Have you just made a KRA Payment to Kenya Revenue Authority (KRA) and need to check and confirm the status of the KRA Payment on iTax Portal (KRA Portal)? In this article, you are going to learn the steps that are involved in How To Check KRA Payment Status Using KRA Status Checker.

The process of paying taxes to Kenya Revenue Authority (KRA) involves different stages. Depending on the type of KRA Payment that a taxpayer needs to make generally you will first need to do a Payment Registration then Generate the KRA Payment Slip and next you will be required to make KRA Payment using KRA Paybill Number or any of the KRA Partner Banks countrywide.

The last step will normally involve checking whether or not Kenya Revenue Authority (KRA) has received the Payment using the KRA Status Checker on iTax Portal. In this article, I am going to share with you the step by step process on How To Check KRA Payment Status Using KRA Status Checker. By the end of this article, you will have learnt and known How To Check KRA Payment Status on iTax using the KRA Status Checker.

READ ALSO: How To Reprint KRA Acknowledgement Receipt Using KRA iTax Portal

Knowing the cycle of KRA Payments in Kenya from the initial stage of Payment Registration, Generating Payment Slip, Making KRA Payment and finally Checking KRA Payment Status is a must for each and every taxpayer in Kenya to learn, know and understand fully.

Normally, it is a prudent behaviour to always confirm if the payment you made at any business, company or organization has been received. The same also applies to KRA Payments. This article will seek to highlight and address key terms and concepts pertaining to KRA Payments.

The key areas that we shall look at includes: What Is KRA Payment, What Is KRA Status Checker, Types Of KRA Payments, Requirements Needed To Make KRA Payments, Requirements Needed To Check KRA Payment Status on iTax Portal and How To Check KRA Payment Status Using KRA Status Checker. By the end of this article, you will have a greater understanding on how you can use the KRA Status Checker to check on the payments that you have made to Kenya Revenue Authority (KRA).

What Is KRA Payment?

KRA Payment is basically a process that a taxpayer takes to pay taxes due or any other form of payment to Kenya Revenue Authority (KRA). As a process, KRA Payment normally involves the act of either making payment using the KRA Paybill Number 572572 or any of the KRA Partner Banks throughout the country. The other mode of KRA Payments that taxpayers can use also includes the use RTGS (Real Time Gross Settlements) or even Cheques.

To be able to make KRA Payments, taxpayers are normally required to Login to their KRA Web Portal Accounts, do Payment Registration, Generate the KRA Payment Slip and finally make KRA Payments using the methods outlined above i.e. either KRA Paybill Number or via Bank. As taxpayers in Kenya, we make KRA Payments as it is our duty to pay taxes from our Employment Income, Business Income or Rental Income depending on what a taxpayer is registered for.

I can address much pertaining to KRA Payments as it is a simple term that anyone can be able to understand from the above given definition. Having looked at what we mean by KRA Payments, we need to look at another key term that is important since we shall be using it. This is basically the question: What Is KRA Status Checker? This is as described and highlighted below.

What Is KRA Status Checker?

KRA Status Checker is a functionality on the KRA iTax Portal that allows taxpayers consult and view the status of their applications or payments at Kenya Revenue Authority (KRA). So the Status Checker allows a taxpayer consult and confirm status of his or her applications that were submitted to KRA via iTax Portal.

There are 3 main functions that a taxpayer can perform using the KRA Status Checker i.e. Consult Status of Registration, Consult Status of Returns and Consult Status of Payment. Since this article focuses on Consulting Status of KRA Payments, our main focus will be on that functionality. But just to brush through these three functionality quickly as illustrated below.

-

Consult Status of Registration

This option allows a taxpayer to consult the status of Registration request that was submitted to Kenya Revenue Authority (KRA). For example, when you apply for Company KRA PIN or Self Help Group KRA PIN using Cyber.co.ke Portal, you can use this option by entering the Reference Number and Search Code to check the status of the Registration.

