Are you looking to file your KRA Tax Returns on KRA iTax Portal? Learn How To File KRA Returns Using iTax Portal In 2020.

The law is quite clear that any individual who has an active KRA PIN Number is supposed to file his or her KRA Returns for the period ended 31st December in the following year. What this simply means is that this year 2020, we are filing the KRA Tax Returns for the year 2019 and thus the KRA Returns period will be from 1st January to 31st December. You need to ensure that you file your KRA Returns before the 30th June 2020 Deadline.

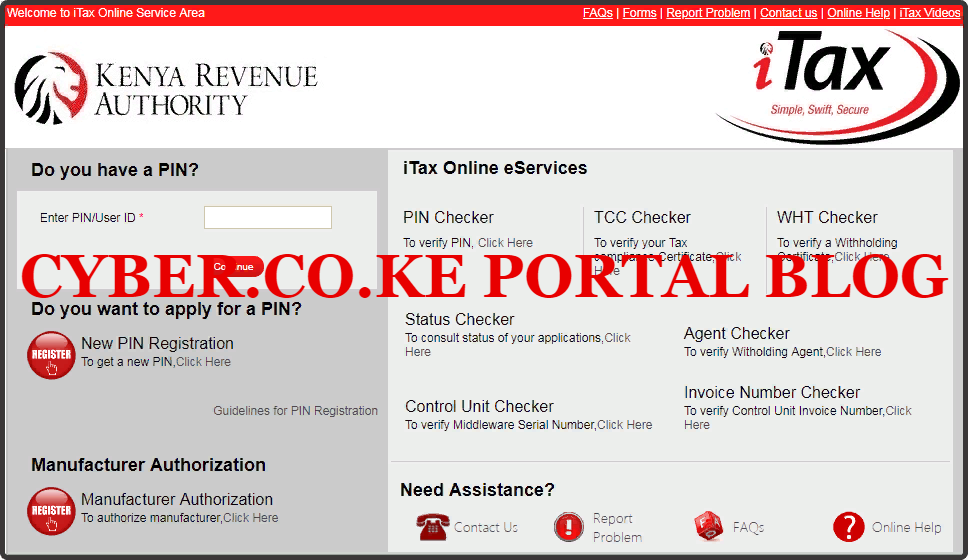

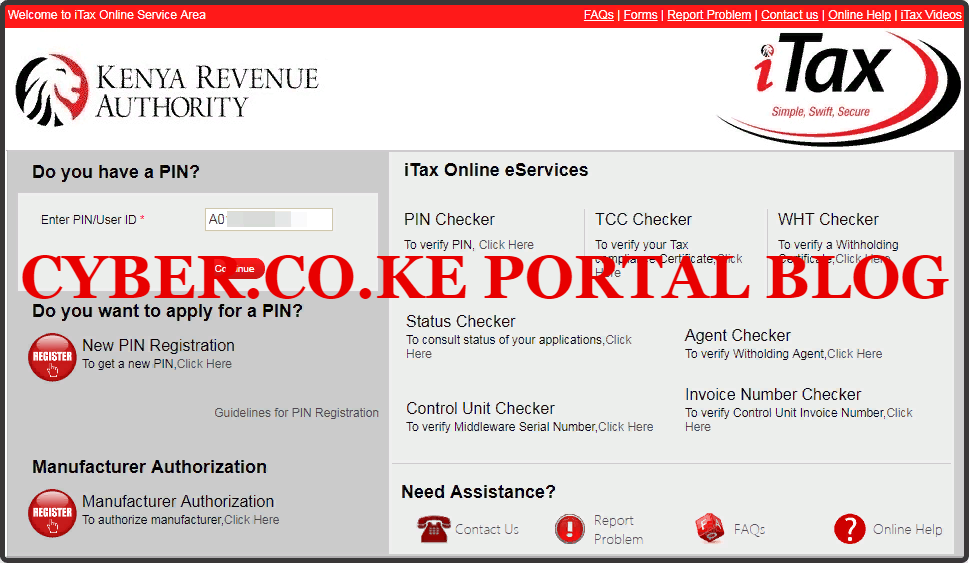

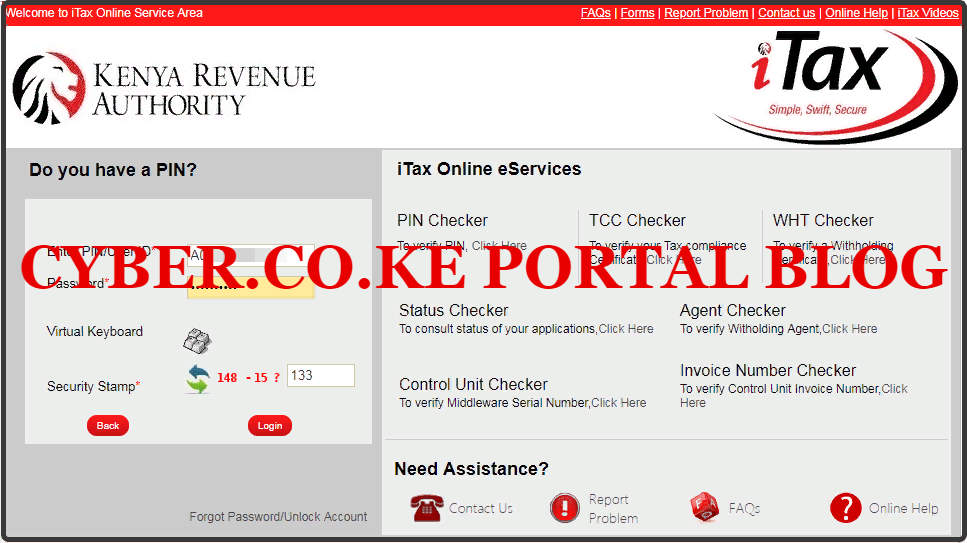

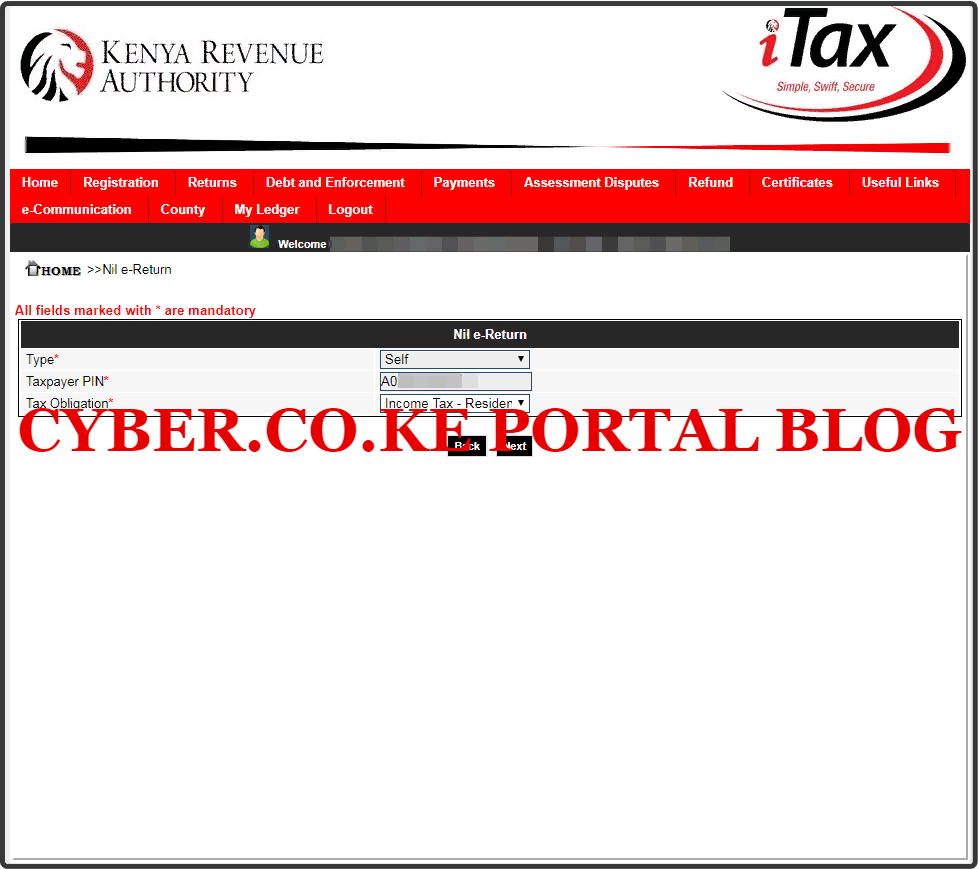

In this article, I am going to share with you the step by step guide on How To File KRA Returns Using iTax Portal In 2020. By the end of this article, you will have learnt how to file your KRA Tax Returns quickly and easily so as to be able to beat the 30th June 2020 deadline. You need to take note that there are normally two types of KRA Returns for Individuals in Kenya i.e. KRA Nil Returns and KRA Employment Returns. This article will mainly focus on filing KRA Nili Returns.

READ ALSO: KRA Announces New PAYE And VAT Rates In Response To COVID-19

