Have you Generated Presumptive Tax Payment Slip and now need to make Presumptive Tax Payment? Learn How To Pay Presumptive Tax Using KRA Paybill Number.

By now you are aware that all businesses whose gross sales per year is less than Kshs. 5,000,000.00 are supposed to be paying the monthly Turnover Tax and the yearly Presumptive Tax. The Presumptive Tax is normally paid at the rate of 15% of the amount paid for the County Permit or Business Licence and should be paid once a year everytime you are applying or renewing your Business Permit or County Business Licence. For example, if your Business Permit costs Kshs. 10,000.00, then the Presumptive Tax that you will pay Kenya Revenue Authority (KRA) is 15% of Kshs. 10,000.00 which is Kshs. 1,500.00 only.

In this article, having learnt and talked about How To Generate Presumptive Tax Payment Slip, we now need to look at the last section i.e. How To Pay Presumptive Tax Using KRA Paybill Number 572572. By the end of this article, you will have learnt and know the steps that you need to take when you want to pay the Presumptive Tax for your Business in Kenya.

READ ALSO: How To Download Latest KRA Returns Template From KRA Portal

You will have known the step by step guide on the Presumptive Tax Payment process using the KRA Paybill Number 572572. You can choose to make Presumptive Tax using any of the KRA Partner Banks in Kenya, but this article will be focusing on paying Presumptive Tax using the KRA Paybill Number.

If you are not familiar with the KRA Presumptive Tax, here at Cyber.co.ke Portal Blog, I have covered the Presumptive Tax in Kenya Topic widely and you can refer to The Complete Beginner’s Guide To Presumptive Tax in Kenya. Also, you can refer to the steps on How To Generate Presumptive Tax Payment Slip.

This article will seek to address key terms and concepts such as: What Is Presumptive Tax Payment, Methods Of Presumptive Tax Payment, What Is KRA Paybill Number, Requirements Needed For Presumptive Tax Payment and How To Pay Presumptive Tax Using KRA Paybill Number 572572.

What Is Presumptive Tax Payment?

Presumptive Tax Payment is the process of paying the yearly Presumptive Tax of a business in Kenya at the rate of 15% of the cost of the Single Business Permit (SBP) County Business Licence to Kenya Revenue Authority (KRA) using either the KRA Paybill Number or any of the KRA Partner Banks. Presumptive Tax is paid by taxpayers who are eligible for the Presumptive Tax and is paid after generating the Presumptive Tax Payment Slip.

Unlike Turnover Tax that has a due date i.e. on or before the 20th day of the month, Presumptive Tax on that other hand does not have a specific due date as it is paid at the point where a taxpayer applies or renews his or her Business Permit or Business Licence. To put this into an example, assuming that you are applying for or renewing your Single Business Permit Licence today, you are required to Pay the Presumptive Tax at the rate of 15% of the amount that you paid for the Business Permit.

The good news about Presumptive Tax is that it is an Advance Tax and that means that the amount that you paid for the Presumptive Tax will be deducted the next time you are paying for your monthly Turnover Tax. To understand this better, assuming you applied for or renewed your business permit or licence in February 2020 and paid Kshs. 10,000.00 for that permit. This means that the amount of Presumptive Tax that you will pay Kenya Revenue Authority (KRA) is 15% of the cost of the business permit and that is simply Kshs. 1,500.00 only.