-

Consult Status of Returns

The other option that is available on the KRA Status Checker is the Returns options. This option basically allows the taxpayer to confirm the status of his or her KRA Returns i.e. KRA Nil Returns or KRA Employment Returns at Kenya Revenue Authority (KRA). So, when you want to check the status of your Returns on iTax Portal, then this option will come in handy.

-

Consult Status of Payment

The last but definitely not least option is that of Payment. Basically, this allows you to confirm the status of the KRA Payment or KRA Payments that a taxpayer made to Kenya Revenue Authority (KRA) using the Payment Registration Number (PRN) and the Search Code as displayed on the KRA Payment Slip. We shall be focusing on this option to check the status of KRA Payment on iTax.

Types Of KRA Payments

There exists a variety of KRA Payments that taxpayers can make using iTax Portal. Just to highlight on the main Tax head that can be chosen by taxpayers includes: Income Tax, Value Added Tax (VAT), Excise, Agency Revenue, Payment for Payment Plan and iTax Prior Assessment. These tax heads for payments have what is referred to the tax sub-head and each has a type of payment.

I will not be focusing on discussing the various types of KRA Payments under each tax head and tax sub-head as that will form the basis of our future articles here at Cyber.co.ke Portal Blog. So, if you want to learn more about the types of KRA Payments, always ensure that you visit Cyber.co.ke Portal Blog as we publish new, authoritative and helpful KRA content on a day to day basis.

Having looked at the types of KRA Payments above, we now need to look at the Requirements that are needed to make KRA Payments. For you as a taxpayer in Kenya, what will you require to make KRA Payment today.

Requirements Needed To Make KRA Payments

Just as I described earlier in this article, KRA Payment basically is the process of paying taxes due or any other form of payment to Kenya Revenue Authority (KRA). Just as I have been mentioning in my pervious articles here at Cyber.co.ke Portal Blog, to be able to make KRA Payment or KRA Payments, a taxpayer needs to have the KRA Payment Slip and M-PESA.

These are the major requirements needed to make KRA Payments in Kenya. You can also choose to use Bank, Cheque or RTG to make the KRA Payment. The choice of method of payment normally lies with the taxpayer. I will be highlighting on the two main important requirements needed to make KRA Payments in Kenya i.e. KRA Payment Slip and M-PESA Mobile Number.

-

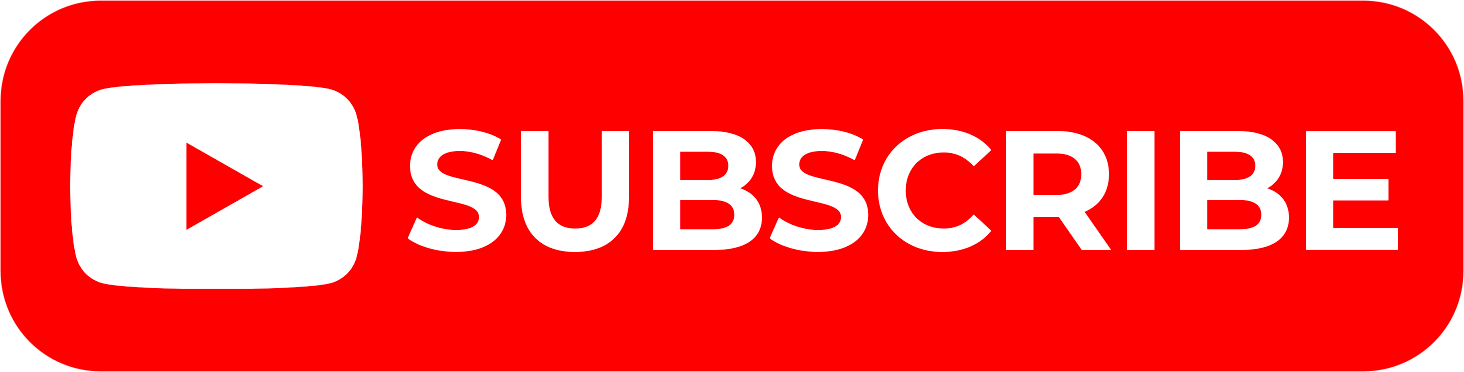

KRA Payment Slip

The first requirement is normally the KRA Payment Payment. You will first need to apply for Payment Registration, Generate ythe KRA Payment Slip and then use the Payment Slip’s Payment Registration Number (PRN) as the account number when you are making the payment to Kenya Revenue Authority (KRA). Without the KRA Payment Slip, then definitely there is no way you can make any KRA Payments on iTax Portal.

