Get to know How To Generate KRA Advance Tax Payment Slip Using iTax. Generate Advance Tax Slip for public service vehicle or commercial vehicle in Kenya.

This is one of a two part blog series under Advance Tax that I will be sharing with you. The first part (Part 1) being How To Generate KRA Advance Tax Payment Slip Using iTax while the second part (Part 2) being How To Make KRA Advance Tax Payment via Bank.

Before we begin, we need to set the ground rules by looking at the three most commonly asked questions about Advance Tax.

- What is Advance Tax?

- What are the Tax Rates for Advance Tax?

- When is Advance Tax Due?

- Is Advance Tax a Final Tax?

Now let us look at each one of them in brief descriptions for easier understanding.

What is Advance Tax?

You need to pay Advance Tax before taking your vehicle for Inspection at any of the National Transport and Safety Authority (NTSA) Inspection Centres countrywide. It is a requirement in Kenya for all public service vehicles (PSVs) and commercial vehicles.

What are the Tax Rates for Advance Tax?

The Tax Rates are grouped into two: Commercial Vehicles and Public Service Vehicles.

- For vans, pick-ups, trucks, prime movers, trailers and lorries; Kshs. 1,500 per ton of load capacity subject to a minimum of Kshs. 2,400 per year of income;

- For saloons, station-wagons, mini-buses, buses and coaches; Kshs. 60 per passenger capacity per month subject to a minimum of Kshs. 2,400 per year of income.

When is Advance Tax Due?

Advance Tax is due yearly i.e it is paid yearly everytime time you need to take your public service vehicle or commercial vehicle for Inspection by NTSA so that you can be issued with a Road Service Licence (RSL) sticker.

Is Advance Tax a Final Tax?

Advance Tax is not a Final Tax. Individuals who have paid any Advance Tax are required to declare the same in their individual income tax returns submitted yearly (by 30th June of each year) and pay any additional tax due. You have to declared the Advance Tax Credits in your yearly returns.

Now that we are done with explaining the nitty gritty of this type of tax, it is time to get down to the next phase i.e How To Generate KRA Advance Tax Payment Slip Using iTax. Below are the eight important things that you will need to have with you before you start:

- Your KRA PIN Number

- Your iTax Password

- The Vehicle Registration Number

- Type of Vehicle i.e Passenger Carrying Vehicles or Luggage Carrying Vehicles

- The Body Type of Vehicle

- The Make of Vehicle

- Passenger Capacity i.e for Public Service Vehicles (PSV) only

- Load Capacity (Tonnage) i.e. for Luggage Carrying Vehicles only

It is quite common that you might have forgotten either your KRA PIN Number or iTax Password. You can relax. Cyber.co.ke Portal got you covered.

If you have forgotten your KRA PIN Number, no need to worry. We’ve got you sorted. You can request for Retrieval online at Cyber.co.ke Portal. The KRA PIN will be Retrieved and sent to your email address.

If you have forgotten your iTax Password, you can check out this guide on How To Reset KRA iTax Password. The password will be sent to your email address. If you need the email address address on your KRA PIN to be changed, you can request for Change of Email Address online today at Cyber.co.ke Portal.

Now that we have all the required items at hand, we can begin the process. In this example, I am going to use a Public Service Vehicle (PSV) i.e I am going to generate the KRA Advance Tax Payment Slip for a Matatu. The process is still the same only prices will be different depending with the type of vehicle chosen. Now let us begin.

