CYBER.CO.KE is an independent Cyber Services website and is not affiliated with any government agency, including Kenya Revenue Authority (KRA). A service fee is charged for the assistance provided to customers in Kenya.

The KRA e-Return Receipt is quite important in that it certifies that a taxpayer has filed his or her KRA Returns for a given Tax Obligation on iTax (KRA Portal). KRA e-Return Receipt is issued as the last step in the process of filing any tax returns online. It normally contains the details or the taxpayer and all the relevant returns information.

If by any chance after filing your KRA Returns on iTax (KRA Portal) you forgot to download the e-Return Receipt, you can still get that e-Return Receipt online in your iTax (KRA Portal) account. To be able to download a copy of the KRA e-Return Receipt on iTax (KRA Portal), you need to ensure that you have with you both your KRA PIN Number and KRA Password (iTax Password).

You are going to need these two important credentials so as to be able to access your iTax account with ease through the logging in process. In this blog post, I will cove the main steps that all taxpayers in Kenya need to follow in order to download KRA e-Return Receipt online quickly and easily today.

READ ALSO: Step-by-Step Process of Downloading Tax Compliance Certificate (TCC)

How To Download KRA e-Return Receipt

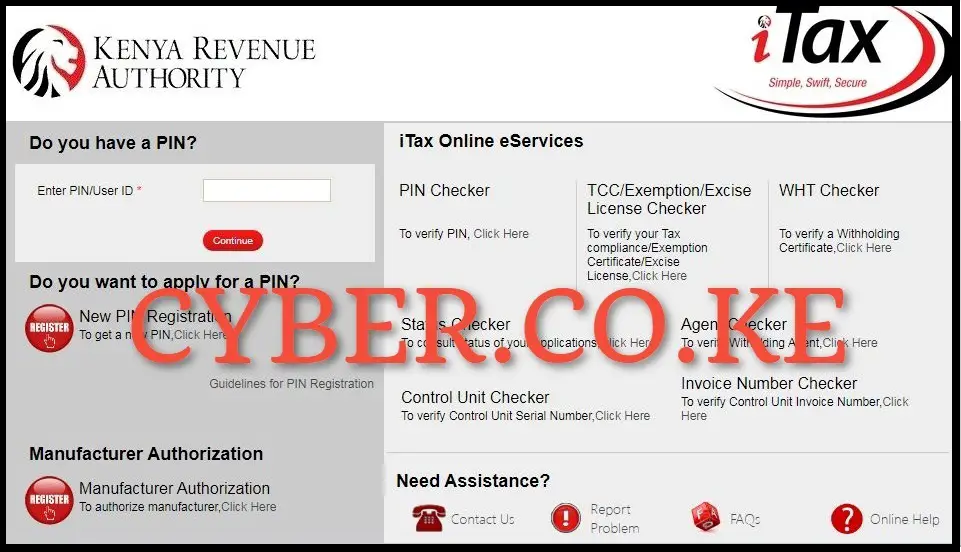

Step 1: Visit iTax (KRA Portal)

The first step in the process of downloading KRA e-Return Receipt is to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

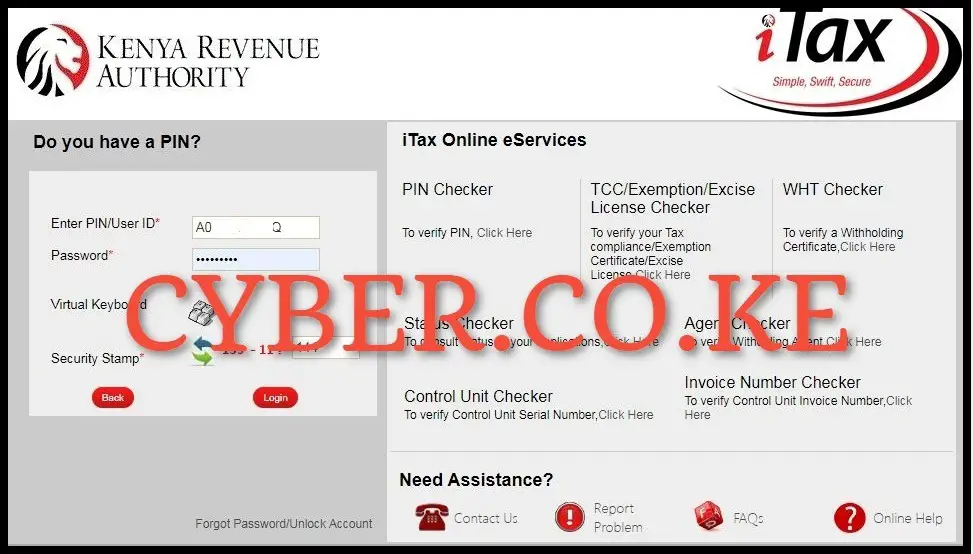

Step 2: Login Into iTax (KRA Portal)

Next, enter your KRA PIN Number, KRA Password (iTax Password), solve the arithmetic question (security stamp) and then click on the “Login” button.

