Learn How To Consult and View KRA Payments Using iTax Portal online today at Cyber.co.ke Portal. Get to know how to view your KRA Payments online today.

When you payments to Kenya Revenue Authority (KRA), it is important to confirm whether those payments have been received or not. So, learning about How to consult and view KRA Payments is very essential to any taxpayer in Kenya.

In this article, I am going to share with you the steps involved in viewing the payments you make to KRA online using iTax Portal. Before we proceed to the steps on consulting and viewing KRA Payments, we need to briefly highlight the key steps and processes that you need to follow as a taxpayer in Kenya inorder to consult and view your KRA Payments on KRA Portal.

READ ALSO: How To File iTax Returns Using The KRA iTax Mobile App

Now, let us look into the above two so as to lay the foundation of our KRA Payments article. We shall look at what KRA Payment is and the different types of KRA Payments that exist today.

To be able to view KRA Payments in your iTax Account, you need to first login using your KRA PIN Number and KRA Password. Logging into KRA Portal or iTax is a process that requires you to have both your KRA PIN Number and iTax Password. To be able to access and view all the resources on iTax, you need to be logged into your iTax Account. The problem is that not that many Kenyans know the process that they need to follow.

The good thing is that incase you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you. Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password.

What Is KRA Payment?

As the name suggests, KRA Payment(s) is any tax payment that is made to Kenya Revenue Authority (KRA) by a taxpayer using his/her iTax account. KRA Payments can be made via Mobile Money, Cash (Bank) or using Cheques.

What are the Different Types of KRA Payments?

There are various types of KRA Payments in Kenya that ranges from: Income Tax Payments, Value Added Tax Payments, Pay As You Earn Payments, Corporate Tax Payments, Withholding Tax Payments, Advance Tax Payments etc. Those are the most common types of KRA Payments.

Having looked at the above two, you now have an understanding of what each entails. We need to highlight the other items that you need to have with you before beginning the process. These includes:

- Your KRA PIN number

- iTax Password

First and foremost, you will need to have with you the KRA PIN Number. If you don’t remember or have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal. If you are looking for a new KRA PIN, you can also request for KRA PIN Registration here.

The next item that you need to have is your iTax Password to enable you login to the iTax Portal. If you have forgotten your iTax Password, you can check our guide on How To Reset iTax Password and a new password will be sent to your iTax registered email address.

If you don’t know, no longer use or have forgotten your iTax email address, you can request for Change of Email Address here also. If you have a KRA PIN that is not on iTax, you can request for KRA PIN Update and have your KRA PIN Number migrated to iTax so as to enable you file your iTax Returns with ease.

Having addressed the above issues, then we can begin the process of How To Consult and View KRA Payments Using iTax Portal.

