CYBER.CO.KE is an independent Cyber Services website and is not affiliated with any government agency, including Kenya Revenue Authority (KRA). A service fee is charged for the assistance provided to customers in Kenya.

The Tax Compliance Certificate (TCC) serves as a crucial document that is issued by the Kenya Revenue Authority (KRA) to validate a taxpayer’s diligent adherence to the various tax obligations that he or she has been registered for as mandated by Kenyan law. Tax Compliance Certificate (TCC) signifies that the taxpayer has dutifully filed relevant tax returns (KRA Returns) and settled all outstanding taxes within the taxation framework here in Kenya.

The issuance of the Tax Compliance Certificate (TCC) is contingent upon the taxpayer’s compliance with tax regulations, evaluated by the Kenya Revenue Authority (KRA) based on available information. However, you need to take note tha KRA reserves the right to revoke the Tax Compliance Certificate if new evidence significantly alters the taxpayer’s compliance status. You will only be issued with the Tax Compliance Certificate if you have filed all your KRA Returns and have paid any taxes due if any and you can also reprint Tax Compliance Certificate if it was already issued to you.

To obtain or reprint the KRA Tax Compliance Certificate (TCC) via the iTax platform (KRA Portal), individuals must possess both their KRA PIN Number and iTax Password (KRA Password). These two main credentials serve as the gateway to accessing the taxpayer’s iTax account (KRA Portal account) and facilitating the reprinting process of KRA Tax Compliance Certificate (TCC). Safeguarding the KRA PIN Number and iTax Password (KRA Password) is paramount for seamless access to the iTax account (KRA Portal account).

READ ALSO: Step-by-Step Process of Downloading KRA Nil Returns Receipt

By adhering to the outlined procedures, taxpayers in Kenya can efficiently manage their tax affairs and ensure compliance with regulatory requirements set forth by the Kenya Revenue Authority (KRA). Below is a detailed breakdown of all the necessary steps that are involved in the process of reprinting KRA Tax Compliance Certificate online using iTax (KRA Portal).

How To Reprint Tax Compliance Certificate

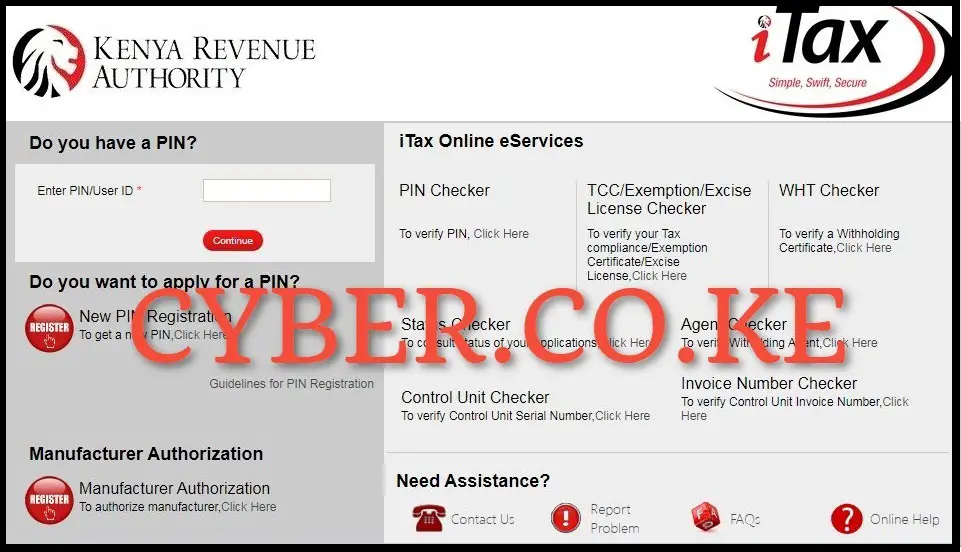

Step 1: Visit iTax (KRA Portal)

The first thing that you are supposed to do in the process of reprinting your Tax Compliance Certificate (TCC) online is to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

