CYBER.CO.KE is an independent Cyber Services website and is not affiliated with any government agency, including Kenya Revenue Authority (KRA). A service fee is charged for the assistance provided to customers in Kenya.

In this step-by-step tutorial, you are going to learn and get to know How To Change Email Address On iTax.

Get KRA PIN Certificate via Email Address and WhatsApp

Submit Service Request

Get KRA PIN Number via SMS

Follow These Steps

How To Change Email Address Registered On iTax

The following are the 8 main steps involved in the process of How To Change Email Address Registered On iTax that you need to follow.

-

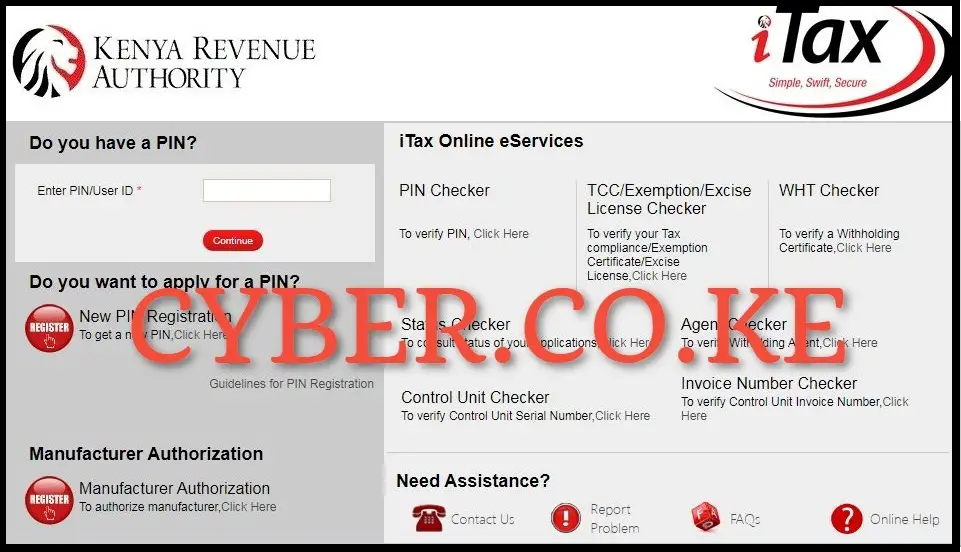

Step 1: Visit iTax (KRA Portal)

The first step in the process of changing the email address that is registered on your iTax account, is to visit iTax by using https://itax.kra.go.ke/KRA-Portal/

-

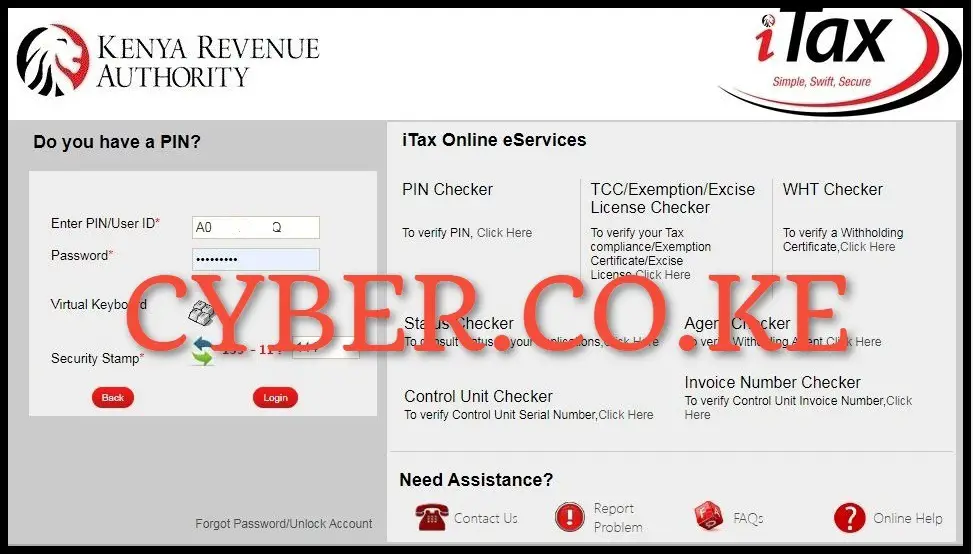

Step 2: Login Into iTax

Next, enter both your KRA PIN Number and KRA Password (iTax Password), solve the arithmetic question (security stamp) and click on the “Login” button to access your iTax account.

-

Step 3: Click On The Registration Menu Tab Followed By Amend PIN Details

Once you are logged into your iTax account successfully, click on the “Registration” menu and then click on “Amend PIN Details” from the drop down menu items list on iTax.

