Get to know How To File KRA Returns Using KRA iTax Portal If Unemployed. Learn How To File KRA Returns if you are Unemployed in Kenya.

Are you unemployed but have a KRA PIN Number? Then you need to start filing your KRA Returns now. The notion that only employed people file KRA Returns is old school nowadays. As long as you have an active KRA PIN Number on KRA iTax Porta, you need to be filing your Returns.

It is that time of the year when the rush to start filing KRA Returns begins. The KRA Tax Returns Period that runs from 1st January 2020 to 30th June 2020. This is an important period in the KRA Tax Calender because it the time whereby taxpayers file, remit and pay their Taxes for the period ended 31st December.

READ ALSO: How To Change KRA iTax Password On KRA Website Portal

Thousands of taxpayers will be walking to KRA Offices, KRA Service Centres, KRA iTax Support Centres, Huduma Centres and also Cyber Cafes to file their KRA Returns for the year 2019 this year between January and June 2020. Kenya Revenue Authority (KRA) is quite lenient by allowing taxpayers a period of 6 months to file the KRA Returns before the 30th June 2020 KRA Returns deadline.

I find find quite astonishing that most Kenyans fail to file their KRA Returns in this tax filing window period. iF 6 six months period is not enough for you, I don’t know what is then. Some even go to the extent of requesting Kenya Revenue Authority (KRA) to extend the deadline. Well, the bad news is that it won’t happen. No Extensions. So, my best advice to you file your KRA Returns as soon as you get time.

Any person who has an active KRA PIN Number and does not have any income is supposed to file his or her KRA Nil Returns between 1st January and 30th June of each year. So, you need to forget about the old notion that KRA Returns is for those who are employed, but rather any Kenyan with an active KRA PIN is supposed to be filing KRA Returns each year.

What Is KRA Returns For Unemployed?

Now, I wont be focusing much of those who are Employed, but rather my main focus will be on those who are Unemployed or Students. The term Unemployed in this context simply refers to the group of people who do not have any active source of income. Active source of income simply comprises of Business Income, Rental Income or Employment Income. So, if you don’t have any income in Kenya, then you need to be filing KRA Nil Returns.

So if you don’t have any source of income listed above you need to file KRA Returns. The type of Returns filed by those who are Unemployed is what is referred to as KRA Nil Returns. So, as long as you have an active KRA PIN Number, you need to be filing your KRA Returns each year.

The catch is quite simple here. You always need to ensure that you file your KRA Returns before the 30th June 2020 deadline as there is normally no extension given to those who do not fail to file Returns before this KRA Deadline. Sparing a few minutes of your time in day will make you finish filing the KRA iTax Returns on time.

What Happens When You Don’t File Your KRA Returns If You Are A Student Or Unemployed?

The most common question that many people normally have in their minds in regards to KRA iTax Returns is: What happens if I don’t file my KRA Returns? The answer to this is quite simple. You will be penalized by Kenya Revenue Authority (KRA).

Well, the penalty in this case refers to the amount that will be imposed on you by KRA failing to file your KRA Returns. How much? A whooping Kshs. 2,000 for each year not filed. Let us put this in an example a Student in University who has an KRA PIN and is still learning.

Assuming you got your KRA PIN Number back in 2015, through KRA PIN Registration services. Let’s say the date that you applied and got your KRA PIN was 18th January 2015. You needed this KRA PIN to apply for HELB Loan and also open a Bank Account to receive the HELB Loan Disbursement facilitate your University Education Course.

Four years later in 30th June 2018 you Graduate from the University with your Degree. Take note that while you were still a student (Unemployed) in the University, you never filed KRA Returns for the years 2015, 2016, 2017 and 2018. In this case, you need to note that you were already penalized for late filing of Returns.