This article will be ultimate beginner’s guide to KRA Returns in Kenya as I shall be highlighting on key terms and aspects relating to KRA Tax Returns that no one has ever done before. This is coupled with the fact that here at Cyber.co.ke Portal, we are the leaders in offering KRA Services to Kenyans daily. This article will cover: What Is KRA Returns, Types Of KRA Returns, Frequently Asked Questions About KRA Returns, Requirements Needed To File KRA Returns and How To File KRA Returns Using iTax Portal In 2020.

You need to take note and understand that any Kenyan with a KRA PIN is supposed to file his or her iTax Returns on or before the deadline. So, whether you are employed or unemployed, as long as you have a KRA PIN Number, filing KRA Returns is a must and failure to do so means that you will receive a penalty from Kenya Revenue Authority (KRA).

Any person who has an active KRA PIN Number and does not have any income is supposed to file his or her KRA Nil Returns between 1st January and 30th June of each year. So, you need to forget about the old notion that KRA Returns is for those who are employed, but rather any Kenyan with an active KRA PIN is supposed to be filing KRA Returns each year

What Is KRA Returns?

KRA Returns is a standard form provided by the Kenya Revenue Authority (KRA) on which a taxpayer reports taxable income with permitted deductions and exemptions and computes his or her tax liability. The KRA Returns can either be KRA Nil Returns for those who do not have a source of income and KRA Employment Returns for those who have employment as a source of income.

