Just got your first job and need to change your KRA Source of Income? Learn How To Add Employment As Source Of Income To KRA PIN On iTax.

As a job seeker in Kenya, getting that lucrative job after a period that is characterised by lots of job applications, rigorous job interviews, job rejections and thorough tarmacking, that is just a tip of the ice berg in your employment life in Kenya.

In this article, I am going to share with you the steps involved in amending your KRA PIN Source of Income details and adding Employment as a source of Income. This will be of great importance to new employees who have just gotten a new job at a company and need to capture the company as their employer on KRA iTax Portal.

READ ALSO: How To Change KRA Password For Locked iTax Account

After receiving that offer letter, your salaries and perks scale, the task now lies on getting you to the company’s payroll system. Here, your current source of income has to be changed so as to become unison with the company’s payroll system. This normally involves adding of the employers pin to your source of income on iTax.

To be able to add employment as a source of income in your iTax Account, you need to login to to your account using both your KRA PIN Number and iTax Password. Logging into KRA Portal or iTax is a process that requires you to have both your KRA PIN Number and iTax Password. To be able to access and view all the resources on iTax, you need to be logged into your iTax Account. The problem is that not that many Kenyans know the process that they need to follow.

The good thing is that incase you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you. Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password.

Types of Source of Income on iTax

On iTax Portal, there are 3 types of source of income that a taxpayer can select. This includes the following:

- Employment Income: For those in employment in Kenya.

- Rental Income: For those owning rental houses in Kenya.

- Business Income: For those who are in business in Kenya.

The main focus of this article will be on Employment as the source of income i.e. amending KRA PIN under source of income on iTax Portal.

So, today in this article I am going to share with you the steps that are involved in adding Employment as a source of Income to your KRA PIN. In simpler terms, the process of adding Employers KRA PIN to your source of Income. This can look like a daunting task, but its quite simple.

Requirements for Amending Source of Income on iTax Portal

In many companies in Kenya, the process of adding the Employers KRA PIN to new employees source of income rests with the Human Resource Department (HR) while in others, the employee is given the Employers KRA PIN and has to add it under their source of Income on iTax.

In our case, we are shall be adding the Employers KRA PIN to a new employee who wants to update the source of Income on iTax Portal. Before we get started, below are the key requirements that we shall need.

- Your KRA PIN Number

- Your iTax Password

- Your Employer’s KRA PIN Number

First and foremost, you need to have your KRA PIN Number with you. If you don’t know your KRA PIN or have forgotten it, you can request for KRA PIN Retrieval Services here at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address. If your KRA PIN is not yet on iTax, you can place KRA PIN Update order and have it updated on iTax at Cyber.co.ke Portal.

Secondly, you need to have your KRA iTax Password. Incase you have forgotten your KRA iTax Password, you can check out our guide on How To Reset KRA iTax Password. If you no longer use the email address and would like to change it, you can place order online for Change of Email Address online at Cyber.co.ke Portal.

Lastly, you are going to need the KRA PIN Number of your new Employer. This is normally issued to you by the Human Resource Department of your company so as to assist you when it’s time for file the annual KRA Returns. That Employers KRA PIN Number comes in handy during the KRA Returns Period. You can check our guide on How To File KRA Returns Using P9 Form. This will help you in filing your KRA Returns during your Employment period.

Now that we have addressed the three key requirements above, we can now begin the process of How To Add Employment As Source Of Income To KRA PIN On iTax. Let’s begin the process.

