Are you looking to File your KRA Returns using the KRA Nil Returns Portal? Learn how by following our KRA Nil Returns Portal Login Step By Step Procedure.

It is that time of the year whereby we are nearly approaching the KRA Returns Deadline of 30th June 2023. Every Kenyan is in a rush to file his or her KRA Returns both KRA Nil Returns and KRA Employment Returns. As for those who don’t have any source of income, you need to access the KRA Nil Returns Portal in order to file your KRA Returns.

In this article, I am going to share with you the KRA Nil Returns Portal Login Step By Step Procedure In 2023 that you need to follow so as to be able to file your KRA Returns before the KRA Returns Deadline 2023 approaches in the next few months. By the end of this article, you will have learnt and known the step by step procedure of KRA Nil Returns Portal Login in 2023.

READ ALSO: How To Apply For KRA Clearance Certificate Using iTax Portal

Knowing the concept of KRA Nil Returns Portal and KRA Nil Returns Portal Login is very important especially when you need to file your KRA Nil Returns 2023 quickly and easily. In this article, we are going to look at important concepts and terms such as: What Is KRA Nil Returns Portal, What Is KRA Nil Returns Portal Login, Who Is Supposed To Use KRA Nil Returns Portal, Requirements Needed To Access KRA Nil Returns Portal Login and KRA Nil Returns Portal Login Step By Step Procedure In 2020.

Logging into KRA Nil Returns Portal or iTax Nil Returns Portal is a process that requires you to have both your KRA PIN Number and iTax Password. To be able to access and view all the resources on iTax, you need to be logged into your iTax Account. The problem is that not that many Kenyans know the process that they need to follow.

The good thing is that incase you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you. Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password.

What Is KRA Nil Returns Portal?

KRA Nil Returns Portal is an online portal that taxpayers can use to file their KRA Nil Returns. Just from the name the Nil Returns Portal allows any taxpayer who does not have any source of income either employment, business or rental to file their KRA Nil Returns online quickly and easily.

KRA Nil Returns Portal is an online portal that taxpayers can use to file their KRA Nil Returns. Just from the name the Nil Returns Portal allows any taxpayer who does not have any source of income either employment, business or rental to file their KRA Nil Returns online quickly and easily.

In simple terms, the KRA Nil Returns Portal is also commonly referred to as KRA iTax Portal or simply iTax Portal. Taxpayers who are unemployed are normally supposed to file their KRA Nil Returns before the 30th June Deadline reaches. To be able to do this, they need to access the KRA Nil Returns Portal Login by providing their KRA Login Credentials to the KRA Nil Returns Portal. Once logged into the KRA Nil Returns Portal, you can go ahead and file the KRA Nil Returns.

What Is KRA Nil Returns Portal Login?

Having looked at the definition of KRA Nil Returns Portal above, we can simply refer to the KRA Nil Returns Portal Login as the procedure of logging into the Nil Returns Portal using the Login Credentials i.e. KRA PIN Number and KRA iTax Password. You only file Nil Returns in cases where you don’t have any source of income and in most cases students and the unemployed are the ones who are supposed to file KRA Nil Returns.

Just as described above, you will need to login to the Nil Returns Portal in order to file your KRA Nil Returns on or before the 30th June deadline. I normally recommend that Kenyans file their KRA Nil Returns earlier before the KRA Returns Deadline 2020 approaches. So, if you meet the criteria of taxpayers eligible to file Nil Returns on the KRA Nil Returns Portal, then you need to file your KRA Returns immediately.

Having looked at the definitions of both KRA Nil Returns Portal and KRA Nil Returns Portal Login, we now need to look at Who Is Supposed To Use KRA Nil Returns Portal. Not every taxpayer is supposed to file Nil Returns as only those who don’t have any source of income are the ones to do so.

Who Is Supposed To Use KRA Nil Returns Portal?

