CYBER.CO.KE is an independent Cyber Services website and is not affiliated with any government agency, including Kenya Revenue Authority (KRA). A service fee is charged for the assistance provided to customers in Kenya.

The iTax Registered email address plays a very key and important role in terms of the iTax (KRA Portal) account of taxpayers in Kenya. During the process of KRA PIN Registration, a taxpayer is supposed to provide an email address that will be linked to the KRA PIN Number on iTax (KRA Portal). In turn, this email address becomes what is commonly referred to as the iTax registered email address.

It is the email address that will receive the new KRA PIN Number, KRA PIN Certificate and KRA Password (iTax Password). Also, future password resets will be sent to the iTax registered email address and if you can also change the email address linked to the KRA PIN Number on iTax (KRA Portal). If you are able to access your iTax (KRA Portal) account by using both your KRA PIN Number and KRA Password (iTax Password), then you can easily change the iTax registered email address with much ease.

There are normally two ways that you can use to change the iTax registered email address: by accessing iTax (KRA Portal) account and by requesting for KRA PIN Change of Email Address services here at CYBER.CO.KE. In this blog post, we shall be looking at the main steps that one is supposed to follow in order to change the iTax registered email address online using iTax (KRA Portal). For you to successfully change the iTax registered email address, ensure you have with you both the KRA PIN Number and iTax Password (KRA Password).

READ ALSO: Step-by-Step Process of Changing iTax Registered Mobile Number

How To Change iTax Registered Email Address

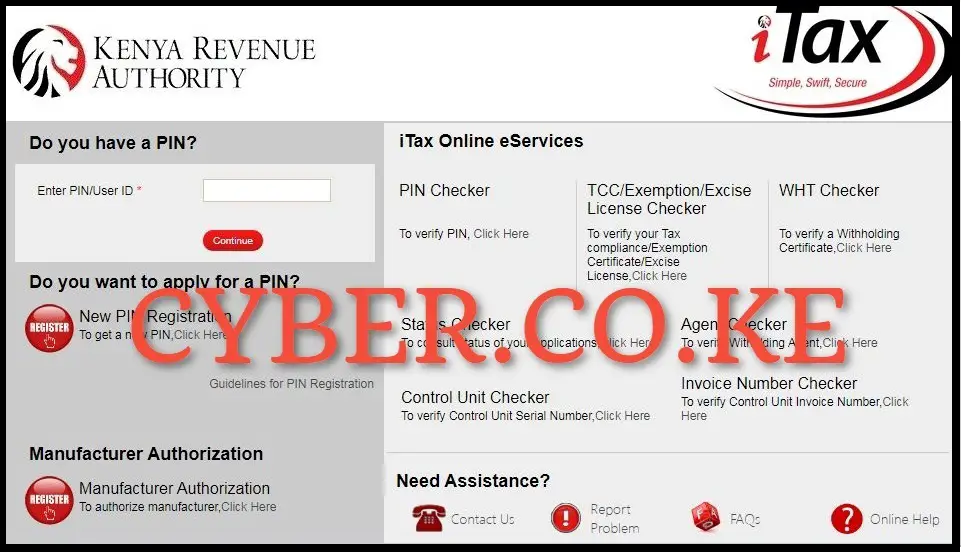

Step 1: Visit iTax (KRA Portal)

For you to be able to change the iTax registered email address online, you first need to visit iTax (KRA Portal) by using https://itax.kra.go.ke/KRA-Portal/

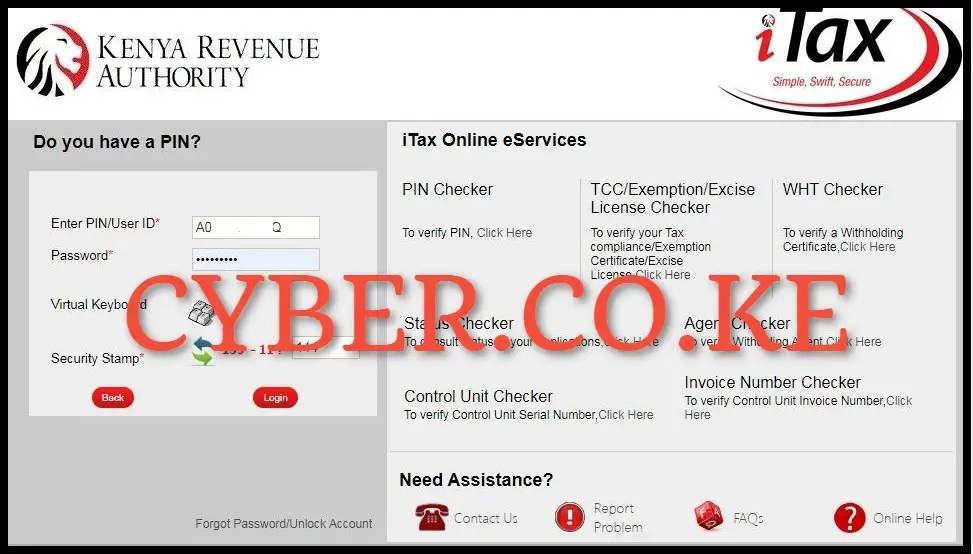

Step 2: Login Into iTax (KRA Portal)

