Are you an Employee in Kenya and need to File your KRA Returns on iTax before the 30th June Deadline? Learn How To File KRA Returns For Employed.

The KRA Returns Deadline of 30th June is fast approaching and nearly majority of the Employees in Kenya are in a last minute rush to ensure that they File their KRA Returns on time before the Deadline of Filing KRA Returns finally reaches.

Not that many Employees in Kenya know How To File KRA Returns on iTax thus some might find it hard and difficult to submit their KRA Returns on iTax in time before the Deadline of 30th June. That brings out the need for Employees or those who are Employed to know How To File KRA Returns For Employed.

READ ALSO: How To Reprint KRA Acknowledgement Receipt Using KRA iTax Portal

Thankfully, in this article I will be sharing with all Employees in Kenya the steps that should be followed in Filing KRA Returns for Employees on iTax i.e. KRA Returns For Employees, What Is KRA Returns For Employed, Categories Of Employees In Kenya, KRA P9 Form For Employees, How To Get KRA P9 Form For Employees, Deadline For Filing KRA Returns For Employees, Requirements Needed In Filing KRA Returns For Employees and How To File KRA Returns For Employed.

If you are an Employee in Kenya, inorder to File KRA Returns For Employees on iTax, you need to ensure that you have with you KRA PIN Number, KRA iTax Password and your KRA P9 Form. Once you have ensured that you have with you the above 3 main requirements for Filing KRA Returns For Employees on iTax, you can proceed to login to iTax, using the iTax Login Credentials, click on Returns then File KRA Returns for Employees, Download the KRA Returns Form, Fill The KRA Returns Form, Validate The KRA Returns Form, Upload It On iTax, Submit and Download the KRA Acknowledgment Receipt.

The Income Tax Laws in Kenya are quite clear when in comes to KRA Returns and Filing of the same on iTax, i.e. any person who has an active KRA PIN which can be obtained online using Cyber.co.ke Portal‘s KRA PIN Registration services, is required to file his or her KRA Returns before the 30th June deadline reaches. The same applies to those who are in Formal Employment in Kenya (Employed/Employees) who have KRA PIN Numbers, they need to file their KRA Returns For Employed. You have to File KRA Returns on iTax if you are Employed in Kenya.

What Is KRA Returns For Employed?

KRA Returns For Employed simply means the type of KRA Returns that is Filed by those who are Employed in Kenya or simply Employees in Kenya. So, if you are an Employee in Kenya, your employer normally deducts and remits Pay As You Earn (PAYE) to Kenya Revenue Authority on a monthly basis. Now, after each year between 1st January to 30th June, as an Employee you are required to File your KRA Returns on iTax.

As an Employee, you are required to File KRA Returns on iTax because failure to do so attracts a Penalty from Kenya Revenue Authority (KRA). To avoid being penalized by KRA, it is good practice to get your KRA P9 Form, Download the KRA Returns Form and start Filing KRA Returns on iTax before the 30th June Deadline reaches. By Filing KRA Returns for Employed on iTax on time, you will be able to beat the last minute rush that is most common on the deadline date in Kenya.

Categories Of Employees In Kenya

In Kenya, Employees can be categorized into two main groups i.e. Private Sector Employees and Public Sector Employees. Since this article is focusing on How To File Returns For Employees on iTax, we need to ensure that we understand what each of these two categories of Employees in Kenya entails.

-

Private Sector Employees

The first group of employees is normally the Private Sector Employees. These are those Employees who are employed by Private Companies and Organizations in Kenya. They form the majority of Employees in Kenya since the Private Sector in Kenya is very big in terms of number of Companies and Organizations registered and operating here.

-

Public Sector Employees

The other group of Employees in Kenya comprises of those who work in the Public Sector. This is mainly comprised of Government of Kenya Employees who are Employed under the Public Service Commission of Kenya (PSCK). These Employees are paid by the Kenyan Government.

Having looked at the main categories of Employees in Kenya above, we now need to look at the most important requirement that is needed in process of Filing KRA Returns For Employed on iTax i.e. KRA P9 Form for Employees. Please note that I will be focusing on the first group of Employees in Kenya i.e. Private Sector Employees.

KRA P9 Form For Employees (Employed)

