Do you need to confirm the validity of KRA Withholding Certificate on iTax Portal? Learn How To Verify KRA Withholding Certificate Using WHT Checker.

It is that time af the year whereby each Kenya is on a rush to file either KRA Nil Returns or KRA Employment Returns. For those in employment, the P9 Form is required and also the KRA Withholding Certificate if they had any Withheld Income for the year ended 31st December.

Getting to know How To Verify the KRA Withholding Certificate using the KRA WHT Checker is quite important i.e how a taxpayer can check the validity and authenticity of the Withholding Certificate on iTax.

READ ALSO: How To Check KRA PIN Certificate Email Address On iTax

In this article, I am going to share with you the step by step guide on How To Verify KRA Withholding Certificate Using WHT Checker. You will learn and get to know how to confirm whether a KRA Withholding Certificate is valid or not and also how to use the KRA WHT Checker Functionality on the KRA iTax Portal. You need to ensure that you are using the right and valid Withholding Certificate in the process of filing your KRA Returns using KRA iTax Portal.

If you have a Withholding Certificate, before you file your KRA Employment Returns using it together with your KRA P9 Form, you need to ensure that it valid and you can only do this by using the KRA WHT Checker Functionality on the KRA iTax Portal.

This article seeks to address key issues that are related to verifying the Withholding Certificate such as: What Is KRA Withholding Certificate, Features Of KRA Withholding Certificate, What Is KRA WHT Checker, Requirements Needed To Confirm The Validity Of KRA Withholding Certificate and How To Verify KRA Withholding Certificate Using WHT Checker.

What Is KRA Withholding Certificate?

The KRA Withholding Certificate is a certificate a taxpayer gets when an employer withholds income tax from the wages of employees and pays them directly to the government. KRA Withholding Certificate is a document that is issued to a taxpayer by the Kenya Revenue Authority (KRA) that shows the details of the Tax that is withheld by the employer and remitted to Kenya Revenue Authority (KRA).

So, this simply means that the Withholding Certificate is a document that shows the amount of tax that an employer has withheld from an employee and remitted it to KRA. Withholding Tax (WHT) is tax paid by the consumer of a good or service on behalf of the seller/consultant/contractor. It is usually a portion of total tax payable. Insurance commission paid earned by insurance firm employees is withheld at 10% by the brokerage firm and paid to KRA on behalf of the employee.

Withholding Tax applies to management and professional fees, generally known as consultancy with the client sending you a withholding tax certificate for the value of the tax and this is done of KRA iTax Portal. At the end of year the employee declares total commission earned and tax payable is calculated less of the tax withheld. Also we can refer to the Withholding Tax (WHT) as tax deducted at source on payments to both resident and non-resident persons on income from various sources. Depending on the income stream WHT can either be a final tax or an advance tax payment. Withholding Tax (WHT) is deductible upon payment of a taxable amount.

There are various payments in Kenya that are subject to the Withholding Tax (WHT). This includes, to mention just a few: withdrawals from a provident fund or pension annuities, winnings from betting and gaming, payments made to non-residents for the use or occupation of property and commission from insurance companies. The Withholding Certificate will be needed in cases the taxpayer has any withheld tax and he or she will have to declare this withheld amount in his annual tax returns.

Now that we have defined what we mean by KRA Withholding Certificate and Withholding Tax (WHT) above, we now need to look at the features of the KRA Withholding Certificate. This is as discussed below.