How To Generate KRA Advance Tax Payment Slip Using iTax

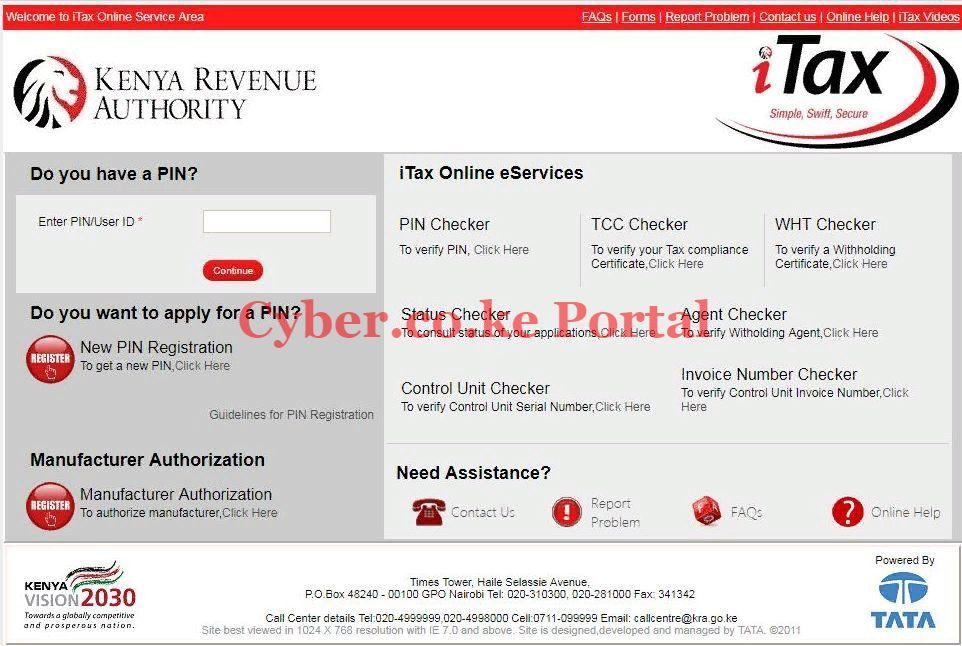

Step 1: Visit iTax Portal

The first thing you need to do is to visit KRA iTax Portal using the provided URL above.

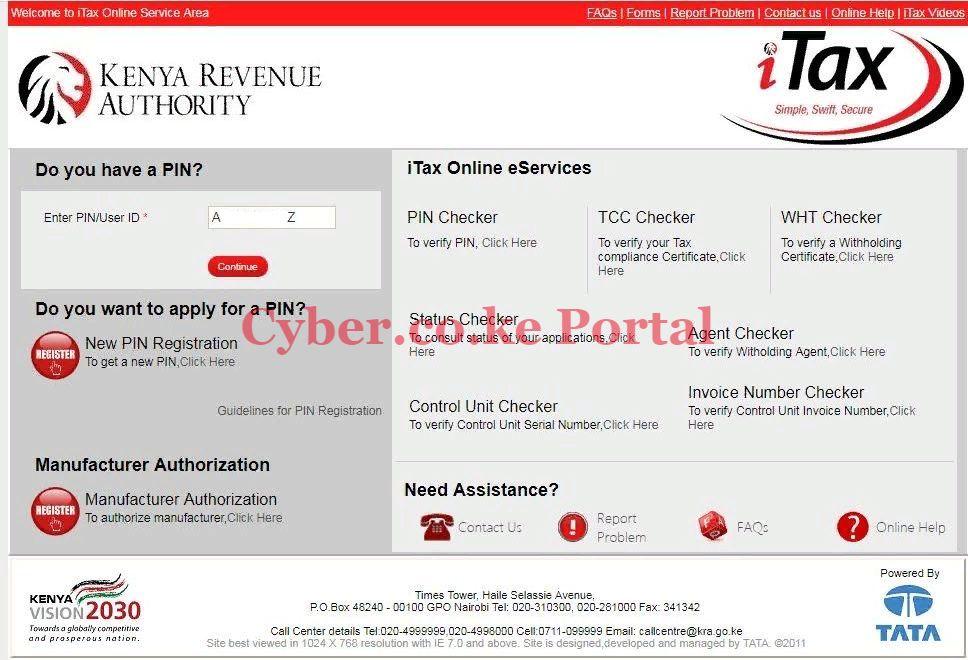

Step 2: Enter Your KRA PIN Number

The next step will be to enter your KRA PIN Number. Once you have entered your KRA PIN Number, click on the “Continue” button.