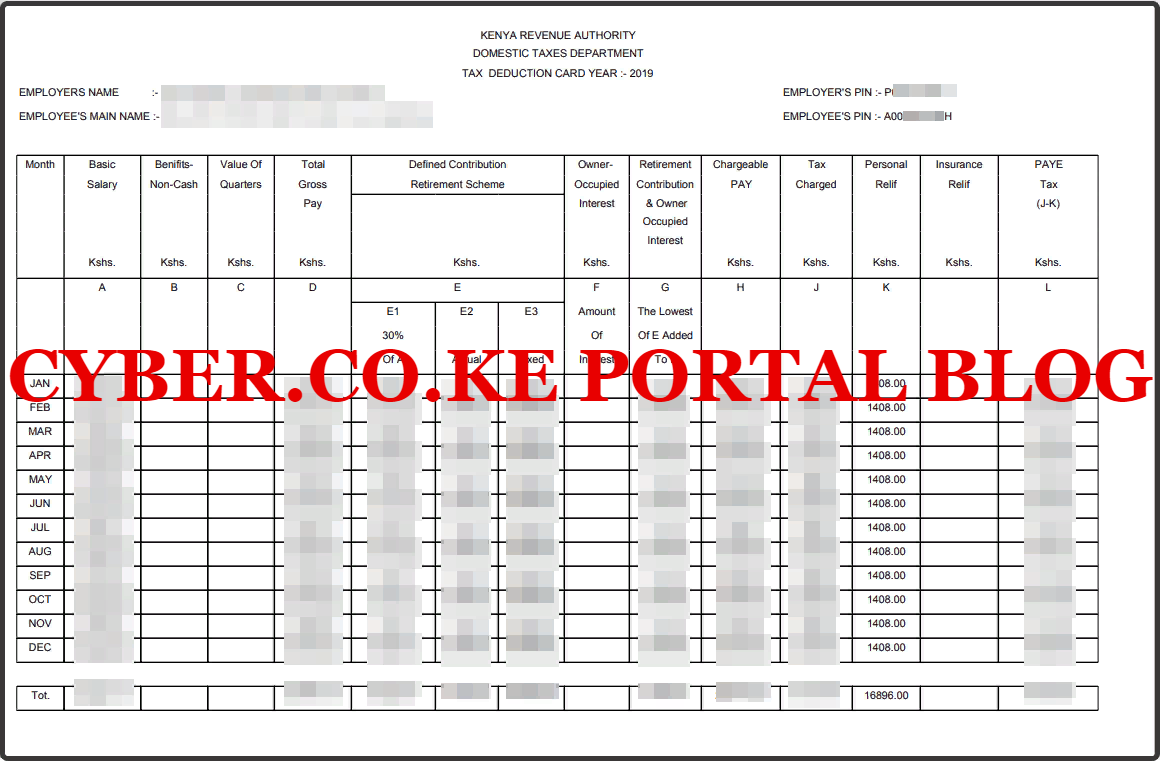

One of the most important document in the process of Filing KRA Returns on iTax for Employees or those who are Employed in Kenya is the KRA P9 Form. As an Employee, you need to ensure that you have with you your KRA P9 Form as it forms part of the most important requirements that is needed in Filing KRA Returns For Employed on KRA iTax Portal. I won’t be talking much about P9 Form, but rather focusing on the most important parts of the KRA P9 Form for Employees in Kenya. Below is a screenshot of a sample of KRA P9 Form for Employees in Kenya i.e Private Sector Employees.

The above is a sample of the KRA P9 Form for Employees in Kenya. Kindly note that different companies and organizations in Kenya have a different layouts of the P9 Forms, but the most important figures still remain to be the Basic Salary, Total Gross Pay, Chargeable Pay, Tax Charges, Personal Relief and PAYE Tax (Pay As You Earn).

When filing KRA Returns for Employees on iTax using the KRA P9 Form for Employees in Kenya, 3 columns of the KRA P9 Form are the most important ones i.e. Total Gross Pay, Taxable Pay, Tax Charged and Personal Relief. One you have the figures then you will type them in the KRA P9 Form for Employed as I will be showing you later on in this article when we reach at the Filing KRA Returns step. Don’t forget to write down the KRA PIN Number for the Employer and your own KRA PIN Number.

How To Get KRA P9 Form For Employees (Employed)

If you are Employed in the Private Sector, you can get your KRA P9 Form from your Employer through the Human Resource (HR) Office. Some companies and organization the Private Sector have online Payroll systems where their Employees can download their KRA P9 Forms. On the other hand, Government of Kenya Employees can get their KRA P9 Form using Public Service Payroll (formerly GHRIS). As for Teachers, the P9 Form can be downloaded at the TSC Portal.

In the scenario that you cannot get the P9 Form from your Employer, you need to ensure that you know the figures for Total Gross Pay, Taxable Pay, Tax Charged and Personal Relief. Once you have those figures, then you are good to start filing KRA Returns For Employed on iTax with much ease by following the steps that are outlined in this article.

Deadline For Filing KRA Returns For Employees

As a long culture in Filing KRA Returns in Kenya, the deadline for Filing KRA Returns For Employees or those who are Employed is on 30th June of each year. There has never been an extension on the deadline to filing KRA Returns using KRA Portal for all individual and non-individual taxpayers in Kenya. So, KRA normally gives all taxpayers a window period of 6 months to ensure that all Teachers to file their KRA Returns on iTax Portal.

The deadline always stands at 30th June of each year meaning that all Employees in Kenya need to file their KRA Returns between 1st January to 30th June of each year failure to which you will end up paying penalties for not filing your KRA Returns on time. To avoid that, ensure that you file your KRA Returns For Employed as early as possible to avoid the last minute rush that is normally experienced on that last day.

Requirements Needed In Filing KRA Returns For Employees (Employed)

If you are an Employee or Employed in Kenya and need to File your KRA Returns For Employed on iTax, there a set of requirements that you are going to need. This includes: KRA PIN Number, KRA iTax Password and KRA P9 Form For Employees. Let me highlight on each one of these key requirements that are needed in the process of Filing KRA Returns for Employees using iTax.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable your Reset KRA iTax Password.

-

KRA P9 Form For Employees

The last and most important requirement is the KRA P9 Form For Employees. Since this article will be focusing on Filing Returns on iTax for Employees in the Private Sector, you can get your KRA P9 Form from your Employer through either the HR Office or Online Payroll System for your Company or Organization. For those who cannot get their P9 Forms, then you need to ensure that you know the figures for Total Gross Pay, Taxable Pay, Tax Charged and Personal Relief. Once you have these, then you can begin the process of Filing Returns for Employees in Kenya on iTax.