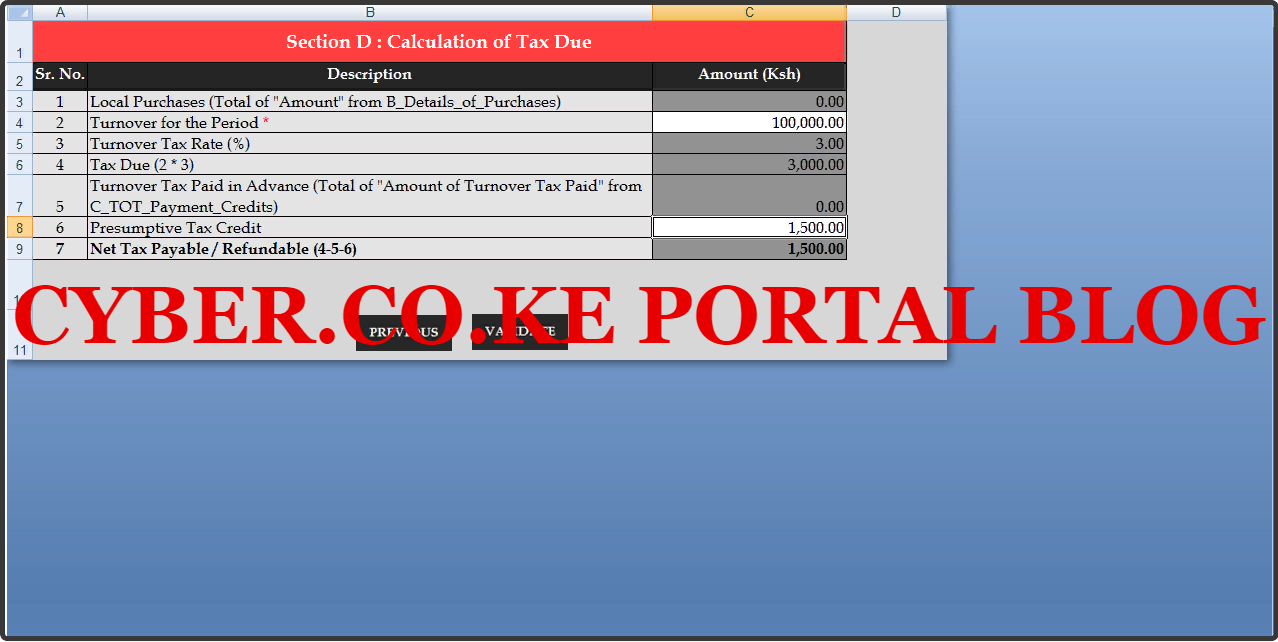

Now, when you will be calculating the monthly Turnover Tax for your business for the month of February 2020, you will have to factor in the Kshs. 1,500.00 that you paid as a Presumptive Tax for your business. So, if your business made a total gross sales of Kshs. 100,000.00 for the month of February, the amount of Turnover Tax will be 3% of the gross sales which is Kshs. 3,000.00 and the Presumptive Tax that you paid for business of Kshs. 1,500.00 will be deducted from the month’s Turnover Tax. This is as illustrated in the simple computation below.

From the screenshot above, you will see that the amount of Presumptive Tax (Tax Credit) is deducted from the Tax Due making the Net Turnover Tax Payable to Kenya Revenue Authority (KRA) for the month of February 2020 to be Kshs. 1,500.00 only. One thing you need to note is that Presumptive Tax Credit should only be filled once in a year. So, if you got your Business Permit or Licence for the year 2020 in February, then you will use the Tax Credit only once when you will be computing the Turnover Tax for your business for the previous month.

One thing you need to take note is that to be able to pay the Presumptive Tax, you will first need to generate the Presumptive Tax Payment Slip. If you need a full understanding on how to generate the Presumptive Tax Payment Slip, you can refer to the article I wrote about How To Generate Presumptive Tax Payment Slip using KRA iTax Portal. You will get to know how you can get the Payment Slip for the Presumptive Tax that is going to play a huge role in How To Pay Presumptive Tax Using KRA Paybill Number 572572.

Having looked and what we mean by Presumptive Tax Payment above, we now need to look at Methods Of Presumptive Tax Payment. This is important for taxpayers to get an indepth understanding of the methods or modes of payment that they can use to pay Presumptive Tax in Kenya.

Methods Of Presumptive Tax Payment

There are two main methods that a taxpayer can use to pay Presumptive Tax for his or her business in Kenya. The Presumptive Tax Payment methods includes: Mobile Money Payment and Bank Payment. We shall look at each of the above Presumptive Tax Payment methods in detailed view below.

-

Mobile Money Payment

A taxpayer can decide to use the Mobile Money Payment option inorder to pay for his or her business Presumptive Tax to Kenya Revenue Authority (KRA). Mobile Money Payment simply refers to M-Pesa Payment through the KRA Paybill Number 572572. Once a taxpayer has generated the Presumptive Tax Payment Slip on KRA iTax Portal, then he or she can use the Mobile Money Payment option to pay for the Business Presumptive Tax.

-

Bank Payment

The other option that a taxpayer can use to pay Presumptive Tax is the Bank Payment option. Once a taxpayer generates the Presumptive Tax Payment Slip on KRA iTax Portal, he or she can choose to pay the Presumptive Tax at any of the KRA Partner banks that are available in Kenya.