How To Consult and View KRA Payments Using iTax Portal

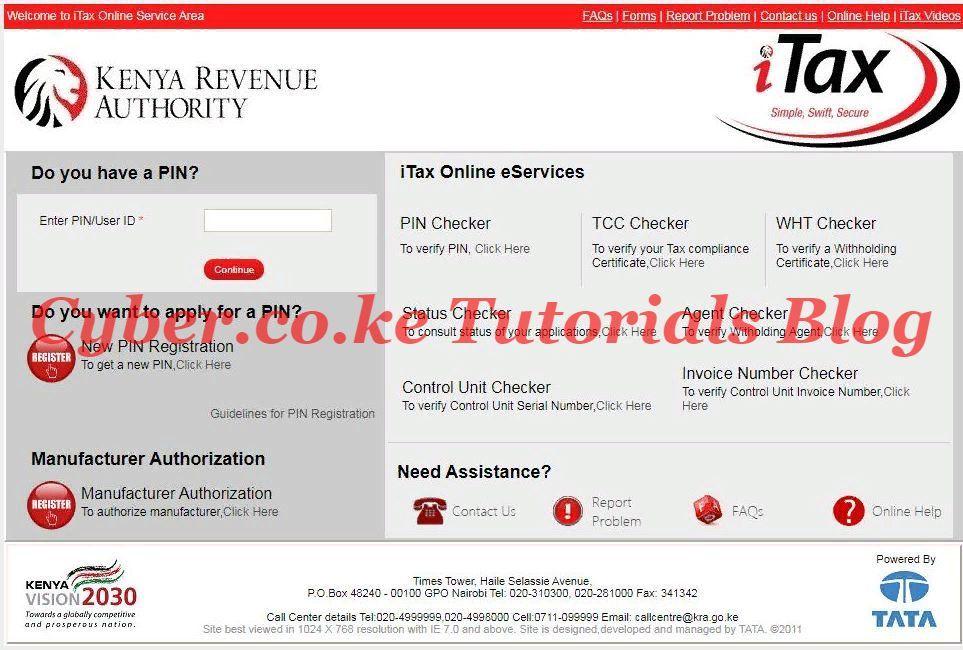

Step 1: Visit iTax Portal

The first thing you need to do is access the KRA iTax Portal using the link provided in the above description.

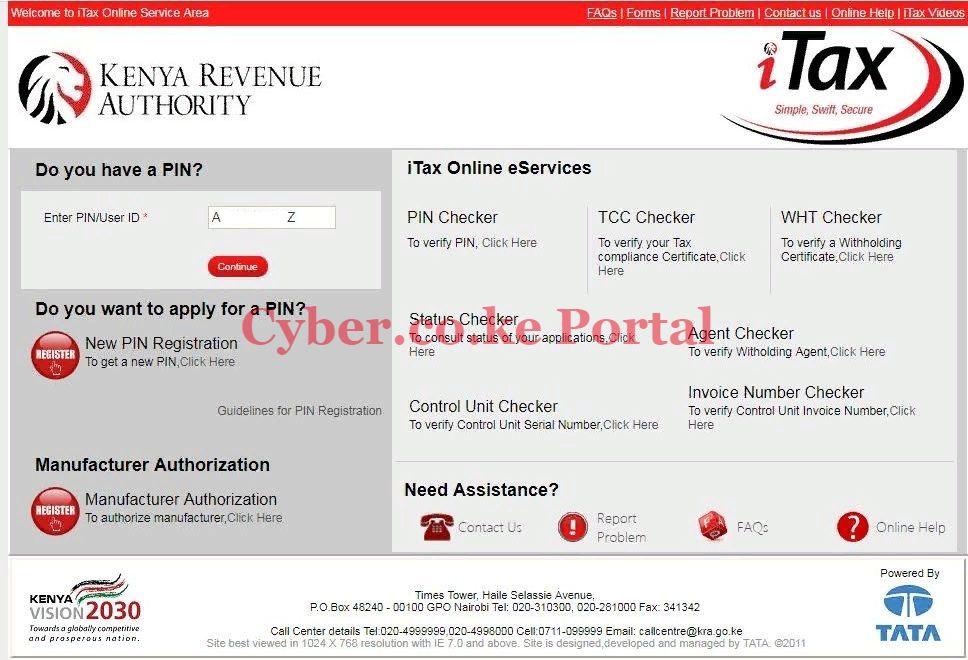

Step 2: Enter KRA PIN Number

Next, you will need to enter your KRA PIN Number. Once you have entered your KRA PIN, click on the “Continue” button.