You file KRA Returns for the Income tax that you have generated for a period of 12 months or 1 year. Income tax is a direct tax that is imposed on income derived from Business, Employment, Rent, Dividends, Interests, Pensions among others. Individual Income Tax is charged for each year of income on all the income of a person, whether resident or non-resident, which accrued in or was derived from Kenya.

KRA Returns are filed between 1st January and 30th June of each year for the Returns of the previous year. For example, this year 2020 we are filing the KRA Tax Returns for the year 2019. And as a taxpayer in Kenya, you have between 1st January to 30th June to ensure that you have file your KRA Income Tax Returns either KRA Nil Returns or KRA Employment Returns.

The Income Tax Laws are quite clear and state that each person with an active KRA PIN Number which can be applied online at Cyber.co.ke Portal through the KRA PIN Registration Services, is supposed to file his or her KRA Returns before the 30th June Deadline. As long as you have an active KRA PIN Number which you can get here at Cyber.co.ke Portal through our KRA PIN Registration Services, you need to file your KRA Tax Returns each and every year.

Failure to file your KRA Tax Returns by the 30th June Deadline leads to automatic penalties being imposed on you by Kenya Revenue Authority (KRA) and you will have to start the process of writing KRA Waiver Letter and Apply for KRA Waiver using iTax Portal, which rarely gets Approved. The only way to avoid all this is by ensuring that you file your KRA Income Tax Returns early.

