Are you looking to file Turnover Tax Returns for your business using the Turnover Tax Returns Form? Learn How To Download Turnover Tax Form Using KRA iTax Portal.

If you registered your Business for the Turnover Tax Obligation on iTax, you need to be filing your Turnover Tax Returns for the business on or before the 20th day of the following month. Knowing How to Download the KRA Turnover Tax Form from iTax Portal is very important for any business owner in Kenya. For you to be able to file the Turnover Tax Returns for your business, you will need to download the Turnover Tax Returns Form on iTax Portal.

In this article, I will be sharing with you the step by step guide on How To Download Turnover Tax Form Using KRA iTax Portal. By the end of this article, as a business owner whose business is registered for Turnover Tax, you will have known how to download the KRA Turnover Tax Returns Form from your iTax Web Portal Account. You will need the KRA Income Tax Turnover Tax Returns form in the process of Turnover Tax Returns filing on KRA iTax Portal thus knowing how to download the form is very important.

READ ALSO: KRA Log In Procedure Using KRA PIN Number And iTax Password

Getting to know the process of downloading the Turnover Tax Returns Form on iTax Portal is really important especially when you need to ensure that you file your business Turnover Tax Returns on or before the 20th day of each month. We are going to look at key terms and concepts.

The concepts that this article will cover includes: What Is Turnover Tax Form, Features Of The Turnover Tax Form, Importance Of The Turnover Tax Form, Requirements Needed To Download Turnover Tax Form and How To Download Turnover Tax Form Using KRA iTax Portal.

Since the Turnover Tax Form is an excel workbook, the taxpayer has to ensure that thay have MS Excel installed in their Laptops or Computers so as to be able to open and fill in the Turnover Tax Form before uploading it to their iTax Account to complete the Turnover Tax Returns Filing process on KRA iTax Portal.

What Is Turnover Tax Form?

The Turnover Tax Form is an Excel Sheet or Form that is used to compute and validate the amount of Turnover Tax for a given month that a business is supposed to pay Kenya Revenue Authority (KRA). It is also referred to as the Income Tax Turnover Tax Returns Form. Just like any other form on the iTax Portal, the taxpayer is supposed to fill in the details of gross sales in the KRA Turnover Tax Returns Form so as to calculate the Turnover Tax that is due to KRA for that given month.

Since the beginning of January this year 2020, businesses whose gross sales for a period of an year is not expected to exceed the Kshs. 5,000,000.00 are supposed to Register for Turnover Tax by amending the source of Income on their iTax profile to Business Income, a process referred to as Business Income Amendment which you can apply and get at Cyber.co.ke Portal today.

Once the business has been registered for the Turnover Tax Obligation on iTax Portal, the business is supposed to file monthly Turnover Tax Returns on KRA iTax Portal. For that business to be able to file the Turnover Tax Returns, the taxpayer has to log in to their KRA Web Portal Account and download the Turnover Tax Form, fill the Turnover Tax Returns Form, validate the KRA Turnover Tax Form and upload the KRA Income Tax Turnover Tax Form on iTax Portal.

Now that we have looked at what we mean by the term Turnover Tax Form, we need to look at the key features of the KRA Turnover Tax Form. This is basically the parts or sections that make up the Turnover Tax Returns Form.

Features Of The Turnover Tax Form

Just as I have mentioned above, the Turnover Tax Form is basically an excel sheet or workbook that a taxpayer who owns and runs a business that qualifies for the Turnover Tax Obligation, needs to fill the gross sales details so as to compute the amount of Turnover Tax that is due to be paid to Kenya Revenue Authority (KRA) on a monthly basis.

Just like any other Returns Form on iTax, the Turnover Tax Form is an excel workbook that is comprised of different sections that I am going to highlight below in full details so as to let you as a taxpayer who owns a business know about this KRA Turnover Tax Form. Basically the Turnover Tax Form is comprised of four key sections i.e. Section A (Return Information), Section B (Details of Local Purchases), Section C (Details of Turnover Tax Paid) and Section D (Calculation of Tax Due).