-

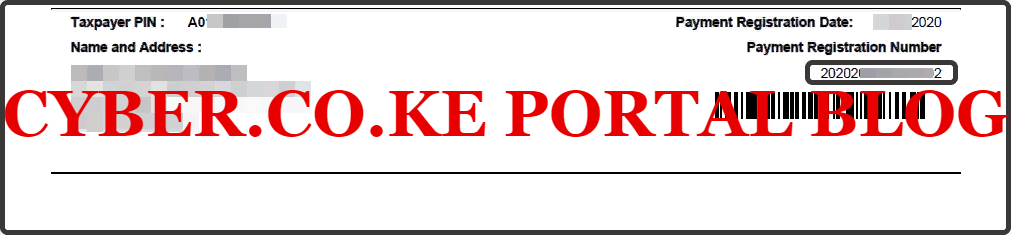

M-PESA Mobile Number

The other requirement that you are going to need is to have a M-PESA Mobile Number. This is because M-PESA makes it easier and flexible to make KRA Payments quickly and easily just with the touch of buttons. You will use the KRA Paybill Number 572572 to make KRA Payment and the Payment Registration Number (PRN) will serve as the account number.

Having looked at the two main requirements needed in the Payment process, we now need to shift gears a little bit and look at Requirements Needed To Check KRA Payment Status on iTax Portal. This is as outlined and described below.

Requirements Needed To Check KRA Payment Status on iTax Portal

For you to be able to check the KRA Payment Status on iTax, you need to ensure that you have with you the Payment Registration Number and Search Code. This is as outlined below.

-

Payment Registration Number (PRN)

At the top of each and every KRA Payment Slip is what we refer to as the Payment Registration Number or in simple term PRN. Basically, the Payment Registration Number serves as the account number when you are making Payments to Kenya Revenue Authority either using M-PESA, Bank, Cheque or even RTGS.

-

Search Code

The other most important requirement that you need to have with you is the Search Code. This code is usually located in the middle of the KRA Payment Slip and it is used to query the status of your KRA Payment Slip on iTax Portal using the KRA Status Checker. Combined with the Payment Registration Number (PRN), these two allows a taxpayer check,consult and confirm KRA Payments Status on iTax Portal.

Now that we have known and addressed the key requirements that are needed in the process of Checking KRA Payment Status on iTax Portal, we can now head towards the homestretch and look at the steps that all taxpayers in Kenya to follow on How To Check KRA Payment Status Using KRA Status Checker.

How To Check KRA Payment Status Using KRA Status Checker

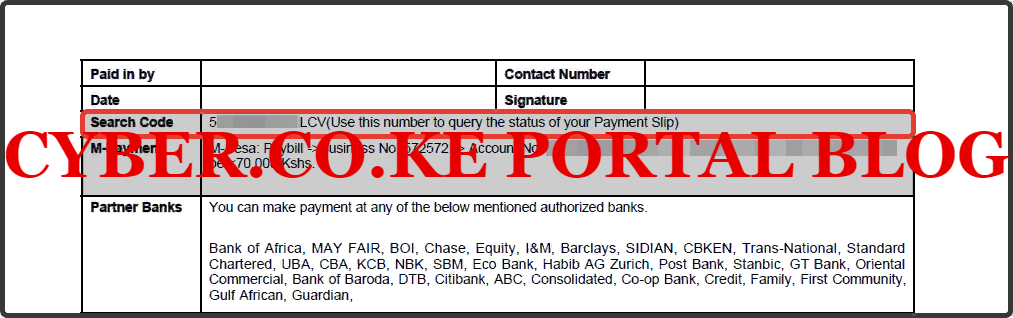

Step 1: Visit KRA Portal

The first step that you need to take in the process of How To Check KRA Payment Status Using KRA Status Checker is to ensure that you visit the KRA iTax Web Portal using the link provided above in the above description. Take note that the above is an external link that will take you to the KRA iTax Portal i.e. link will open in a new tab.

