Get to know How To Confirm The Validity Of KRA PIN Using iTax PIN Checker. Check for KRA PIN using the KRA iTax PIN Checker today.

Having a KRA PIN Number is one thing, conforming whether that KRA PIN Number is valid or not is another task. Most taxpayers don’t know the steps that they should take in confirming the validity of a KRA PIN.

In this article, I am going to share with you the step by step guide on how to confirm whether a KRA PIN is valid or not using the iTax KRA PIN Checker functionality on iTax Portal. We are going to look at the steps to take when you need to confirm a KRA PIN Number using iTax PIN Checker on the KRA iTax Portal.

READ ALSO: How To Confirm The Validity Of KRA Tax Compliance Certificate

Before we go any further, we need to define a very important term that article is focusing on in depth. We need to understand what iTax PIN Checker means in relation to a KRA PIN Number.

The iTax PIN Checker plays a very important role on the KRA Portal. We all know that having a KRA PIN is one thing, but sometimes, you also need to check and check whether the KRA PIN that you have is valid or not, and that has been simplified by the iTax PIN Checker functionality on the KRA Portal or simply iTax Portal.

If by any chance you have forgotten your KRA PIN Number, you can request for KRA PIN Retrieval using Cyber.co.ke Portal. Our team will work on your KRA PIN Retrieval request and send you the KRA PIN Number together with the KRA PIN Certificate to the email address that you prefer. That will surely make it easier for you to use the iTax PIN Checker with much ease and convenience.

What is iTax PIN Checker?

The iTax PIN Checker is a functionality on iTax Portal that allows you to confirm whether or not a particular KRA PIN Number is Genuine (Valid) or Not Genuine (Invalid). A Genuine KRA PIN Number is generated by the Kenya Revenue Authority (KRA) Domestic Taxes Department System and is in Active Status.

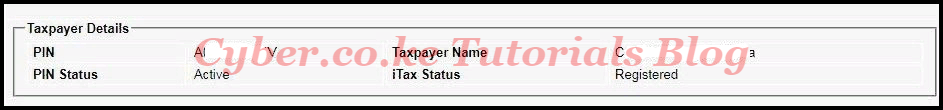

You need to take note that the iTax PIN Checker results is limited to only the basic details of the Taxpayer i.e Taxpayer Details and Obligation Details. We need to understand what each of the two details means and what each entails.

KRA PIN Taxpayer Details

This is the first part of the iTax PIN Checker results. The Taxpayer Details is comprised of the KRA PIN Number of the Taxpayer, Taxpayer Name, KRA PIN Status and iTax Status.

KRA PIN Obligation Details

The second part of the iTax PIN Checker results is the Obligation Details. This comprises of the Obligation Name, Current Status, Effective From Date and Effective To Date.

The above two form the backbone of the KRA iTax PIN Checker Results on iTax Portal. If a KRA PIN is genuine the the above two fields ie. Taxpayer Details and Obligation Details will be populated in the results. If the KRA PIN is Invalid, no PIN Checker Results Details will be shown.

Now, we need to know what is needed before using the iTax KRA PIN Checker to confirm whether a KRA PIN is Valid or Invalid.

What Do You Need For You To Use The iTax PIN Checker?

There is only one requirement that you need for you to use the KRA iTax PIN Checker Functionality on KRA iTax Portal. For use to use the iTax KRA PIN Checker, you need to have your KRA PIN Number. If you dont know or have forgotten your KRA PIN, you place and submit KRA PIN Retrieval order online at Cyber.co.ke Portal and have your KRA PIN Number Retrieved and sent to your Email Address.

On the other hand, if you are looking to have a new KRA PIN Number, you can place and submit your KRA PIN Registration order at Cyber.co.ke Portal and our support team will work on your order and send to your Email Address a new KRA PIN Certificate today.

Reasons Why You Need To Confirm Your KRA PIN Number Using KRA iTax PIN Checker

There are three core reasons why you need to use the iTax Portal PIN Checker. These includes: PIN Status, iTax Status and Obligation Name. Let us look at what each one entails in brief.

- PIN Status: The PIN Status results helps you know whether your KRA PIN is Active or Inactive.

- iTax Status: The iTax Status results helps you know whether your KRA PIN is on iTax or Not yet Updated on iTax Portal.

- Obligation Names: The Obligation Names results helps you know what type of KRA Tax Obligation that you are Registered under i.e Income Tax Resident Individual.

Now that we have addressed all the important aspects of the KRA iTax PIN Checker, we can now begin the process of How To Confirm The Validity Of KRA PIN Using iTax PIN Checker.

How To Confirm The Validity Of KRA PIN Using iTax PIN Checker

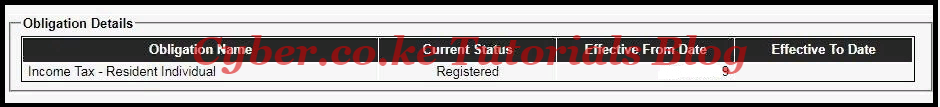

Step 1: Visit KRA Portal

The first step involves accessing the KRA iTax Web Portal using the link provided in the above description. The illustration below shows the KRA iTax homepage.

