Are you looking for a way, steps or procedure on How to login to your KRA Portal? Get to know the KRA Portal Login Procedure That You Need To Follow.

Having acquired your new KRA PIN using Cyber.co.ke Portal’s KRA PIN Registration or KRA PIN Retrieval Retrieval services is a great thing, but the process does not end there. You need to know the KRA Portal login procedure that you should always follow.

In this article, I am going to share with you the full guide and resources on KRA Portal Login Procedure That You Need To Follow. By the end of this resourceful article, you will have learnt the steps that are involved in logging into KRA Portal.

READ ALSO: How To File Nil Returns For Students

We shall be covering the beginner’s process of KRA Portal i.e. how a taxpayer in Kenya can be able to login to KRA Portal. This will entails covering important aspects such as: What Is KRA Portal, KRA Portal Functionalities, KRA Portal Front-End, KRA Portal Back-End, Requirements Needed In KRA Portal Login Procedure and KRA Portal Login Procedure That You Need To Follow.

The KRA Portal plays an important role as it serves as the link between taxpayers and the Kenya Revenue Authority (KRA) whereby taxpayers can make a variety of requests such as KRA PIN Registration for Individuals and Non-Individuals, KRA Returns Filing, KRA Tax Payments just to name bu a few main ones.

Each and every taxpayer in Kenya once they are issued with a KRA PIN which you can apply and get here at Cyber.co.ke Portal, KRA also creates for them what is referred to as KRA Portal Account Account that the taxpayers can access by providing the login credentials that were sent to their email addresses when they applied for the KRA PIN at Cyber.co.ke Portal.

What Is KRA Portal?

KRA Portal is simply an online system by Kenya Revenue Authority (KRA) that allows Kenyans access a variety of KRA Online Services by simply logging into their KRA Portal Accounts and submitting or requesting the same. The KRA Portal is also referred to as iTax or iTax Portal. So, when you hear somebody mentioning KRA Portal, just know that are referring to iTax.

Since being launched some few years ago, the KRA Portal has advanced in many functionalities that were not there in the previous and now defunct KRA Mapato System. There are a myriad of tasks that a taxpayer can perform on KRA Portal. By acting as a link between taxpayers and KRA, it removes the need to visit KRA Offices or Huduma Centres as the services can be applied and gotten online with ease and convenience.

Some of those requests and services by taxpayers can also be accessed here at Cyber.co.ke Portal such as KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update, KRA PIN Change of Email Address, KRA PIN for Companies, KRA PIN for Groups, Business Income Amendment, Turnover Tax Registration, Presumptive Tax Payment Registration, Turnover Tax Returns Filing, KRA Nil Returns Filing and KRA Employment Returns Filing.

KRA Portal Functionalities

As an online system, the KRA Portal has a variety of functionalities both on the Front-End and also at the Back-End. Just to give you a list of these Portal functionalities but just to name and highlight on a few of the most important ones that are mainly used on a day to day basis by taxpayers in Kenya. We have to categorize these into two groups i.e. Front-End Functionalities and Back-End Functionalities.