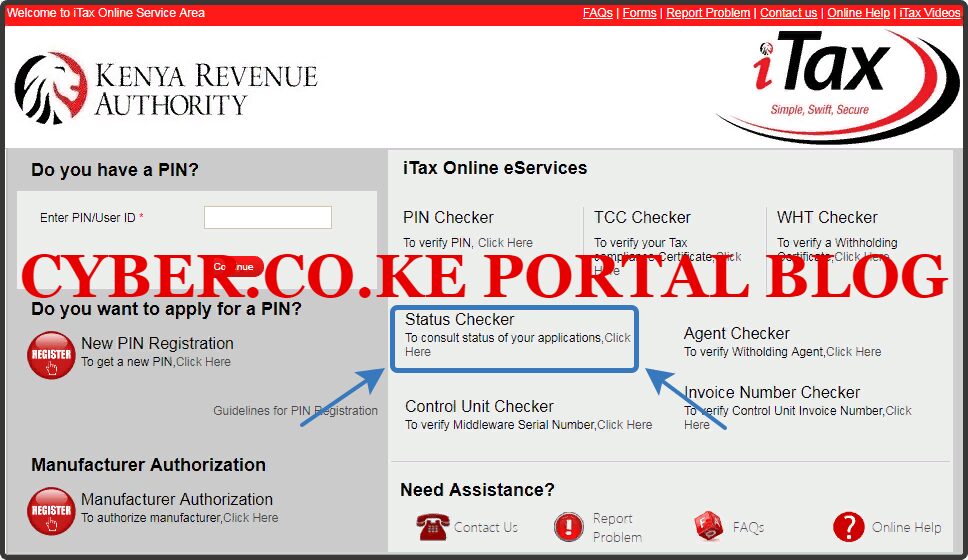

Step 2: Click On KRA Status Checker

Since we need to check the status of KRA Payment, you will need to click on the Status Checker functionality on the iTax homepage as illustrated below.