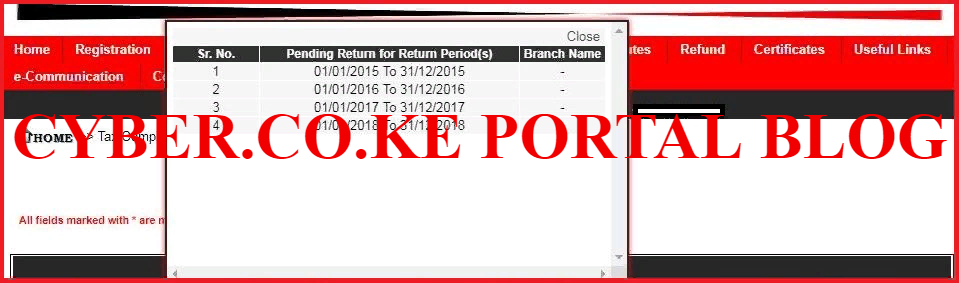

Doing that math, you will find that the penalty accumulated to about Kshs. 8,000. Now fast forward, in 2019 you were looking for a Job in Kenya and one of the Requirements is a KRA Tax Compliance Certificate. You apply for it on iTax, and response you get from KRA is: “Please note that you cannot apply for TCC as you have pending return/payment to be filed or liability to paid. Please click OK to view the details of pending returns.”

The message simply means that you did not file your KRA Returns for a certain year (i.e 2015,2016,2017 and 2018) and you will need to file those pending returns before trying to apply for a Tax Compliance Certificate again. Now that is major consequence of failing to file KRA Returns when you are or were a Student or Unemployed.

You will have to Apply for KRA Waiver using iTax and as long as you provide sufficient evidence to add weight to your KRA Waiver Application, it could be approved. If not approved, you just have to go ahead and pay those pending penalties to Kenya Revenue Authority (KRA).

That’s why it is important to be filing your KRA Returns each year even if you are student, don’t have a job or are employed. What waits for you ahead for failing to file KRA Returns is a bunch of KRA Penalties bundled together in Kshs. 2,000 in liabilities.

Now that we have looked at the types of KRA iTax Returns that Students or Unemployed people file together with what happens when you fail to file your yearly KRA Returns on KRA iTax Portal, we need to look at the requirements needed in Filing KRA Returns is you are a Student or Unemployed in Kenya.

Requirements Needed To File KRA KRA Returns If You Are A Student Or Unemployed

Before you can start filing, you need to have with you KRA PIN Number and iTax Password. These form the two major requirements that you need to have with you when you need to file iTax KRA Online Returns. Now, let us look at what each requirement entails.

-

KRA PIN Number

The first thing that you need to have with you is your KRA PIN Number. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

-

iTax Password

The next item that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable your Reset KRA iTax Password.

Now that you have with you the KRA PIN Number and your iTax Password, we now look at the steps involved in How To File KRA Returns Using KRA iTax Portal If Unemployed or Student.

How To File KRA Returns Using KRA iTax Portal If Unemployed

Step 1: Visit KRA Portal

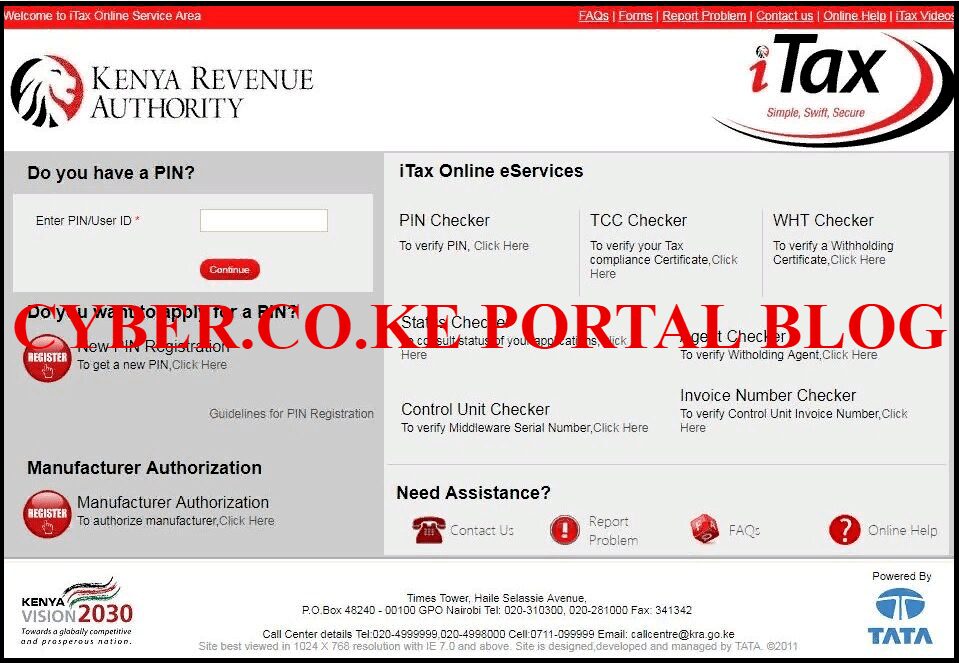

The first step that you need to take is to ensure that you visit the KRA iTax Portal using the link provided above in the title.