Features Of KRA Withholding Certificate

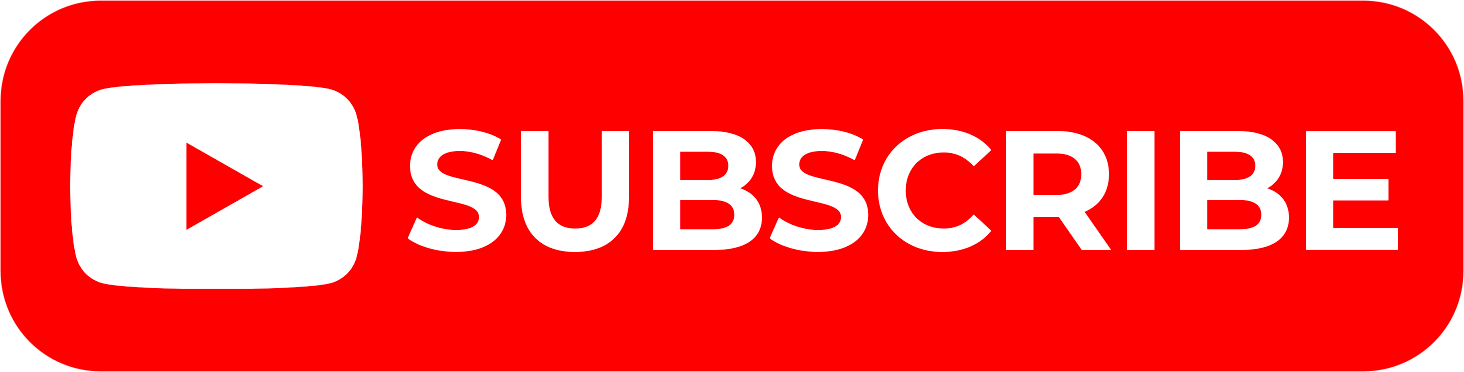

Just as I mentioned above, the KRA Withholding Certificate is basically a document that shows the amount of Withheld tax that an employer has withheld from the employee and remitted the same to Kenya Revenue Authority (KRA). Just like any other document that is issued by KRA to a taxpayer, the Withholding Certificate also has unique features that we are going to address. Below is a sample illustration of the KRA Withholding Certificate for a taxpayer.

From the above screenshot of the Withholding Certificate, you will note that it is made up of 4 important sections i.e. Certificate Serial Number, Withholder Details, Withholdee Details and Details of Tax Withheld. Now let us look briefly at what each part of the Withholding Certificate entails.

-

Certificate Serial Number

The first section of the Withholding Certificate is the Certificate Serial Number. You need to take note that the Certificate Serial Number plays an important role when one needs to confirm the validity and authenticity of the Withholding Certificate using the KRA WHT Checker.

-

Withholder Details

The next section is the Withholder Details. Just as from the name, this is simply the details of the Withholder. It is normally comprised of PIN of Withholder, Name of Withholder and the Address of the Withholder. In most cases, the Withholder is a company in Kenya.

-

Withholdee Details

The Withholdee Details are basically the details of the taxpayer who was issued with the Withholding Certificate. The Withholdee Details is normally comprised of PIN of the Withholdee, Name of the Withholdee and the Address of the Withholdee.

-

Details of Tax Withheld

The last section is what is referred to as the Details of Tax Withheld. This is comprised of Nature of Transaction, Transaction Date, Gross Amount of Transaction (in Kenya Shillings), Withholding Tax Rate and the Amount of Tax Withheld.

Now that you fully understand the different sections of the Withholding Certificate, we now need to look briefly at What Is KRA WHT Checker. This is in relation to the process of confirming the validity and authenticity of a KRA Withholding Certificate that is issued to a taxpayer in Kenya.

What Is KRA WHT Checker?

The KRA WHT Checker is basically a functionality on the KRA iTax Portal that allows a taxpayer to confirm the validity and authenticity of the Withholding Certificate that he or she has been issued with. WHT simply stands for Withholding Tax, so in this context it means the Withholding Tax Certificate Checker on the KRA iTax Web Portal.

So, whenever you need to confirm the validity of any Withholding Certificate, then the KRA WHT Checker will come in handy and this article seeks to teach you the step by step process of how to confirm the validity of the Withholding Certificate on the iTax Web Portal.

Let’s now change gears and look at the Requirements Needed To Confirm The Validity Of KRA Withholding Certificate. If you can recall from the sections of the KRA Withholding Certificate above, to be able to verify and confirm the validity and authenticity of the Withholding Certificate on iTax using the KRA WHT Checker, you will need to have with you the Withholder KRA PIN Number and the Withholding Certificate Number.

Requirements Needed To Confirm The Validity And Authenticity Of KRA Withholding Certificate

Just as I have described above, you are going to need the Withholder KRA PIN Number and the Withholding Certificate Number so as to be able to verify the validity of any Withholding Certificate using the KRA WHT Checker on iTax Portal.

-

Withholder KRA PIN Number

The first requirement that you need to have in this process is the Withholder KRA PIN Number. This KRA PIN Number is normally displayed on the Withholding Certificate under the Withholdee Details i.e. KRA PIN of the Withholdee whom the Tax is being withheld from.

-

Withholding Certificate Number

The other requirement that you need to ensure that you have with you is the Withholding Certificate Number. This is sometimes referred to as the Certificate Serial Number and is located at the top of the Withholding Certificate just under the Date of Certificate in the header of the Withholding Tax Certificate document.