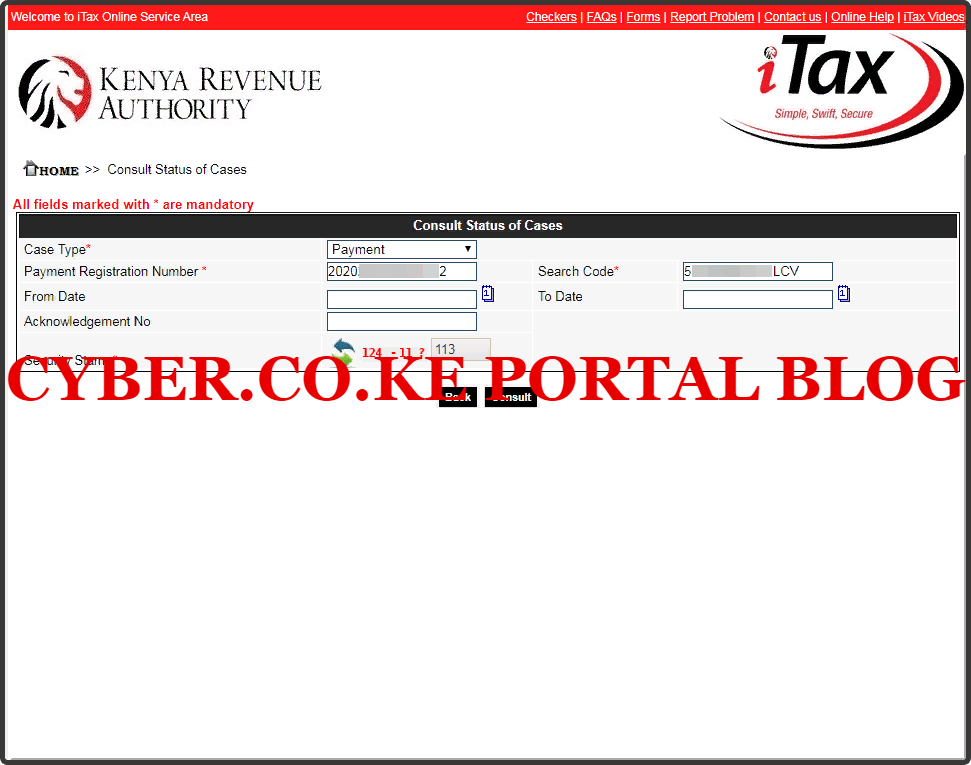

Step 3: Fill In Case Type, Payment Registration Number (PRN) And Search Code

In this step, since we are focusing on checking the status of Payment at KRA, we shall select the Case Type as Payment, then proceed to enter the Payment Registration Number (PRN) as displayed on the KRA Payment Slip and finally enter the KRA Search Code as also displayed on the KRA Payment Slip. Once you have all these, proceed and solve the arithmetic question (Security Stamp) and click on the “Consult” button. This is as illustrated and shown below.

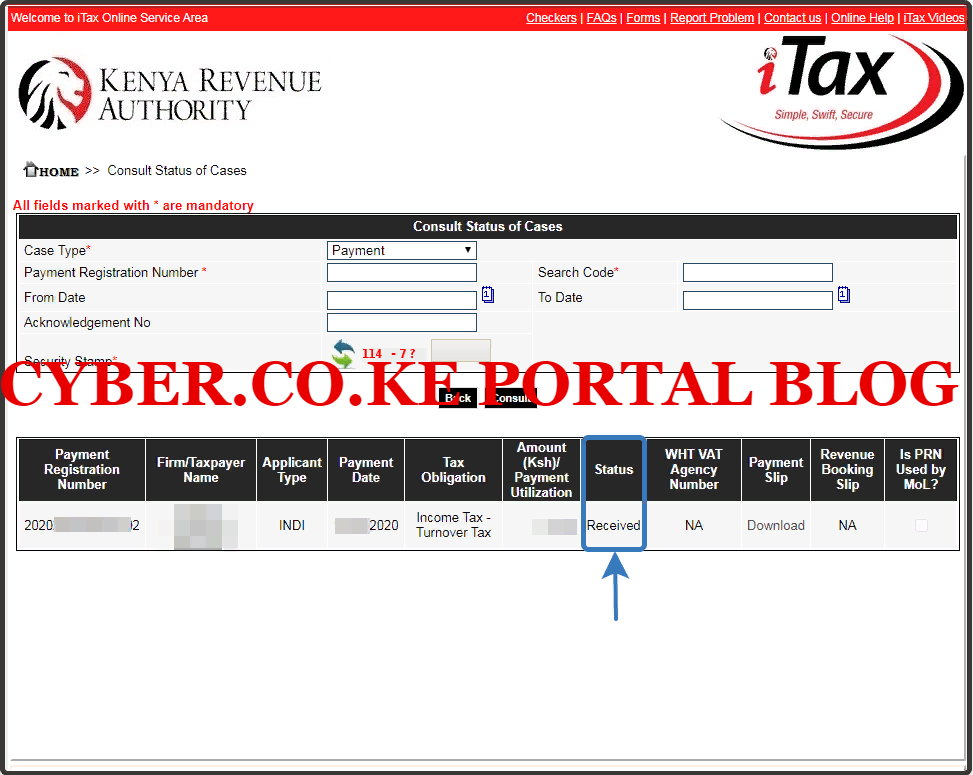

Step 4: Results Of KRA Payment Status

This is the last and the most important step in the process of How To Check KRA Payment Status on iTax Portal. After you have successfully entered the Payment Registration Number and KRA Search code as explained in Step 3 above, you will be present with the results of the Payment Status on iTax.

