Get to know How To Download KRA PIN Certificate From KRA iTax Portal. Learn How to Download and Print KRA PIN Certificate today.

To get a copy of your KRA PIN Certificate on iTax Portal, you need to know how to download that KRA PIN Certificate something that many taxpayers don’t know how to go about it. Getting to know how to download KRA PIN Certificate on iTax Portal should not be that hard as you will learn from this article.

In this article, I am going to share with you the step by step procedure that you need to follow each time you need a copy of your KRA PIN Certificate for immediate use. We shall be focussing on how to download your KRA PIN Certificate hardcopy format (PDF version).

READ ALSO: How To Use KRA iTax PIN Checker Functionality On iTax Portal

KRA PIN has nowadays become one of those documents that you can’t do anything in Kenya without. Gone are the days where there used to be a misconception amongst many Kenyans that having a KRA PIN Number is not good. Forget those naysayers and get a KRA PIN Number today. As Albert Einstein once said, “The person who follows the crowd will usually go no further than the crowd. The person who walks alone is likely to find himself in places no one has ever been before.”

Many Kenyans were afraid back in the days (years ago) that Kenya Revenue Authority (KRA) will go after each person who has a KRA PIN and does not pay any taxes.(We used to judge Kenya Revenue Authority based on the opinions of others). To some extent, some people were even afraid of visiting KRA Offices or KRA Service Centres countrywide, fearing that when their KRA PIN Number is checked in the system and found that no returns or taxes were remitted then they will be arrested immediately.

So, KRA PIN Certificate can be put in that category “A” of documents that you ought not to ignore. The same way you cherish having an National ID, should be replicated the same way to your KRA PIN Certificate. Can you try to imagine any transaction that you can possibly do in Kenya, without being asked for your KRA PIN Number. Be it Jobs, Banks, Tenders, HELB or NTSA, you need to carry or have your KRA PIN Number and Certificate with you.

What Is KRA PIN Certificate?

