Learn How To Use KRA iTax PIN Checker Functionality On iTax Portal today. Get to know how to use the PIN Checker Functionality on KRA iTax Portal.

Confirming whether or not a KRA PIN Number is valid is not a daunting task thanks to the KRA iTax PIN Checker functionality on iTax Portal. Learning the steps that you should take in confirming the validity of a KRA PIN on iTax is quite simple.

In this article, I am going to share with you on how to use one of the KRA iTax functionality to confirm a KRA PIN Number. Kindly note that KRA iTax Portal has a wide range of functionalities that a taxpayer can use to query or perform a variety of tasks on iTax Portal.

READ ALSO: How To Access KRA Portal Using PIN Number And Password

Before we go any further, we need to understand what we mean by the term KRA iTax Functionality in relation to KRA iTax Portal. In this article we shall be referring to it as the PIN Checker Functionality on iTax Portal.

Just like any other portal on the internet, each has its core functionalities. With iTax, with functionalities are what enables the taxpayers to perform a variety of queries and applications. KRA iTax Functionality is the core backbone of the KRA iTax Portal.

Since we shall be covering on the PIN Checker iTax Functionality, the other Functionalities will be covered in future articles. I am just going to briefly highlight on what each of the above KRA iTax Functionalities entails.

What is KRA iTax Functionality?

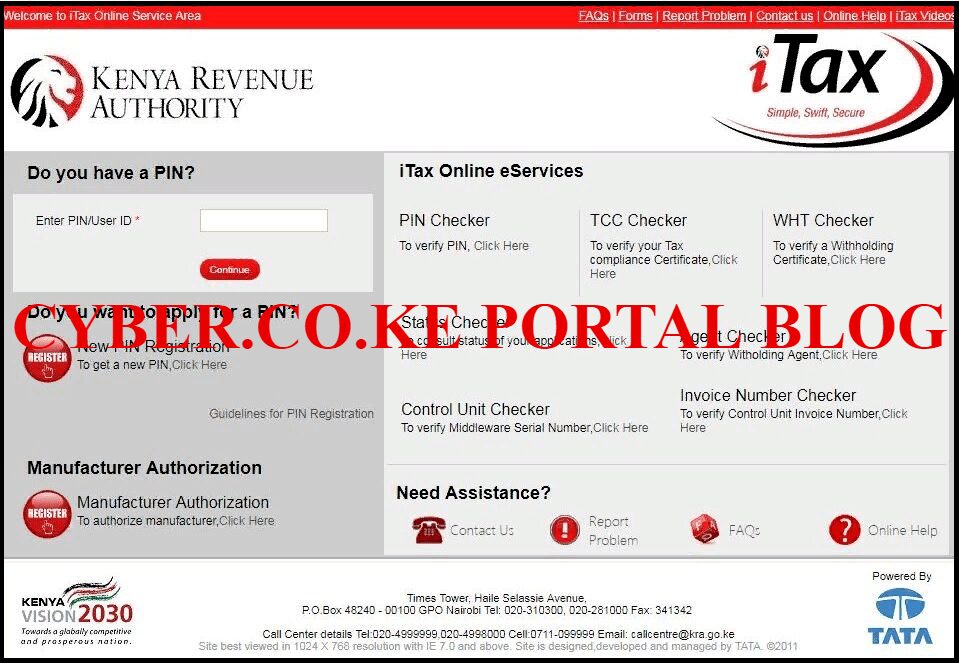

KRA iTax Functionality is a range of operations that a taxpayer can perform on the KRA iTax Portal. The most common iTax Functionality includes: PIN Checker, TCC Checker, WHT Checker, Status Checker, Agent Checker, Control Unit Checker and Invoice Number Checker. Below are the different types of functionalities on the iTax Portal:

-

PIN Checker:

The PIN Checker functionality on KRA iTax is used to confirm the validity of a KRA PIN Number on KRA iTax Portal. The PIN Checker allows you to confirm whether or not a particular PIN is genuine.

-

TCC Checker

The TCC Checker functionality on KRA iTax is used to verify Tax Compliance Certificate. The TCC (Tax Compliance Certificate) Checker allows you to confirm the validity of a Tax Compliance Certificate.