Now that you have with you the main requirements that are needed in the process of Filing KRA Returns for Employed in Kenya, we can now begin the process and the steps that all those who are Employed in Kenya need to follow in How To File KRA Returns For Employed.

How To File KRA Returns For Employed Individuals (Employees)

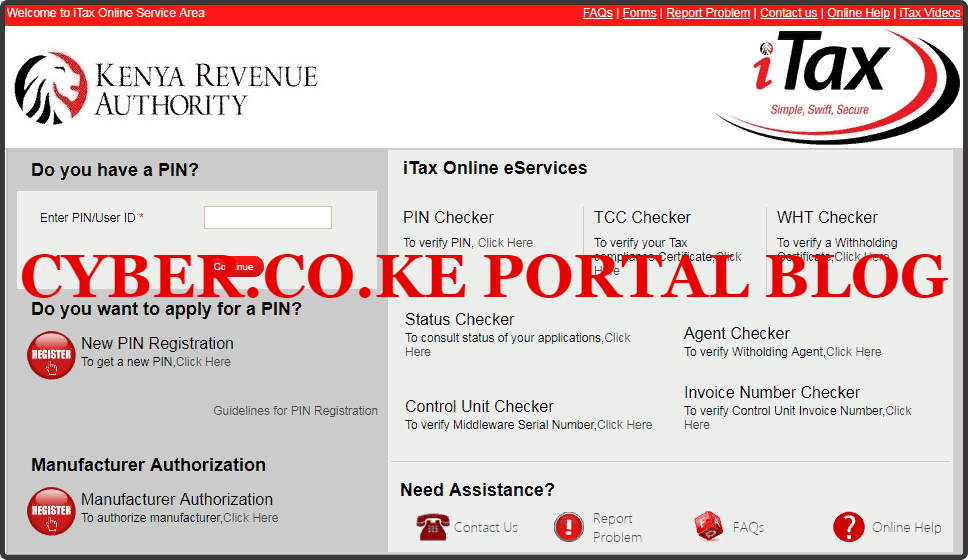

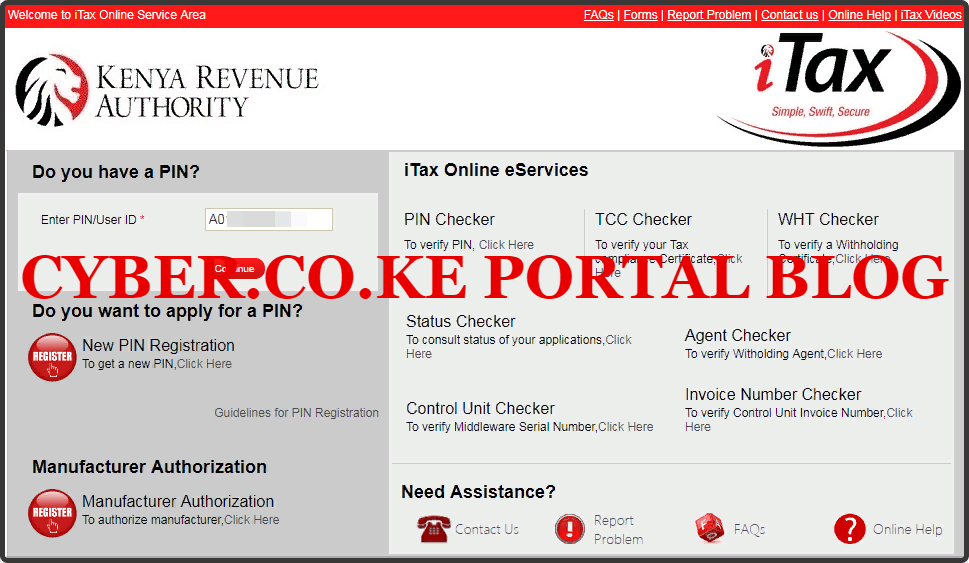

Step 1: Visit KRA Portal

The first step that you need to take in the process of How To File KRA Returns For Employees is to ensure that you visit the iTax Portal using the link provided above in the above description. Note, the above is an external link that will take you to the KRA iTax Portal.