On the Results Page of the KRA Status Checker, you will see different columns including: Payment Registration Number (PRN), Firm/Taxpayer Name, Applicant Type, Payment Date, Tax Obligation, Amount (Kshs)/Payment Utilization, Status, WHT VAT Number, Payment Slip, Revenue Booking Slip and Is PRN Used by MoL.

I know those columns can’t be quite confusing, but you only need to focus on one main column i.e. the Status Column. This column is important in the process of checking KRA Payment Status on iTax as it tells you if the payment was successfully received by Kenya Revenue Authority (KRA). This is as illustrated in the screenshot below.

From the above screenshot, you will notice that when the Payment has been successfully made to Kenya Revenue Authority, then the Status column will normally show “Received” confirming that the payment was successfully paid to KRA against the Payment Registration Number (PRN) that serves as the Account Number.

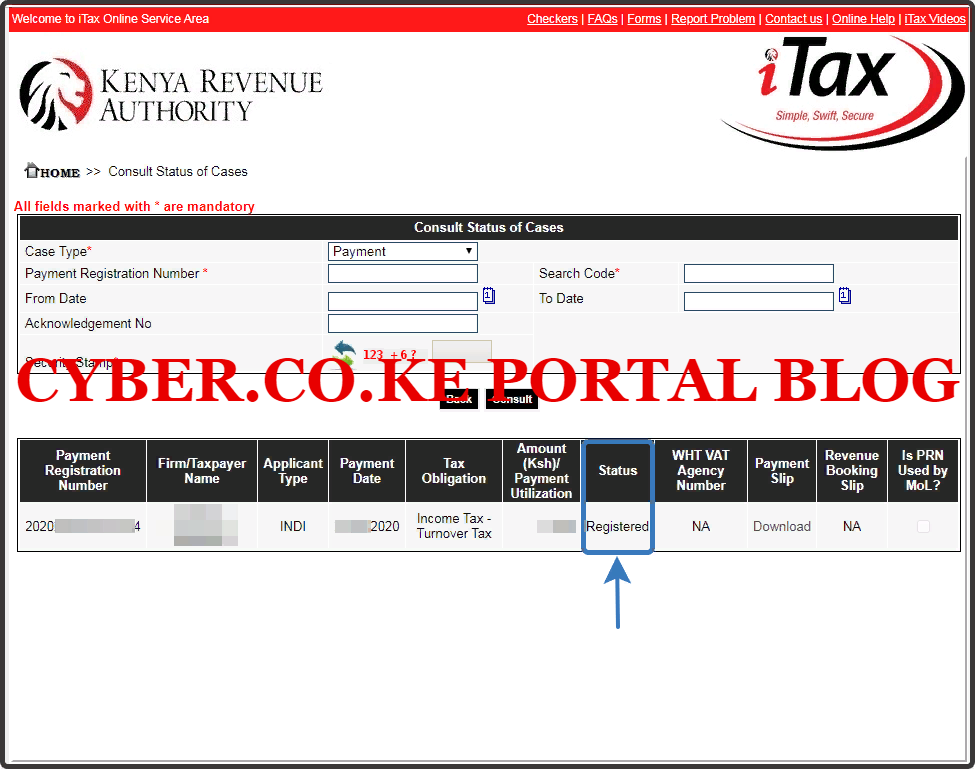

In case you have generated the KRA Payment Slip but have not made any payment yet, the Status column will normally show “Registered” meaning it has been registered or generated but the taxpayer has not yet made the Payment. This is as illustrated in the screenshot below.

READ ALSO: How To Pay Presumptive Tax Using KRA Paybill Number 572572

The above steps sums up the process involved in How To Check KRA Payment Status using KRA Status Checker functionality on iTax Portal. Next time you need to check and confirm whether the Payment that you made to Kenya Revenue Authority (KRA) has been received or not, just follow this step by step guide on How To Check KRA Payment Status Using KRA Status Checker.