Normally, I recommend the Mobile Money Payment option due to the flexibility and can be done on your phone quickly and easily. But if you are fond of and used to queuing, then paying the Presumptive Tax at the Banks will be suitable for you. The choice always rests and depends on the taxpayer.

Having looked at the Methods that a taxpayer can use to pay Presumptive Tax in Kenya, we now need to look at what we mean by KRA Paybill Number. Since this article will be focusing on How To Pay Presumptive Tax using Paybill Number, we need to understand what we mean by KRA Paybill Number.

What Is KRA Paybill Number?

The KRA Paybill Number is a Mobile Money Payment option that taxpayers in Kenya can use to pay their Presumptive Tax after generating the KRA Presumptive Tax Payment Slip on KRA iTax Portal. The KRA Paybill Number is normally 572572, and taxpayers can use this KRA Paybill Number to make payments to the Kenya Revenue Authority (KRA).

Kenya Revenue Authority (KRA) choose to have a Paybill Number so as to make the process of paying for Taxes and other KRA Payments such as Presumptive Tax by taxpayers in Kenya easy and flexible at the palm of the taxpayers hands. Now that’s a plus for the KRA Paybill Number which makes paying of taxes efficient and seamless thanks to M-Pesa.

Using the KRA Paybill Number to pay Presumptive Tax in Kenya is not only fast but also efficient. So, since most taxpayers have M-Pesa in Kenya, then the KRA Paybill Number is the best option to use inorder to make Turnover Tax Payment quickly and easily by just using your mobile phone.

Having looked at the definition of the KRA Paybill Number above, we now need to change gears a little bit and look at Requirements Needed For Presumptive Tax Payment. This is basically to understand the requirements that a taxpayer needs to have with him or her so as to be able to pay Presumptive Tax using the KRA Paybill Number 572572.

Requirements Needed For Presumptive Tax Payment

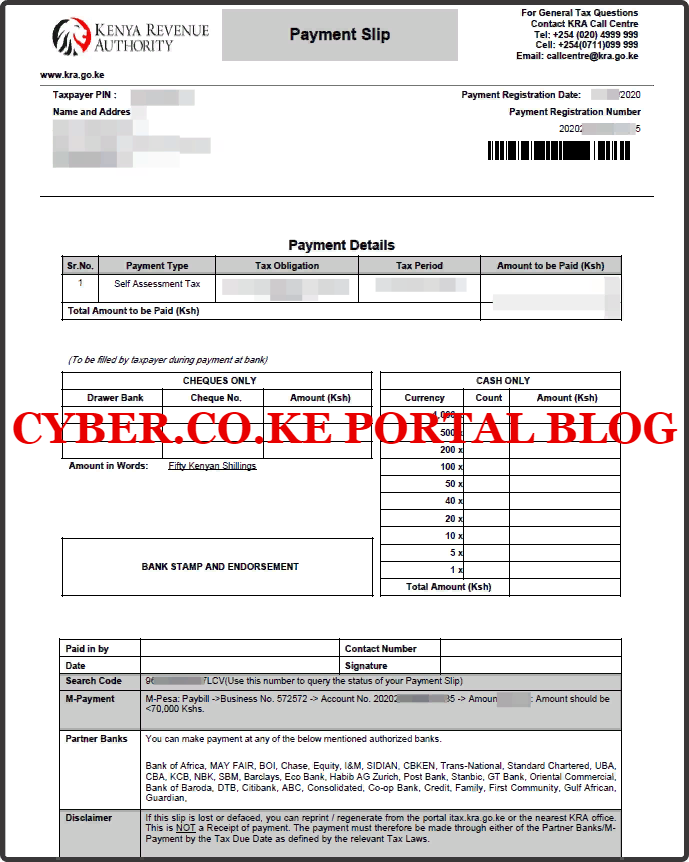

To be able to make Presumptive Tax Payment, you need to ensure that you have with you the KRA Presumptive Tax Payment Slip and M-Pesa Number. These are the two key requirements that a taxpayer needs to have in order to make Presumptive Tax Payment quickly and easily. The most important being the Presumptive Tax Payment Slip as illustrated below.

-

Presumptive Tax Payment Slip

The first and definitely most important requirement that you need to ensure you have with you is the Presumptive Tax Payment Slip. Normally you will have to generate the Presumptive Tax Payment Slip on KRA iTax Portal and then use that Presumptive Tax Payment Slip to pay the Presumptive Tax for your Business in Kenya. Below is a sample of a generated KRA Presumptive Tax Payment Slip.