-

WHT Checker

The WHT Checker functionality on KRA iTax is used to verify a Withholding Certificate. With the Withholding Tax Checker, one is able to verify IT Withholding, VAT Withholding and MRI Withholding.

-

Status Checker

The Status Checker functionality on KRA iTax is used to consult and view status of your applications at Kenya Revenue Authority (KRA). It allows you to check the status of your applications such as Registration, Payments, Returns and even status of Reported of Problems.

-

Agent Checker

The Agent Checker on KRA iTax allows you to verify Withholding Agents on iTax. The Agent Checker allows you to identify authorized KRA Withholding VAT Agent or KRA Tenant Withholding Agent.

-

Control Unit Checker

The Control Unit Checker on KRA iTax allows you to verify Middleware Serial Number on iTax by entering the Control Unit Checker.

-

Invoice Number Checker

The Invoice Number Checker on KRA iTax allows you to verify Control Unit Invoice Number by entering the same on iTax Portal.

Now that we have briefly explained the what each of the most common iTax functionalities are. We now have to look at the main functionality that this article will be focusing on, and that is the KRA iTax PIN Checker functionality.

KRA iTax PIN Checker Requirements

For you to use the PIN Checker functionality on iTax Portal, you need to have with you your KRA PIN Number. If you are looking to get a new KRA PIN in Kenya, you can place an order online at Cyber.co.ke Portal for KRA PIN Registration services. Our support teams will work on your KRA PIN Registration order and send the KRA PIN Certificate to your email address.

On the other hand, if you don’t know or have forgotten your KRA PIN Number, you can retrieve it today by placing your KRA PIN Retrieval order online at Cyber.co.ke Portal. Our support teams will also work on your KRA PIN Retrieval and will send you the KRA PIN Number and also at the same time the KRA PIN Certificate.

Now that you have with you the most important requirement with you, it’s time to use it on the PIN Checker functionality on iTax KRA Portal.

How To Use KRA iTax PIN Checker Functionality On iTax Portal

Step 1: Visit iTax Portal

The first step that you need to take is to ensure that you visit the KRA iTax portal using the link provided above in the title.

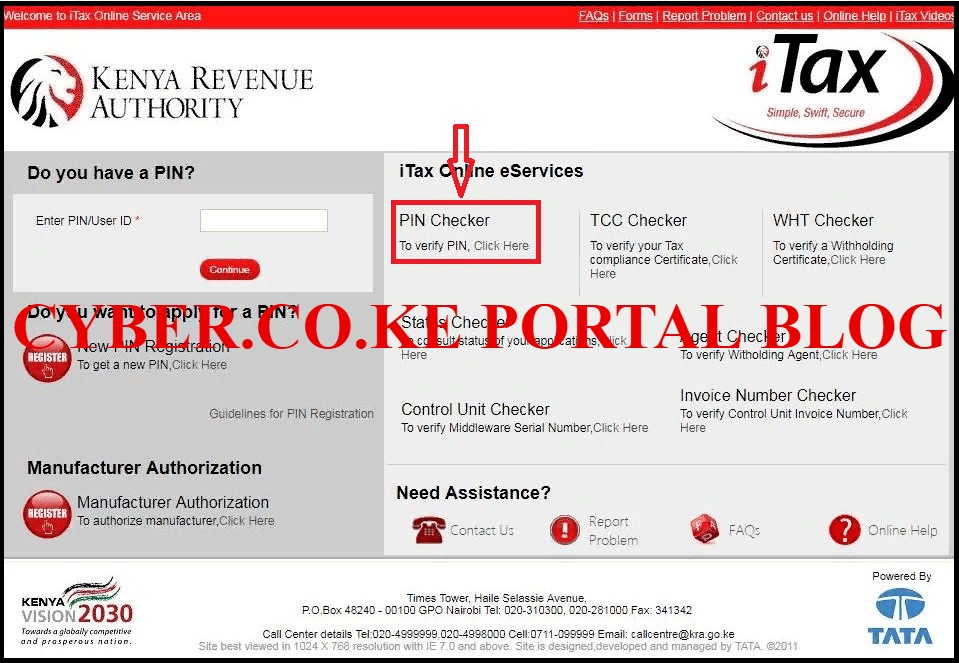

Step 2: Click on PIN Checker on KRA iTax Portal

Once you have successfully accessed the KRA Portal, you will need to click on the PIN Checker functionality. This is as illustrated below:

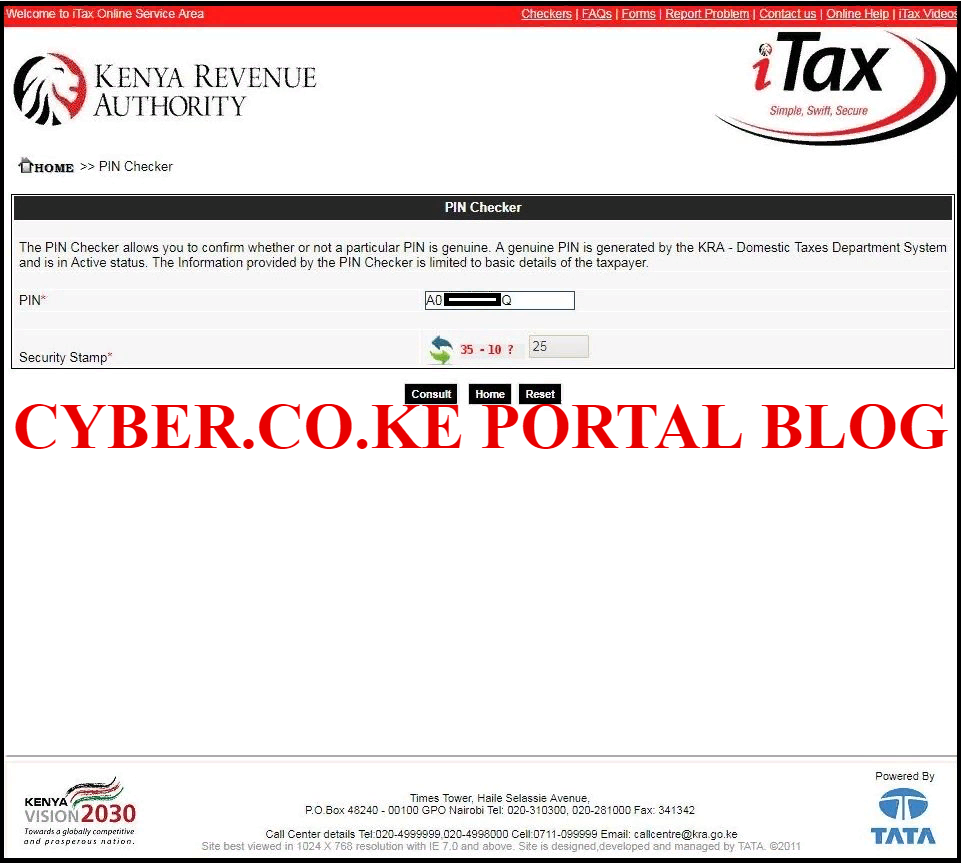

Step 3: Enter KRA PIN Number and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA PIN Number and also solve the arithmetic question (security stamp). If you don’t know or have forgotten your KRA PIN Number, you can submit KRA PIN Retrieval order here at Cyber.co.ke Portal and your KRA PIN Number will be sent to your Email Address. Once you have entered your KRA PIN and solved the arithmetic question, click on the “Consult” button. This is as illustrated below:

Step 4: KRA iTax Portal PIN Checker Results and Details

Once you have successfully validated your KRA PIN, the PIN Checker functionality will query the KRA PIN number against millions of other PIN numbers in the KRA Taxpayer Database, hence bringing out the PIN Checker Results (PIN Details).

Analysis of the KRA iTax PIN Checker Results

From Step 4 above, you can deduce from the PIN Checker results on iTax Portal that a valid KRA PIN Number is Active under the PIN Status and Registered or Updated in the iTax Status. Also the KRA PIN will display the obligations in which the KRA PIN is registered under in the KRA iTax Web Portal.

READ ALSO: How To Apply For Tax Compliance Certificate (Simplified Process)

You will see the Obligation Name, Current Status, Effective From Date and Effective To Date (normally remains blank). Those are the four basic steps that you will need to follow each time you want to validate a KRA PIN on iTax Web Portal. Just follow the quick step by step guide on How To Use KRA iTax PIN Checker Functionality On iTax Portal.