How To Add Employment As Source Of Income To KRA PIN On iTax

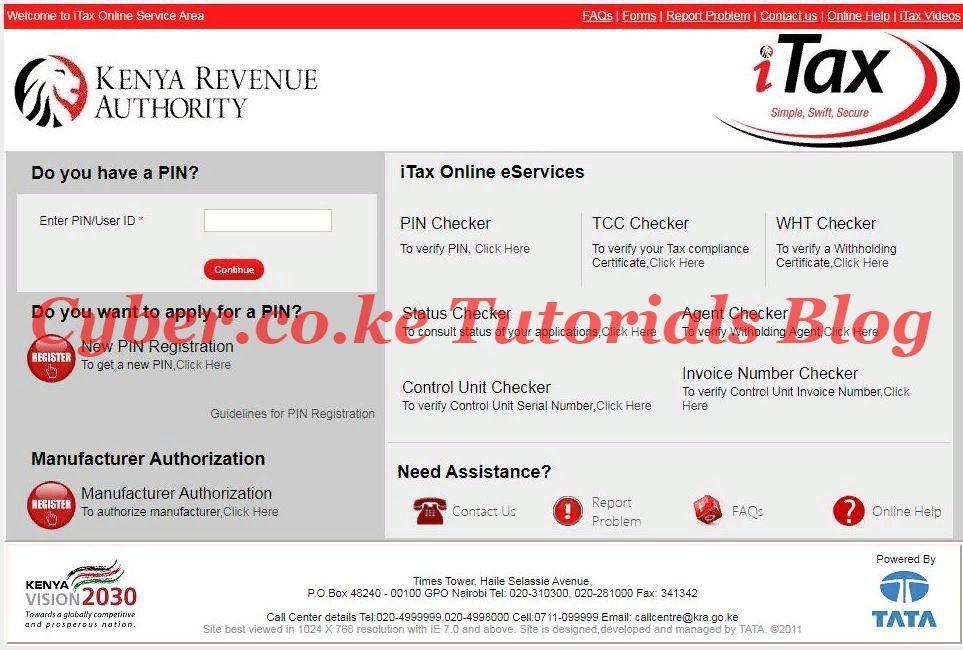

Step 1: Visit iTax Portal

In the first step, you need to access the KRA iTax Portal using the link provided in the above description.

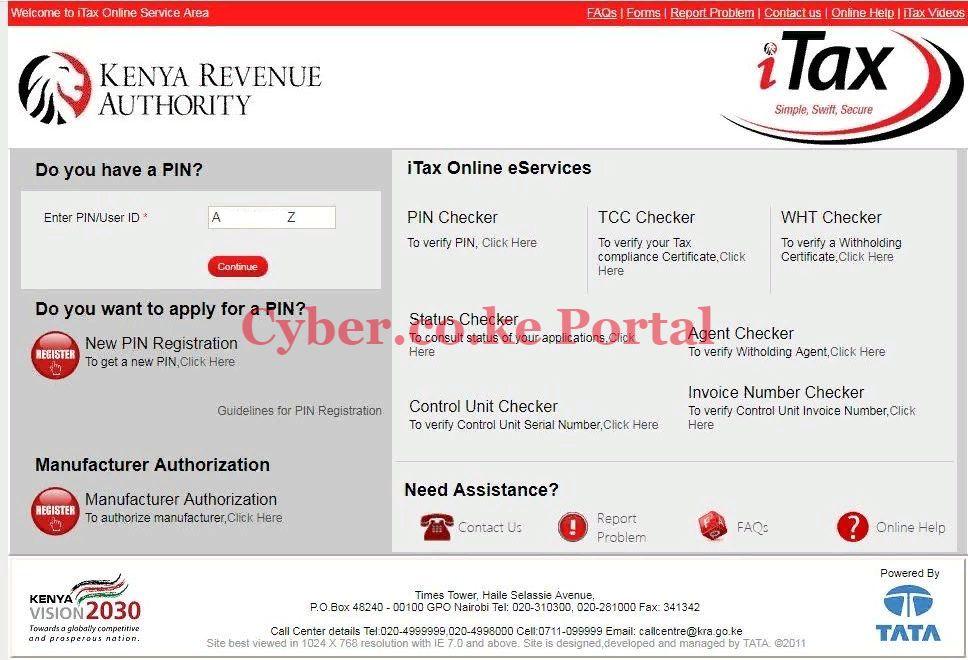

Step 2: Enter Your KRA PIN Number

Next, you will be required to enter your KRA PIN Number on the “Enter PIN/User ID” input box. Once done, click on the “Continue” button.

