Do you need to calculate and know how much Turnover Tax your business is supposed to pay to KRA? Learn How To Calculate Turnover Tax In Kenya Using Turnover Tax Form.

If you own and run a business in Kenya that is eligible to be paying the monthly Turnover Tax on the gross sales for a given month, then knowing how to use the Turnover Tax Form to Calculate Turnover Tax is a must for every taxpayer and business owner in Kenya. Before you get to the nitty gritty of the Turnover Tax Calculations, you need to Register for Turnover Tax using Cyber.co.ke Portal, then start paying for the KRA Turnover Tax each and every month.

In this article, I am going to share with you the step by step guide on How To Calculate Turnover Tax In Kenya Using Turnover Tax Form. By the end of this article, as a business owner in Kenya you will have learnt and known How To Calculate Turnover Tax by using the Turnover Tax Form.

READ ALSO: How To Generate Presumptive Tax Payment Slip Using iTax Portal

No need to use the Turnover Tax Calculators which are normally not recommended by KRA but rather download the Turnover Tax Returns Form and use it to Calculate Turnover Tax for your business.

There are many sites out there in Kenya purporting to have the Turnover Tax Calculator, but I don’t recommend using those third party sites to Calculate Turnover Tax. The Kenya Revenue Authority (KRA) recommends that taxpayers Download the Turnover Tax Form from their iTax Web Portal Account and use the Turnover Tax Form to Calculate Turnover Tax Due for any given month.

We shall be addressing key concepts and terms related and pertaining to calculation of Turnover Tax including: What Is Turnover Tax Calculation, What Is Turnover Tax Form, Do I Need To Use Turnover Tax Calculators, Importance Of Turnover Tax Form For Turnover Tax Calculation, Requirements Needed To Calculate Turnover Tax and How To Calculate Turnover Tax In Kenya Using Turnover Tax Form.

What Is Turnover Tax Calculation?

Turnover Tax Calculation is the process of calculating the amount of Turnover Tax that a business which is eligible for Turnover Tax is supposed to file and pay to Kenya Revenue Authority (KRA) at the rate of 3% of the business gross monthly sales for a given month. All business owners are supposed to Calculate Turnover Tax, File Turnover Tax Returns and Pay the Turnover Tax each month to KRA.

As a process, Turnover Tax Calculation requires that the business owner or taxpayer keep the records for the gross monthly sales for their business as you are going to need the gross monthly sales for a given month e.g. February 2020 to file and pay the Turnover Tax after calculating the Turnover Tax using the Turnover Tax Form on or before the 20th day of the next month e.g. March 2020.

Taxpayers are normally recommended to download the Turnover Tax Form which is the key requirement that is needed in the process of How To Calculate Turnover Tax in Kenya on a monthly basis. Also, once the taxpayer or business owner has calculated the Turnover Tax due and validated the Turnover Tax Returns Form, he or she is supposed to upload the Turnover Tax Returns form that has the computed Turnover Tax amount due to KRA on their KRA iTax Web Portal accounts.

Since this article will be focusing on How To Calculate Turnover Tax using Turnover Tax Form, we need to understand what we mean by the term Turnover Tax Form. I shall be highlighting briefly about the Turnover Tax Returns form because I have already a full article about KRA Turnover Tax Returns Form here at Cyber.co.ke Portal Blog titled “How To Download Turnover Tax Form Using KRA iTax Portal.”

Next, you are going to need the Turnover Tax Form which serves as the Turnover Tax Calculator that taxpayers need to use to calculate the amount of Turnover Tax due. You can check our article on How To Download Turnover Tax Form Using KRA iTax Portal so as to know how to download the Turnover Tax Returns Form on iTax Portal.

With the Turnover Tax Form you don’t need to use any other Turnover Tax Calculator as once you have calculated the amount of Turnover Tax due, all you need to do next is to validate and upload the Turnover Tax Returns Form in your KRA Web Portal account.