In this step, you need to enter your KRA PIN Number, KRA Password (iTax Password), solve the arithmetic question (security stamp) and then click on the “Login” button to access iTax (KRA Portal) account.

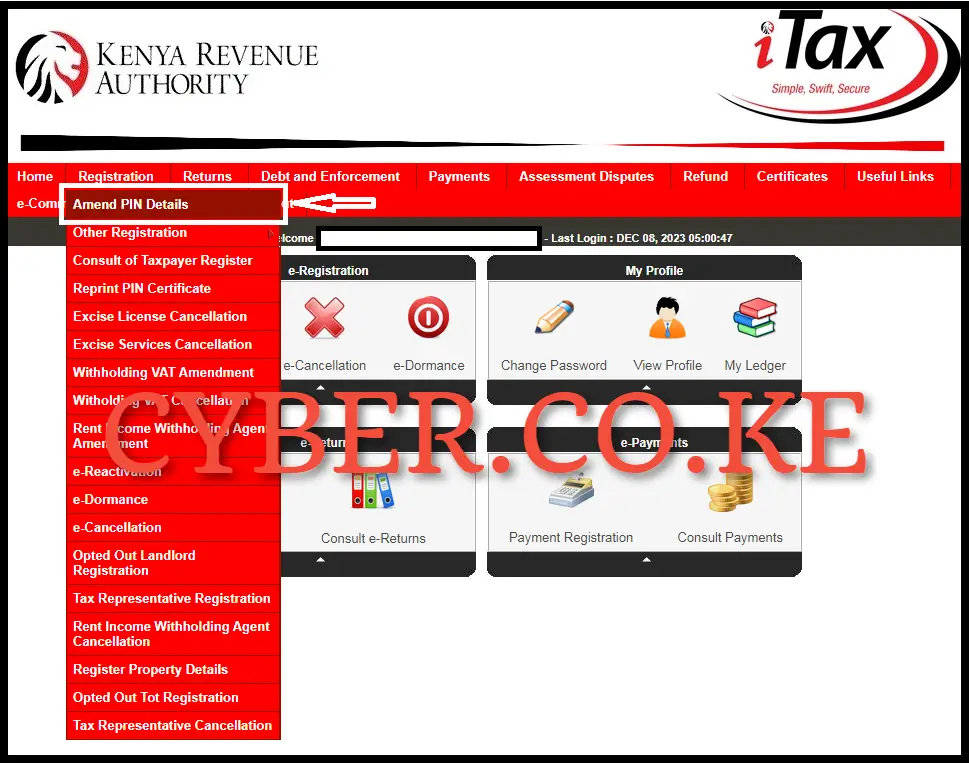

Step 3: Click On The Registration Menu Tab Followed By Amend PIN Details

Upon successful login into iTax (KRA Portal) account, on the top menu click on “Registration” then proceed to click on “Amend PIN Details” from the drop down menu items list that will appear.

Step 4: Select The Mode of Amendment in the e-Amendment of Registration Form

In this step, you need to choose the mode or amendment either “Online Form” or “Upload Form” as the two options. For you to do amendments of KRA PIN faster, choose “Online Form” option. The system will automatically populate other fields on the e-Amendment of Registration Form, including Applicant Type, Taxpayer Name, and Taxpayer Name. After selecting the amendment mode, proceed to the next step by clicking the “Next” button.

Step 5: Fill In The Individual Registration Amendment Form

In this step, you need to complete the Individual Registration Amendment form by navigating ticking the check boxes for PIN and Basic Information. This is necessary as the Email Address that you want to change is situated under Basic Information within the Principal Contact Details of the Individual Registration form. Once you’ve chosen these two fields, proceed by clicking the “Submit” button.