-

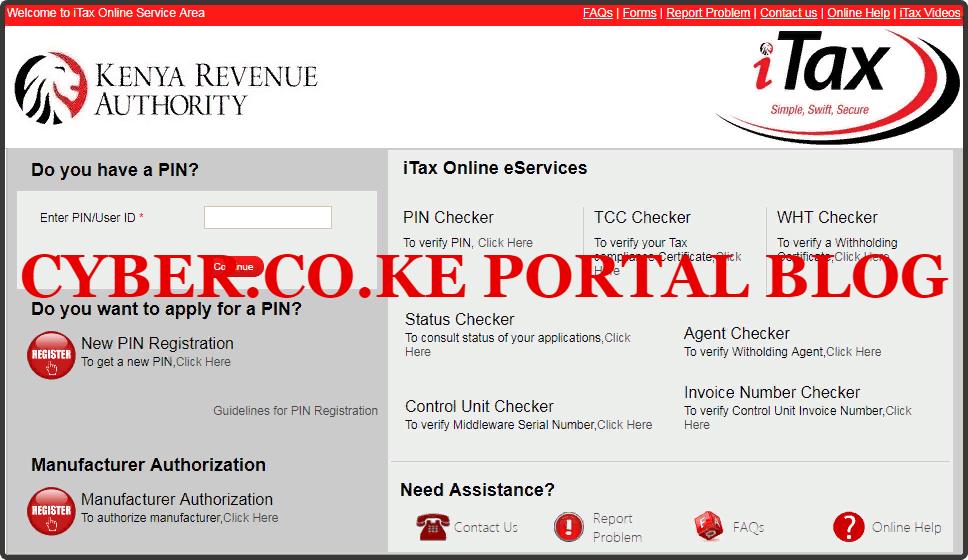

Front-End Functionalities

On the front-end side of the KRA Portal, we have functionalities such as: New PIN Registration, Manufacturer Authorization, PIN Checker, TCC Checker/Exemption Checker, WHT Checker, Status Checker, Agent Checker, Control Unit Checker and last but not the least is the Invoice Number Checker.

-

Back-End Functionalities

The most important part of the KRA Portal is the back-end. This is composed of many functionalities that taxpayers can access. On the back-end side of the KRA Portal, we have functionalities such as: Registration (Amend PIN Details; Other Registration – Excise Licence, Tax Relief Scheme, Excise Services, Application for Destruction of Excisable Goods, Remission of Excise Duty on Denatured Spirit, Import Certificate, Tax Agent Registration, Tax Agent Cancellation, Management of Sub Agent; Consult of Taxpayer Register, Reprint PIN Certificate, Excise Licence Cancellation, Excise Services Cancellation, Transfer Excise Licence, Withholding VAT Amendment, Withholding VAT Cancellation, Tenant Withholding Agent Amendment, e-Reactivation, e-Dormance, e-Cancellation, Opted Out Landlord Registration, Tenant Withholding VAT Cancellation and Register Property Details.

Also we have, Returns (File Return, File Amended Return, View Filed Return, File Nil Return and ITR for Employment Income Only), Debt and Enforcement (Request for Waiver of Penalties and Interests), Payments (Payment Registration, Make Payment, Apply for Payment Plan, Consult Payments and Consult CGT Returns), Assessment Disputes (Objection Application, Notice of Intention to Appeal – Appeal to the Local Committee/Tribunal, Appeal to the High Court and Appeal to the Court of Appeal), Objection Application WHT VAT and Notice of Intention to Appeal – Appeal to the Local Committee/Tribunal, Appeal to the High Court and Appeal to the Court of Appeal).

The final sets of functionalities includes: Refund (VAT, Income Tax, Excise, Stamp Duty, Land Rent, Inventory and FACredit Self Utilization), Certificates (Reprint Withholding Certificate, Withholding VAT Certificate Cancellation, Rental Income Withholding Certificate Cancellation, Withholding Certificate Cancellation, Apply for Tax Compliance Certificate – TCC, Consult and Reprint TCC, Reprint VAT Withholding Certificate and Reprint Rental Income Withholding Certificate), Useful Links (FAQ, Track Status of Application, Generate Tax Type Specific Password, PIN Checker, Site Survey, TCC/Exemption Checker, WHT Checker, Feedback, Report Problem, Consult and Reprint Acknowledgement Receipts and Certificates).

Now that we have looked at the main functionalities of the KRA Portal above, we need to look at what we mean by KRA Portal Front-End and KRA Portal Back-End. This will enable us understand what we were referring to in the above descriptions of the functionalities on the KRA Portal.

KRA Portal Front-End

The front-end of the KRA Portal is basically what you see when you visit the portal using the link: https://itax.kra.go.ke/KRA-Portal on your browser. The front-end is also what we refer to as the homepage. You will see all the functionalities that we highlighted that are found on the front-end of KRA Portal.

KRA Portal Back-End

On the other hand, the back-end of the KRA Portal is what you see when you have successfully logged into your KRA Portal Account using KRA PIN Number and KRA iTax Password. Here, you will see the tons of functionalities that I highlighted in the above description. Only logged in users can see the above screenshot in the KRA Portal Accounts.