-

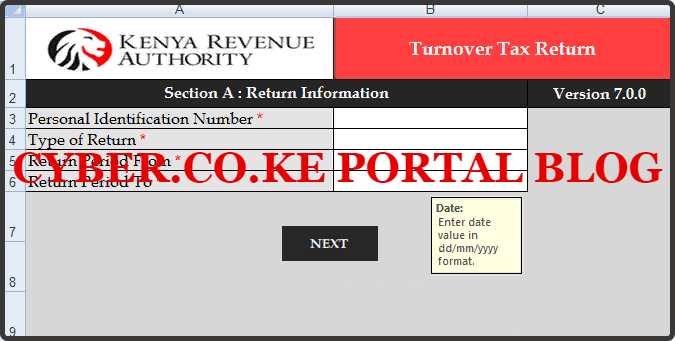

Section A (Return Information)

The first section of the Turnover Tax Returns Form is the Return Information Sections. Basically in this section, the taxpayer is supposed to write his or her Personal Identification Number (KRA PIN), Type of Return (Original or Amended), Return Period From and the Return Period To. Once those fields on the KRA Income Tax Turnover Tax Returns Form, the next button to load the next section.

-

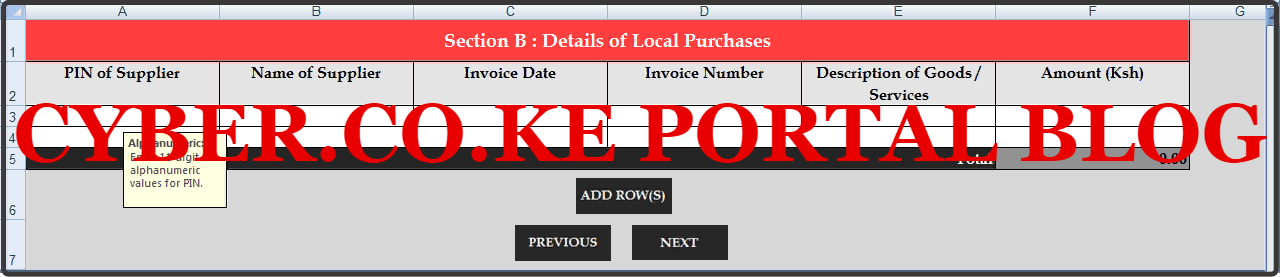

Section B (Details of Local Purchases)

The next section of the Turnover Tax Returns Form is the Details of Local Purchases. In this section, if your business made any local purchases, you need to fill in all those details in this section. This includes: KRA PIN of Supplier, Name of Supplier, Invoice Date, Invoice Number, Description of Goods/Services and Amount (Kshs.). If you made those local purchases during the month, then you need to fill this section. If not just skip this section by clicking on the Next button.

-

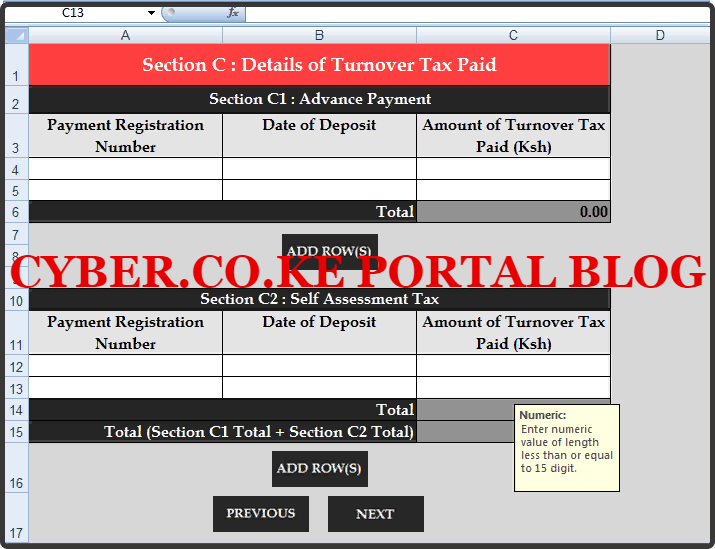

Section C (Details of Turnover Tax Paid)

