Learn How To Confirm The Validity Of KRA Tax Compliance Certificate using KRA Tax Compliance Certificate Checker (TCC Checker) on iTax Portal.

The need for confirming whether or not a KRA Tax Compliance Certificate is valid or invalid is very crucial. This is especially in cases whereby the Tax Compliance Certificate is needed for purposes of tax compliancy by a tax payer.

In this article, I am going to share with you the steps that are involved in confirming whether a KRA Tax Compliance Certificate in Valid or Invalid using the iTax TCC Checker on KRA iTax Portal. As usual, before we dive any further into this article, we need to lay down some basic terminologies that includes the following:

READ ALSO: How To Reprint KRA PIN Certificate On KRA iTax Portal

The KRA Tax Compliance Certificate (TCC) is a document that is issued to compliant taxpayers by Kenya Revenue Authority (KRA). In the context of “Compliant Taxpayers” meaning those who have filed both their Employment Income Tax Return and also the Nil Income Tax Returns.

KRA Tax Compliance Certificate is one of those documents that you will need when applying for a Job in Kenya, Applying for Tenders in Kenya and any other form of business transaction that will require the document. This document is generated by iTax Portal and is sometimes referred to as the KRA iTax Tax Compliance Certificate

The KRA Tax Compliance Certificate (TCC) is a document that is issued to compliant taxpayers by Kenya Revenue Authority (KRA). In the context of “Compliant Taxpayers” meaning those who have filed both their Employment Income Tax Return and also the Nil Income Tax Returns.

What is KRA Tax Compliance Certificate Checker (TCC Checker)?

KRA Tax Compliance Certificate Checker (TCC Checker) is a functionality on iTax Portal that allows you to confirm the validity of a Tax Compliance Certificate (TCC). By entering a genuine and valid TCC Number, the system will generate and display the KRA PIN, Name of the Holder and the TCC Status.

Now that we have laid down the foundation by defining the two important aspects in this article i.e Tax Compliance and Tax Compliance Certificate Checker, we can dive deeper into this article. If you need to get your Tax Compliance Certificate online, you can check our previous article on How To Apply for KRA Tax Compliance using iTax Portal.

In that article, I have shared all the steps that you need to follow when applying for KRA Tax Compliance Certificate on iTax Portal. It will help you know How To Apply for Tax Compliance Certificate in Kenya. It is a detailed Tax Compliance Certificate Application detailed procedures and steps that ensure your KRA Tax Compliance Certificate Application gets approved easily.

KRA Tax Compliance Certificate is one of those documents that you will need when applying for a Job in Kenya, Applying for Tenders in Kenya and any other form of business transaction that will require the document. This document is generated by iTax Portal and is sometimes referred to as the KRA iTax Tax Compliance Certificate

Requirement for Confirming Validity of Tax Compliance Certificate

We need to look at the requirements needed in the process of confirming whether or not a KRA Tax Compliance Certificate is valid or invalid. The main requirement that is needed in this process is:

-

Tax Compliance Certificate Number

We need to understand what we mean by Tax Compliance Certificate Number in relation to the TCC Document. You will need the Certificate Number for the process of confirming the validity of that KRA Tax Compliance Certificate.

What is Tax Compliance Certificate Number?

The Tax Compliance Certificate Number is a 16 digits/characters unique identifier that confirms the Tax Compliance Certificate (TCC) in the KRA Systems. The Tax Compliance Certificate Number comprises of 6 alphabetical identifier at the beginning and 10 numerical digits, thus forming the 16 characters long TCC Number.

The TCC Number is located at the top right hand side of the Tax Compliance Certificate just underneath the Certificate Date and below it the bar code strips.

Now that we know what we need to check the validity of a KRA TCC, we can proceed and learn the steps involved on How To Confirm The Validity Of KRA Tax Compliance Certificate using the iTax TCC Checker.

How To Confirm The Validity Of KRA Tax Compliance Certificate

Step 1: Visit KRA Portal

The first step involves accessing the KRA iTax Web Portal using the link provided in the above description. The illustration below shows the KRA iTax homepage.

