in the Reason for Application. In our case, we need this Tax Compliance Certificate for Job Application process.

Once you have filled in the reason for Tax Compliance Certificate application, click on the “Submit” button to submit the application request to Kenya Revenue Authority (KRA).

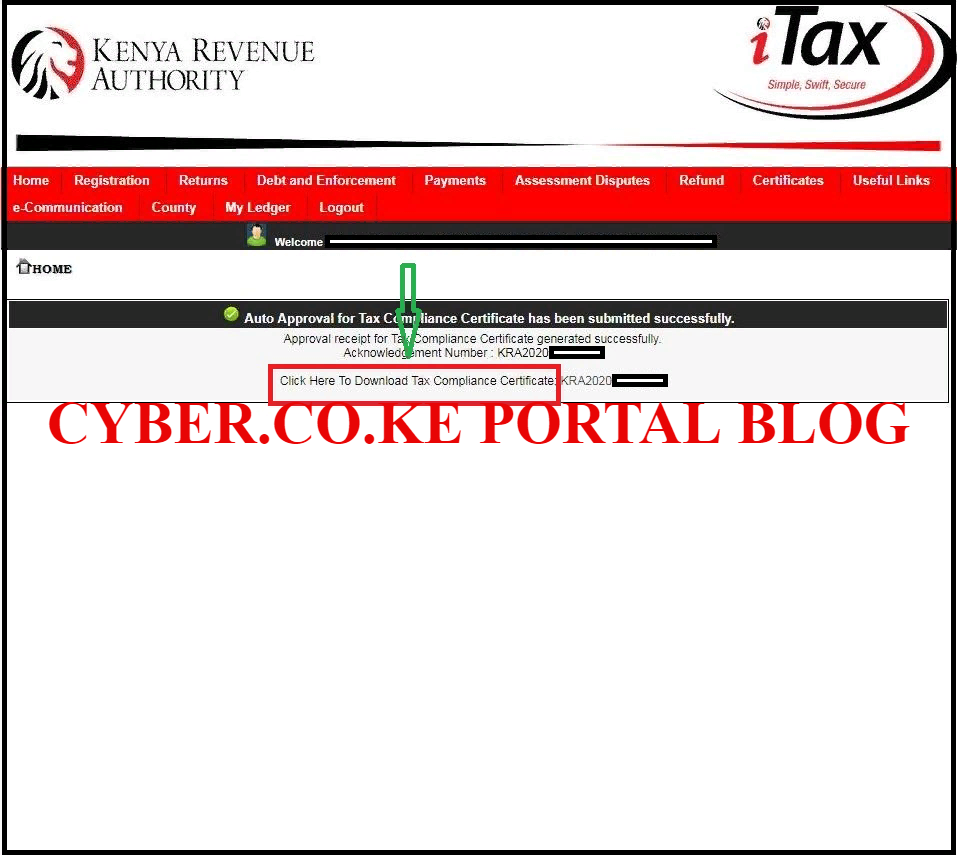

Step 6: Download Tax Compliance Certificate

This is the last step whereby you will need to download the Approved Tax Compliance Certificate. You will also need to take note of the approval receipt for the KRA Tax Compliance Certificate that also has an acknowledgement number associated with it. This is as shown below:

Once you have downloaded the KRA Tax Compliance Certificate, you will be able to make copied for future uses when it will be needed. Also you need to take note that the TCC is only valid for a period of 12 months from that date it was issued.

Group of Taxpayers Entitled To Get Tax Compliance Certificate (TCC) Immediately Upon Application

So, the KRA TCC will be issued to any taxpayer who has filed and complied with the tax laws in Kenya. The group of people whom when they apply for KRA Tax Compliance Certificate will be issued immediately in 3 minutes includes:

- New Taxpayers i.e those who have just gotten their new KRA PINs.

- Compliant Taxpayers i.e those who have filed relevant tax returns and paid taxes due as provided by Law.

