Are you looking to amend your KRA PIN details? Get to know How To Amend KRA PIN Principal Physical Address Details (KRA PIN Amendment).

Amending KRA PIN Physical Address is quite important especially in cases whereby you have moved to a new county or town. Getting to know how to amend the physical address on KRA PIN Certificate is something that you need to know to do.

In this article, I am going to share with you the step by step guide on how to amend the KRA PIN Physical Address Details appearing on your KRA PIN Certificate (Amend PIN Details). First and foremost, we need to understand what is meant by KRA PIN Amendment.

READ ALSO: How To Download KRA PIN Number Online on iTax Portal

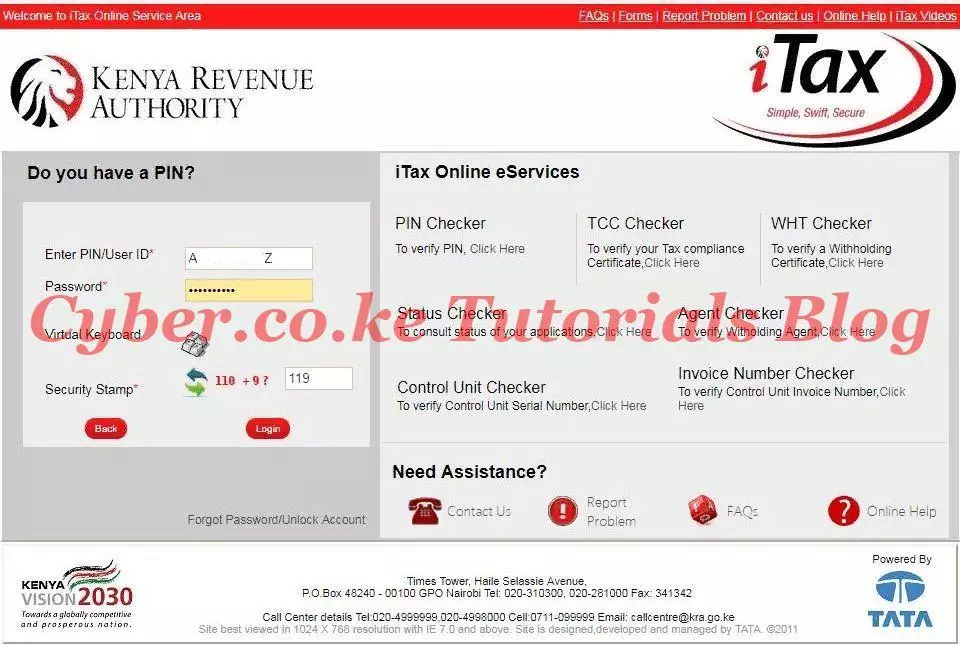

To be able to amend the details on your KRA PIN, you need to first login to your iTax Account using both your KRA PIN Number and KRA Password or iTax Password.

Logging into KRA Portal or iTax is a process that requires you to have both your KRA PIN Number and iTax Password. To be able to access and view all the resources on iTax, you need to be logged into your iTax Account. The problem is that not that many Kenyans know the process that they need to follow.

The good thing is that incase you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you. Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password.

What Is KRA PIN Amendment?

KRA PIN Amendment is the process of editing/changing either the Basic Information that includes: (Principal Contact Details, Principal Postal Address, Principal Physical Address, Alternative Address and Contact Details, Bank Account Details, Partnership Details, Relationship to other Taxpayer), Obligation Details, Source of Income Details and Agent Details.

The above describes what is meant by PIN Amendment and what information can be amended on the KRA PIN Certificate. You will need to take note that some PIN Amendment details will require approval by Kenya Revenue Authority (KRA) while others are approved automatically. Lets look at the conditions for Auto Approval of Amendment.

Differences Between KRA PIN Amendment and KRA PIN Update

Many people confuse KRA PIN Amendment and KRA PIN Update. Some even interchange the two terms. You need to take note that each is different from the other. As described above, KRA PIN Amendment involves changing the details of a KRA PIN Number that is already on iTax Portal.

KRA PIN Update on the other hand is the process of migrating/updating KRA PINs that are not on iTax Portal. You can request for KRA PIN Update services here at Cyber.co.ke Portal. Here at Cyber.co.ke Portal, we offer unmatched KRA PIN Update services to all taxpayers in Kenya.

Conditions for Auto Approval of KRA PIN Amendment

Please take note that verification task (that requires approval from KRA Officer) will not be generated if you make changes to the following fields of KRA PIN.

Section A: Basic Information

- Trading/Business Name if different than Registered Name.

- Declaration of Legal Representative.

- Principle Postal Address.

- Principle Contact Details.

- Alternative Address and Contact Details.