Step 2: Enter Your KRA PIN Number

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

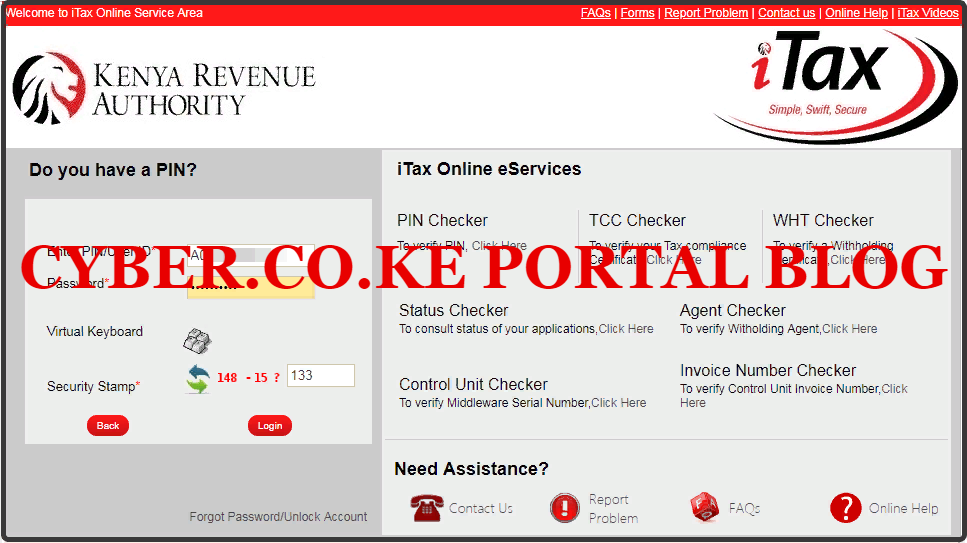

Step 3: Enter KRA iTax Password and Solve Arithmetic Question

In this step, you will be required to enter your iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: iTax Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your iTax Portal Account Dashboard. Since we need to file KRA Returns for Employed on iTax, we proceed to Step 5 below.

Step 5: Click On The Returns Menu

In this step, on the iTax Account menu list, navigate to “Returns” menu tab and click on “File Return” from the drop down menu list. This is as illustrated in the screenshot below.

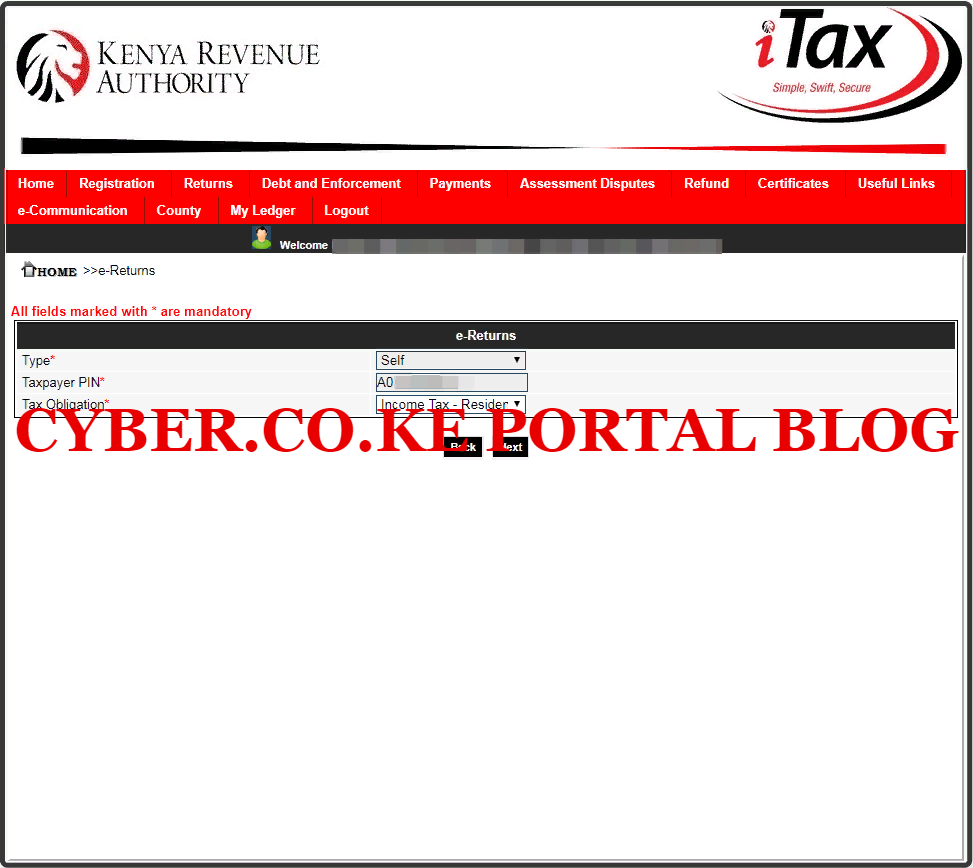

Step 6: Select Tax Obligation As Income Tax Resident Individual

In this step, you will need to select the tax obligation as Income Tax Resident Individual this is because we are filing KRA Returns for Teachers. The Type and Taxpayer PIN are automatically pre-filled. Once you have selected the Tax Obligation, click on the “Next”button.