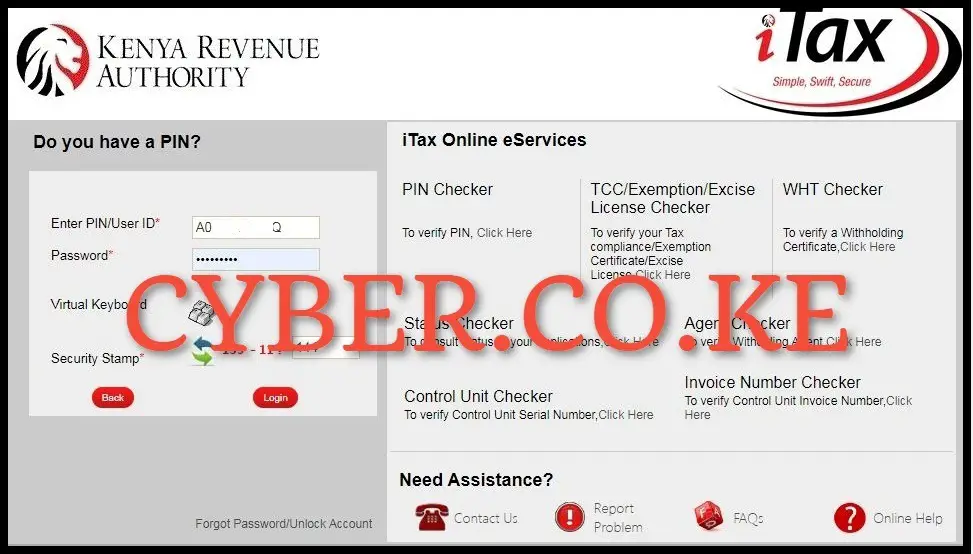

Step 2: Login Into iTax (KRA Portal)

In this step, you need to enter you KRA PIN Number, KRA Password (iTax Password), solve the arithmetic question (security stamp) and then click on the “Login” button to access your iTax account (KRA Portal account) so as to reprint KRA Tax Compliance Certificate (TCC).

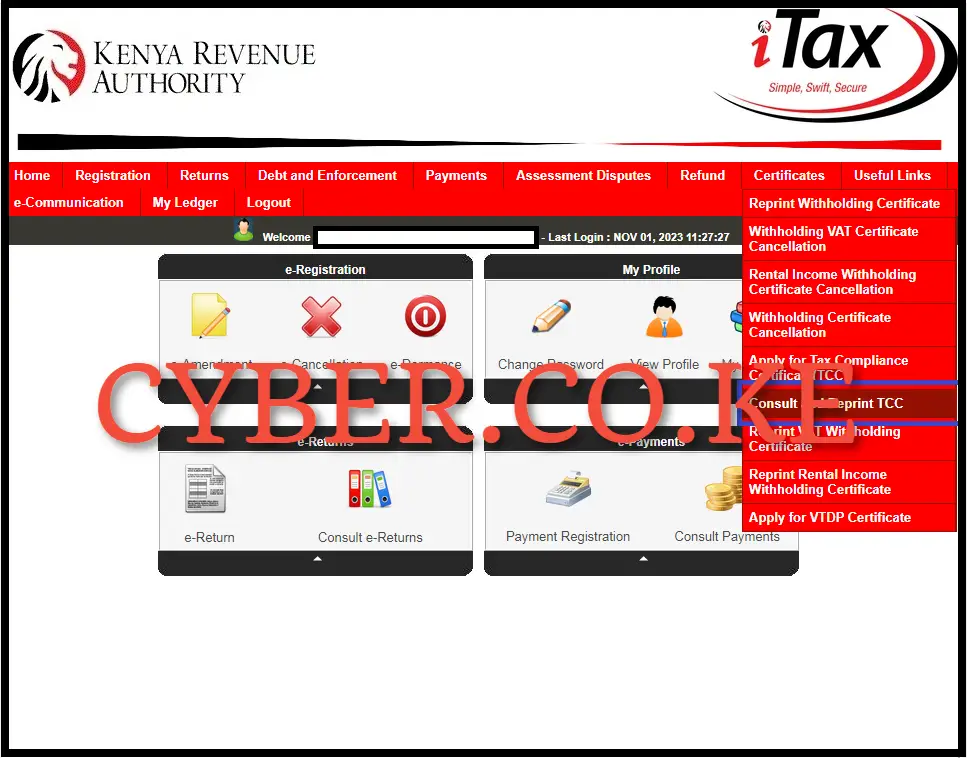

Step 3: Click on Certificates and then Consult and Reprint Tax Compliance Certificate (TCC)

Upon successful login into your iTax account (KRA Portal account), navigate to the “Certificates” tab and then click on “Consult and Reprint Tax Compliance Certificate (TCC)” from the drop-down menu items list.