In this case, if you don’t fall under the above two categories of taxpayers, then the chances of you getting the Tax Compliance Certificate as very slim to nothing. Let me explain with an example.

Group of Taxpayers Not Entitled To Get Tax Compliance Certificate (TCC) During Application

This is the group of taxpayers who cannot apply for Tax Compliance Certificate on iTax. This comprises of the following two categories of taxpayers:

- Taxpayers with Pending Returns i.e those who have not filed their KRA Returns for a certain year(s) on iTax.

- Taxpayers with Pending Payments i.e those who have not paid tax liabilities or penalties on iTax.

Assuming you have an active KRA PIN and need a Tax Compliance Certificate either for Job Application or even Tender Application in Kenya, you head over to iTax Portal and follow the steps that we have just shared above. Knowing that you have never filed any KRA Returns or forgot to file for a certain year? What will happen. Let me illustrate it for you.

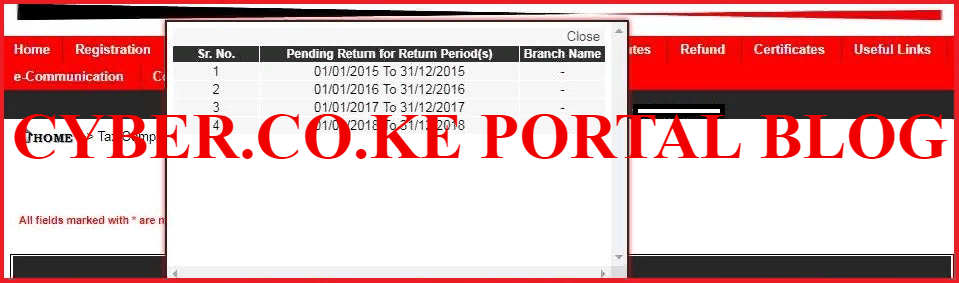

When you try to apply for TCC in the enhanced system, you will see a popup as shown above with the message: “Please note that you cannot apply for TCC as you have pending return/payment to be filed or liability to paid. Please click OK to view the details of pending returns.” The message simply means that you did not file your KRA Returns for a certain year and you will need to file those pending returns before trying to apply for a Tax Compliance Certificate again.

At the bottom of the same page, you will see a box with the title “Details of Pending Returns” You will need to click on the Details of Pending Returns -ITR (Income Tax Resident) to view the pending returns for the years not filed. This is as illustrated below.

So, in this scenario this taxpayer will have to file all those pending returns on iTax before trying to apply again for a Tax Compliance Certificate. Filing of those pending returns is the the final step as there will be a penalty that will be imposed as a result of late filing. The taxpayer can choose to apply for KRA Waiver and if “Approved” proceed to apply for the TCC.

In case the waiver application is “Declined” then the taxpayer will have to pay those pending penalties as they form part of the liability preventing him/her from applying and getting the Tax Compliance Certificate. With this new enhance on the process of TCC Application, I can definitely give a thumbs up to Kenya Revenue Authority (KRA).

Why? In the past (previous years) when you applied for Tax Compliance Certificate on iTax, you had to wait for a KRA Officer to go through your tax ledger to see if you have any pending returns or liabilities. This process could take days or even to some extent months.

READ ALSO: 3 Important KRA Returns Requirements That You Need To Have With You

But now with this new enhancement on the Tax Compliance Certificate application process, this has been simplified as you will get a popup notice telling you whether you can apply or not apply for a KRA Tax Compliance Certificate. So, next time you need to apply for a Tax Compliance Certificate (TCC) just follow the above steps and get your TCC within minutes of application.

TRENDING BLOG POSTS IN KENYA

CYBER.CO.KE

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

CLICK HERE TO REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

CLICK HERE TO RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

CLICK HERE TO UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CLICK HERE TO CHANGE KRA PIN EMAIL ADDRESS