Total Gross Sales For The Month

Last but definitely not the least requirement is the Total Gross Sales For The Month. This amount is very important in the process of How To Calculate Turnover Tax for your Business in Kenya. Every business in Kenya that is eligible for Turnover Tax is supposed to keep their monthly gross sales as it is needed to calculate the amount of Turnover Tax that the business is supposed to pay to Kenya Revenue Authority (KRA).

So, always keep a records of your business gross sales for each month since the KRA Turnover Tax is filed on a monthly basis on or before the 20th day of the next moth. Failure to file your business Turnover Tax Returns attracts a penalty for late filing. So, ensure that you have your monthly gross sales with you in order to calculate, file and pay the KRA Turnover Tax on a monthly basis.

Having addressed all the above pertaining to How to Calculate Turnover Tax above using the Turnover Tax Form, we need now to start and look at the Turnover Tax Calculations i.e. How To Calculate Turnover Tax In Kenya Using Turnover Tax Form.

How To Calculate Turnover Tax In Kenya Using Turnover Tax Form

Step 1: Download the Turnover Tax Form

First and foremost, you need to download the KRA Turnover Tax Returns Form that is going to serve as the Turnover Tax Calculator. You can check our article on How To Download Turnover Tax Form or click on the link below titled Turnover Tax Form to download the latest Turnover Tax Returns Form for 2020.

Download::: KRA Turnover Tax Returns Form (Excel Version 2020)

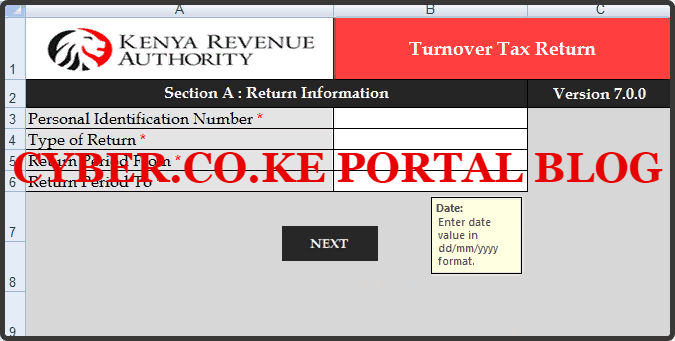

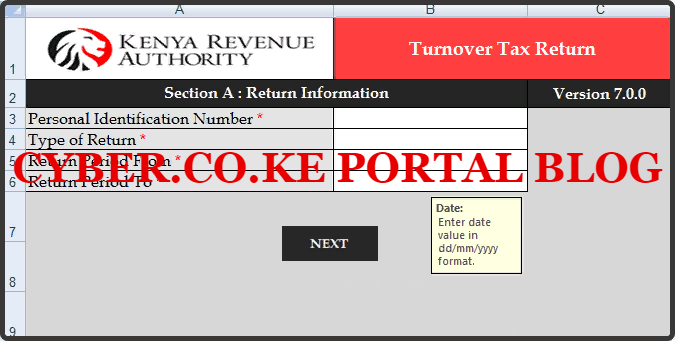

Step 2: Fill In Section A Return Information

Next, you will need to fill in the Section A with your KRA PIN Number, Type of Return, Return Period From and Return Period To. Once you have filled in the above details, you will now move to the next step where you need to Calculate Turnover Tax using the KRA Turnover Tax Returns Form.