- Bank Account Details.

Section C: Source of Income Details

- Details of Economic Activities.

Section E: Agent Details

- Details of Tax Agent

- Details of Intermediary Agent

Any PIN Amendment made to the above sections will be automatically approved by the KRA System. Now that we have looked into the meaning of KRA PIN Amendment, and the conditions for Auto Approval, we need to look at what the Principal Physical Address on the KRA PIN Certificate entails.

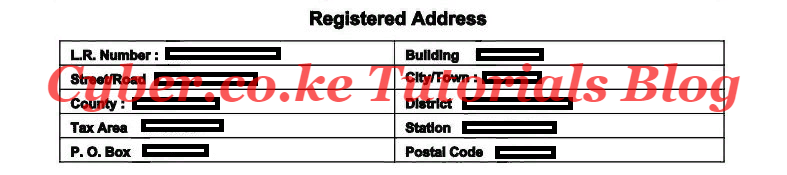

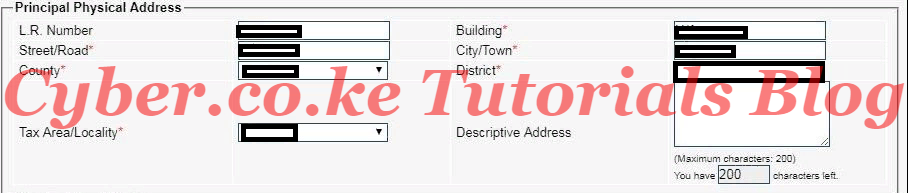

What is Principal Physical Address on the KRA PIN Certificate?

The Principal Physical Address Details on KRA PIN Certificate is comprised of the following fields:

- L.R Number

- Building

- Street/Road

- City/Town

- County

- District

- Tax Area/Locality

- Descriptive Address

The above are the physical address details that are on a KRA PIN Certificate. Our main focus will be in amending those physical details or the registered address as shown below.

Reasons for Amending KRA PIN Principal Physical Address

There exist many reasons that a Taxpayer would want to amend the Physical Address details on a KRA PIN Certificate. This includes:

- Moved to a new County/Town/District

- Changed Postal Address

- Changed Tax Station/Tax Area

- Changed Street/Road

Now lets dive into the steps on How To Amend KRA PIN Principal Physical Address Details (KRA PIN Amendment).

Requirements for Amending KRA PIN Principal Physical Address Details on iTax Portal

The following are two requirements that you need to have before amending your KRA PIN on iTax Portal. This includes the following:

- Your KRA PIN number

- iTax Password

First and foremost, you will need to have with you the KRA PIN Number. If you don’t remember or have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal. If you are looking for a new KRA PIN, you can also request for KRA PIN Registration here.

The next item that you need to have is your iTax Password to enable you login to the iTax Portal. If you have forgotten your iTax Password, you can check our guide on How To Reset iTax Password and a new KRA Password will be sent to your iTax registered email address.

If you don’t know, no longer use or have forgotten your iTax email address, you can request for Change of Email Address here also. If you have a KRA PIN that is not on iTax, you can request for KRA PIN Update and have your KRA PIN Number migrated to iTax so as to enable you file your iTax Returns with ease.

Having addressed the above issues, then we can begin the process of How To Amend KRA PIN Principal Physical Address Details (KRA PIN Amendment).

How To Amend KRA PIN Principal Physical Address Details (KRA PIN Amendment)