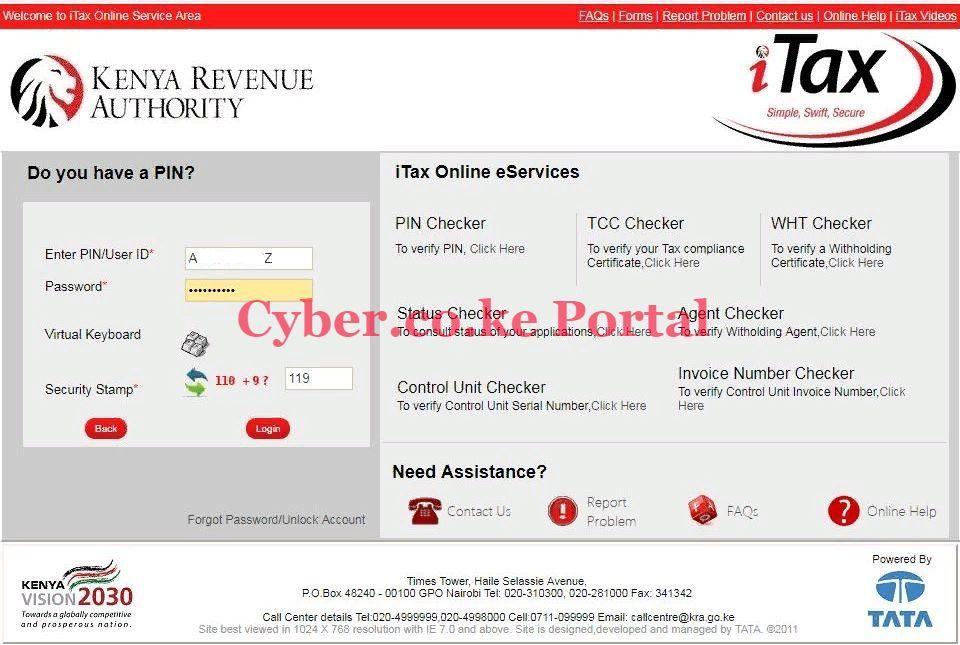

Step 3: Enter Your iTax Password and Security Stamp

In this step, you will be required to enter your KRA iTax Password and the Security Stamp (solve the arithmetic question). Then click on the “Login” button.

Step 4: Your iTax iPage Dashboard

Once you have successfully logged into your KRA iTax Account, you will be able to see your iTax Dashboard as shown below.

Step 5: Click on The Payments Tab then Payments Registration

The next thing you need to do is to move over and click on the Payments tab then followed by Payments Registration tab from the sub-menu dropdown category.

Step 6: iTax e-Payment

Once you have clicked on the Payment Registration tab, you will taken to the iTax e-Payment page. The fields at this section are pre-selected meaning there is nothing you do except just click on the Next button icon.

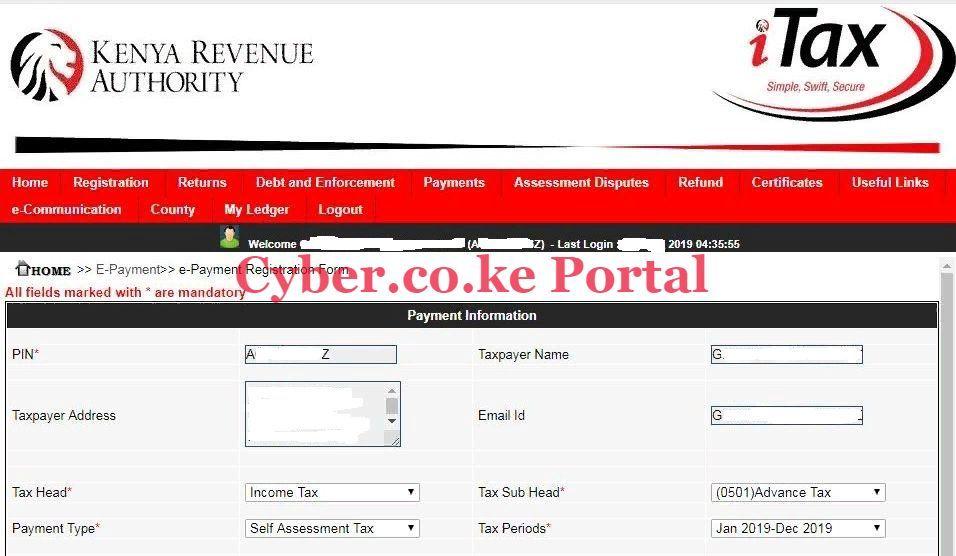

Step 7: iTax e-Payment Registration Form

This is the most important step in the process of generating the Advance Tax Payment Slip. This section has two parts i.e. payment information and how do you want to pay. You will note that the PIN, Taxpayer Name, Taxpayer Address and Email Id are already pre-filled by the system.