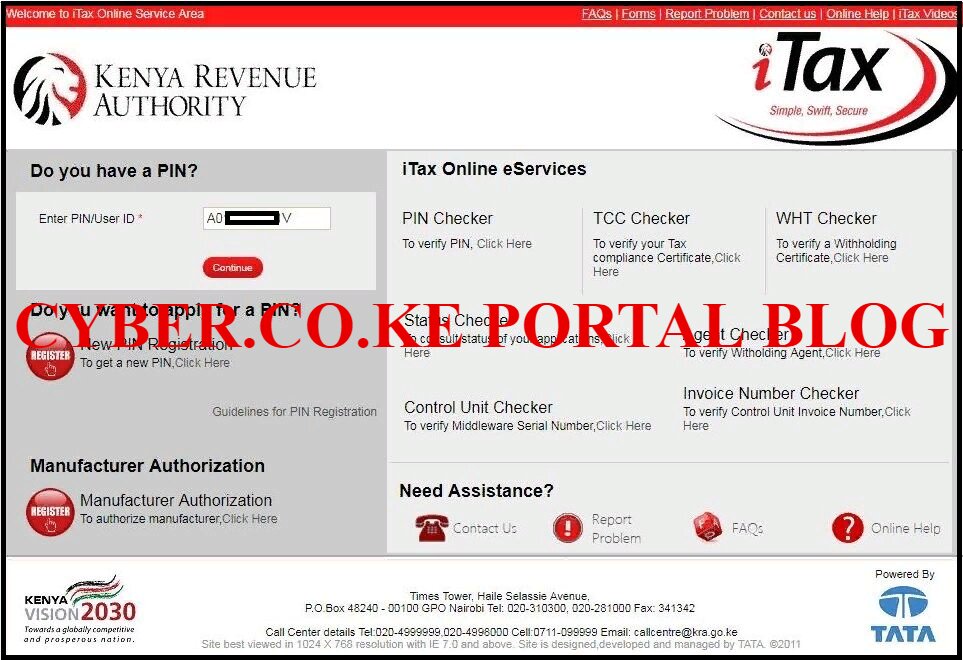

Step 2: Enter Your KRA PIN Number

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

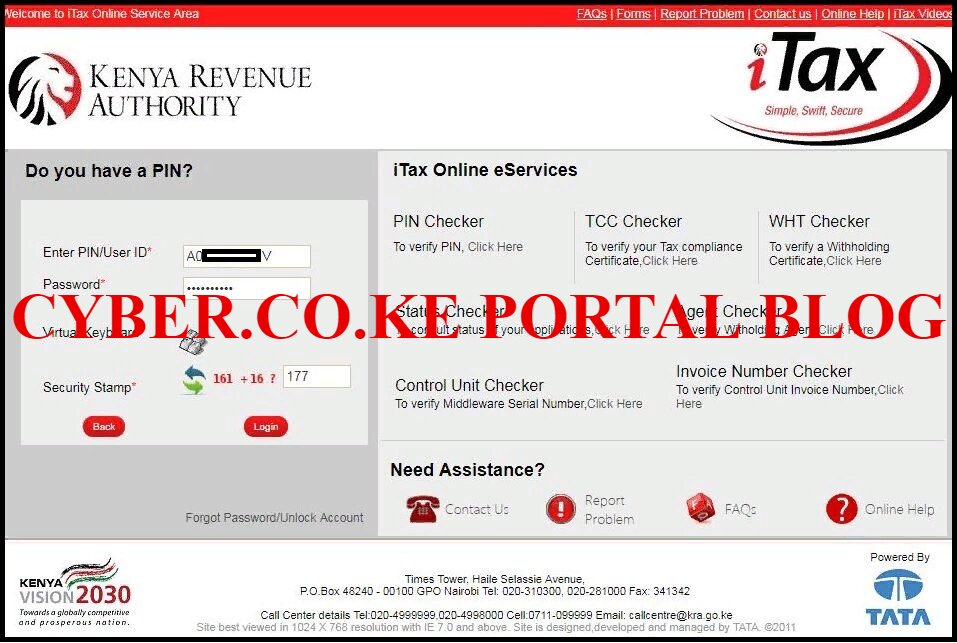

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: iTax Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be able to see and access your iTax Account Dashboard. This is as illustrated in the screenshot below.