You can check out our article on How To Generate Presumptive Tax Payment Slip Using KRA iTax Portal or you can submit your order for Presumptive Tax Payment Registration service request here at Cyber.co.ke Portal and our support will gladly assist you in generating the Presumptive Tax Payment Slip for your Business.

-

M-Pesa Mobile Number

The other requirement that you need to have with you is the M-PESA Mobile Number. The M-PESA Number will serve as the main method of Payment for Presumptive Tax. So, with the M-PESA Mobile Number, we are going to use the KRA Paybill Number 572572 to make Presumptive Tax Payment in Kenya for the business.

Now that you have with you the two key requirements that are needed in the process of Presumptive Tax Payment in Kenya, we can head towards into the homestretch and look at How To Pay Presumptive Tax in Kenya. We shall look at the step by step processed that all taxpayers need to follow on How To Pay Presumptive Tax Using KRA Paybill Number 572572.

How To Pay Presumptive Tax Using KRA Paybill Number 572572

Step 1: Go To M-PESA Sim Toolkit

The first step will involve you accessing your M-PESA Sim Toolkit on your Sim Card so as to be able to use the Safaricom M-PESA. This is as illustrated below.

Step 2: Go to Lipa na M-Pesa

Next, you will click on the M-PESA menu, then click on Lipa na M-PESA from the options that appear. This is as illustrated below.

Step 3: Select Paybill

Once you have clicked on Lipa na M-PESA, you will now need to click on Paybill. This is as shown in the screenshot below.

Step 4: Enter Business Number: 572572

Next, you will need to enter the KRA Paybill Number. The Paybill Number for Kenya Revenue Authority (KRA) is 572572. First you will see the Enter Business Number option and next you will click on it and enter the KRA Paybill Number which is the Business Number. This is as illustrated below.

- Click On Business Number

- Enter Business Number

Step 5: Enter Account Number: 202020***********5 (Payment Registration Number is the Account Number)

In this step, you will need to enter the Payment Registration Number (PRN) that appears on the Presumptive Tax Payment Slip. The PRN will serve as the account number. This is as shown below.

Step 6: Enter the amount: Kshs. ***** (As Displayed On The Presumptive Tax payment Slip)

Next, you will enter the amount of Presumptive Tax that your business needs to pay to Kenya Revenue Authority (KRA). This amount should be the same as the one displayed on the Presumptive Tax Payment Slip. This is as illustrated below.

Step 7: Enter your M-PESA PIN and Confirm the Details

In this step, you will need to enter your M-PESA PIN so as to authorize the Turnover Tax Payment to Kenya Revenue Authority (KRA) as shown below.

If you have successfully entered your M-PESA PIN and confirmed the payment details and clicked on the send option, the Presumptive Tax amount will be sent to Kenya Revenue Authority (KRA) for that specific account number (PRN) for your business in Kenya. Once you paid the Kshs. ****** Presumptive Tax Payment, you will get a notification from M-PESA and KRA confirming payment for the same. That will serve as the final confirmation that you have paid the KRA Presumptive Tax using KRA Paybill Number 572572. You should be able to receive two messages i.e. from M-Pesa and from KRA through ELMA.

- M-Pesa Message

OB******TX Confirmed. Kshs. *****.** sent to Kenya Revenue Authority for account 20202*********5 on 15/3/20 at 4:00 PM.

- KRA Message (ELMA)

Dear customer, we confirm your payment Ref OB******TX for E-Slip No. 20202*********5 of KES *****.** has been received on 14/03 16:00 by KRA.

The above two messages serve as a confirmation that your Payment for Presumptive Tax has been successfully received by Kenya Revenue Authority (KRA). That will mark the successful end of Presumptive Tax Payment using KRA Paybill Number 572572. If you need any help or assistance on How To Pay Presumptive Tax in Kenya, you can subit your order online here at Cyber.co.ke Portal and we shall gladly assist you on the same.

READ ALSO: How To Print KRA PIN Certificate Using KRA iTax Portal

The above steps sum up the process of Presumptive Tax Payment in Kenya using the KRA Paybill Number 572572. Just as a reminder, to be able to pay Presumptive Tax for your business in Kenya, you need to ensure that you have with you the Presumptive Tax Payment Slip which is the main point of reference in the process of paying Presumptive Tax in Kenya. So, next time you need to Pay Presumptive Tax in Kenya, just follow the above steps on How To Pay Presumptive Tax Using KRA Paybill Number 572572.