The taxpayers who are supposed to use the KRA Nil Returns Portal includes those who don’t have any active source of income. The sources of income can be categorized into three i.e. Employment Income, Business Income and Rental Income Income.

-

Employment Income

Taxpayers who are not employed are supposed to file Nil Returns on the KRA Nil Returns Portal. So, if you no that you don’t have employment income, then you need to file your KRA Nil Returns before the 30th June Deadline.

-

Business Income

Taxpayers who do not have any business are supposed to file Nil Returns on the KRA Nil Returns Portal. So, if you no that you don’t have business income, then you need to file your KRA Nil Returns before the 30th June Deadline.

-

Rental Income Income

Taxpayers who do not own any rental houses or apartments are supposed to file Nil Returns on the KRA Nil Returns Portal. So, if you no that you don’t have rental income, then you need to file your KRA Nil Returns before the 30th June Deadline.

Having looked at the three categories of taxpayers who are supposed to file KRA Returns using the KRA Nil Returns Portal, we now need to shift gears and look at Requirements Needed To Access KRA Nil Returns Portal Login.

Requirements Needed To Access KRA Nil Returns Portal Login

To be able to access the KRA Nil Returns Portal Login, you need to ensure that you have with you the KRA PIN Number and KRA iTax Password. These are the main requirements that you are going to need in order to access the KRA Nil Returns Portal through the KRA Nil Returns Portal Login.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable your Reset KRA iTax Password.

Having looked at the requirements needed to access the KRA Nil Returns Portal using the KRA Nil Returns Login procedure, we now need to look at the KRA Nil Returns Portal Login Step By Step Procedure In 2023.

KRA Nil Returns Portal Login Step By Step Procedure In 2023

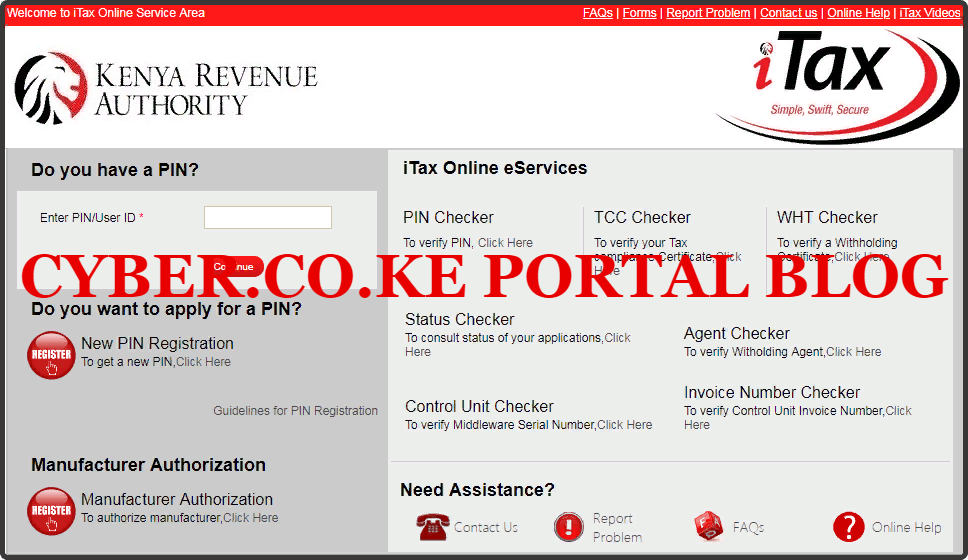

Step 1: Visit KRA Nil Returns Portal

The first step that you need to take in the process of KRA Nil Returns Portal Login is to visit the KRA iTax Portal by clicking on the link provided in the above description.