The next section is the Details of Turnover Tax paid. Basically in this section, you will have to capture either the Advance Payment or Self Assessment Tax if you have. In both sections you will need to fill in the Payment Registration Number (PRN), Date of Deposit, Amount of Turnover Tax Paid (Kshs.). Once you have filled the above sections click on the Next button.

-

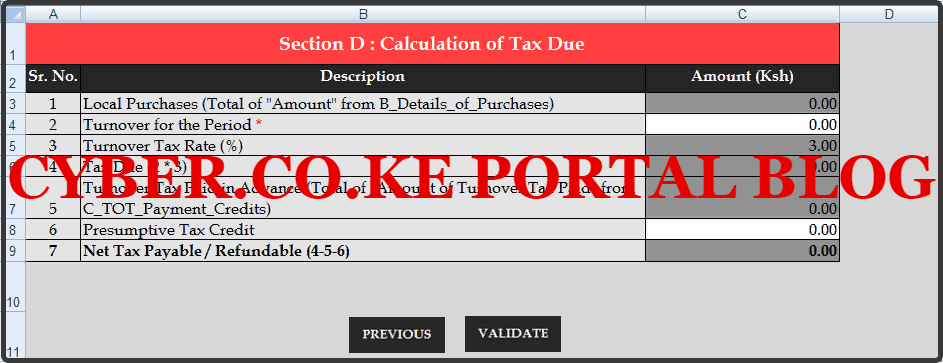

Section D (Calculation of Tax Due)

This is definitely the most important section of the KRA Turnover Tax Returns Form. This is where a taxpayer will do the Turnover Tax calculation for the business for a given month. In this section, you only fill the Turnover for the Period (the gross sales for the month). If you have paid Presumptive Tax for the business, you can enter the amount paid on the Presumptive Tax Credit section. This will be deducted from the turnover tax to get the Net Tax payable to Kenya Revenue Authority (KRA). Once you have filled in the section, click on the Validate button and upload the form in your iTax account.

Importance Of The Turnover Tax Form

From the above, you might have already noted that the KRA Turnover Tax Returns Form plays an important role in helping the taxpayer who owns and runs a business in Kenya to calculate the amount of Turnover Tax that is due to be paid to Kenya Revenue Authority (KRA). I don’t think if there is any other important use of the Income Tax Turnover Tax Returns Form other than the KRA Turnover Tax Returns Filing.

So, the KRA Turnover Tax Form is simply used to compute the TOT that the business has to pay to KRA for a given month. Since Turnover Tax is paid monthly, then the taxpayer needs to always have the latest version of the KRA Turnover Tax Returns Form on iTax Portal. Once downloaded, then the taxpayer can use the TOT Form to calculate the tax dues from the gross monthly sale of the business for a given month.

Now that we have addressed the above, we need to shift gears and look at the key requirements that a taxpayer needs to have so as to be able to download the Turnover Tax Form from the KRA iTax Portal. The requirements that are needed are basically two i.e. KRA PIN Number and KRA iTax Password. This is as illustrated and highlighted below.

Requirements Needed To Download Turnover Tax Form

To be able to download the KRA Turnover Tax Form, you need to have with you KRA PIN Number Number and KRA iTax Portal. These are what we call the iTax Login Credentials that you need to access your KRA iTax Portal Account. This is as illustrated below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same as the one you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable you Reset KRA iTax Password.

Now that we have looked at the key requirements that are needed in the process of downloading the Turnover Tax Returns Form above, we now need to look at the step by step guide on How To Download Turnover Tax Form Using KRA iTax Portal.