-

Step 4: Select The Mode of Amendment in the e-Amendment of Registration Form

In this step, you must choose the Amendment mode. In this example, we will opt for the Online Form mode. Although you have the option to utilize the Upload Form mode for the amendment, we recommend using the Online Form mode. The system will automatically populate other fields on the e-Amendment of Registration Form, including Applicant Type, Taxpayer Name, and Taxpayer Name. After selecting the amendment mode, proceed to the next step by clicking the “Next” button.

-

Step 5: Fill In The Individual Registration Amendment Form

During this step, complete the Individual Registration Amendment form by navigating ticking the check boxes for PIN and Basic Information. This is necessary as the Email Address that you want to change is situated under Basic Information within the Principal Contact Details of the Individual Registration form. Once you’ve chosen these two fields, proceed by clicking the “Submit” button.

-

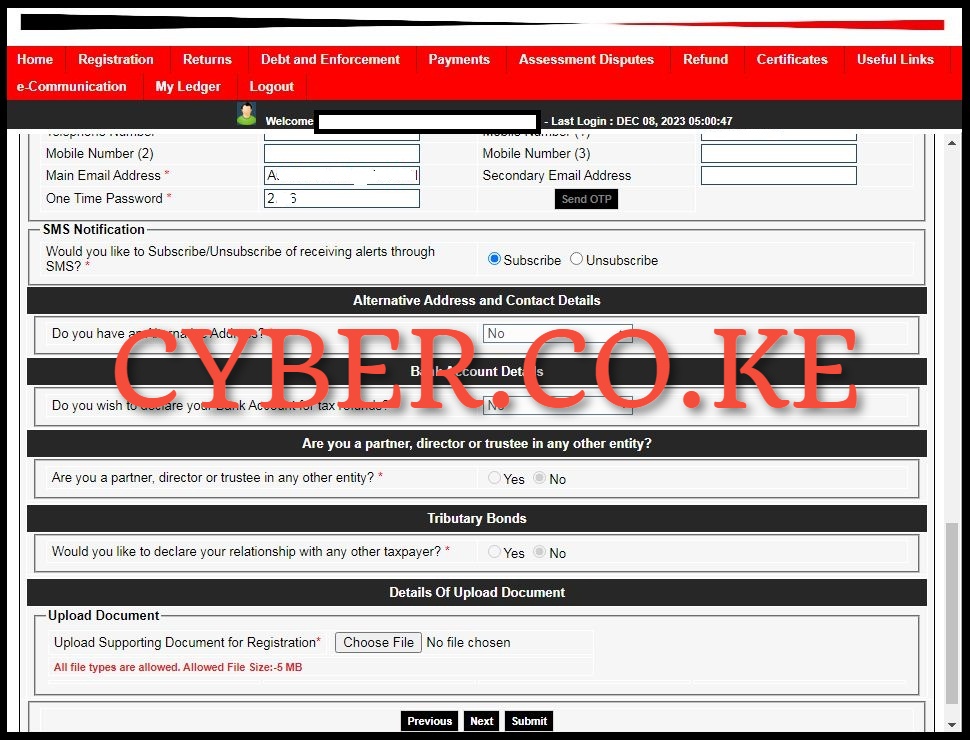

Step 6: Under Basic Information Section, Scroll to Principal Contact Details

In this step, scroll down to the “Principal Contact Details” section and on the Main Email Address part, type in the new email address that you want to use on iTax. In order to continue using iTax functionality you are required to verify your email address.Please click “Send OTP” button to receive OTP on mentioned email address.

-

Step 7: Enter The Generated KRA OTP For Email Address Verification

In your updated email address on iTax, look for the KRA OTP email address verification code sent to confirm that the Kenya Revenue Authority (KRA) has received your request for Email address verification on iTax. The KRA OTP Code is crucial for final approval of the new email address intended for use on iTax. After entering the KRA OTP verification code, click on the “Submit” button. A pop-up will emerge, prompting you to confirm the new Email Address as your primary email address on the iTax. This updated Email Address is the designated channel for receiving communications and updates from the Kenya Revenue Authority (KRA). Click on the “OK” button, and Do you want to submit the data? also click on “OK” button to proceed to the last step.

