Filing of KRA Returns online applies to every individual in Kenya who has a KRA PIN Number whether employed or not employed. This means that if you are Unemployed, you are required to file your KRA Returns online using KRA Portal (iTax Portal). The old-age notion that KRA Returns are filed by employees is not correct, rather as long as you have an active KRA PIN Number regardless of your employment status in Kenya, you are supposed to file KRA Returns before the elapse of the deadline set by Kenya Revenue Authority (KRA).

The category of Kenyans who are unemployed are supposed to file KRA Returns for Unemployed which is also commonly referred to as KRA Nil Returns or Nil Returns. So, always remember that even though you might not be employed, you need to file KRA Returns for Unemployed online using iTax Portal (KRA Portal). Failure to file KRA Returns normnally attracts a penalty of Kshs. 2,000/= per year not filed or for late filing of KRA Returns after the elapse of the set deadline of 30th June of each year.

To be able to file KRA Returns for Unemployed online, there are a set of two key requirements that you need to ensure that you have with you. This includes the KRA PIN Number and KRA Password (iTax Password). These two form part of the login credentials that you need to use so as to be able to access your KRA Portal (iTax Portal) account and file your KRA Returns for Unemployed online quickly and easily.

READ ALSO: How To Get Tax Compliance Certificate Online (In 5 Steps)

Requirements Needed In Filing KRA Returns for Unemployed Online

To be able to file KRA Returns for Unemployed online using KRA Portal (iTax Portal), you need to have with you both the KRA PIN Number and KRA Password (iTax Password) which are needed so as to be able to login to your account and file your KRA Returns. Below is a brief description of what each of these requirements entails in raltion to filing KRA Returns for Unemployed.

-

KRA PIN Number

The KRA PIN Number is the most important requirement that you need to have with you when you want to login to KRA Portal (iTax Portal) so as to be able file KRA Returns for Unemployed online. If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

-

KRA Password (iTax Password)

The next requirement that you need to have with you in the process of filing KRA Returns for Unemployed on iTax Portal (KRA Portal) is your KRA Password (iTax Password), which you will need to access your KRA Portal account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for KRA Password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at CYBER.CO.KE and have your Email Address changed so as to enable your Reset KRA Password.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To File KRA Returns For Unemployed Online (In 6 Steps)

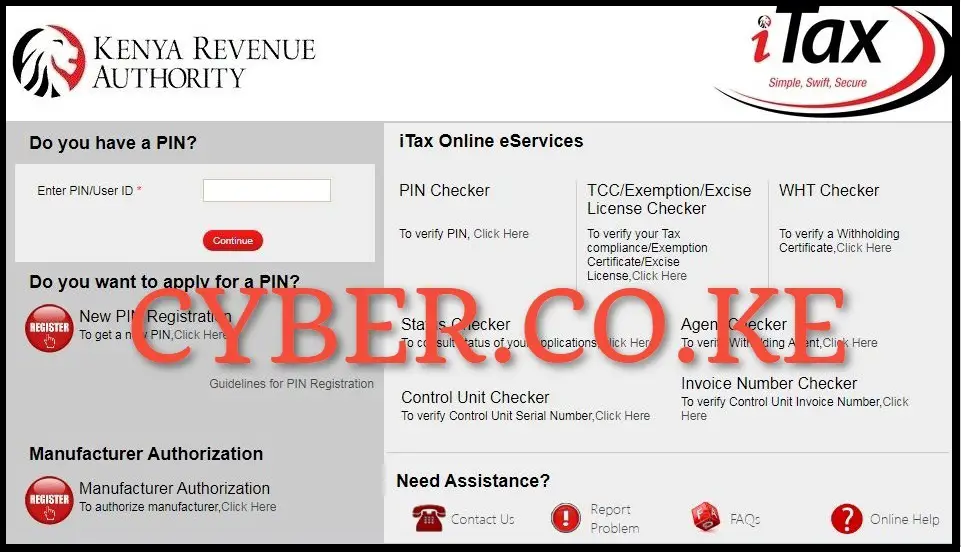

Step 1: Visit KRA Portal

The first step in the process of filing KRA Returns for Unemployed online is to visit KRA Portal using https://itax.kra.go.ke/KRA-Portal/