Requirements Needed In KRA Portal Login Procedure

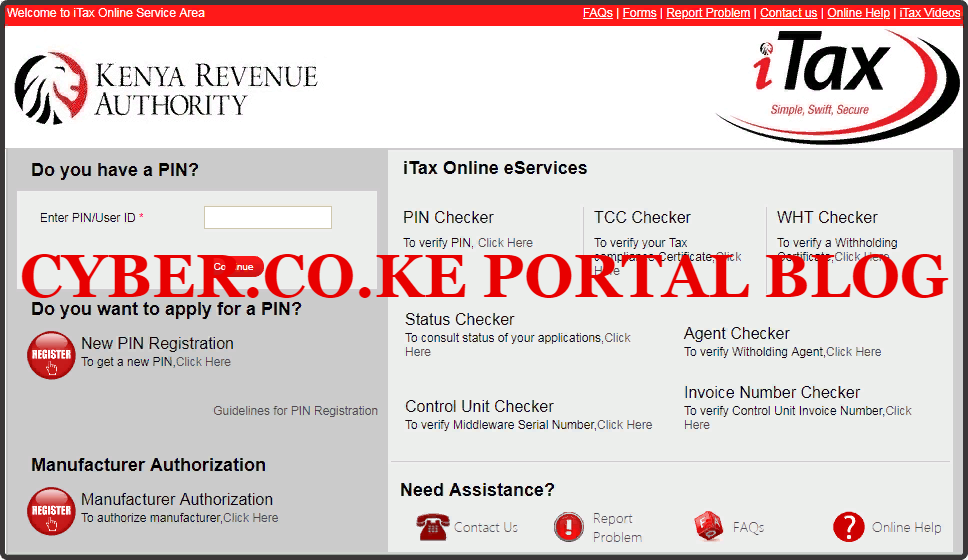

In order for a taxpayer to login to KRA PIN, there are a set of requirements that they need to ensure that they have with them. This is what we normally refer to as the KRA Portal login credentials or simply iTax Login credentials. This comprises of the KRA PIN Number and KRA iTax Password as I have described below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable your Reset KRA iTax Password.

Having known the requirements that you are going to need in the KRA Portal Login process, we can now look at KRA Portal Login Procedure That You Need To Follow.

KRA Portal Login Procedure That You Need To Follow

Step 1: Visit KRA Portal

The first step that you need to take in the process of KRA Portal Login Procedure That You Need To Follow is to ensure that you visit the KRA Portal using the link provided above in the above description. Note, the above is an external link that will take you to the KRA Portal.

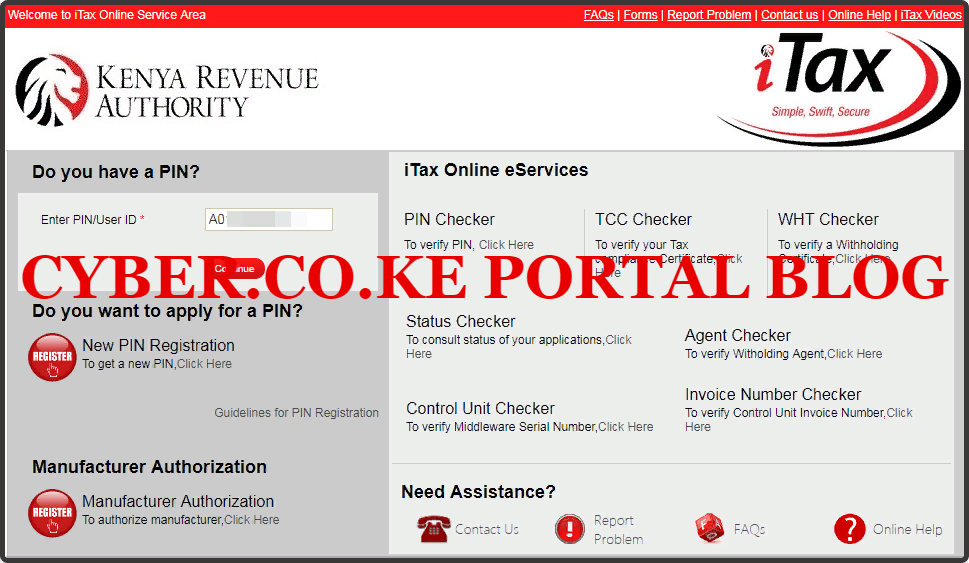

Step 2: Enter Your KRA PIN Number

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

Step 3: Enter KRA iTax Password and Solve Arithmetic Question

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA Portal Account Dashboard

In the last step, once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA Portal Account Dashboard. Inside your KRA Portal Account, you will see the myriad of functionalities that are found in the back-end of the portal. This is as illustrated in the screenshot below.

READ ALSO: New KRA PAYE Rates Apply To All Benefits And Emoluments Earned In April 2020

The above four steps sums up the steps and procedure that all taxpayers in Kenya need to follow so as to be able to login to KRA Portal with much ease. But two things you need to ensure that you have with you are KRA PIN Number and KRA iTax Password, once you have these two login credentials then you will be able to login to your KRA Portal.