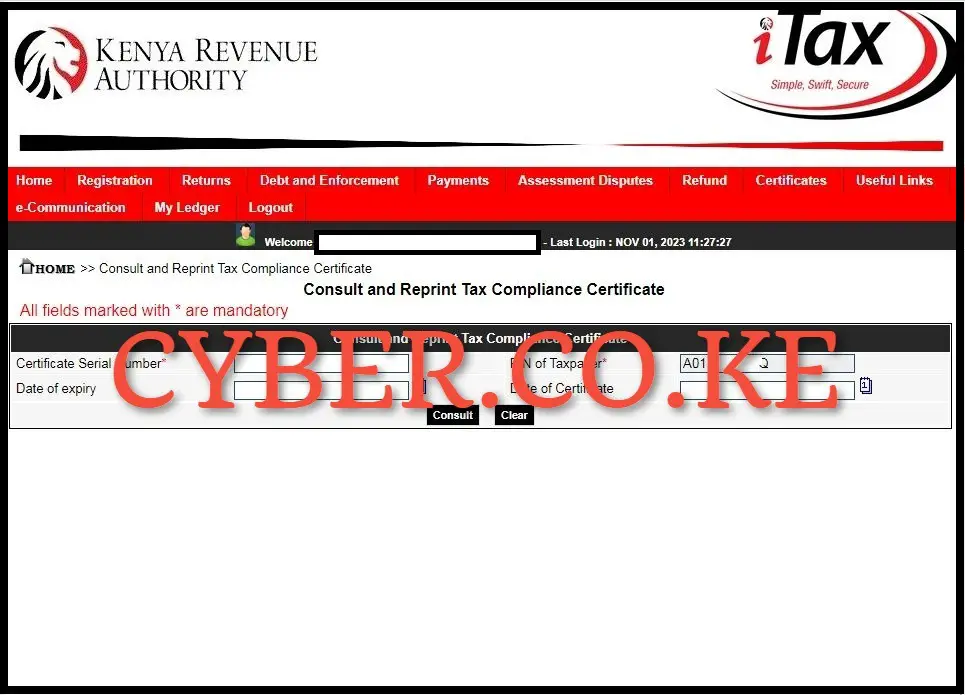

Step 4: Consult and Reprint Tax Compliance Certificate (TCC)