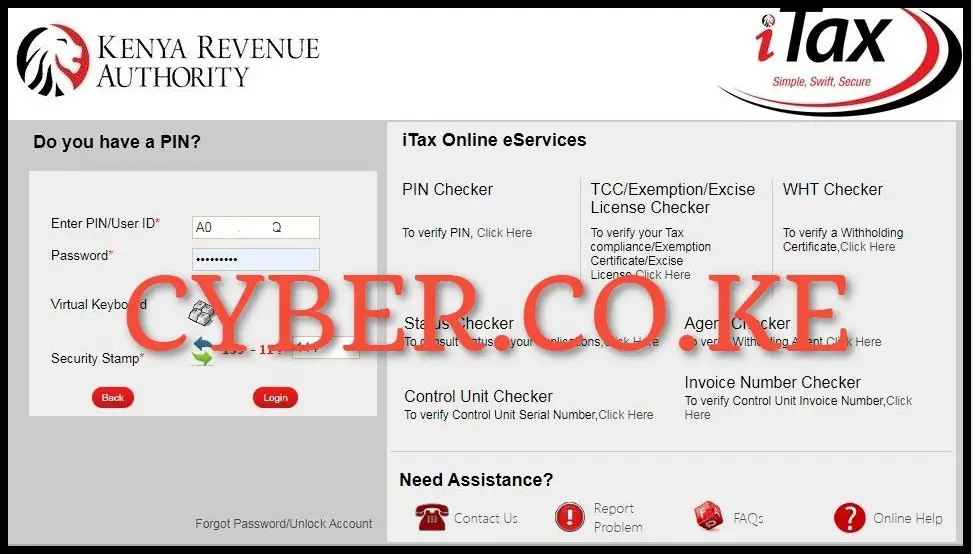

Step 2: Login to KRA Portal

Next, using both your KRA PIN Number and KRA Password (iTax Password), solve the arithmetic question (security stamp) and click on the “Login” button.

Step 3: Click on Returns then File Nil Return

Once you are logged into your iTax account, on the top menu, click on “Returns” and from the drop down menu list, click on “File Nil Return” to begin the process of filing KRA Returns for Unemployed online.

Step 4: Select KRA Tax Obligation

Next, you need to select the KRA Tax Obligation that you want to file the Returns for. In our case, since we are filing KRA Returns for Unemployed, we select the KRA Tax Obligation as “Income Tax – Resident Individual” after selecting, click on the “Next” button.

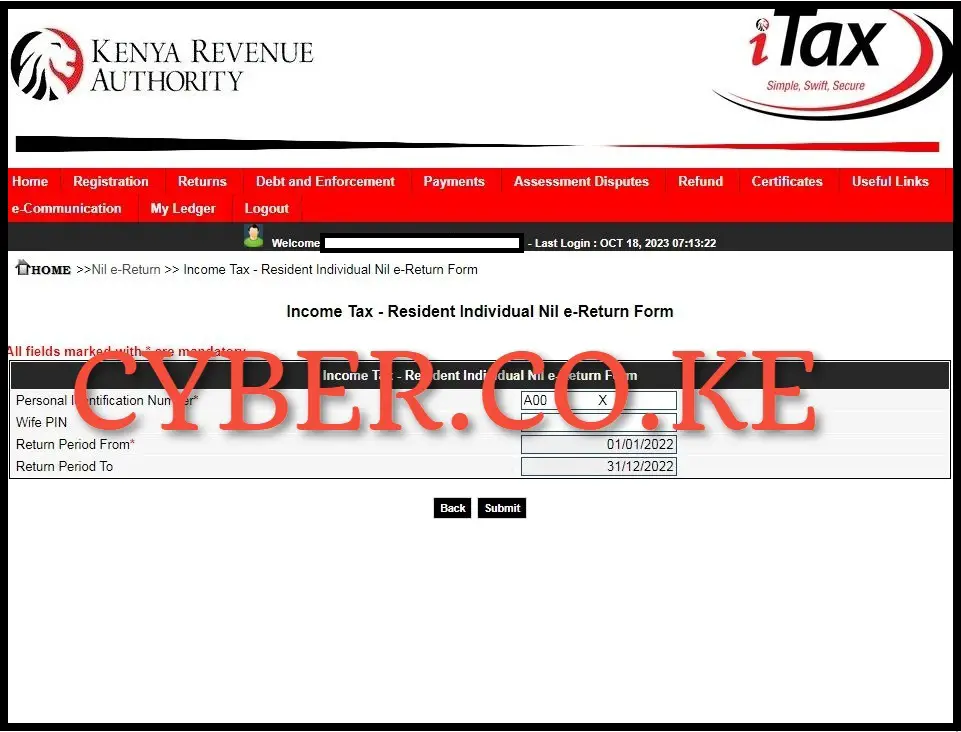

Step 5: Income Tax – Resident Individual Nil e-Return Form

In this step, you just need to enter the Return Period From which will then auto-populate the Return Period To. Take note that this happens only if your KRA Returns filing are up to date. So, in our case we put the Return Period From as 01/01/2022 which will set the Return Period To as 31/12/2022 afterwards, click on the “Submit” button.

Step 6: Download KRA Returns Acknowledgement Receipt

The last step in the process of filing KRA Returns for Unemployed involves downloading the generated KRA Returns Receipt or simply the KRA Returns Acknowledgement Receipt which confirms that you have successfully filed KRA Returns for Unemployed online using KRA Portal (iTax Portal). To download the KRA Returns Receipt, just click on the “Download Returns Receipt” text link to save the KRA Returns Acknowledgement Receipt on your device and even print a copy of the KRA Returns Receipt.

READ ALSO: How To File KRA Returns For Students Online (In 6 Steps)

The above 6 steps sums up the process that unemployed individuals in Kenya need to follow in order to file their KRA Returns online quickly and easily. The important thing you need to take into consideration is that you need to have both your KRA PIN Number and KRA Password (iTax Password) which are essential in the process of filing KRA Returns for Unemployed online in Kenya. Once you have these two, you can follow the above 6 steps so as to be able to file your KRA Returns for Unemployed easily.