Now that we have looked at what we mean by KRA Returns above, we need to go a notch higher and look at the types of KRA Returns for Individual taxpayers in Kenya. These are the KRA Nil Returns and KRA Employment Returns. This is as discussed below.

Types Of KRA Returns

There exists two types of KRA Tax Returns for Individual taxpayers in Kenya. These are KRA Nil Returns and KRA Employment Returns. I am going to briefly highlight on each of these types of KRA Returns below.

-

KRA Nil Returns

The first type of KRA Returns is called the KRA Nil Returns. This type of KRA Return is filed by taxpayers who do not have any source of income either Business, Rental or Employment. KRA Nil Returns just as from its definition refers to Nil or Zero (0) tax return for taxpayers who don’t have any source of income. In most cases, when a taxpayer applies for a KRA PIN on Cyber.co.ke Portal, maybe because they need the PIN to apply for a job or even get a new DL from NTSA.

Majority of taxpayers who are supposed to file KRA Nil Returns tend to forget about KRA Returns. Some end up not filing their KRA Nil Returns before the 30th June Deadline and thus end up with the Kshs. 2,000/= imposed by KRA for late filing of returns. An this consequently leads to the taxpayer being denied a Tax Compliance Certificate due to pending KRA Nil Returns which they have not Filed on iTax Portal.