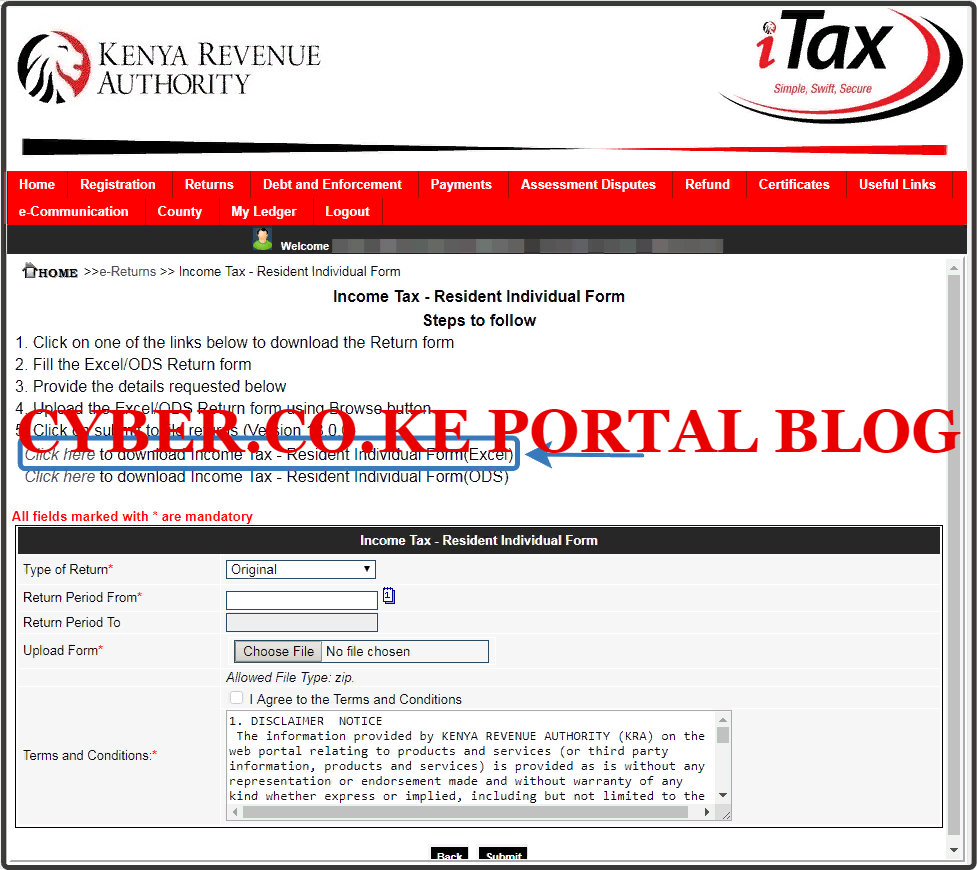

Step 7: Download KRA Returns Form

In this step, you will need to download the KRA Returns Form (KRA Excel Sheet) that is referred to as the Income Tax Resident Individual Form the iTax Account. As I mentioned in the beginning of this article, this is a zipped file and you need to ensure that your laptop or computer has MS Office suite that has the MS Excel installed.

Once you click on the Download KRA Returns Form on iTax, a zipped file will be downloaded to your Computer or Laptop. You will need to unzip the file so as to open the KRA Returns Form that is an Excel Workbook or Excel Worksheet (Excel Sheet). Just as I mentioned above, you need to ensure that you have the latest version of Office installed on your device.

The next steps will involve filling in the KRA Returns Form using the details contained on the KRA P9 Form for Employees. You need to ensure that you have your KRA PIN Number, Employer’s KRA PIN Number, KRA P9 Form and KRA Returns Form that you have just downloaded from iTax.

Step 8: Fill The KRA Returns Form (KRA Excel Sheet/KRA Returns Template)

In this step, you are supposed to fill in the KRA Returns Form (Excel Sheet) that you have just downloaded from your iTax Account with the details shown on your P9 Form for Employees in Kenya. That means you will open the zipped file and click on the Returns Form (IT1_Individual_Resident_Return.xls) so as to open it. You will have to enable Macros so to fill in the KRA Returns Form. Also note that you can’t copy and paste into the Returns Form.

In the process of filling in the KRA Returns Form or KRA Excel Sheet that you have downloaded from your iTax Account, there are important sections that are supposed to be filled. The sections of the Returns Form includes: Basic Information Section, Employment Income Section, Details of PAYE Deducted Section and Tax Computation Section. Now let us look briefly at what each section of the KRA Returns Form entails.

-

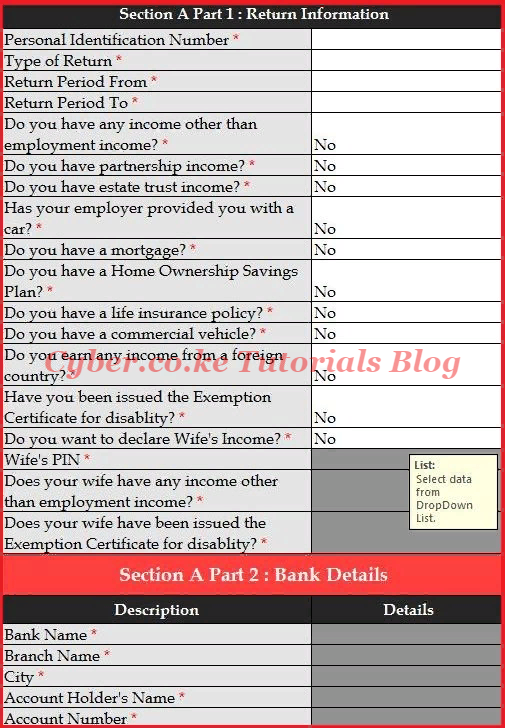

Section I: Basic Information Section of the KRA Returns Form

This is the first part of the KRA Returns Form. In this section, you need to take note of Part 1 and Part 2 of Section A. The Section A Part 1 is basically the Return Information section while the Section A Part 2 is the Bank Details section. This is illustrated in the screenshot below.