How To Download Turnover Tax Form Using KRA iTax Portal

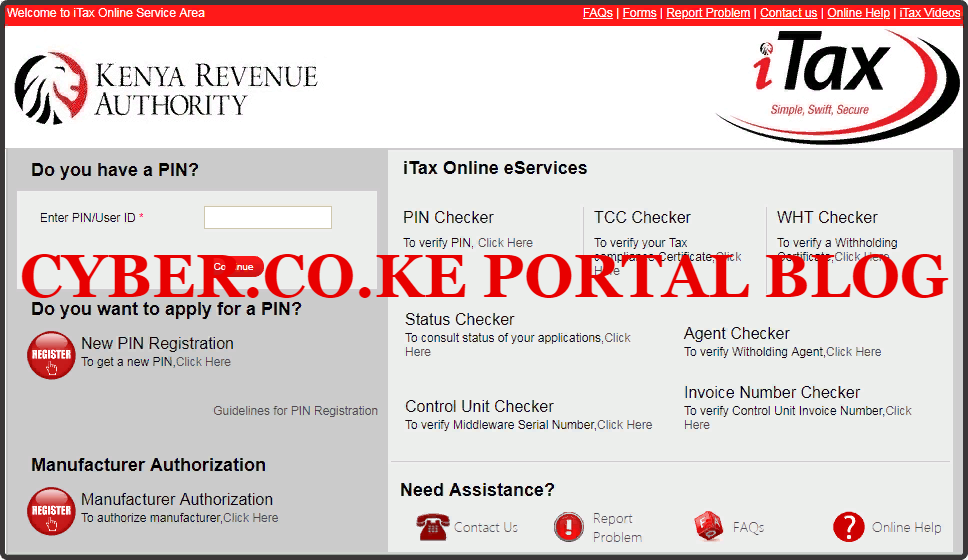

Step 1: Visit KRA Portal

The first step that you need to take in How To Download Turnover Tax Form Using KRA iTax Portal is to ensure that you visit the KRA iTax Web Portal using the link provided above in the description. Take note that the above is an external link that will take you to the KRA iTax Portal i.e. link will open in a new tab.