Step 6: Under Basic Information Section, Scroll to Principal Contact Details

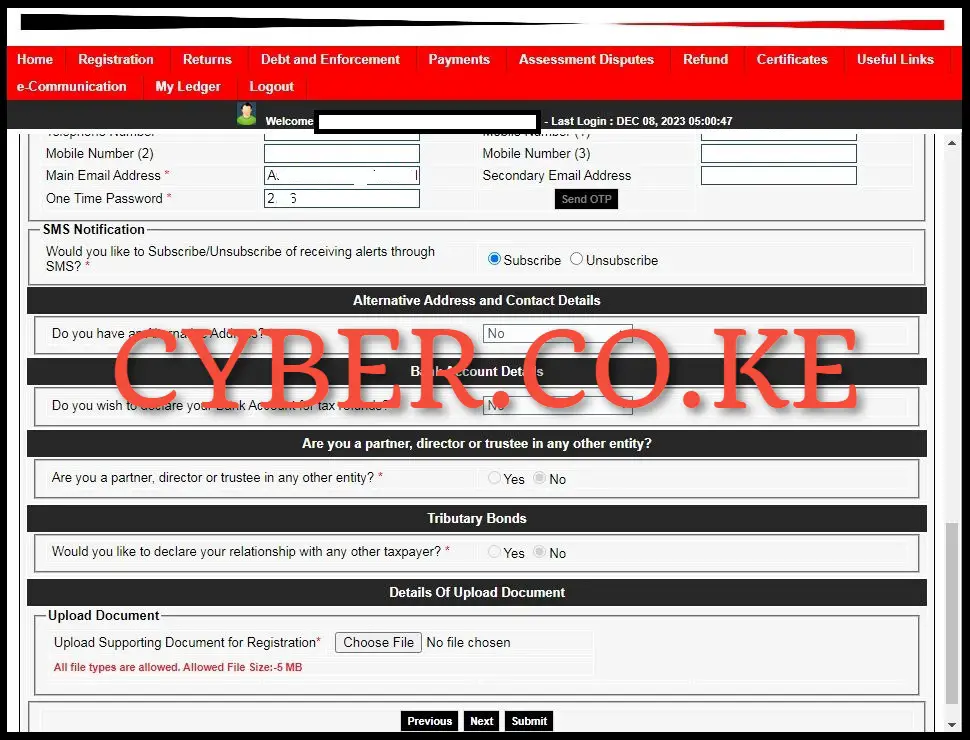

Next, under the basic information section, you need to scroll down to Principal Contact Details section as it is where the iTax registered email address is located. In order for you to continue using iTax functionality you are required to verify your email address.Please click “Send OTP” button to receive OTP on mentioned email address.

Step 7: Enter The Generated KRA OTP For Email Address Verification

In this step, you need to check your new email address for the KRA OTP Verification code that has been sent there. The KRA OTP Verification code is used to validate the email address registered on iTax (KRA Portal). After entering the KRA OTP verification code, click on the “Submit” button. A pop-up will appear, prompting you to confirm the new Email Address as your primary email address on the iTax (KRA Portal).

This updated Email Address is the designated channel for receiving communications and updates from the Kenya Revenue Authority (KRA) and it will now become the new iTax registered email address. Click on the “OK” button, and Do you want to submit the data? also click on “OK” button to proceed to the last step.