-

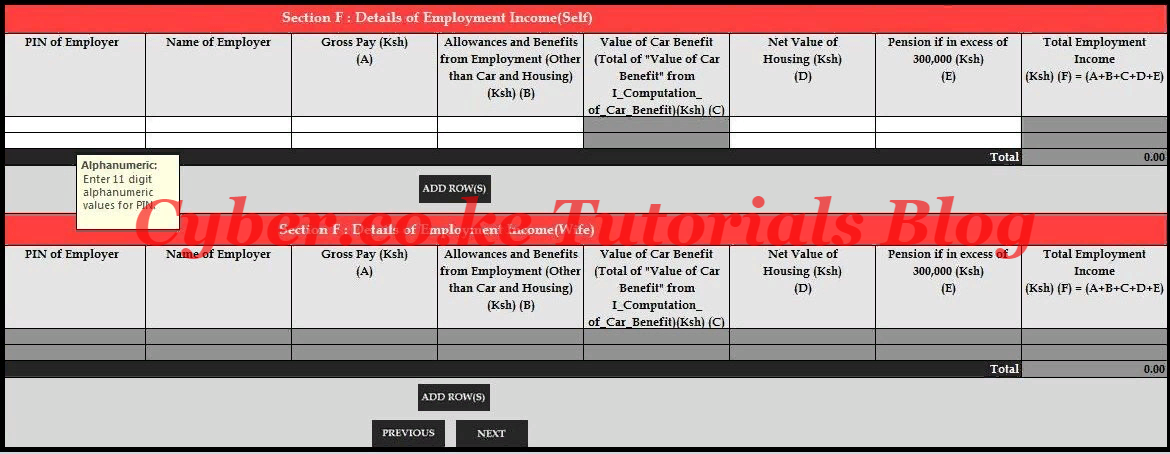

Section II: Employment Income Section of the KRA Returns Form

The next section is the Employment Income Section. This is the section whereby you fill in the details of employment as per you P9 Form. This is illustrated below.

-

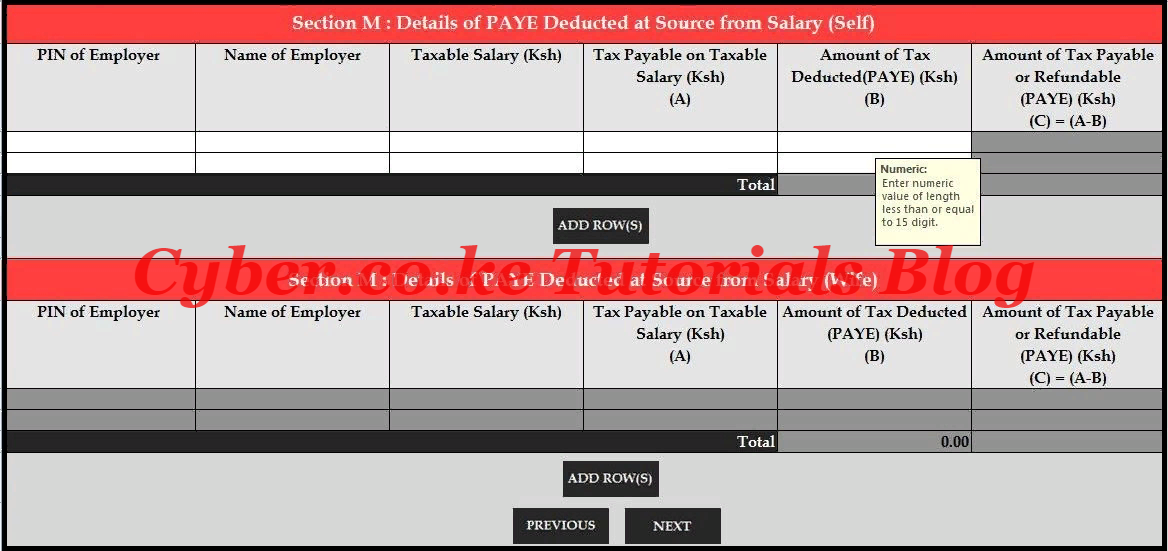

Section III: Details of PAYE Deducted Section of the KRA Returns Form

The next section of the KRA Returns Form is the Details of PAYE deducted section. This is where you fill in the PAYE deducted for they year as shown in your P9 Form. This is as illustrated below.