-

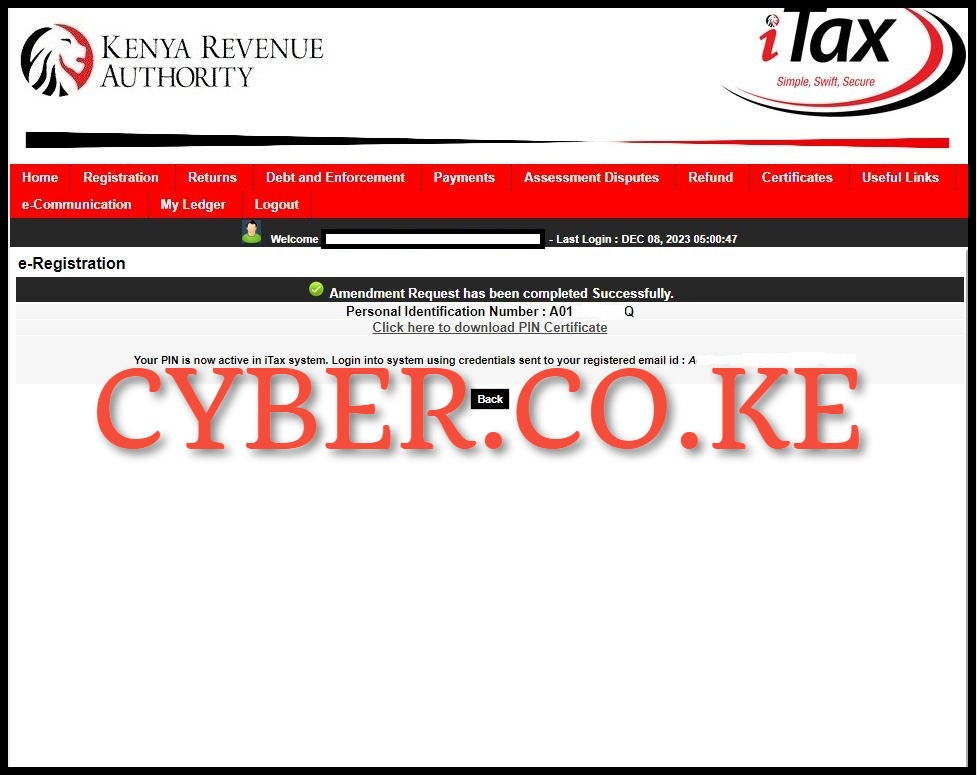

Step 8: Amendment Request Has Been Completed Successfully

The last step in the process of changing the email address on iTax is tp download the newly generated KRA PIN Certificate that now contains your new email address. To download the KRA PIN Certificate, just click on the text link titled “Click here to download PIN Certificate” which will initiate the downloading of the KRA PIN Certificate. You will also receive an email from KRA about Approval of Registration Amendment as illustrated below;

Dear Taxpayer,

This is to inform you that your Registration Amendment Application submitted on 09/12/2023 with Acknowledgement Number KRA2023*******7 has been approved.

Please find the updated PIN Certificate attached.

Regards,

Commissioner

Medium and Small Taxpayer Office

Kenya Revenue Authority

This email serves as the final confirmation that the change of email address on iTax has been successful. The email also comes with an attachment of your KRA PIN Certificate which you can also download.

The above 8 steps sums up the whole process that is involved in changing the email address on iTax account. For the process to be successful, you need to ensure that you are able to login into iTax account using both your KRA PIN Number and KRA Password (iTax Password). Once you are logged into iTax account, follow the steps outlined above on How To Change Email Address Registered On iTax.

Matthews Ohotto is a Writer at CYBER.CO.KE where he specializes in writing helpful and informative Step-by-Step Tutorials that empower Kenyans with practical skills and knowledge. He holds a Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT). Get KRA Individual Services and KRA Returns Services in Kenya.

Check Out Our Popular Blog Posts

Check Out Our KRA Individual Services

Register KRA PIN Number

Submit Service Request →Retrieve KRA PIN Certificate

Submit Service Request →Update KRA PIN Number

Submit Service Request →Change KRA PIN Email Address

Submit Service Request →Check Out Our KRA Returns Services

File KRA Nil Returns

Submit Service Request →File KRA Employment Returns

Submit Service Request →File KRA Amended Returns

Submit Service Request →File KRA Withholding Tax Returns

Submit Service Request →Check Out Our KRA Tax Calculators

Calculate Turnover Tax (TOT)

TOT Calculator →Calculate Monthly Rental Income (MRI)

MRI Calculator →Calculate Value Added Tax (VAT)

VAT Calculator →Calculate Pay As You Earn (PAYE)

PAYE Calculator →CYBER.CO.KE

Get KRA Services Online Today

CYBER.CO.KE is a trusted online cyber services website dedicated to providing KRA Individual Services and KRA Returns Services to customers in Kenya on a day to day basis.

The KRA Individual Services that we offer to customers includes: Registration of KRA PIN Number, Retrieval of KRA PIN Certificate, Updating of KRA PIN Number and Changing of KRA PIN Email Address.

The KRA Returns Services that we offer to customers includes: Filing of KRA Nil Returns, Filing of KRA Employment Returns, Filing of KRA Amended Returns and Filing of KRA Withholding Tax Returns.

If you are looking for dependable, fast and reliable KRA Services in Kenya, we are ready and available to support you at every step of the way.

We prioritize customer convenience, clear communication and prompt service delivery, making sure that your submitted service request is completed in the shortest time possible.