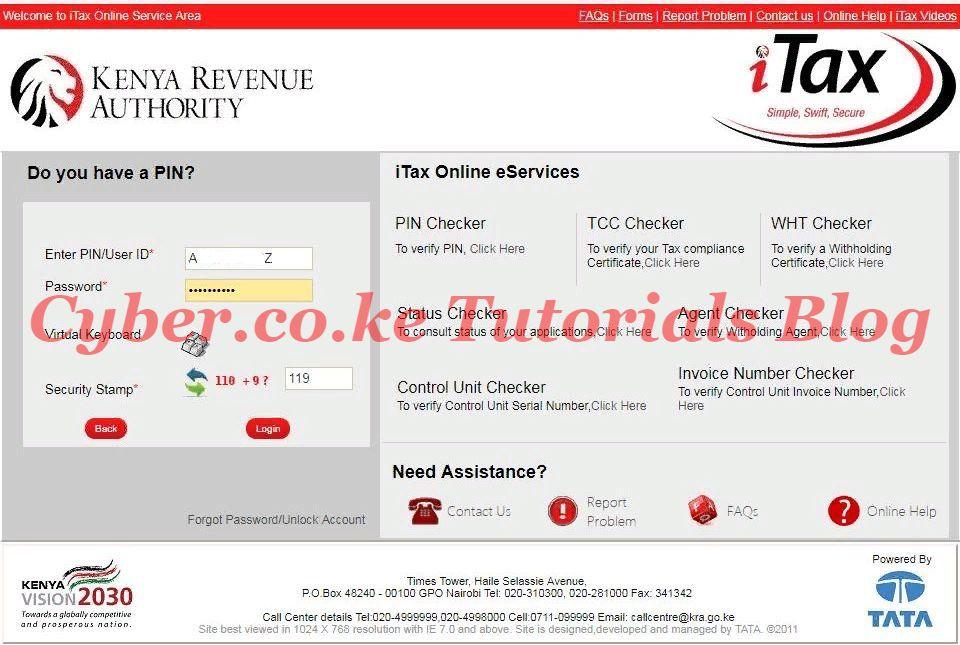

Step 3: Enter Your KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you need to enter your KRA iTax Password then solve the arithmetic question (security stamp). Once done, click on the “Login” button.

Step 4: iTax Account Dashboard

Once you have successfully logged into iTax Portal, you will be able to see your iTax Account iPage dashboard. This is shown below.

Step 5: Click on Amend PIN Details

Next, on your iTax Account, click on the “Amend PIN Details” tab just under “Registration” menu tab.

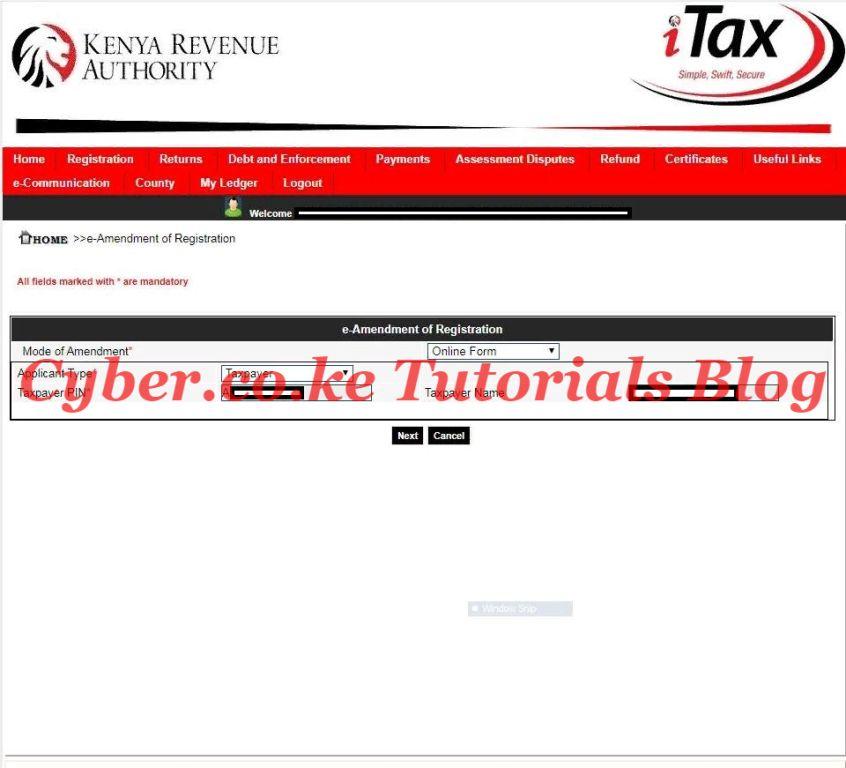

Step 6: e-Amendment of Registration

In this step, you need to select the mode of Amendment i.e Online Form. The other fields such as Applicant Type, Taxpayer PIN and Taxpayer Name are automatically auto-filled. So, you just need to click on the “Next” button.

Step 7: e-Amendment for Individual

In this step, you are supposed to select the PIN to view the sections to be amended. Since this article is focussing on the “Adding Employment As Source of Income For KRA PIN,” we shall tick the “Source of Income” checkbox. This is as shown below.