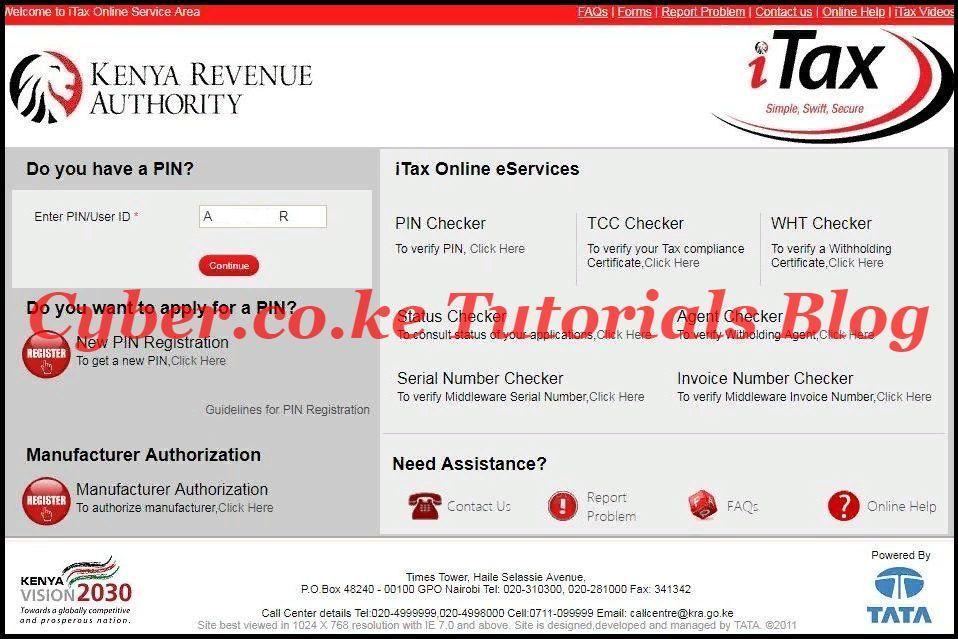

Step 2: Under iTax Online eServices, click on PIN Checker

Next, under the iTax Online eServices title, click on “PIN Checker.” This is as shown in the illustration below.

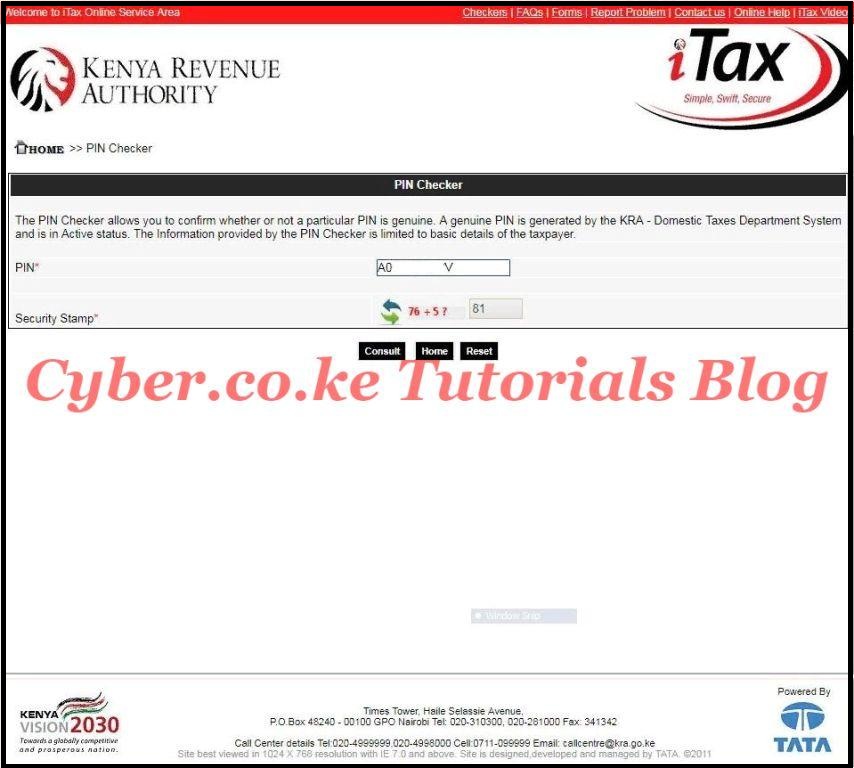

Step 3: Enter KRA PIN Number and Solve Arithmetic Question (Security Stamp)

In this step, you are required to enter your KRA PIN Number and solve the Arithmetic Question (Security Stamp).