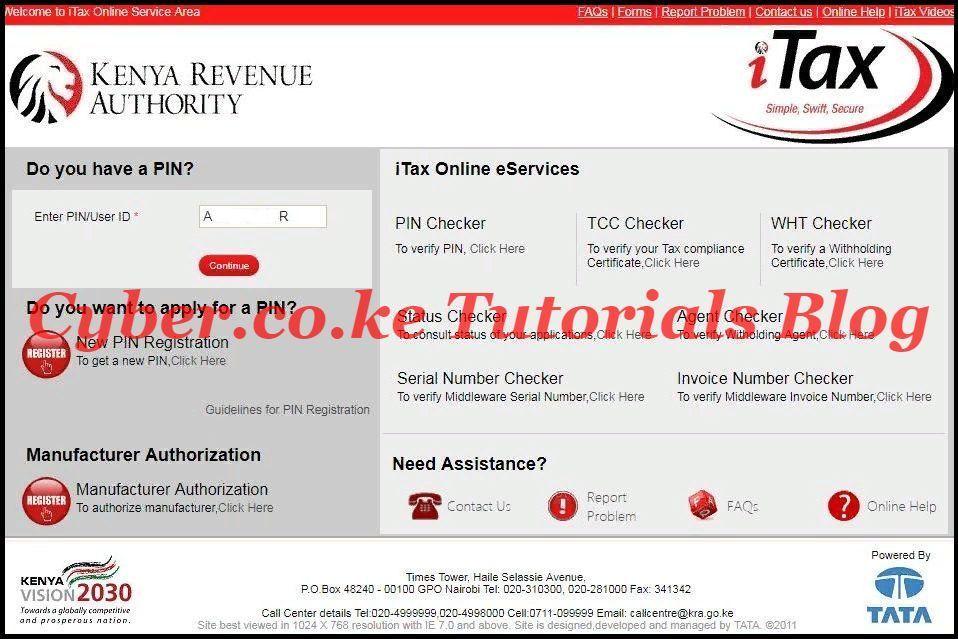

Step 2: Under iTax Online eServices, click on TCC Checker

In this step, just underneath the iTax Online eServices, click on the TCC Checker. This is as illustrated in the screenshot below.

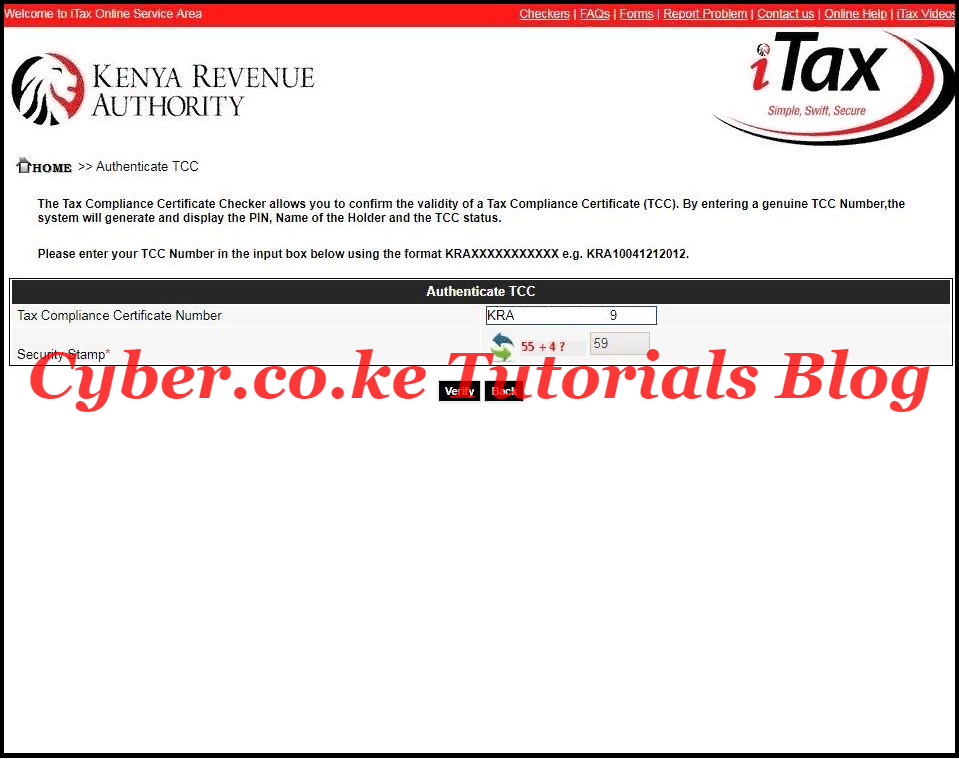

Step 3: Enter Tax Compliance Certificate Number

In this step, you will be required to enter the 16 digits Tax Compliance Certificate Number so as the authenticate the TCC on the KRA iTax Systems.

Once yu have enter your TCC Number and solved the arithmetic question (Security Stamp), click on the “Verify” button.