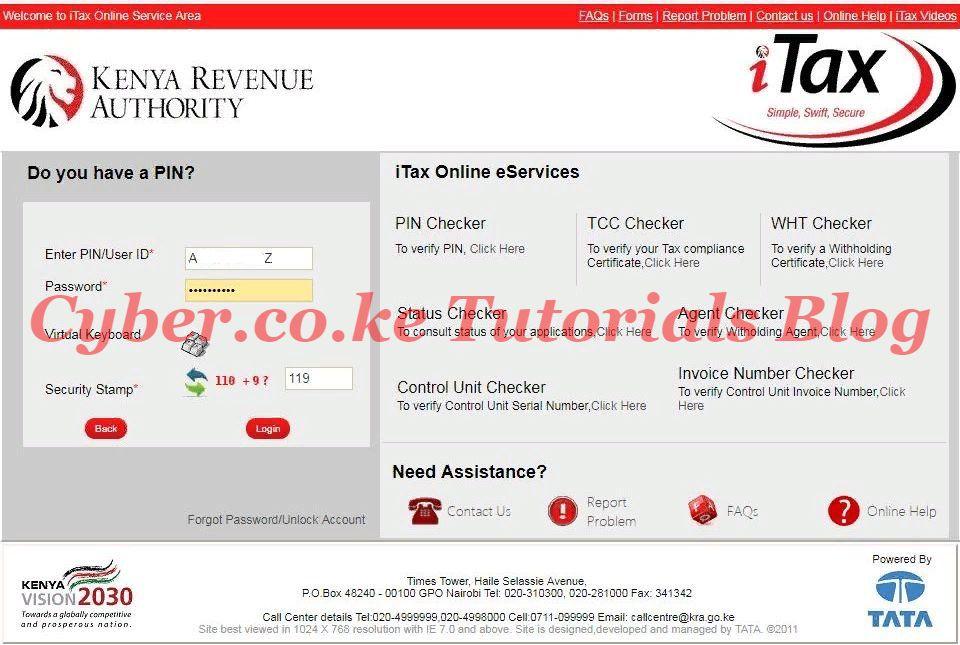

Step 3: Enter Your iTax Password and Security Stamp (Solve Arithmetic Question)

In this step, you will need to enter your iTax Password and solve the arithmetic question (security stamp). Once done, click on the “Login” button.

Step 4: iTax iPage Dashboard

When you successfully logged into your iTax account, you will be able to see various iTax functionalities and features. This is as shown in the screenshot below.

Step 5: Click on Consult Payments Tab

Next, you will click on the “Consult Payments” tab that is located inside the e-Payments functionality box. This is as shown in the screenshot below.

Step 6: Consult Payments Page

Once you have clicked on the “Consult Payments” tab, it will load the Consult Payments information page. Here you will see the following:

- Case Type — This is the Payment.

- PIN — The taxpayer KRA PIN.

- Security Stamp – Solve the arithmetic question.

The above fields are the most important and you will notice that they are mandatory. Solve the arithmetic question and click on the “Consult” button.

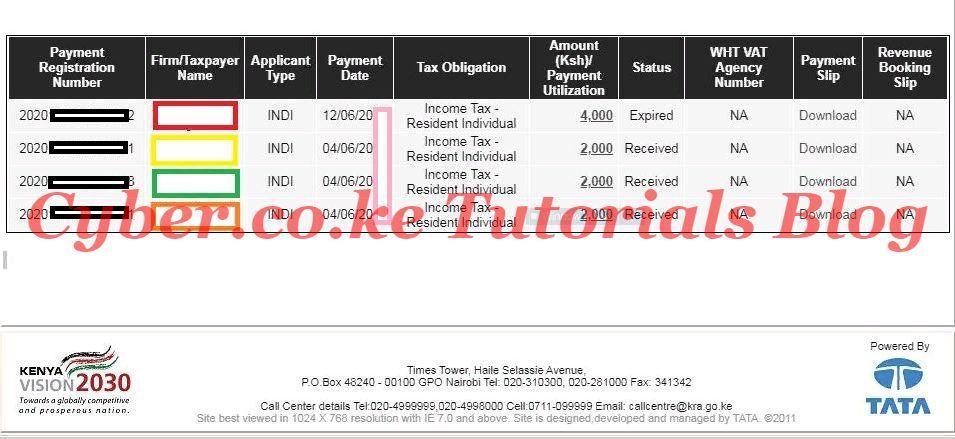

Step 7: KRA Payments Results

In this last step, you will see that the details of all the payments that you made to KRA will be shown. You will take note of the following fields:

- Payment Registration Number

- Firm/Taxpayer Name

- Applicant Type

- Payment Date

- Tax Obligation

- Amount in Kenya Shillings / Payment Utilization

- Status

- WHT VAT Agency Number

- Payment Slip

- Revenue Booking Slip

From the above, you will notice the KRA Payments results on iTax contains the payment registration number, taxpayer name, applicant type, payment date, tax obligation, amount paid, status and payment slip download.

READ ALSO: How To Change iTax Password During iTax First Time Login

And those are the basic steps involved in consulting and viewing KRA Payments in your iTax account. Check out our next article on How To Download KRA PIN Number Online On iTax Portal.