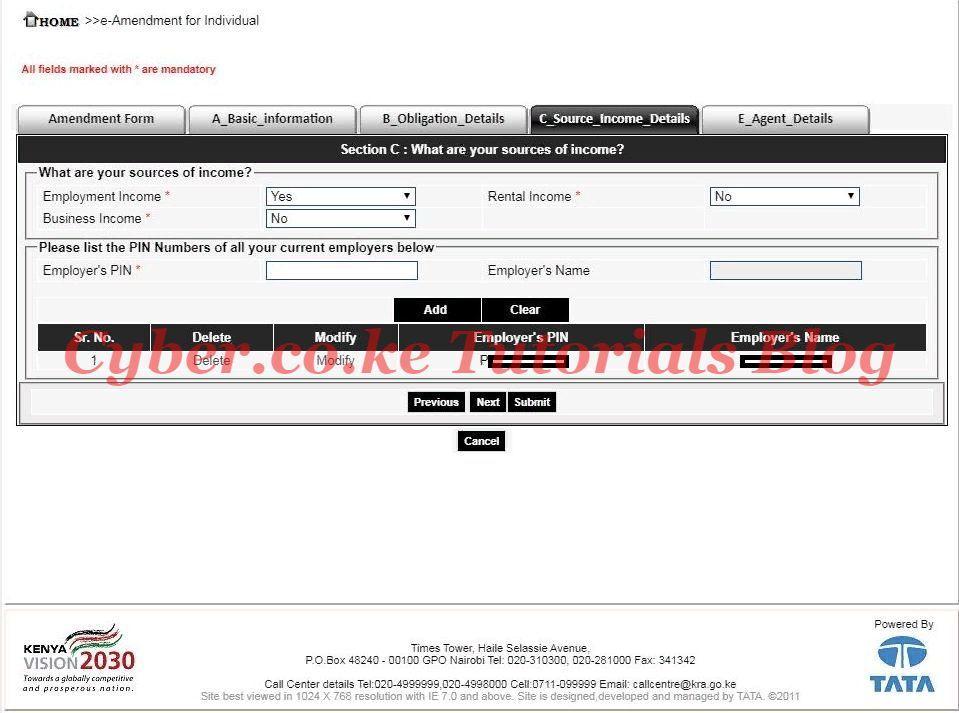

Step 8: Click on Source of Income Details tab and Add Employers KRA PIN Number

In this step, you will click on the “Source of Income Details” tab. You supposed to choose your source of income. In our case, we are going to select “Employment Income” by selecting “Yes” from the dropdown selection. We shall enter the “Employers PIN” and it will load the “Employer’s Name.” Once you have entered your Employer’s KRA PIN number, click on the “Add” button. Finally, click on the “Submit” button.

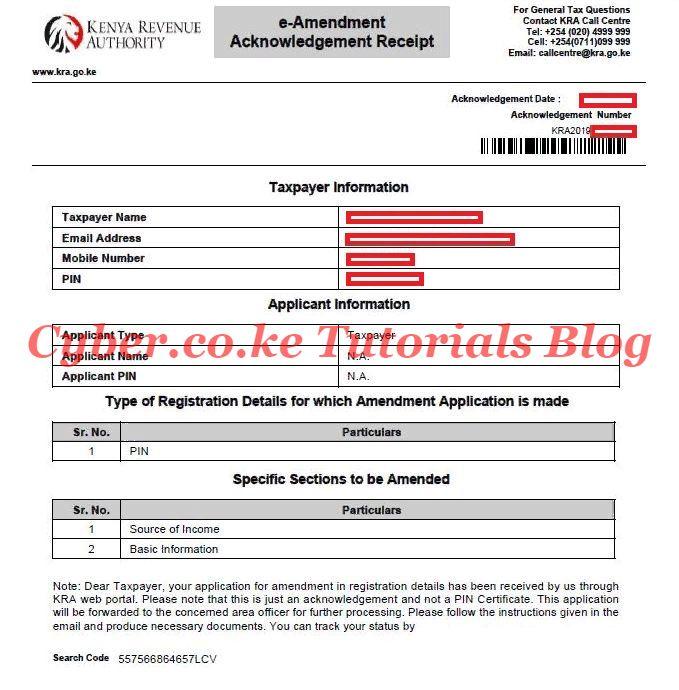

Step 9: Download Acknowledgement Receipt

This is the final step where you will download the e-Amendment Acknowledgement receipt. The application will be forwarded to the concerned area KRA officer for further processing.

You will also receive an email confirmation of the change of KRA Source of Income on iTax Account.

Dear Taxpayer,

We acknowledge receipt of your Registration Amendment Application on **/**/2019 at **:**:** EAT.

The Reference Number for your Registration Amendment application is KRA2019*********.

The final status of your Registration Amendment application and the updated PIN Certificate in case of approval will be sent to you via e-mail.You may track the status of your application on KRA Web Portal using “e-Track Status” function.

Please find the e-Amendment Acknowledgement Receipt attached.

Thank You for using KRA Web Portal.

Regards,

Commissioner

Medium and Small Taxpayer Office

Kenya Revenue Authority______________________________________________________

Note: This is a system generated mail. Please DO NOT reply to it.

READ ALSO: How To Amend KRA PIN Principal Physical Address Details (KRA PIN Amendment)

NOTE: When you add Employer’s KRA PIN Number to your source of Income, since this is an amendment, the process will go for approval, and once approved and email will also be sent to your iTax Registered email address with the new KRA PIN Certificate. Those are the steps involved in adding your new Employer KRA PIN on your Employment as a Source of Income.