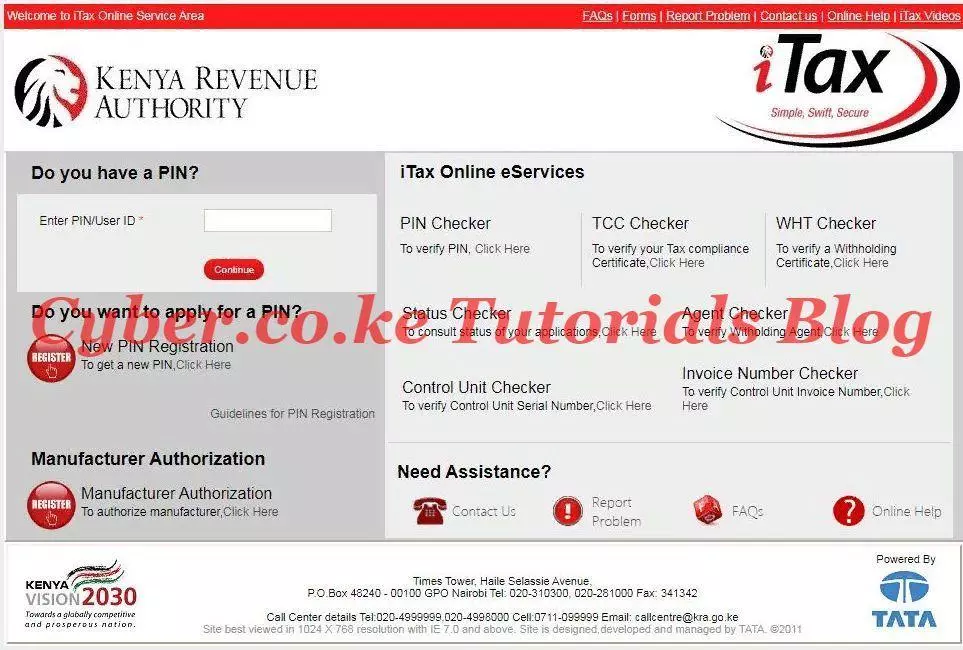

Step 1: Visit KRA Portal

The first thing you need to do is to access the KRA iTax Web Portal using the link provided in the above description.

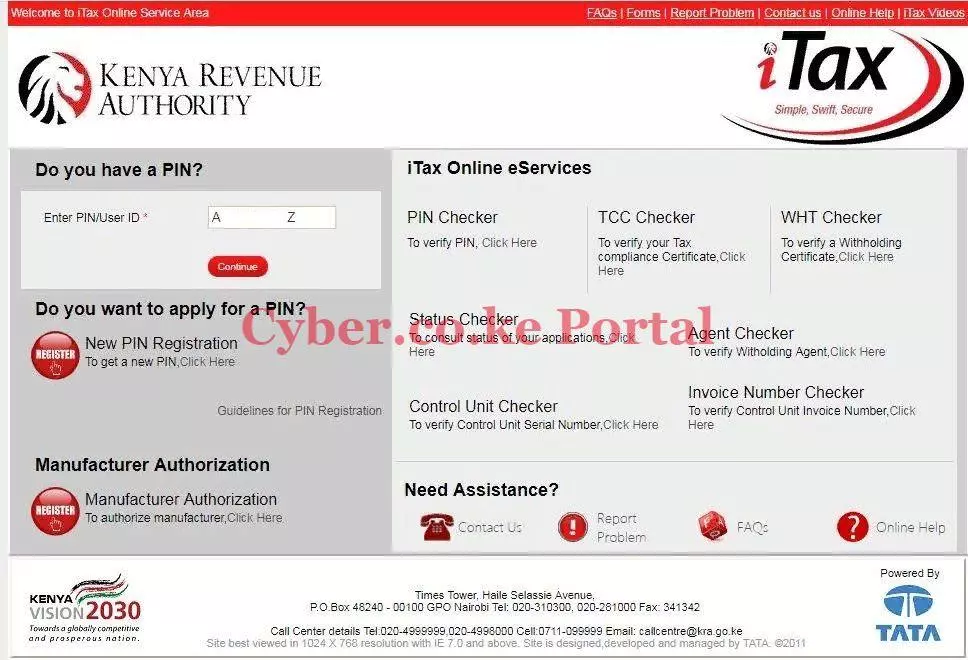

Step 2: Enter KRA PIN Number

Next, you will be required to enter your KRA PIN Number. Once you have entered the KRA PIN, click on the “Continue” button.

Step 3: Enter KRA iTax Password and Security Stamp (Arithmetic Question)

Next, you will need to enter your KRA iTax Password and solve the arithmetic question (security stamp). Once done, click on the “Login” button.

Step 4: iTax Account Dashboard

Upon successful login, you will be able to see your iTax iPage Account Dashboard that is loaded with various functionalities.