Having looked at the key requirements that are needed in the process of verifying the Withholding Tax Certificate on KRA iTax Portal, we now need to look at the steps that are involved in How To Verify KRA Withholding Certificate Using WHT Checker. Kindly take note that on the KRA WHT Checker, you can check the validity of the Withholding Tax Certificate under 3 types of Tax Obligations i.e. IT Withholding (Income Tax Withholding), VAT Withholding (Value Added Tax Withholding) and MRI Withholding (Monthly Rental Income Withholding). In our case, we are going to use the IT Withholding Tax Obligation option, but the process is the same for the other two obligations.

How To Verify KRA Withholding Certificate Using WHT Checker

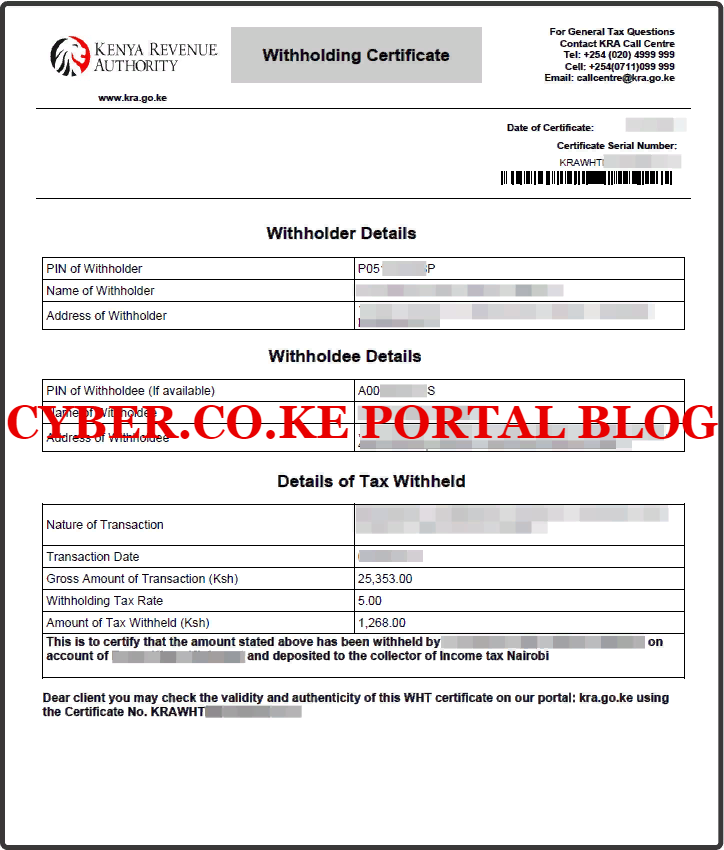

Step 1: Visit KRA Portal

The first step that you need to take in confirming the validity of KRA Withholding Tax Certificate is to ensure that you visit the KRA iTax Web Portal using the link provided above in the description. Take note that the above is an external link that will take you to the KRA iTax Portal i.e. link will open in a new tab.

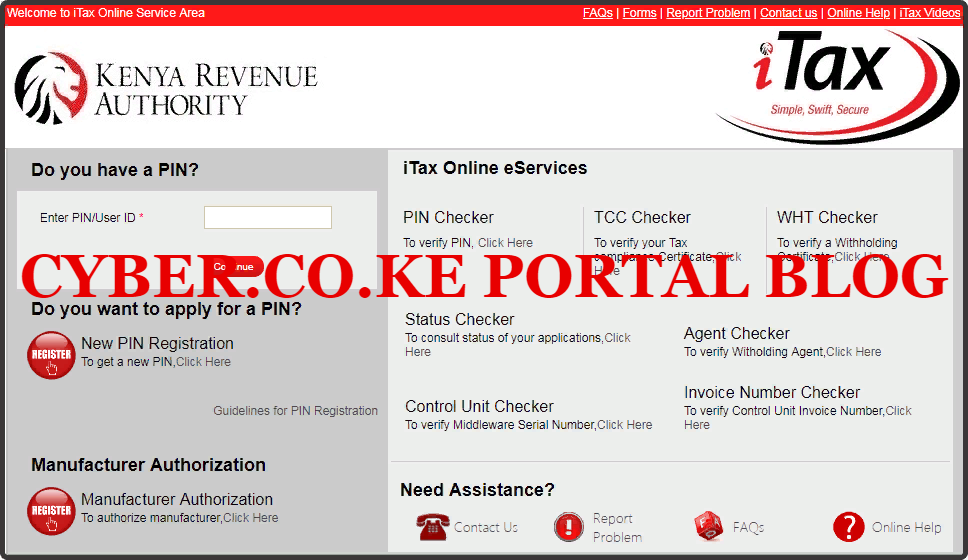

Step 2: Click On The KRA WHT Checker Functionality

Next, on the KRA iTax Portal homepage, you will need to click on the link under the “WHT Checker” section. The link is titled “To verify Withholding Certificate, Click Here” This is as illustrated in the screenshot below.