-

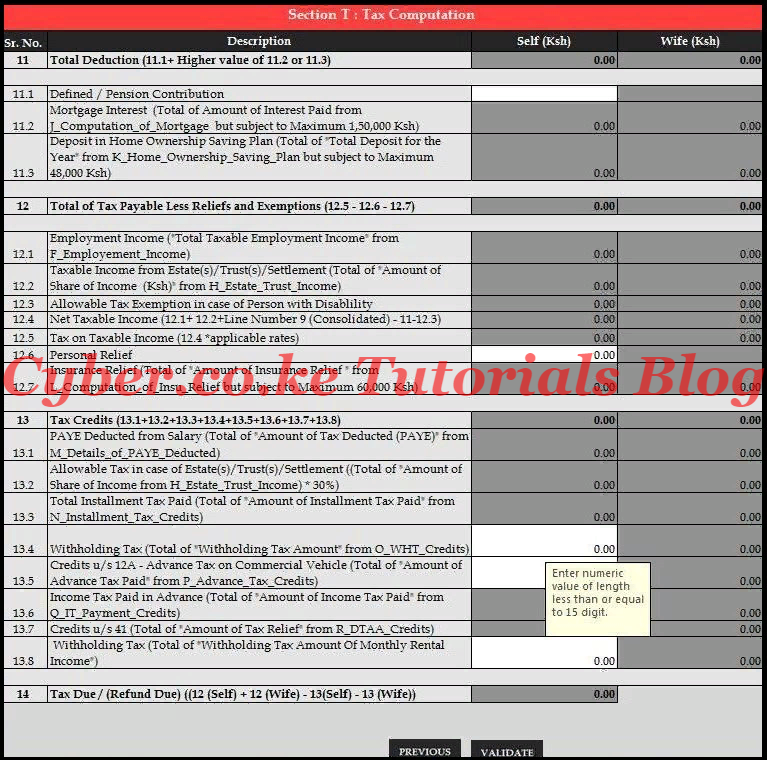

Section IV: Tax Computation Section of the KRA Returns Form

The last and most important section of the KRA Returns Form is the Tax Computation Section. This is the section where you compute the amount of Tax Due or Refund Due and validate the KRA Returns Form so that you can upload it in your KRA Web Portal Account. Below is a screenshot of the same.

Once you have filled in the KRA Returns Form, you need to Validate the date so as to be able to upload the generated validated zipped folder in your iTax Account. The KRA Excel Sheets will be generated and saved in your computer under Documents section or whichever file location that you are using. Now you will head back to your iTax Account and upload the validated and generated KRA Returns Form that is zipped.

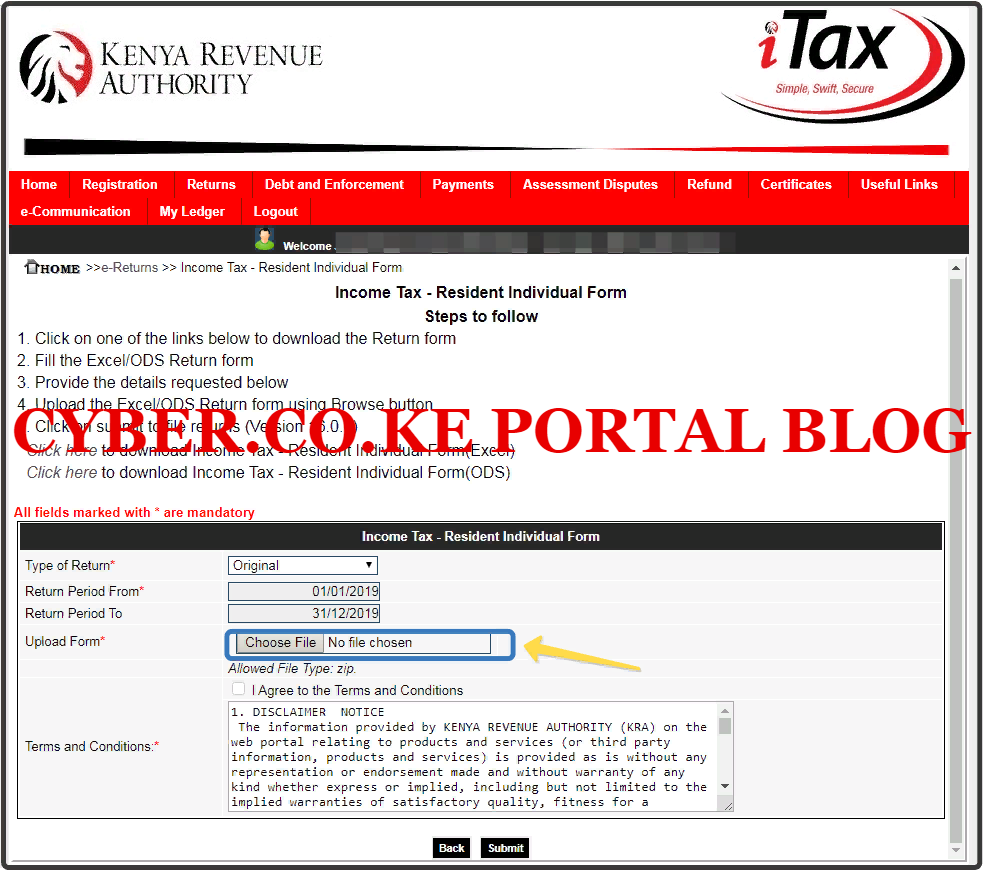

Step 9: Upload The Validated KRA Returns Form

In this step, you will now need to upload the generated KRA Returns form into iTax Portal. Click on the Choose File box and upload the KRA Returns Form that you have just filled in for the Employee. Once you have uploaded the validated KRA Returns Form, tick the check box titled “I Agree to the Terms and Conditions” and click “Submit” button to submit your KRA Returns For Employed.