Step 5: Click On Returns tab then File Nil Return from Dropdown Menu list

In this step, on the menu list items, click on Returns and then from the dropdown item list, click on File Nil Returns.

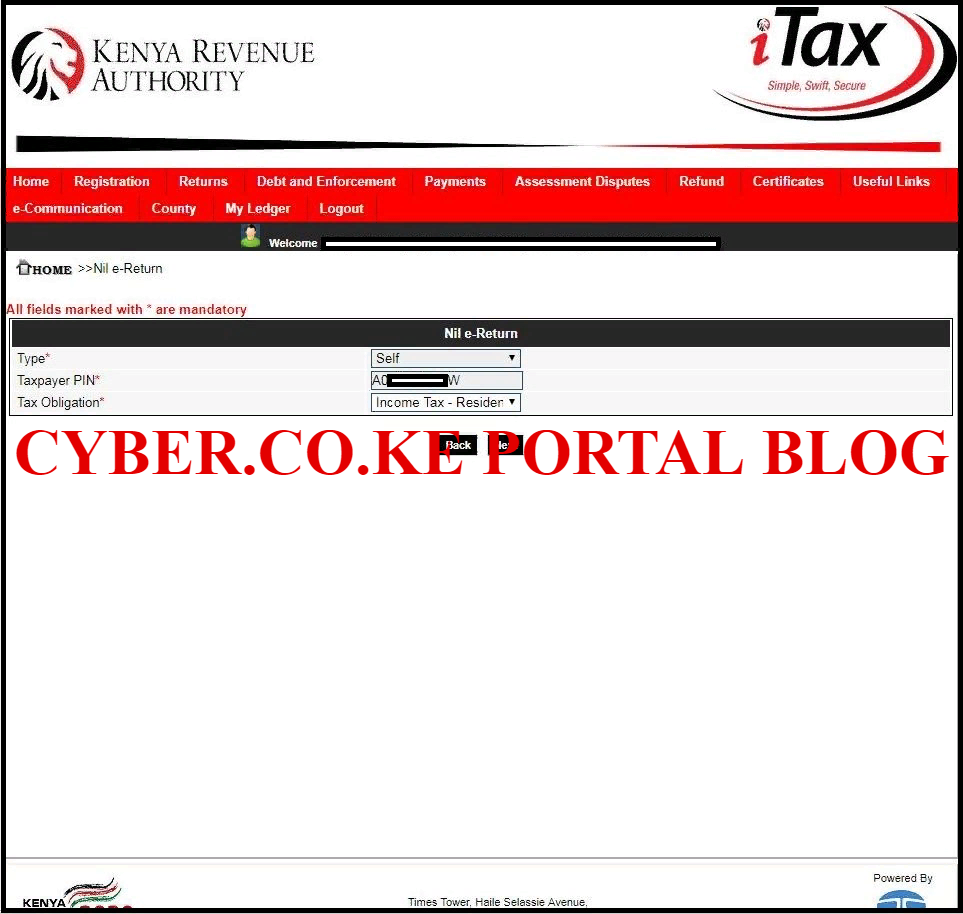

Step 6: Select Nil e-Return Tax Obligation

In this step, you will need to select the Tax Obligation. In our case, since we are filing KRA Returns for Individual, it will be Income Tax Resident Individual. The Type and Taxpayer PIN are automatically pre-filled in this step.Once you have selected the KRA Tax Obligation, click on the “Next” button.