Step 3: Calculate The Turnover Tax

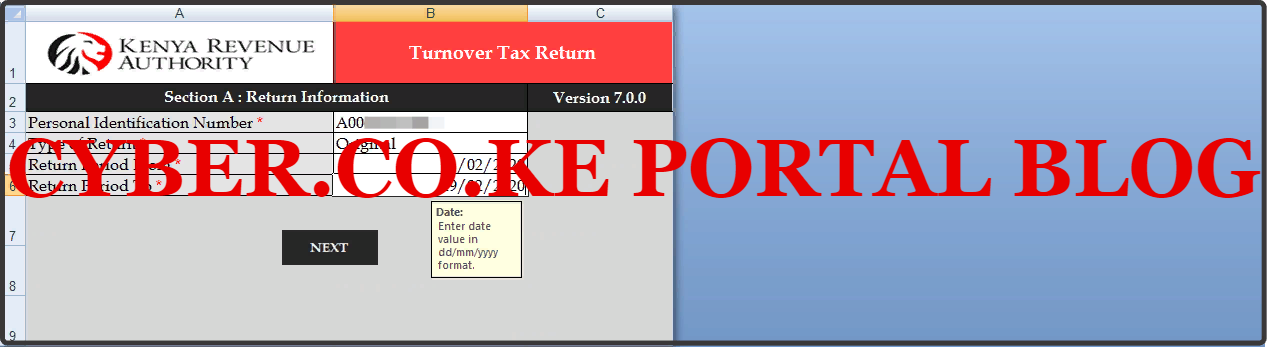

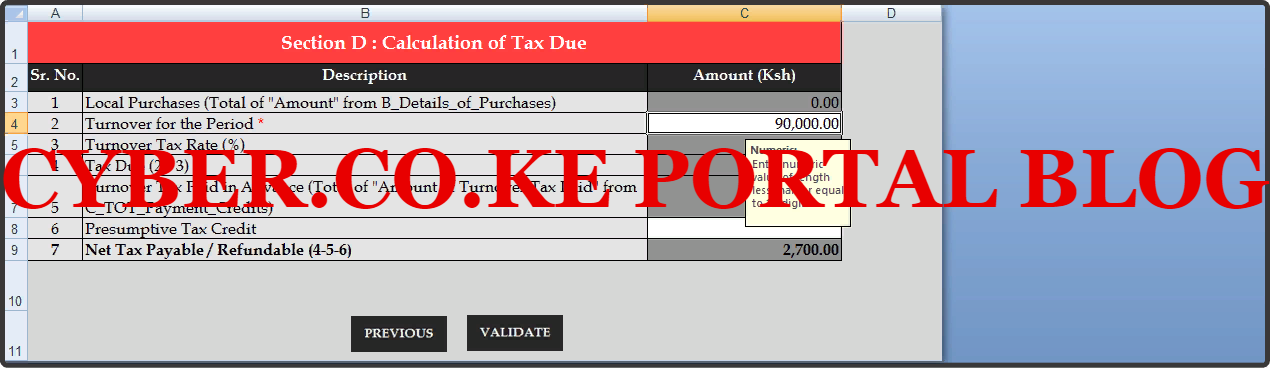

In this step, you are now going to calculate the amount of Turnover Tax that is due from your business gross sales to the Kenya Revenue Authority (KRA). You are going to need the Gross Sales for the previous month i.e. February 2020 so as to use the Turnover Tax Form to calculate Turnover Tax.

As an example, assuming we own a small business whose total gross sales for the month of February 2020 was Kshs. 90,000.00, we shall use the gross sales so as to Calculate Turnover Tax that is due to KRA for the month of February 2020. This is as shown below.

From the above Turnover Tax Calculation, you will notice that it is calculated at the rate of 3% of the monthly gross sales. The amount of Turnover Tax paid by various businesses in Kenya is different as each make different gross sales per month but all have to calculate Turnover Tax using the Turnover Tax Form that serves as the Turnover Tax Calculator. Once you have calculated the Turnover Tax above, all you need to do next is to click on the “Validate” button and upload the Turnover Tax Form in your KRA iTax Web Portal Account.

READ ALSO: How To Check And Confirm Your KRA PIN Using iTax PIN Checker

The above sums up the steps that every taxpayer who owns and runs a business that is eligible for Turnover Tax should follow on How To Calculate Turnover Tax In Kenya Using Turnover Tax Form. All you need to know is that the Turnover Tax Returns Form serves as the Turnover Tax Calculator that you need to use to calculate the amount of Turnover Tax due. If you need to Register for Turnover Tax, you can submit your order online for Turnover Tax Registration and also KRA Turnover Tax Returns Filing.