Step 8: Amendment Request Has Been Completed Successfully

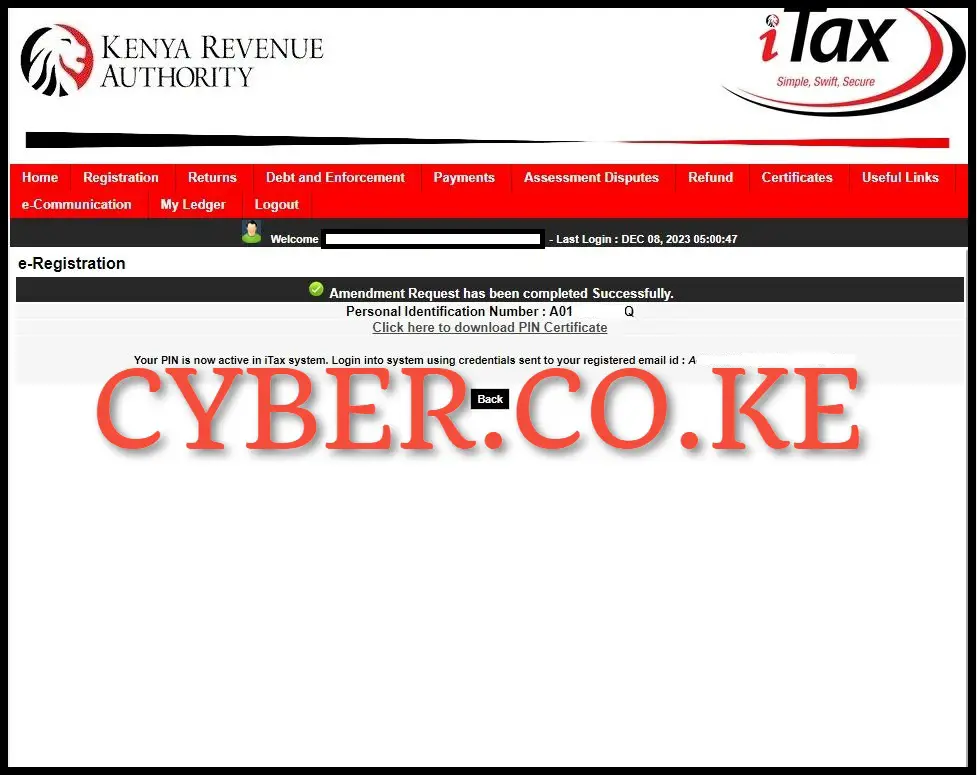

Once you have successfully verified and confirmed the new iTax registered email address, you will see the message “Amendment request has been completed successfully” meaning that you have changed the email address on iTax (KRA Portal) to a new one.

To download the newly updated KRA PIN Certificate showing the new iTax registered email address, just click on the text link titled “Click here to download PIN Certificate” which will initiate the downloading of the KRA PIN Certificate. You will also receive an email from KRA about Approval of Registration Amendment as illustrated below;

Dear Taxpayer,

This is to inform you that your Registration Amendment Application submitted on 04/03/2024 with Acknowledgement Number KRA2024*******7 has been approved.

Please find the updated PIN Certificate attached.

Regards,

Commissioner

Medium and Small Taxpayer Office

Kenya Revenue Authority

This email from Kenya Revenue Authority (KRA) serves as the final confirmation that the change of email address on iTax (KRA Portal) has been successful. The email also comes with an attachment of your KRA PIN Certificate (containing the new email address) which you can also download, save or print out a copy.

READ ALSO: Step-by-Step Process of Reprinting Company Tax Compliance Certificate

The above 8 steps sums up the process of How To Change iTax registered email address online. For you to successfully change the email address that is registered on your iTax (KRA Portal) account, you need to ensure that you are able to login using both your KRA PIN Number and KRA Password (iTax Password). Alternatively, here at CYBER.CO.KE, we offer KRA PIN Change of Email Address services for all taxpayers in Kenya. Once you have the two iTax (KRA Portal) login credentials, you can follow the outlined steps above so as to change the iTax registered email address quickly and easily.

Matthews Ohotto is a Writer at CYBER.CO.KE where he specializes in writing helpful and informative Step-by-Step Tutorials that empower Kenyans with practical skills and knowledge. He holds a Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT). Get KRA Individual Services and KRA Returns Services in Kenya.

ADVERTISEMENT

Check Out Our Popular Blog Posts

Check Out Our KRA Individual Services

Register KRA PIN Number

Submit Service Request →Retrieve KRA PIN Certificate

Submit Service Request →Update KRA PIN Number

Submit Service Request →Change KRA PIN Email Address

Submit Service Request →Check Out Our KRA Returns Services

File KRA Nil Returns

Submit Service Request →File KRA Employment Returns

Submit Service Request →File KRA Amended Returns

Submit Service Request →File KRA Withholding Tax Returns

Submit Service Request →Check Out Our KRA Tax Calculators

Calculate Turnover Tax (TOT)

TOT Calculator →Calculate Monthly Rental Income (MRI)

MRI Calculator →Calculate Value Added Tax (VAT)

VAT Calculator →Calculate Pay As You Earn (PAYE)

PAYE Calculator →CYBER.CO.KE

Get KRA Services Online Today

CYBER.CO.KE is a trusted online cyber services website dedicated to providing KRA Individual Services and KRA Returns Services to customers in Kenya on a day to day basis.

The KRA Individual Services that we offer to customers includes: Registration of KRA PIN Number, Retrieval of KRA PIN Certificate, Updating of KRA PIN Number and Changing of KRA PIN Email Address.

The KRA Returns Services that we offer to customers includes: Filing of KRA Nil Returns, Filing of KRA Employment Returns, Filing of KRA Amended Returns and Filing of KRA Withholding Tax Returns.

If you are looking for dependable, fast and reliable KRA Services in Kenya, we are ready and available to support you at every step of the way.

We prioritize customer convenience, clear communication and prompt service delivery, making sure that your submitted service request is completed in the shortest time possible.

ADVERTISEMENT