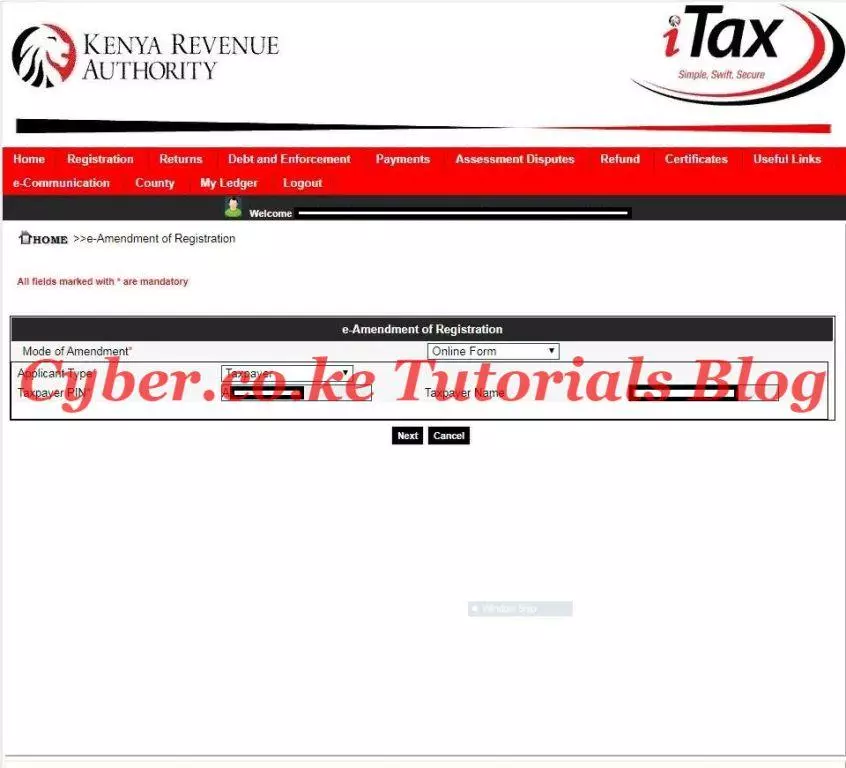

Step 5: Click on Registration then Amend PIN Details tab

In this step, you will need to click on the Registration tab followed by the Amend PIN Details from the dropdown menu.

Step 6: e-Amendment of Registration

In this step, you need to select the mode of Amendment i.e Online Form. The other fields such as Applicant Type, Taxpayer PIN and Taxpayer Name are automatically auto-filled. So, you just need to click on the “Next” button.

Step 7: e-Amendment for Individual

In this step, you are supposed to select the PIN to view the sections to be amended. Since this article is focussing on the Amendment of the Principal Physical Address (Registered Address), we shall tick the “Basic Information” checkbox. This is as shown below.

Step 8: Click on Basic Information tab the scroll to Principal Physical Address

Next, you will need to click on the “Basic Information” tab then on that page scroll down to “Principal Physical Address” information dialog.

As I had earlier highlighted above, the main reason why in our case we need to amend the principal physical address (registered address) is that we have relocated to a new County. Hence we need to Amend the KRA PIN to have our latest Physical Address information. You will need to fill in your new County, new City/Town, District and finally the Tax Area/Locality. Once you have filled in your new Physical Address information, click on the “Submit” button.

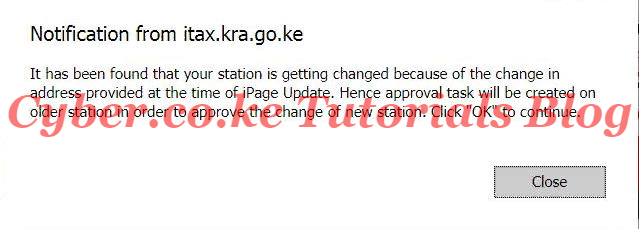

NOTE:

You need to take note of the following. If you are amending a KRA PIN that was migrated to iTax, change of County, Town and District will trigger a “KRA Task” creation that will mean the PIN Amendment will undergo Approval Process on the older Tax Station in order to approve the change of new Tax Station.

In this case you will be issued with an Acknowledgement of Application for Registration Amendment. The final status of your Registration Amendment application and the updated PIN Certificate in case of approval will be sent to you via e-mail.You may track the status of your application on KRA Web Portal using “e-Track Status” function.

If you currently don’t have any liabilities in form of penalties at your old KRA Tax Station, then the change to a new Tax Station will be approved easily. Otherwise, unpaid penalties in the Tax Station will lead to rejection of your PIN Amendment Application.

Step 9: Acknowledgement of application for Registration Amendment

The last step will involve you downloading the PIN Amendment acknowledgement receipt that you will use to track the status of your KRA PIN Amendment. An email will also be sent with a copy of the acknowledgement receipt. Below is a sample message that will be sent to your email address.

Dear Taxpayer,

We acknowledge receipt of your Registration Amendment Application on **/**/2019 at 00:000:00 EAT.

The Reference Number for your Registration Amendment application is KRA2019********.

The final status of your Registration Amendment application and the updated PIN Certificate in case of approval will be sent to you via e-mail. You may track the status of your application on KRA Web Portal using “e-Track Status” function.

Please find the e-Amendment Acknowledgement Receipt attached.

Thank You for using KRA Web Portal.

Regards,

Commissioner

Medium and Small Taxpayer Office

Kenya Revenue Authority

READ ALSO: How To Consult and View KRA Payments Using iTax Portal

That being the last step on How To Amend KRA PIN Principal Physical Address Details (KRA PIN Amendment), you will wait for approval of that PIN Amendment and receive a copy with the Updated Physical Address details in your email address. Has your KRA iTax Account been locked? Check out our guide on How To Change KRA Password For Locked iTax Account.