Step 3: Verify Withholding Certificate

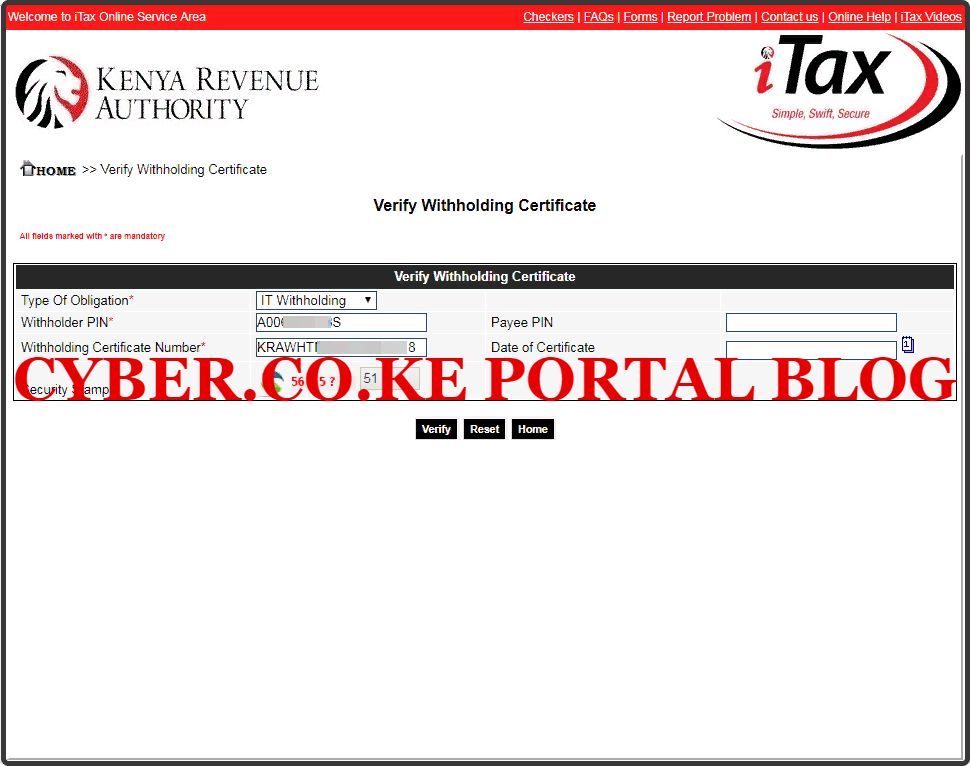

This is the most important step in the process of verifying the Withholding Certificate on iTax Portal. In this step, you will need to select the type of obligation either IT Withholding, VAT Withholding or MRI Withholding. Next enter the Withholder KRA PIN Number, enter the Withholding Certificate Number and lastly solve the arithmetic question (security stamp). Once you have done done, click on the “Verify” button. This is as illustrated below.

In our case, since we are verifying the Withholding Certificate of a taxpayer, we select the type of obligation as IT Withholding (Income Tax Withholding). You will choose the type of obligation depending on the type of obligation you are trying to verify the Withholding Certificate with. The results of the WHT Checker are normally two:

- The Details of the Withholding Certificate are Valid: meaning that the Withholding certificate is valid and authentic.

- The Details of the Withholding Certificate are not Valid: meaning that the Withholding certificate is invalid and not authentic.

The above are the steps that you need to take when you want to verify the WHT Certificate on iTax Portal using the KRA WHT Checker. Once you have verified the same, then you can proceed to file your KRA Returns on iTax Portal. If you need to Download or Reprint your KRA Withholding Certificate, you can check out our article on How To Reprint KRA Withholding Certificate on iTax Portal.

READ ALSO: KRA PIN Reprint Steps To Follow Using KRA iTax Portal

If you require any help with KRA Returns filing especially if you have WHT Certificate, you can submit your KRA Employment Returns Filing order request and our support team will assist you in filing your KRA Returns using the KRA Withholding Certificate.