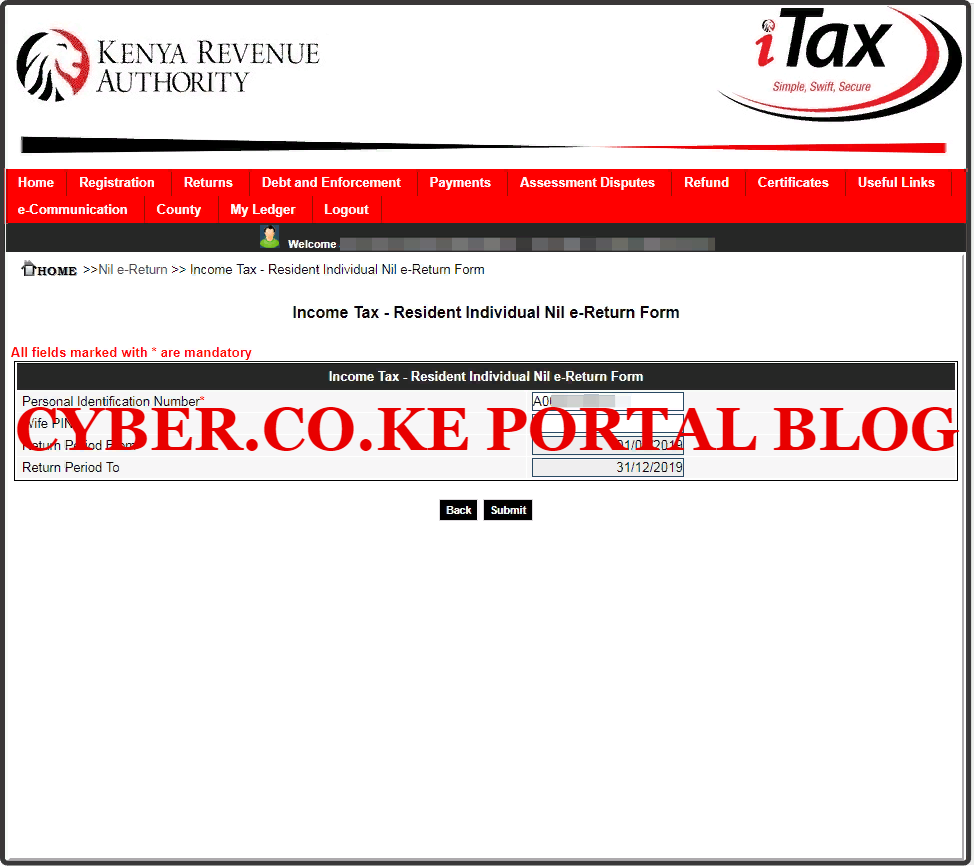

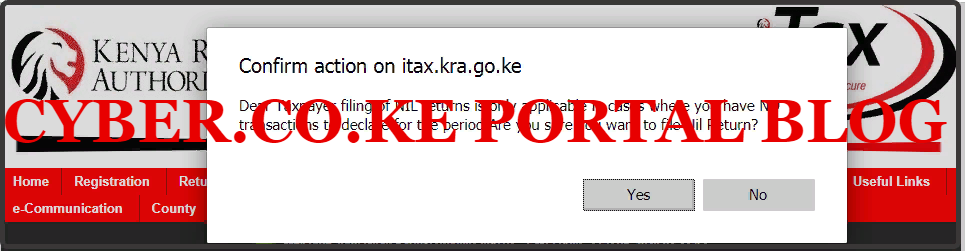

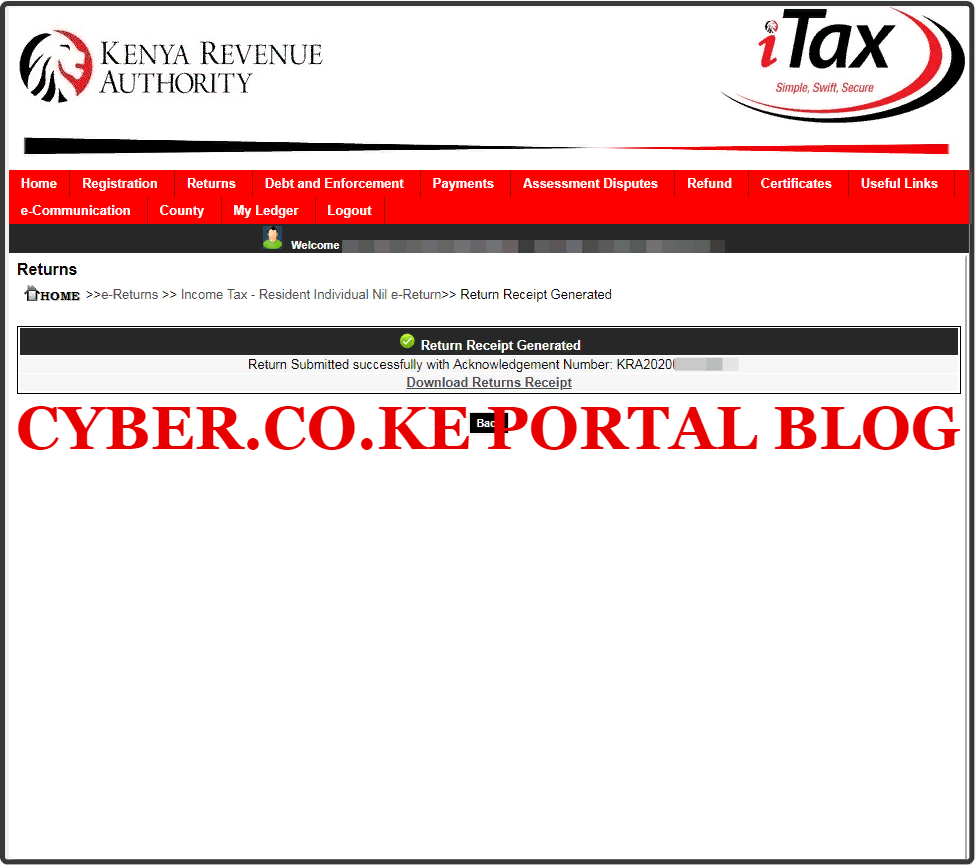

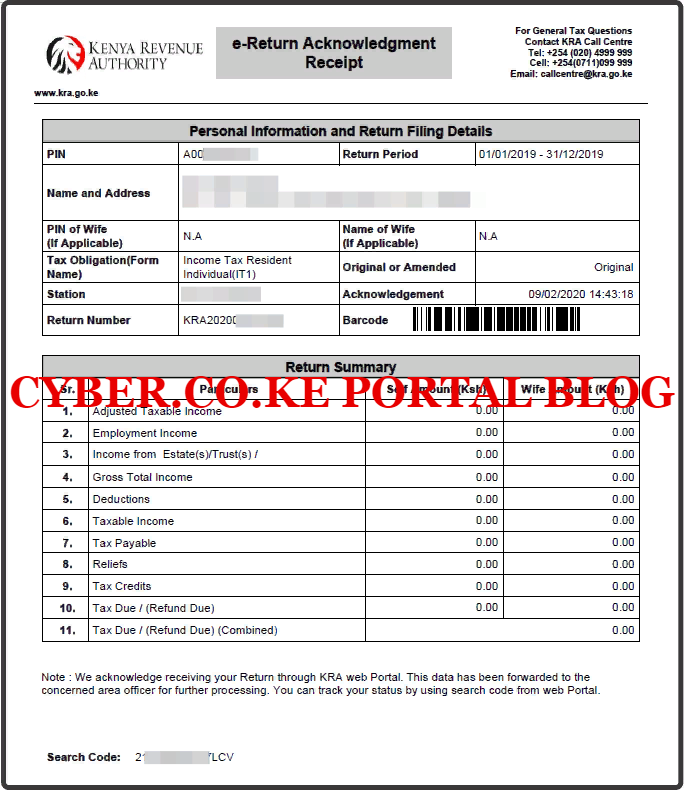

To be able to file KRA Nil Returns on iTax Portal, you can check out our article on How To File KRA Nil Returns using iTax Portal or How To File KRA Returns for Students using iTax Portal. If you require any help and assistance in filing KRA Nil Returns on iTax, you can fill and submit your order online for KRA Nil Returns Filing service request here at Cyber.co.ke Portal and our support team will be able to file your KRA Nil Returns in less than 3 minutes on iTax Portal.

-

KRA Employment Returns

The other type of KRA Returns is what is referred to as the KRA Employment Returns. This is the type of KRA Return that is filed by taxpayers who have employment as their source of income. In other words, those taxpayers who have a source of income through their employment. This group of taxpayers are what is referred to as the employed.

The good thing thing about those who are in employment is that they never tend to forget to file the KRA Income Tax Returns unlike the group of taxpayers who are unemployed and use the notion that they don’t have a job so there is no need to file their Returns. For those in employment PAYE (Pay As You Earn) is deducted at source by the employer and remitted to KRA on a monthly basis before the 9th day of the month.

By using their P9 Forms that they get from their employers, these taxpayers are supposed to log into their KRA iTax Web Portal Accounts and download the KRA Returns Excel Form which they need to fill in with the data that is captured on their KRA P9 Forms. Once done, this KRA Returns Form is supposed to to validated and uploaded into KRA iTax Account of the taxpayer.

To be able also to file your KRA Employment Returns on iTax Portal, you can refer to our article on How To File KRA Returns using P9 Form. Just remember that you need to have with you the KRA P9 Form and the KRA Returns Form. If you need assistance in filing your KRA Income Tax Returns, you can fill and submit your order for KRA Employment Returns Filing here at Cyber.co.ke Portal and our support will gladly assist you in filing your KRA Returns quickly and easily today.

Having looked at the types of KRA Tax Returns above, we now need to go a notch higher and look at the Frequently asked questions about KRA Returns by taxpayers in Kenya. I shall only be highlighting the key questions that most Kenyans ask when talking about KRA Tax Returns.

Frequently Asked Questions About KRA Returns

I had previously written an in depth article on Frequently Asked Questions About KRA Returns By Taxpayers which you can check out. I shall just be highlighting the most important questions pertaining to KRA Tax Returns in Kenya.

-

KRA Nil Returns Questions