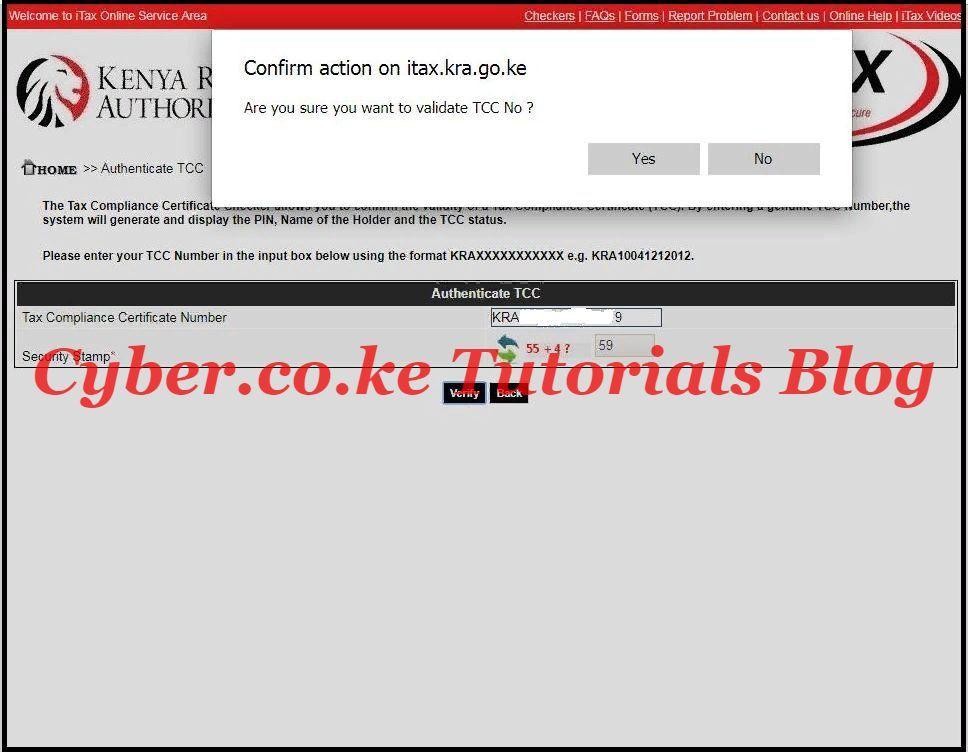

Step 4: Confirm action on itax.kra.go.ke

Once you click on the “Verify” button as illustrated in Step 3, a pop up will display asking you to “Confirm action on itax.kra.go.ke” portal. This simply asks you if you are sure you want to validate the TCC Number on iTax Portal. Click on the “Yes” button to validate the KRA Tax Compliance Certificate Number.

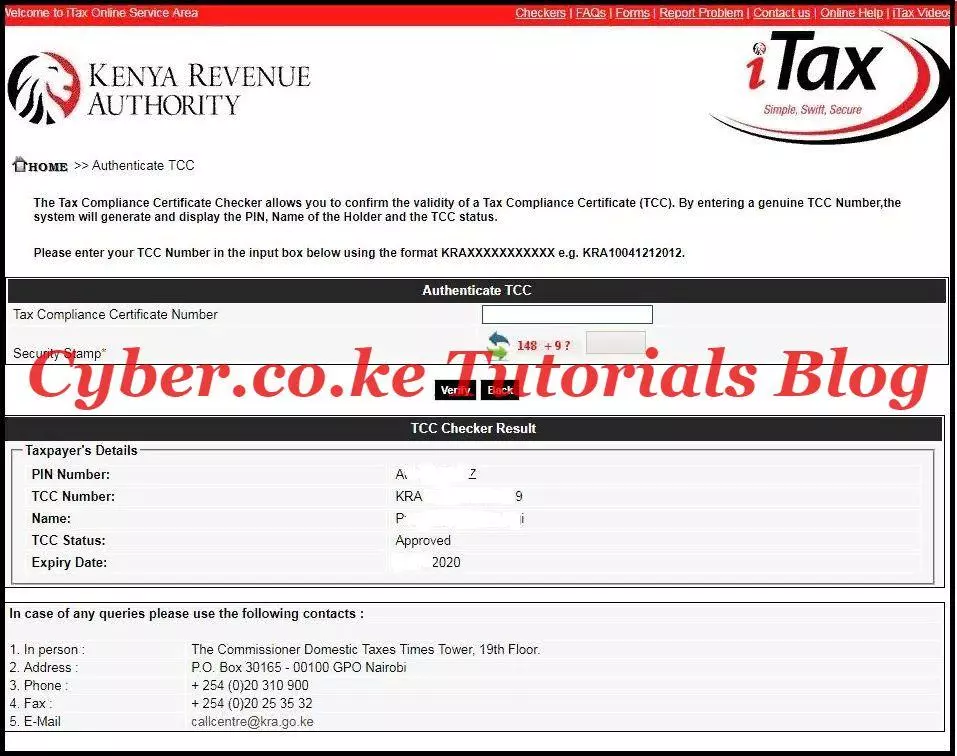

Step 5: View KRA TCC Checker Results

This is the last step in the process of confirming the validity of a TCC on iTax Portal. This is the step whereby the TCC Checker results will be displayed. The TCC Checker Results will show the Taxpayer Details i.e PIN Number, TCC Number, Name, TCC Status and Expiry Date. This is as illustrated below:

Let me now explain what the KRA TCC Checker Results entails. You need to take note that the tax compliance results contains details of the taxpayer. This is as elaborated below:

PIN Number: This is the KRA PIN Number of the Taxpayer.

TCC Number: This is the Tax Compliance Certificate Number.

Name: This is the Name(s) of the Taxpayer.

TCC Status: This is the status of the Tax Compliance Certificate (Approved).

Expiry Date: This is the dated that the Tax Compliance Certificate is supposed to expire in. The period of the KRA Tax Compliance is normally 12 months (1 year).

If you authenticate a KRA Tax Compliance Certificate on iTax using the TCC Checker and it loads the results as shown above with an “Approved” TCC Status, then that Tax Compliance Certificate is VALID.

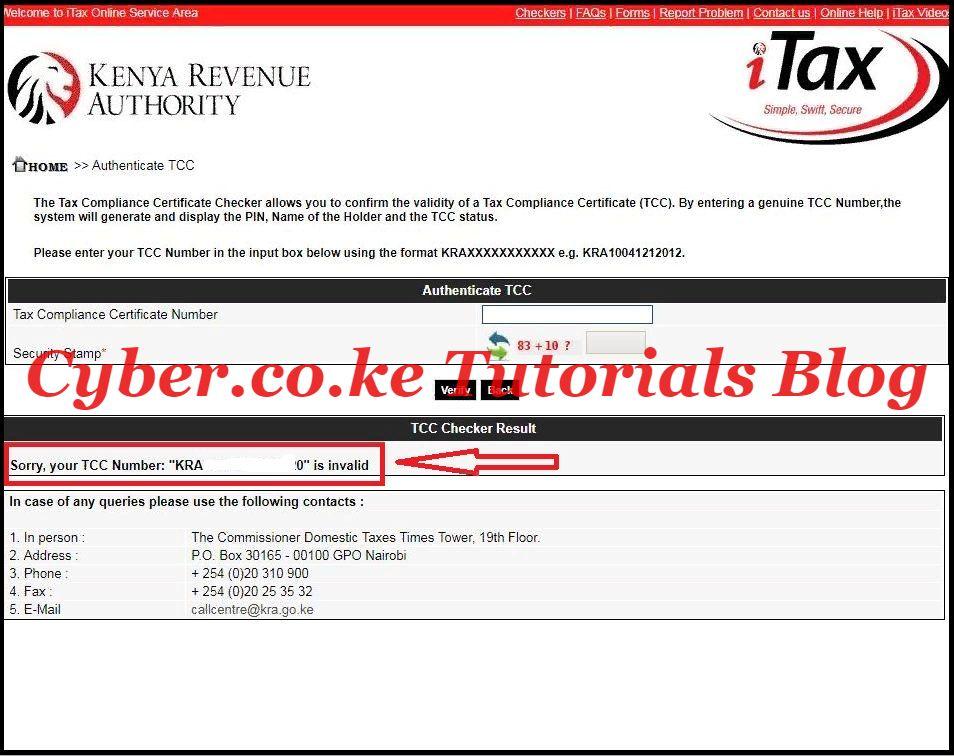

If the TCC shows “APPROVED” in the TCC Status section, then this simply means that the Tax Compliance Certificate is “VALID / GENUINE.” If the TCC has expired, then the TCC Status status field will show “EXPIRED” status. If the TCC is “INVALID / NOT GENUINE” the TCC Checker Results will not show any taxpayer details only the message “Sorry, your TCC Number” KRA************0 is invalid.” If you get that message when trying to validate a Tax Compliance Certificate, that simply means it is not valid at all. This is as shown below:

READ ALSO: How To Find The KRA Email Address Used On KRA iTax Portal

To sum up everything, always remember that providing the right documents is very essential. Don’t take shortcuts thinking that the TCC that you are using to apply for either a job or tender can’t be verified. Most of the times, the TCC has to be verified. So, if you are in doubt, you can always follow the above procedures to confirm the validity of your KRA Tax Compliance Certificate in Kenya today.