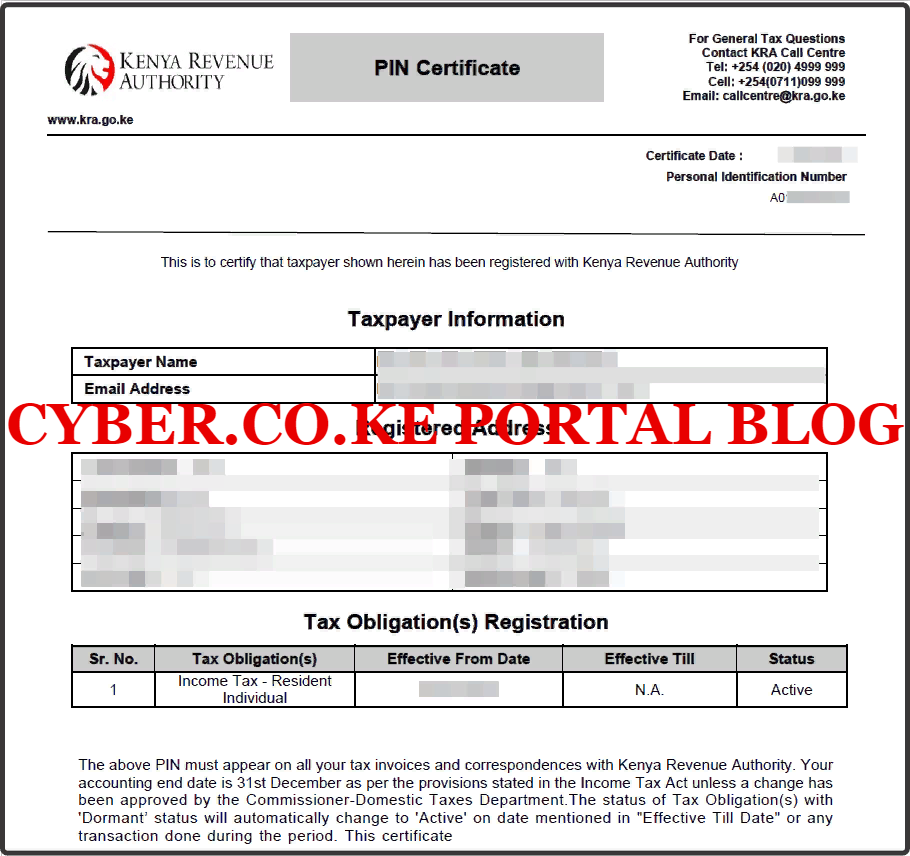

KRA PIN Certificate is a document issued to taxpayers in Kenya upon successful KRA PIN Registration process on the KRA iTax Portal. The PIN Certificate serves as an official document certifying that the taxpayer whose name appears on the PIN Certificate has been registered with Kenya Revenue Authority (KRA) and a Personal Identification Number (PIN) is shown on the PIN Certificate.

Now that we have explained what a KRA PIN Certificate is, we need to understand the parts that make up the PIN Certificate as a document. Below is break down of the most important parts of the KRA PIN Certificate.

-

Certificate Date

The Certificate Date as the name suggests is the date the the KRA PIN Certificate was issued to a taxpayer in Kenya. The date could also be the one that the PIN Certificate was downloaded or updated on in the KRA iTax Portal.

-

Personal Identification Number

Basically, this is the most important number in the PIN Certificate. The Personal Identification Number is an eleven digit number (PIN) that is issued to taxpayer by Kenya Revenue Authority (KRA). It serves as a way of identification of a taxpayer in KRA iTax System. Each PIN is unique and cannot be duplicated.

-

Taxpayer Information

The taxpayer information on the KRA PIN certificate is basically comprised of Taxpayer Name and also the Taxpayer Email Address.

-

Registered Address

The Registered Address of the taxpayer comprises of the following; L.R Number, Building, Street/Road, City/Town, County, District, Tax Area, Station, P.O.Box and Postal Code.

-

Tax Obligation(s) Registration

This part shows the obligation(s) which a taxpayer is registered for in iTax Portal. The most common tax obligation for all individual taxpayers being the Income Tax – Resident Individual. This part of the KRA PIN Certificate also comprises of; Sr. No, Tax Obligation(s), Effective From Date, Effective Till Date and Status of the KRA PIN Number.

The last part of the PIN Certificate document is the notice from Kenya Revenue Authority (KRA) stating; “The above PIN must appear on all your tax invoices and correspondences with Kenya Revenue Authority. Your accounting end date is 31st December as per the provisions stated in the Income Tax Act unless a change has been approved by the Commissioner-Domestic Taxes Department.The status of Tax Obligation(s) with ‘Dormant’ status will automatically change to ‘Active’ on date mentioned in “Effective Till Date” or any transaction done during the period. This certificate shall remain in force till further updated.”

We close the PIN Certificate by the Disclaimer part that simply states;”This is a system generated certificate and does not require signature.” The first generation PIN Certificates were the ones that required a signature when they were issued back in the yester years. The second generation PIN Certificates under the now Defunct Mapato System (Legacy), also never required signature. An finally the third generation PIN Certificates on iTax are system generated and do not need a signature.

Now I believe this is getting interesting. We have talked about what a PIN certificate is and the basic parts that for the KRA Certificate. Inline with our article on How To Download KRA PIN Certificate From KRA iTax Portal, we need to look at the requirements that we are going to need in downloading the KRA PIN Certificate from iTax Portal.

Requirements For Downloading KRA PIN Certificate On KRA iTax Portal

For you to download your Certificate on KRA iTax Portal, you will need to have with you your KRA PIN Number and iTax Password. Also, you will need to ensure that your KRA PIN is Updated on iTax.