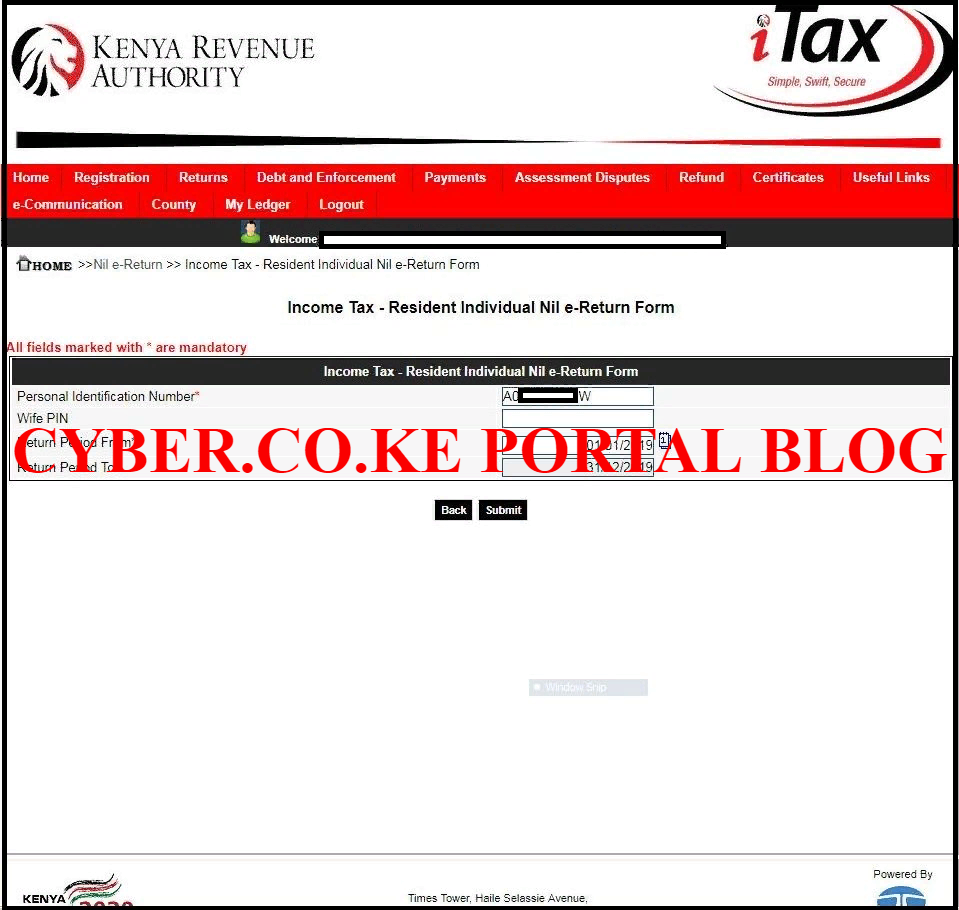

Step 7: Fill the Income Tax Resident Individual Nil e-Return Form

In the Nil e-Return form on KRA iTax Portal, you will need to enter the “Return Period From” and the “Return Period To.” In our case, since we are filing the iTax Returns for the year 2019, we are going to write 01/01/2019 in the “Return Period From” box and 31/12/2019 in the “Return Period To.” You don’t need to fill in the Wife PIN here. Click on the “Submit” to submit the KRA Returns 2020 to Kenya Revenue Authority (KRA).

Once the pop up box as shown above appears, you will need to click on the “Yes” button to submit your KRA Returns. As long as you don’t have any source of income, you can proceed to clicking on “Yes” button to submit KRA Returns to KRA.