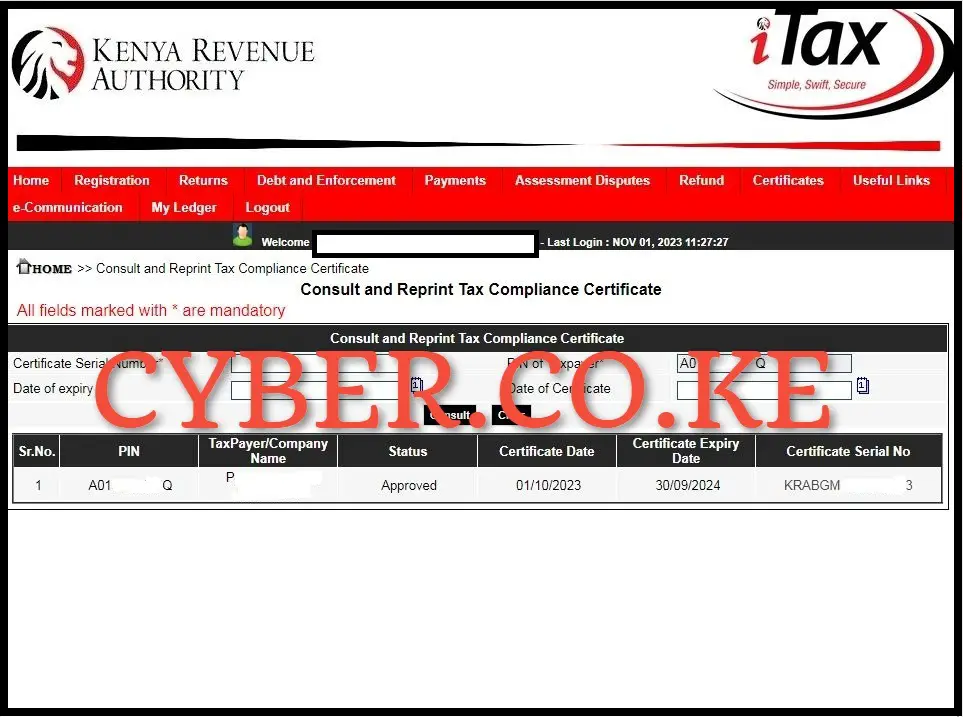

There is not much to do in this step but to just click on the “Consult” button, thereafter a pop up notification window will appear asking “Are you sure you want to Consult?” You just need to click on the “OK” button to initiate the process of Tax Compliance Certificate reprinting on iTax (KRA Portal).

Step 5: Download The Reprinted Tax Compliance Certificate (TCC)

In this final step, you now need to download the reprinted Tax Compliance Certificate (TCC) on iTax (KRA Portal). For you to be able to download the Reprinted Tax Compliance Certificate (TCC) on iTax (KRA Portal), you just need to click on the Certificate Serial Number section i.e. KRABGM*********3 which will automatically download and save a copy of the KRA Tax Compliance Certificate (TCC) to the device that you are using. The choice to print or save a copy of the Tax Compliance Certificate is rests on you to decide depending on where you want to use the KRA Tax Compliance Certificate (TCC).

READ ALSO: Step-by-Step Process of Reprinting KRA Clearance Certificate

After you have downloaded the reprinted Tax Compliance Certificate on iTax (KRA Portal) you can present it where it is required. You need to take note that reprinting Tax Compliance Certificate is only possible if you had already been issued with a valid Tax Compliance Certificate (TCC) by Kenya Revenue Authority (KRA) and you just want a copy of the same Tax Compliance Certificate (KRA TCC). Also you need to ensure that you have with you both the KRA PIN Number and KRA Password (iTax Password), which you need in order to successfully access your iTax account (KRA Portal account). Once you have all of these, you can follow the well outlined steps that you need to follow in order to reprint your KRA Tax Compliance Certificate (TCC) using iTax (KRA Portal).

Matthews Ohotto is a Writer at CYBER.CO.KE where he specializes in writing helpful and informative Step-by-Step Tutorials that empower Kenyans with practical skills and knowledge. He holds a Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT). Get KRA Individual Services and KRA Returns Services in Kenya.

ADVERTISEMENT

Check Out Our Popular Blog Posts

Check Out Our KRA Individual Services

Register KRA PIN Number

Submit Service Request →Retrieve KRA PIN Certificate

Submit Service Request →Update KRA PIN Number

Submit Service Request →Change KRA PIN Email Address

Submit Service Request →Check Out Our KRA Returns Services

File KRA Nil Returns

Submit Service Request →File KRA Employment Returns

Submit Service Request →File KRA Amended Returns

Submit Service Request →File KRA Withholding Tax Returns

Submit Service Request →Check Out Our KRA Tax Calculators

Calculate Turnover Tax (TOT)

TOT Calculator →Calculate Monthly Rental Income (MRI)

MRI Calculator →Calculate Value Added Tax (VAT)

VAT Calculator →Calculate Pay As You Earn (PAYE)

PAYE Calculator →CYBER.CO.KE

Get KRA Services Online Today

CYBER.CO.KE is a trusted online cyber services website dedicated to providing KRA Individual Services and KRA Returns Services to customers in Kenya on a day to day basis.

The KRA Individual Services that we offer to customers includes: Registration of KRA PIN Number, Retrieval of KRA PIN Certificate, Updating of KRA PIN Number and Changing of KRA PIN Email Address.

The KRA Returns Services that we offer to customers includes: Filing of KRA Nil Returns, Filing of KRA Employment Returns, Filing of KRA Amended Returns and Filing of KRA Withholding Tax Returns.

If you are looking for dependable, fast and reliable KRA Services in Kenya, we are ready and available to support you at every step of the way.

We prioritize customer convenience, clear communication and prompt service delivery, making sure that your submitted service request is completed in the shortest time possible.

ADVERTISEMENT