-

KRA PIN Number

The most item that you need to have in this process is your KRA PIN Number. If you have forgotten your KRA PIN and need it urgently, you can submit KRA PIN Retrieval order at Cyber.co.ke Portal and our support team will gladly help with your PIN Retrieval order and send you your KRA PIN via Email Address. If you have a KRA PIN that is not yet updated on KRA iTax Portal, you can submit KRA PIN Update order here at Cyber.co.ke Portal. Our support team will update your KRA PIN in iTax Portal and send you your KRA PIN Certificate and Password to your Email Address.

If you are new to all this KRA matters and need a new KRA PIN, you can get one here at Cyber.co.ke Portal in less than 3 minutes. Just submit your KRA PIN Registration order online today and have your KRA PIN Number, PIN Certificate and Password sent to your Email Address within 3 minutes of submitted your PIN Registration request at Cyber.co.ke Portal.

-

iTax Password

You will be needing your KRA iTax Password to be able to log into your KRA iTax Account. If by any chance you have forgotten your iTax Password, you can always Reset the Password and have a new one sent to your Email Address by Kenya Revenue Authority (KRA). Follow the steps in our article on How To Reset KRA iTax Password. If you need to change your Email Address so as to be able to receive the KRA iTax Passwords, you can submit your order at Cyber.co.ke Portal for KRA PIN Change of Email Address today and have your iTax Email changed so at to reset your iTax Account.

If you are all set with your KRA PIN Number and iTax Password, we can begin the process of downloading our KRA PIN Certificate on KRA iTax Portal i.e How do you download KRA PIN Certificate on KRA iTax Portal.

How To Download KRA PIN Certificate From KRA iTax Portal

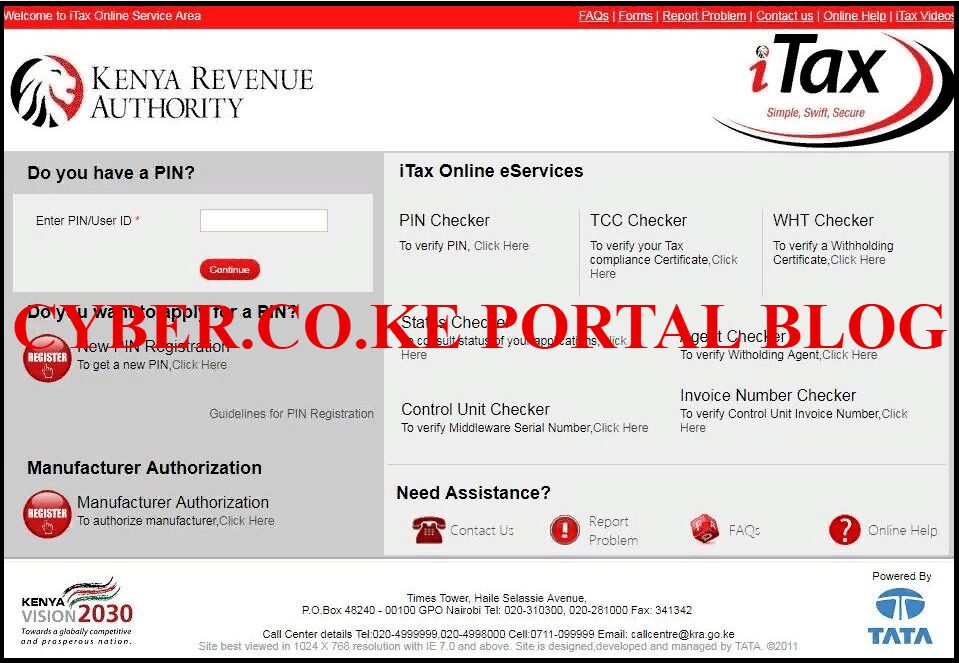

Step 1: Visit KRA Portal

The first step that you need to take is to ensure that you visit the KRA iTax Portal using the link provided above in the title.