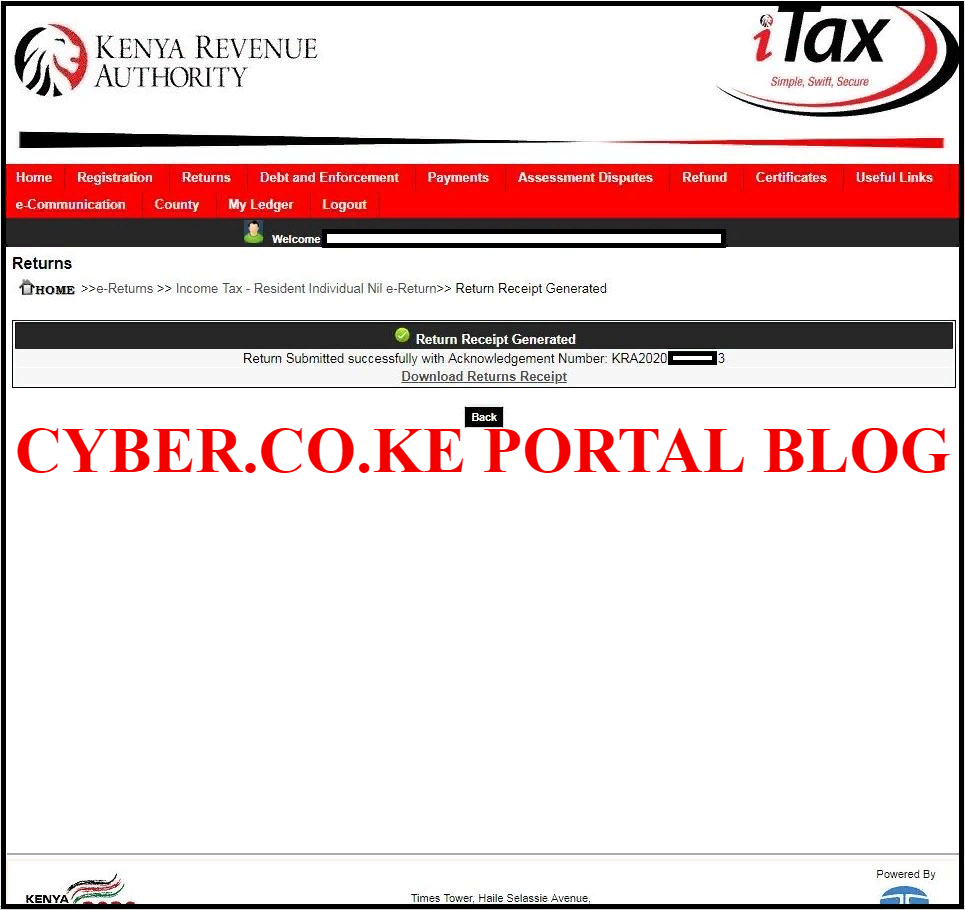

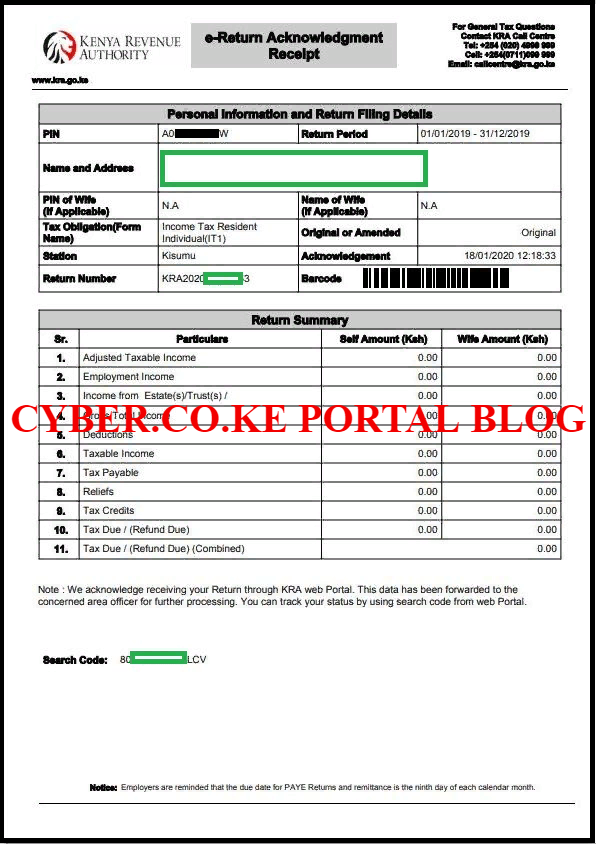

Step 8: Download KRA Returns Receipt

This is the last step whereby you will need to download the generated KRA Returns Receipt. This is the final confirmation that your KRA Return has been successfully submitted and an acknowledgement number of the same will also be generated.

The KRA Returns 2020 receipt is the final confirmation that you have filed your KRA Returns for 2019 this year.

Next time you need help with filing KRA Returns if you are Unemployed or a Student in Kenya, just follow the above 8 steps and you will be able for iTax Returns within 5 minutes without much hassle as this article is the ultimate guide on How To File KRA Returns in Kenya.

READ ALSO: How To Download KRA PIN Certificate From KRA iTax Portal

As a closing tip, always remember that as long as you have a KRA PIN and whether you are Unemployed or a Student, you need to file KRA Returns in time before the KRA Returns Deadline 2020 of 30th June 2020. Don’t take Returns lightly even if they are KRA Nil Returns. You have to ensure you are Tax Compliant by filing your KRA Returns today.