Your work in this step will be to select the Tax Head, Tax Sub Head and Payment Type fields on the e-Payment Registration Form. The following section applies to both the Passenger Carrying Vehicles and Luggage Carrying Vehicle.

- Tax Head — Income Tax

- Tax Sub Head — Advance Tax (0501)

- Payment Type — Self Assessment Tax

- Tax Period — Jan 2019 to Dec 2019 (in our case the vehicle goes for Inspection this year)

You can refer to the screenshot below:

Click on the “By Web Form” checkbox. (In our case we shall be using the web form option). Once you have selected the fields as shown above, we move to the next section of the iTax e-Payment Registration Form. This is the Advance Tax Details section.

Taking into consideration that in this example, we are generating the Advance Tax Payment Slip for a PSV (Matatu). You will fill in the fields depending on the type of vehicle that you are generating the Advance Tax for.

For PSV Matatus (in our case we are using a 14 seater matatu /mini bus), the following you will need to input the following fields:

- Type of Vehicle — Passenger Carrying Vehicle

- Vehicle Registration Number — K** ***Y

- Body Type — Mini Bus (Matatu)

- Make — Nissan

- Passenger Capacity — 14

- Amount Payable — Kshs. 10,080 (this pre-fills automatically when you have entered the above fields)

- Amount to be Paid — Kshs. 10,080

You can confirm the fields as shown below:

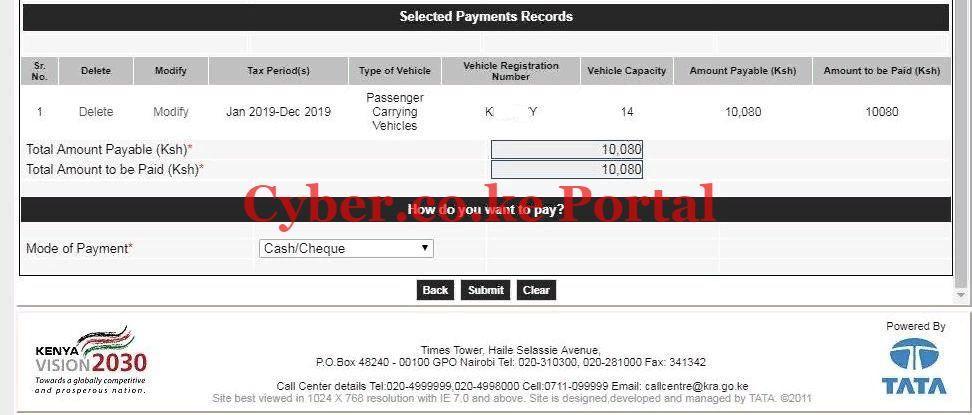

Once you have entered the amount to be paid, click on the “Add” button. It will load the Selected Payments Records. Move over to How do want to pay section i.e. Mode of Payment either Cash/Cheque or RTGS (Real Time Gross Settlement). Since we shall be paying the Advance Tax via Bank, we select the Cash/Cheque option. This is as shown below:

Once you have selected the Mode of Payment, click on the “Submit” button.