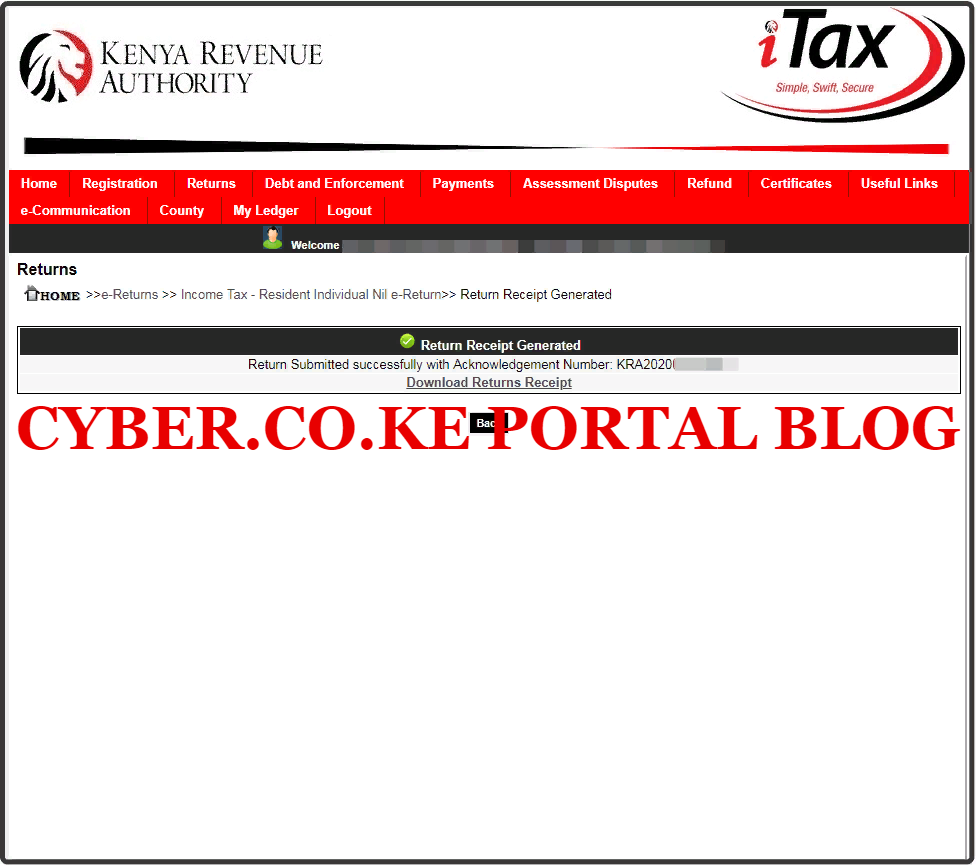

Step 10: Download KRA Returns For Employed Acknowledgement Receipt

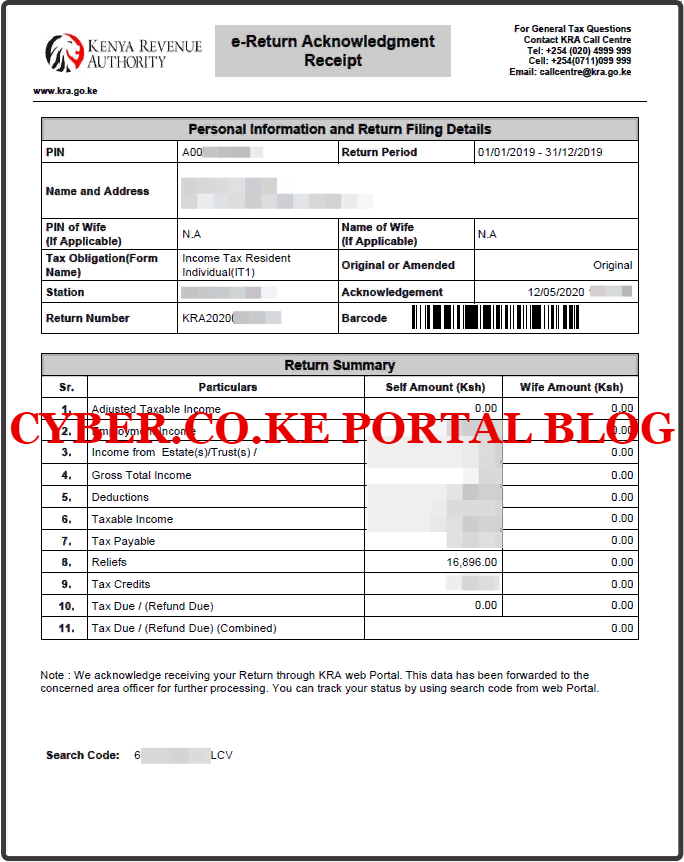

In this last step, you will need to download the KRA Returns for Employed Acknowledgement Receipt that has been generated by the iTax system successfully. This is a final confirming that your KRA Returns for Employee has been successfully submitted to Kenya Revenue Authority (KRA). An Acknowledgement Number will also be generated for that KRA Return that we have just filed.

Below is the e-Return Acknowledgement Receipt that is a final confirmation that we have successfully file the KRA Returns for Employees using iTax Portal. Normally it is a good practice to save a copy of the KRA Acknowledgment Receipt for the KRA Returns that you have just filed on iTax.

Once you have followed the above steps on How To File Returns For Employed or How To File Returns For Employees in Kenya using iTax, then you will have completed the most important aspect of your Employment i.e. Filing KRA Returns on iTax. All you need to take note as an Employee in Kenya is that you need to have with you your KRA PIN Number, KRA iTax Password and KRA P9 Form.

This article has outlined the key steps that you always need to follow so as to File KRA Returns For Employed on iTax with much ease and convenience. As long as you have with you the requirements for Filing KRA Returns For Employees on iTax, filing and submitting KRA Returns for Employed or Employees in Kenya will be a walk in the park for you.

READ ALSO: How To Download Latest KRA Returns Template From KRA Portal

If you need any help or assistance in Filing KRA Returns for Teachers on iTax, you can always submit your request here at Cyber.co.ke Portal and our support team will gladly file for you the KRA Returns as fast as possible. Just submit your order online using our KRA Employment Returns Filing section.