Step 4: iTax PIN Checker Results

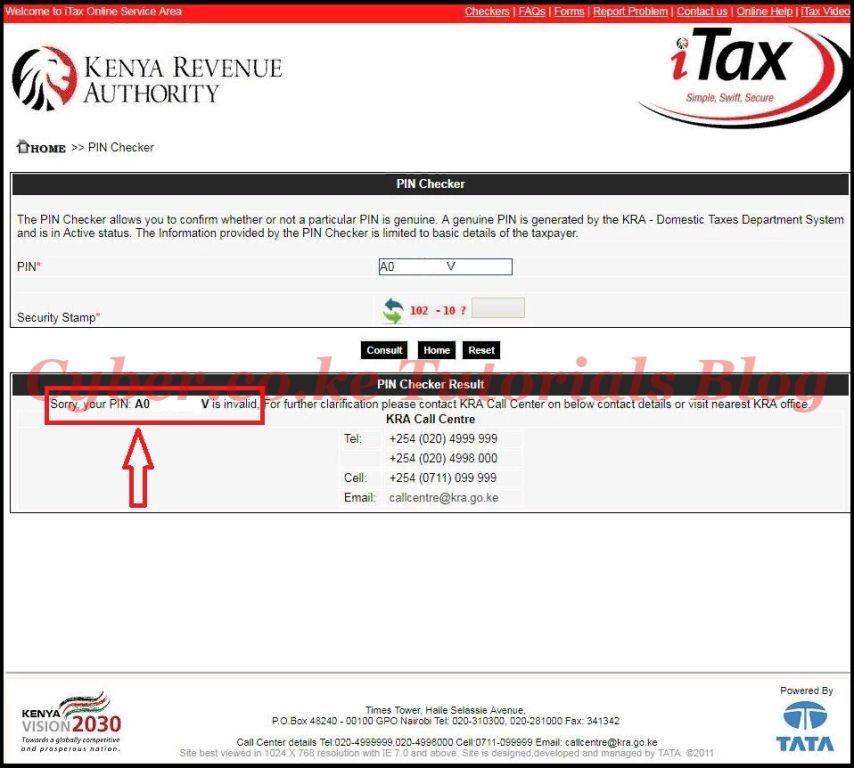

This is the last step in the process of confirming whether or not a KRA PIN Number is Valid or Invalid. As I had explained above, if the KRA PIN is valid, the both the Taxpayer Details and Obligation Details will be shown in the PIN Checker Results Page. This is as illustrated below.

You need to take note of the two highlighted sections: PIN Status and iTax Status. As explained earlier above, the PIN Status shows whether a KRA PIN is Active or Inactive while the iTax Status shows whether a KRA PIN is Registered on iTax or Not.

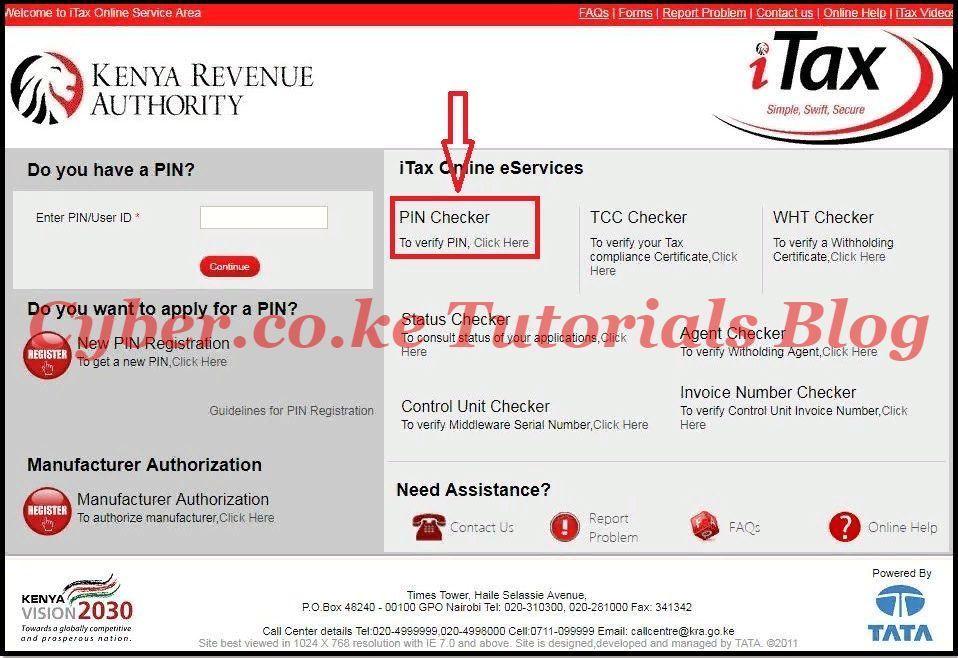

The two sections serve as the main parts that confirms whether a KRA PIN is Valid or Invalid. For an Invalid KRA PIN Number, the iTax KRA PIN Checker results don’t display both the Taxpayer Details and the Obligation Details. This is as shown in the illustration below.

READ ALSO: How To Reprint KRA PIN Certificate On KRA iTax Portal

As you can see from the above illustration, no details will be loaded or shown if the KRA PIN is Invalid. So, next time you need to confirm the validity of a KRA PIN Number, you can follow the above steps on How To Confirm The Validity Of KRA PIN Using iTax PIN Checker.