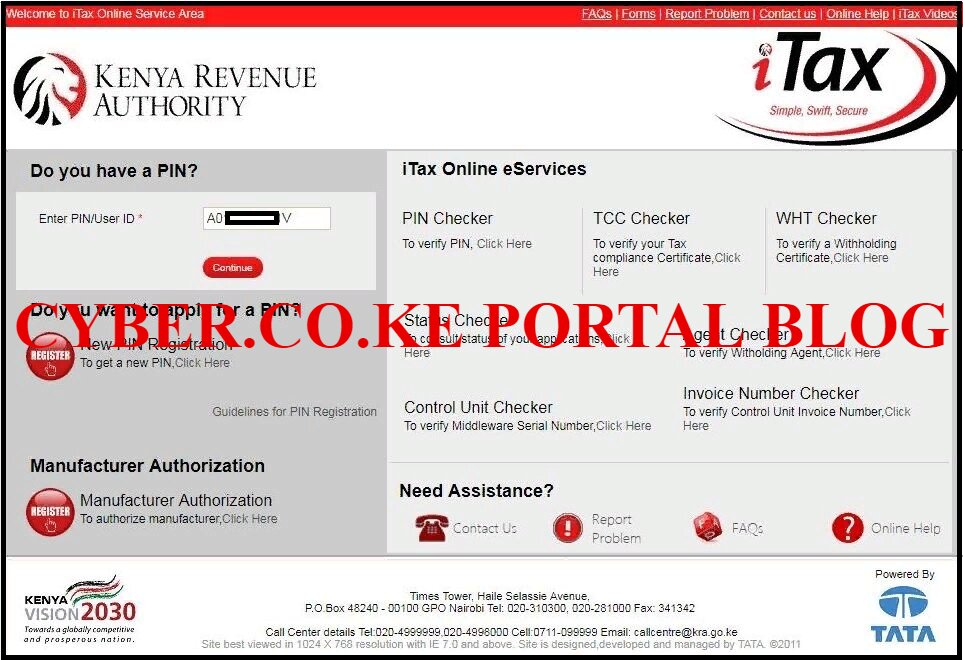

Step 2: Enter Your KRA PIN Number

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN Number, click on the “Continue” botton to proceed to the next step.

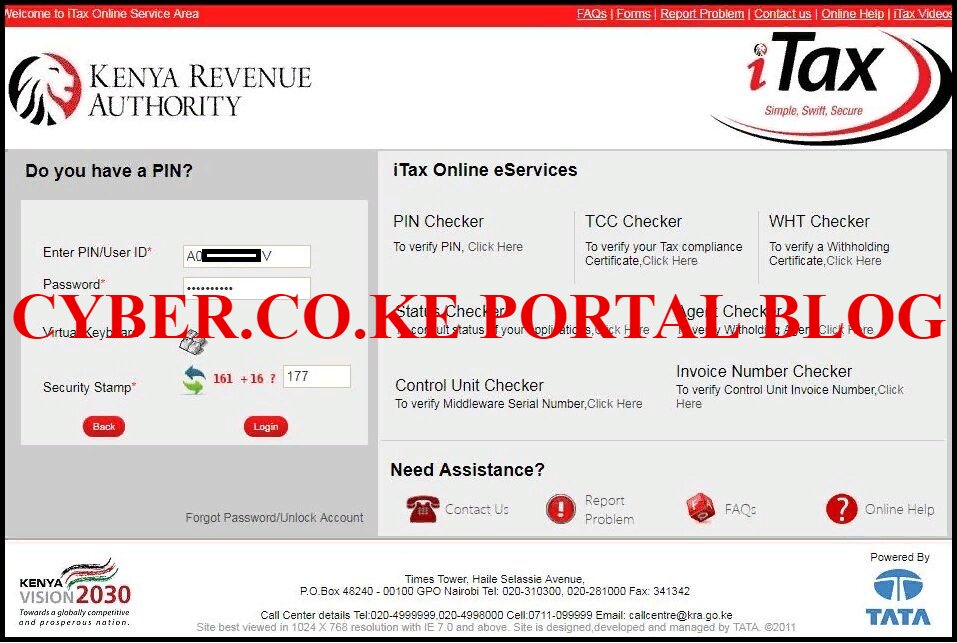

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Portal Account.