Step 3: Click on Useful Links then Consult and Reprint Acknowledgement Receipt and Certificates

In this step, once you are logged into iTax (KRA Portal) account, on the top right hand side, click on “Useful Links” then click on “Reprint Acknowledgement Receipt and Certificates” from the drop down list.

Step 4: Fill the Consult and Reprint Acknowledgement Receipt Form

This is the most important step in the process of How To Download KRA e-Return Receipt on iTax (KRA Portal). In this step, you need to fill in the following important fields on the form; Business Process – Taxpayer Return Processing; Business Sub Process – Original Return Filing; Obligation Name – Income Tax Resident Individual; Tax Period From; 01/01/2023 and Tax Period To: 31/12/2023 (choose the tax return period that you want the KRA e-Return Receipt for). Once you have filled in those details, click on the “Consult” button to load the e-Return Receipt by KRA. Note, on the pop up window “Do you want to consult with given details?” click on “OK” button.

Step 5: Download KRA e-Return Receipt

In this last step, you now need to download the generated KRA e-Return Receipt on iTax (KRA Portal). To download the KRA e-Return Receipt on iTax (KRA Portal), on the output section of the consult criteria form just under the “Acknowledgement Number” column, click on the acknowledgement serial number i.e KRA2023***********7, which will in turn initiate the downloading of KRA e-Returns Receipt on the iTax (KRA Portal).

READ ALSO: Step-by-Step Process of Applying for Tax Compliance Certificate (TCC)

After you have downloaded the KRA e-Return Receipt, you can choose to either print a copy or even save a copy to your device. It is important to note that KRA e-Return Receipt download if you had already filed your KRA Returns on iTax (KRA Portal) and you want a copy of the e-Returns Receipt. Also, ensure that you are able to access your iTax (KRA Portal) account using both your KRA PIN Number and KRA Password (iTax Password). Afterwards, you can follow the above 5 main steps to successfully download your KRA e-Return Receipt on iTax (KRA Portal) with ease and convenience.

Matthews Ohotto is a Writer at CYBER.CO.KE where he specializes in writing helpful and informative Step-by-Step Tutorials that empower Kenyans with practical skills and knowledge. He holds a Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT). Get KRA Individual Services and KRA Returns Services in Kenya.

ADVERTISEMENT

Check Out Our Popular Blog Posts

Check Out Our KRA Individual Services

Register KRA PIN Number

Submit Service Request →Retrieve KRA PIN Certificate

Submit Service Request →Update KRA PIN Number

Submit Service Request →Change KRA PIN Email Address

Submit Service Request →Check Out Our KRA Returns Services

File KRA Nil Returns

Submit Service Request →File KRA Employment Returns

Submit Service Request →File KRA Amended Returns

Submit Service Request →File KRA Withholding Tax Returns

Submit Service Request →Check Out Our KRA Tax Calculators

Calculate Turnover Tax (TOT)

TOT Calculator →Calculate Monthly Rental Income (MRI)

MRI Calculator →Calculate Value Added Tax (VAT)

VAT Calculator →Calculate Pay As You Earn (PAYE)

PAYE Calculator →CYBER.CO.KE

Get KRA Services Online Today

CYBER.CO.KE is a trusted online cyber services website dedicated to providing KRA Individual Services and KRA Returns Services to customers in Kenya on a day to day basis.

The KRA Individual Services that we offer to customers includes: Registration of KRA PIN Number, Retrieval of KRA PIN Certificate, Updating of KRA PIN Number and Changing of KRA PIN Email Address.

The KRA Returns Services that we offer to customers includes: Filing of KRA Nil Returns, Filing of KRA Employment Returns, Filing of KRA Amended Returns and Filing of KRA Withholding Tax Returns.

If you are looking for dependable, fast and reliable KRA Services in Kenya, we are ready and available to support you at every step of the way.

We prioritize customer convenience, clear communication and prompt service delivery, making sure that your submitted service request is completed in the shortest time possible.

ADVERTISEMENT