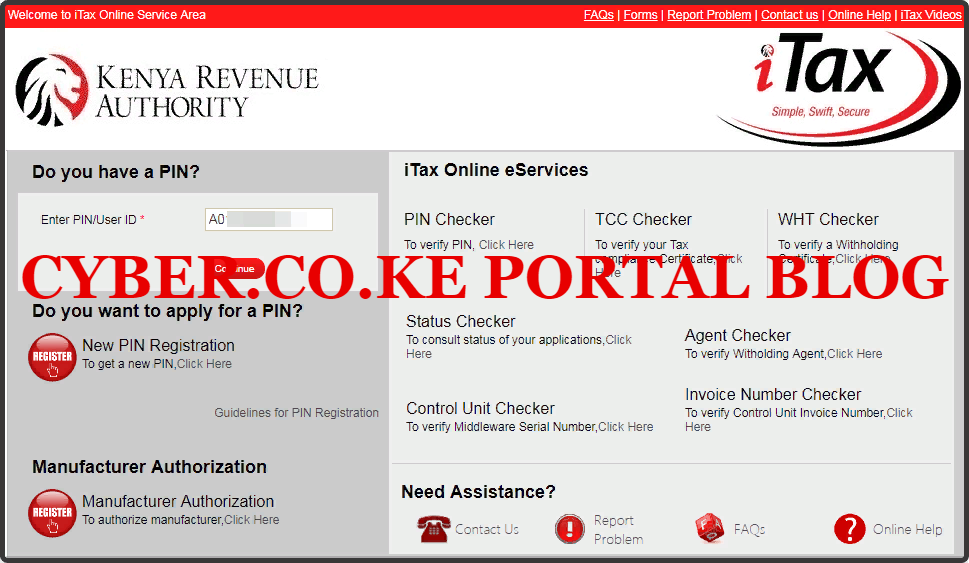

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

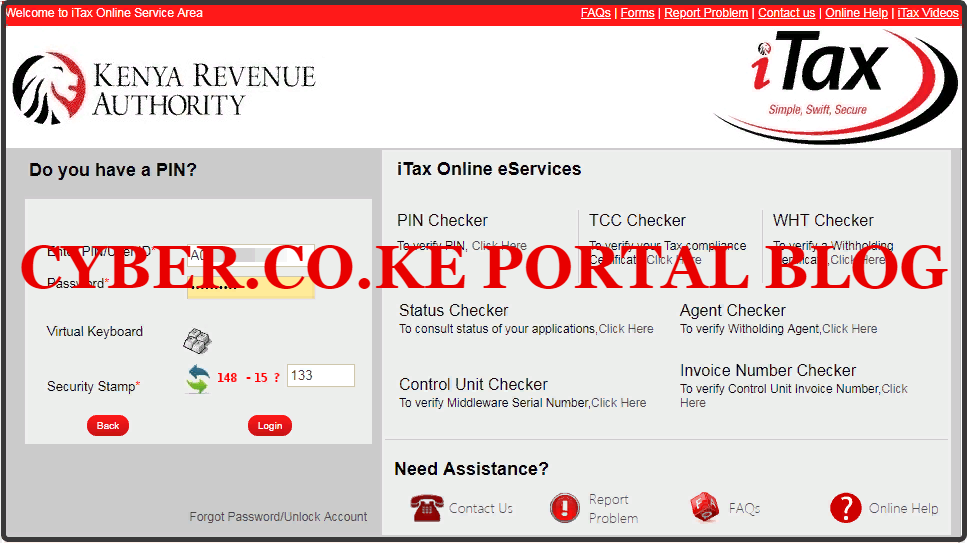

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA iTax Web Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Portal Account Dashboard. By entering the correct KRA PIN Number and iTax Password in the KRA Log In process, then you will be able to access you KRA Web Portal Account dashboard. Since we need to download the Turnover Tax Returns Form, we proceed to Step 5.

Step 5: Click On Returns Menu Tab

Next, you will need to click on the Returns menu tab and from the drop down menu list items, click on File Return. This is because the KRA TOT Returns Form is located under the Returns section. This is as illustrated below.