Step 4: iTax Portal Account Dashboard

Once you have entered the correct iTax Password as illustrated in Step 3 above, you will be able to see and access your iTax Account Dashboard. In your KRA Portal account, you will able to see a myriad of tabs usch as; Registration, Returns, Debt and Enforcement, Payments, Assessment Disputes, Refund, Certificates, Useful Links, e-Communication, County and My Ledger. This is as illustrated in the screenshot below.

Since our main focus in this article is on How To Download KRA PIN Certificate, we shall lay more focus and emphasis on the “Registration” menu tab.

Step 5: Click on Reprint PIN Certificate under the Registration menu tab

In this step, you will need to click on the Registration tab then under it from the drop-down menu list, select Reprint PIN Certificate.

NOTE: We normally don’t use blue watermarks but in this scenario (Step 5), we had to use it a departure from the red colour we have been using on all our image screenshots here. This is so as to make you see where the Reprint PIN Certificate is located from the drop down menu list items under the Registration tab.

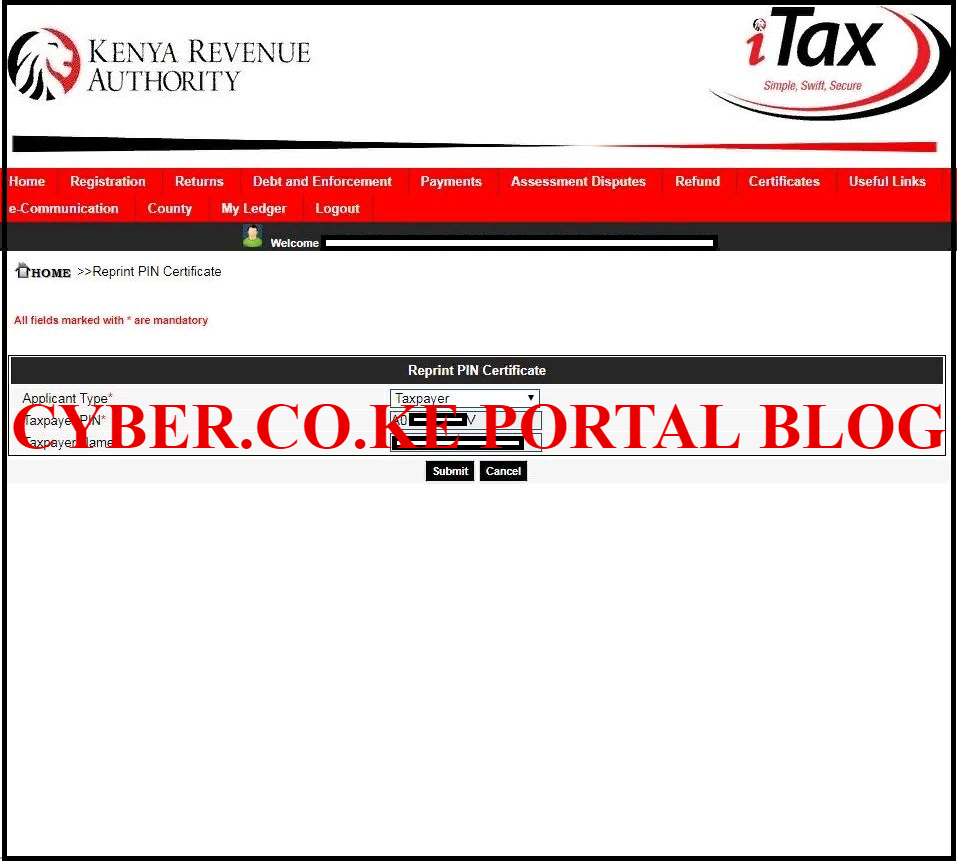

Step 6: Select Applicant Type

In this step, you will need to select the Applicant Type. In our case, we are going to select Taxpayer and this will pre-fill the Taxpayer PIN and Taxpayer Name automatically on the form. This is as illustrated below.