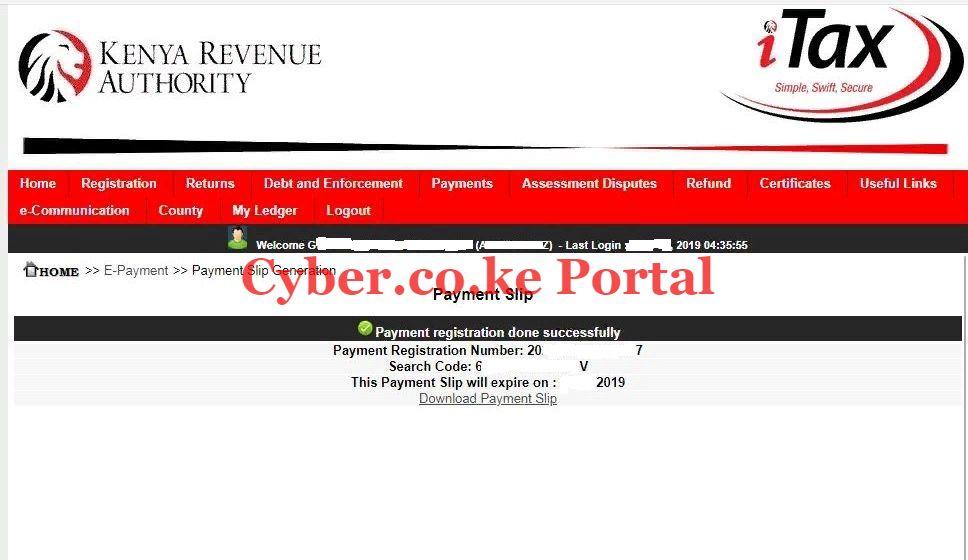

Step 8: Download The Generated Advance Tax Payment Slip

Now, this is the last step whereby you will need to download the generated Advance Tax Payment Slip. You will need this when you will be making the Advance Tax Payment at the Bank.

You will need to print the Advance Tax Payment Slip and have a copy of the same. The Advance Tax payment slip is valid for 30 days after which it will expire if you will not have made payment to the bank.

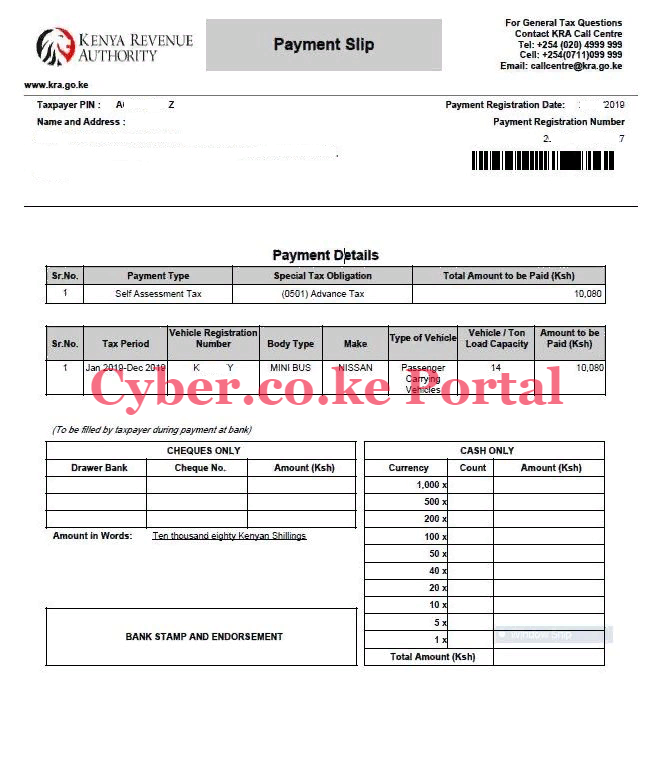

Below is a sample of the generated KRA Advance Tax Payment Slip.

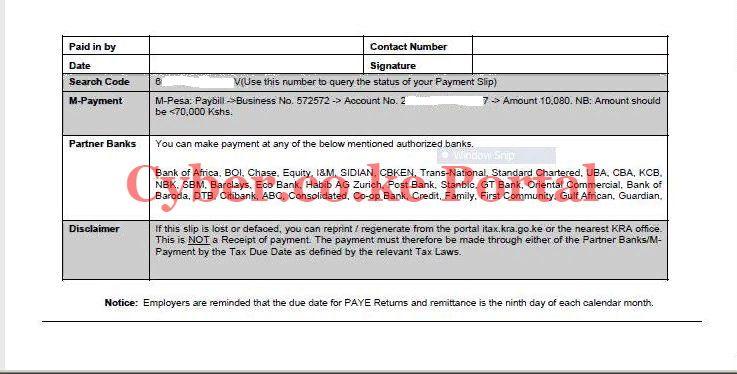

You need to take into account that the Advance Tax Payment slip comprises of two pages. The above is the first page (payment details) and below is the second page (bank details).

And that is How To Generate KRA Advance Tax Payment Slip Using iTax. Stay tuned for the next post where I will be sharing with you How To Make KRA Advance Tax Payment via Bank.