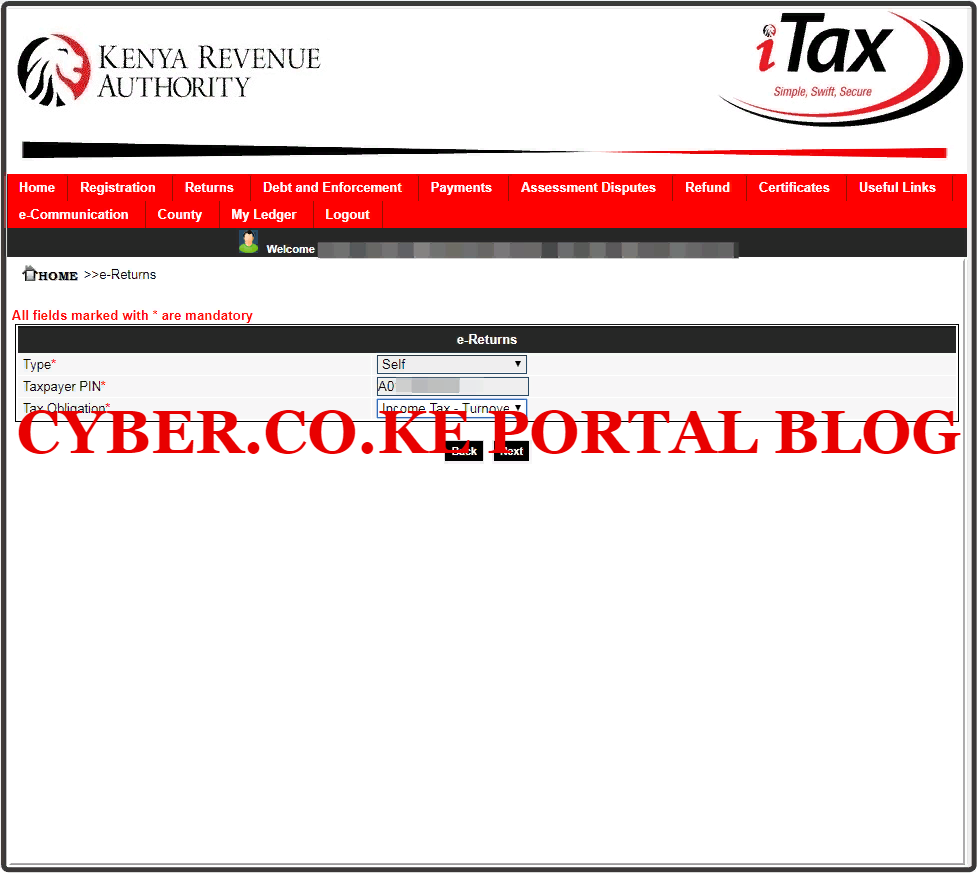

Step 6: Select Tax Obligation As Turnover Tax

In this step, you will need to select the Tax Obligation as Turnover Tax because we need to download the KRA Turnover Tax Returns Form. Once you have entered the Tax Obligation as Turnover Tax, click on the “Next” button.

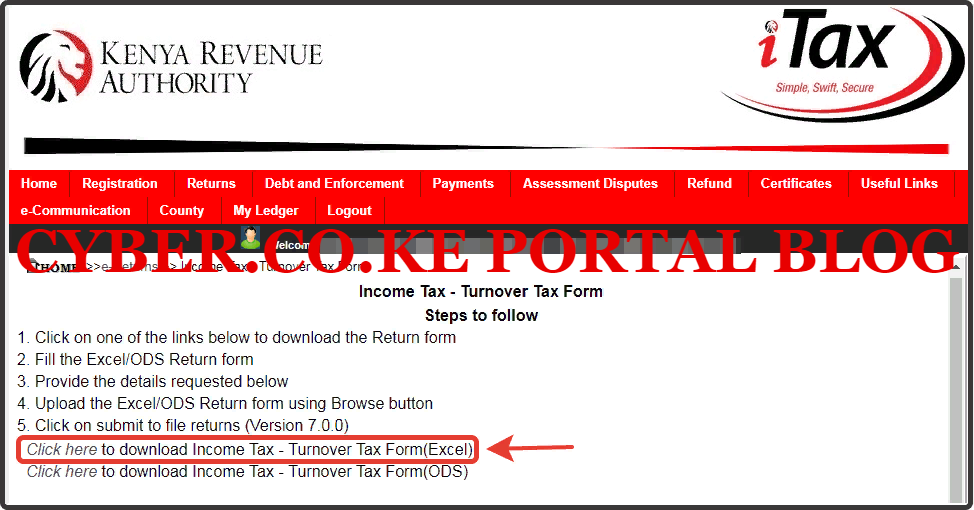

Step 7: Download Turnover Tax Form

In this last step, you will need to download the KRA Turnover Tax Returns Form from your iTax Account. You will note that there are two versions of the Turnover Tax Returns Form i.e. Excel Version and the ODS version. It is highly recommended that you download the Turnover Tax Returns Form Excel Version. You will need to have MS Excel inorder to open the Turnover Tax Returns Form.

Download::: KRA Turnover Tax Returns Form (Excel Version 2020)

READ ALSO: How To Access KRA PIN Portal Account Using iTax Login Credentials

The above sums up the steps that a taxpayer needs to take in order to download the KRA Turnover Tax Returns Form on your iTax Web Portal Account. One thing you just need to note is that to be able to download the Turnover Tax Returns Form, you need to have with you both the KRA PIN Number and KRA iTax Password. So, when you want to file the Turnover Tax Returns Returns for your business, just follow the above steps on How To Download Turnover Tax Form Using KRA iTax Portal.