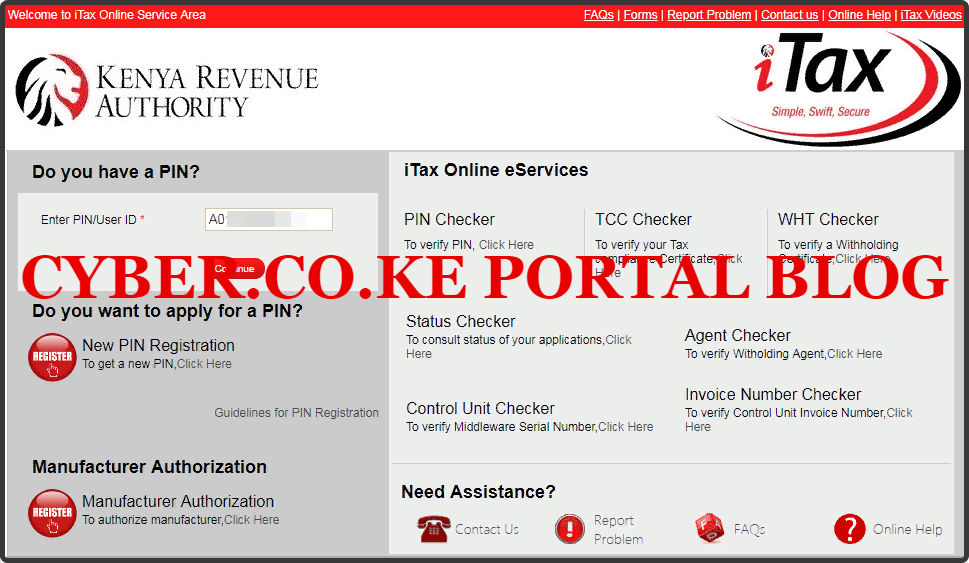

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

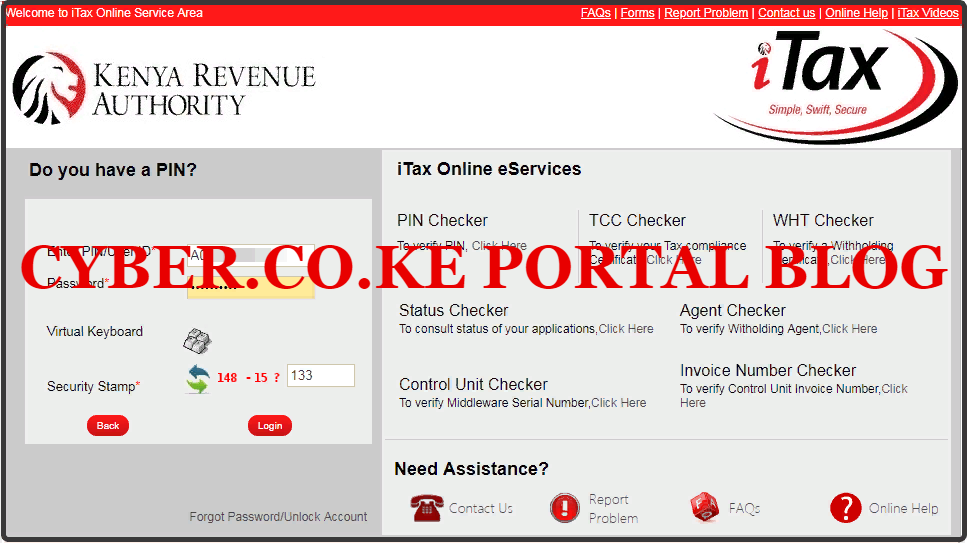

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA Nil Returns Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA Nil Returns Portal Account Dashboard. Here upon successful login process, you will be able to file your KRA Nil Returns. You can refer to our article on How To File KRA Nil Returns In 2020 and How To File KRA Nil Returns Using KRA iTax Portal.

The above steps sums up the procedure that you need to follow to access the KRA Nil Returns Portal using the KRA Nil Returns Portal Login credentials i.e. KRA PIN Number and KRA iTax Password. If you need any help in filing your KRA Nil Returns, you can submit your order online here at Cyber.co.ke Portal for KRA Nil Returns Filing.