Once the fields have been auto-populated automatically by the system, click on the “Submit” button to proceed to last step in this process.

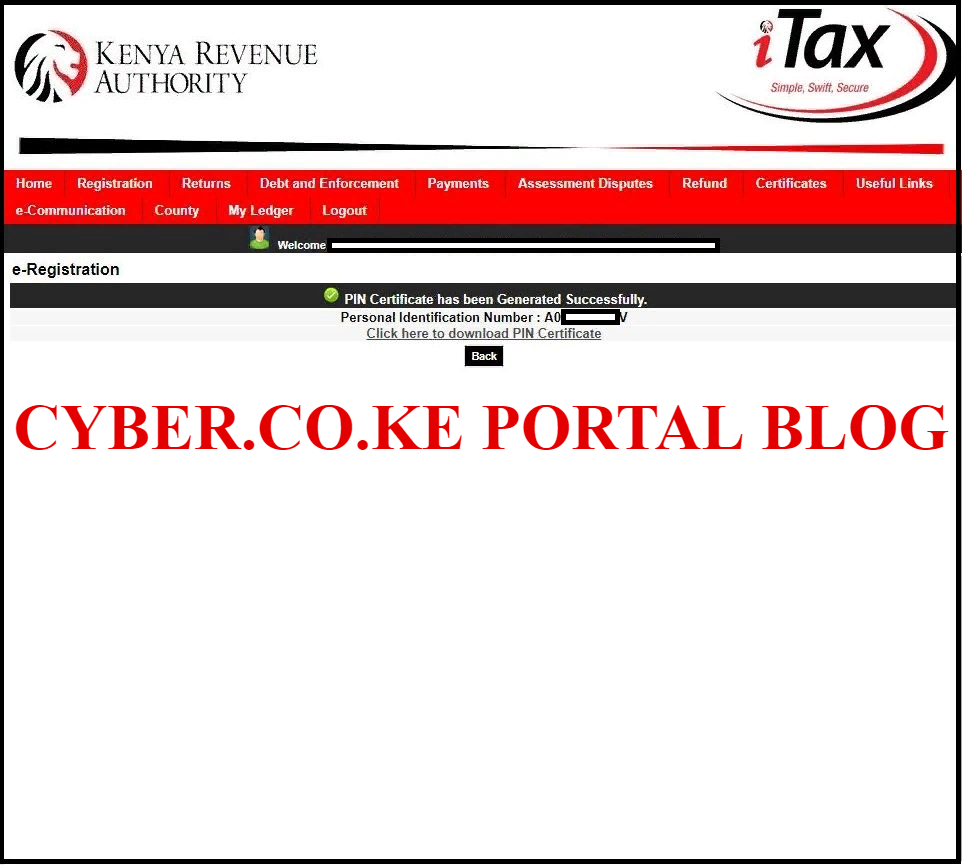

Step 7: Download KRA PIN Certificate

This is the last step whereby you will be able to download your KRA PIN Certificate. The system will generate your PIN Certificate and you will have the chance to download the KRA Certificate from iTax Portal.

You need to take note that the KRA PIN Certificate is a PDF file and you will need a PDF Reader such as the popular Adobe Reader installed in your computer or your Smartphone. There a variety of PDF apps for smartphones that will enable you view the PIN Certificate in any device that you are using.

READ ALSO: How To Access KRA Portal Using PIN Number And Password

Now that you have successfully downloaded your KRA PIN Certificate from KRA iTax Portal, you make print it out and make copies which you will use when you are required to present your KRA Certificate.